With the beginning of the new year, the US dollar enters a new phase in Iraq

US dollar dealers in Iraq are awaiting the arrival of the new year 2025, which is now approaching and will end the work of the electronic platform for monitoring the movement and transfer of currencies outside the country, according to what the Central Bank of Iraq announced.

The video for this blog post is below here:

Financial and banking experts consider the suspension of the dollar selling platform by the Central Bank of Iraq a “bold step” as it has multiple economic and regulatory dimensions, but on the other hand, the suspension of the platform may open the door to new challenges.

Experts confirm that the success of this decision depends largely on how it is implemented. If the Central Bank is able to provide strong regulatory alternatives and ensure comprehensive awareness for traders and importers, it may be able to achieve the desired goals of this step.

However, if the process is not managed carefully, it could have negative effects on the stability of the financial market and the overall economy of Iraq, according to experts.

In detail, Kazem Al-Shammari, a member of the Economic Committee in the Iraqi Council of Representatives, says, “The job of the Central Bank is to maintain the cash reserve and the unified exchange rate, so it is not its job to sell the dollar, but rather it is the job of the banks, but because of the economic situation and legal chaos, the Central Bank has taken control of selling the currency.”

Al-Shammari confirmed to Shafaq News Agency, "The committee is in favor of banks selling the currency, but it must be subject to strict restrictions and monitoring, as there are many uses for the currency, and the US administration has imposed sanctions on many banks because of this matter."

Al-Shammari believes that “there are Arab or foreign banks that receive more than 40 to 50% of currency sales, and this causes great harm to the Iraqi economy. Therefore, we must focus on Iraqi banks that are not sanctioned and are able to deliver the dollar to those who deserve it, including traders and industrialists.”

He pointed out that "the House of Representatives is currently in legislative recess, and after the resumption of the House's work, the Governor of the Central Bank will be hosted in this regard, and work will be done to impose strict control over currency exchange and purchase entities."

Fear of unexpected obstacles

For his part, the head of the Iraqi Economic Alliance, Adi Al-Alawi, says, “Transfers, whether buying dollars for travel or otherwise, were made through a platform linked between the Central Bank of Iraq, the US Federal Reserve, another company for auditing accounts and information, and the Iraqi banking authority. When any of these four entities stops working, the entire process stops.”

Al-Alawi explained the platform’s working method to Shafaq News Agency, saying, “The transfer goes through a series of stages starting with submitting invoices to the bank, which in turn submits them to the platform, then to the Central Bank, the auditing company, and then the US Federal Reserve, to decide whether to proceed with it or return it. If it approves it, it goes to an intermediary bank, which sends the amount to the beneficiary.”

He added, "These stages have been shortened and the new process has become much easier, as the bank sends the transfer directly to the intermediary bank without going through the Central Bank of Iraq and the US Federal Reserve, while the auditing company remains. Thus, the bank that raises the transfer is the decision-maker and responsible before the Central Bank of Iraq and before the entire global financial sector."

He points out, "But the problem is that the Iraqi banks that have correspondents are only five out of 60 to 70 banks, so only five banks will operate in the next phase, which may cause congestion in withdrawals until things are arranged and organized."

Al-Alawi points out that “the Central Bank’s step is correct and we support it, but the Central Bank does not have real tools and a supervisory authority to rely on, so there is a fear of unexpected obstacles that usually arise during practical application, which requires quick measures and a response to the requirements of reality, which the Central Bank lacks based on previous experiences.”

Pros and Cons

In turn, international economic expert, Nawar Al-Saadi, says, "The suspension of the dollar selling platform by the Central Bank of Iraq is a bold step as it has multiple economic and regulatory dimensions."

Al-Saadi told Shafaq News Agency, "The main goal of this measure, as stated by the Central Bank, is to enhance transparency in financial transfer operations, and reduce reliance on a platform that was considered a primary tool for monitoring the flow of dollars."

He added, "For years, the platform has provided an effective means of regulating dollar sales and ensuring that they are directed to authorized purposes, such as imports and supporting the Iraqi economy, while trying to limit money laundering or smuggling of dollars abroad."

He believes that “this decision is supposed to be part of efforts to improve compliance with international banking standards, by moving to a more direct system in dealings between local banks and foreign correspondent banks, reducing bureaucracy and simplifying financial operations.”

Al-Saadi added, “Also, this decision could help reduce the operational costs associated with maintaining and managing the platform itself, which could be interpreted as a positive economic step towards rationalizing resources.”

But on the other hand, stopping the platform “may open the door to new challenges, such as the possibility of increasing reliance on the black market to obtain dollars, especially if there are no clear mechanisms to ensure that dollars reach traders and importers,” says Al-Saadi.

“This could lead to a rise in the exchange rate of the dollar against the Iraqi dinar, which would put pressure on local prices and raise inflation rates. In addition, small traders may find themselves in a difficult situation, as their reliance on the platform provided them with easy access to foreign currency,” he added.

Another challenge that may arise, according to Al-Saadi, is “the issue of the lack of strict oversight that the platform used to provide, as the platform allowed for close monitoring of financial transfers, thus reducing illegal activities such as money laundering or terrorist financing.”

“In the absence of an effective alternative, there may be a risk of these activities increasing, putting Iraq in a sensitive position on the international financial scene,” Al-Saadi said.

The international economic expert confirms that "the success of this decision depends largely on how it is implemented. If the Central Bank can provide strong regulatory alternatives and ensure comprehensive awareness for traders and importers, it may be able to achieve the desired goals of this step."

“However, if the process is not managed carefully, it could have negative effects on the stability of the financial market and the overall economy of Iraq,” Al-Saadi said.

Potential damage to the economy

The financial and economic researcher, Diaa Al-Mohsen, agrees with what Nawar Al-Saadi said about the potential damages, whether to Iraqi traders or to the Iraqi economy in general, as a result of stopping the platform.

Regarding the most prominent damages, Al-Mohsen explained to Shafak News Agency, "It is likely that the suspension will lead to an increase in demand for the dollar in the parallel market, which will push its price to rise significantly."

He added, "There is also a negative impact on the economy, which may lead to an increase in the prices of imported goods and services, which in turn leads to an increase in the inflation rate and a reduction in the purchasing power of citizens."

He added, "In addition to the decline in commercial activity resulting from traders' reluctance to import due to high shipping costs, which leads to a shortage of goods in the markets and an increase in their prices."

"There may also be difficulty in obtaining the dollars needed to import goods, which affects their business," Al Mohsen added.

Al-Mohsen points to the possibility of “an increase in unemployment rates as well, given that any slowdown in business activity results in increased unemployment, especially in sectors that depend on imports, which may generate social unrest such as protests and demonstrations.”

He points out that "the damages may not appear immediately, and may take some time to fully appear, noting that the severity of these damages depends on many factors, such as the duration of the suspension, the economic policies followed, and the general economic situation of the country."

To avoid damage to the monetary authority, the financial and economic researcher calls for the importance of “taking alternative measures, such as gradually increasing the supply of dollars in the market, facilitating procedures for traders to obtain dollars, and supporting the affected economic sectors.”

The possible reasons for stopping the platform, according to Al-Mohsen, are “an attempt to control the parallel market, as the Central Bank wants to reduce the difference between the official and market exchange rates by reducing the supply of dollars in the market.”

Al-Mohsen adds that it also "represents a step to reduce corruption and tax evasion, and the Central Bank of Iraq is also trying to protect foreign reserves from depletion."

Platform Termination Statement

According to a statement by the Central Bank on September 4, the electronic platform for foreign transfers began at the beginning of 2023 as a first phase to reorganize financial transfers in a way that ensures proactive oversight of them instead of subsequent oversight by the Federal Reserve auditing daily transfers.

The statement added that this was "an exceptional measure, as the Federal Reserve does not usually do this, and a gradual shift was planned towards building direct relationships between banks in Iraq and foreign correspondent and approved banks, mediated by an international auditing company to conduct a preliminary audit of the transfers before they are executed by correspondent banks."

He continued: "During the year 2024 and until now, 95% of the transfer process from the electronic platform to the correspondent banks mechanism directly between it and Iraqi banks has been achieved, which means that only about 5% of it remains within the platform, which will be transferred using the same mechanism before the end of this year and according to the plan."

The statement of the Central Bank of Iraq indicated that "some expectations about possible effects on the exchange rate and transfer operations are baseless, because the process will not be sudden or in one payment at the end of this year, but rather it was achieved in the past period with effort and careful follow-up, except for the remaining small percentage that will be accomplished in the coming short period."

The Central Bank of Iraq confirmed that trade with the UAE, Turkey, India and China represents about 70% of Iraq's foreign trade as imports, which prompted the Central Bank of Iraq to find channels for transfer in euros, Chinese yuan, Indian rupees and UAE dirhams, through approved correspondent banks in those countries.

He added in this regard: "13 Iraqi banks have actually started conducting transfer operations with the prior audit mechanism that has been agreed upon and approved, in addition to transfers in dollars, with the provision of channels for personal transfers for legitimate purposes and external purchases through electronic payment channels and international money transfer companies and cash sales to travelers, and the payment of cash dollars for incoming transfers to the parties and purposes specified in the Central Bank's published instructions."

The bank noted that it has placed foreign transfer operations and fulfilled dollar requests on sound paths consistent with international practices and standards and the Anti-Money Laundering and Terrorist Financing Law.

The Central Bank’s statement concluded that “providing the aforementioned channels for all purposes at the official dollar price makes this price the true indicator of economic practices, which is proven by the reality of price stability and control of inflation. Any other price traded outside of these channels is an abnormal price that those with unorthodox or illegal practices resort to, who avoid official channels in their dealings, and bear the additional costs alone by purchasing at a higher price than the official price to deceive others about the difference between the official price and the other.”

Expectations from Trump's plan: Iraq must buy more from America

We will see the "stick" a lot.

Economist Ziad al-Hashemi said that Iraq will see “Trump’s stick a lot,” by pushing the Iraqi-American trade balance to be more moderate than it is now, as the balance is currently tilted in Iraq’s favor, due to the increase in its oil exports to the United States, which will push the new White House administration to pressure Baghdad to increase purchases and contracts with its companies. He expected that the new American president will not resort to waging wars, due to the high rates of public debt, but that will not prevent him from dealing roughly and “breaking bones.”

The economic expert’s blog:

Trump is coming soon and he has a huge public debt file and a trade imbalance with countries around the world, including Iraq. So how will Trump act and will we see “Trump’s stick” despite the economic pressures?

The US public debt has reached $35 trillion, which is a huge number that may put the Trump administration in conflict with Congress to raise the US public debt ceiling!

The trade imbalance in favor of other countries at the expense of the United States will be one of the most important issues that Trump will focus on addressing, by imposing an increase in American exports, especially energy, on Europe or imposing tariffs on Chinese imports!

As for Iraq, the trade balance is in Iraq’s favor at the expense of the United States (i.e. Iraq exports more to the United States and imports less from it), and this may prompt the Trump administration to pressure Iraq to adjust the balance through more American purchases and contracts!

The huge and unprecedented US public debt and the US government’s continuous borrowing will likely prevent the Trump administration from waging any large-scale wars, military operations, or changing regimes, given the enormous economic costs and unknown results!

But this does not mean that Trump will not deal harshly, severely and in a “bone-crushing” manner with parties that he sees as having gone too far within the American perspective and crossed the red lines in this or that country, so it is very likely that we will see the “American stick” a lot during the next four years!

The "Grand Deal" to Change the Middle East... Undeclared Messages from Washington to Tehran via Baghdad

Informed sources revealed, today, Monday (December 30, 2024), what they called the features of the grand deal between Washington and Tehran to shape the future of the Middle East for at least half a century.

The sources said in an interview with "Baghdad Today", "There is an unannounced movement of American delegations coming from Washington to Baghdad and others from Gulf countries to convey messages presenting the vision of the new White House administration for the future of the Middle East for at least half a century."

She added, "One of the American delegations proposed the phrase 'the grand deal', which is the secret of the negotiations that Washington is trying to complete with Tehran through several mediators, including Iraqis, consisting of at least 18 points, according to what was leaked, related to the nuclear program, the Quds Force, armed factions, economic sanctions, interventions, and the occupying entity."

The sources indicated that "Trump is determined to leave his mark in the Middle East by concluding a comprehensive deal with Tehran that may put an end to tensions for at least half a century and dispel the concerns of his ally, in reference to Tel Aviv."

The sources continued, "Tehran is going through very difficult economic conditions with an unprecedented setback in the energy file, which is matched by the loss of most of its cards in the region, whether in Lebanon or Syria, which makes Trump pressure towards a deal that puts an end to Iran's ambitions in the nuclear program and ensures that it does not affect American interests and its allies in the region."

Al-Sudani starts 2025 with a vis it to Iran

An informed source revealed on Monday that Prime Minister Mohammed Shia al-Sudani will begin a visit to Iran at the end of next week, to discuss developments in the region .

The source told Shafaq News Agency that Al-Sudani will discuss several files with Iranian leaders, most notably the recent developments in Syria .

Al-Sudani had made several visits to countries in the region after the fall of Bashar al-Assad's regime, including Jordan and Saudi Arabia, where he discussed security issues with the leaders of these countries. Iraq also participated in the Aqaba Conference held in Jordan, with the participation of several countries, including the United States .

Iranian President Masoud Pezeshkian visited Iraq on September 11, and made a three-day tour that included Baghdad, Erbil, Sulaymaniyah, Najaf, Karbala and Basra .

On May 22, Al-Sudani also visited Tehran to participate in the funeral of Iranian President Ebrahim Raisi, who was killed in a plane crash .

Sudanese advisor reveals government's philosophy for future of national economy

Saleh told {Euphrates News} that: "The initiation of the idea of a sovereign wealth fund is essential and is consistent with the renaissance of natural resources and undoubtedly comes in parallel with the development path strategy and its outcomes in generating a leading industrial renaissance in the national economy. This is Iraq's outline in building the future of its economy for the twenty-first century and in two directions {the export-oriented development model and the other, and the development model directed towards maximizing the input-output tables and replacing imports within the national economy}.

He added, "Therefore, the sovereign wealth fund will adopt a vision that expresses the strength and basis of the interconnections between the outputs of national wealth from natural resources and the inputs of the production function in the national economy, which requires another model in managing sovereign wealth funds directed towards the interior."

Saleh explained that "the sovereign fund will work to accelerate the diversification of the three basic sectors, which are the manufacturing industry, agriculture and services, in an advanced digital age. This is what the government program aspires to in its philosophy for the future of the national economy, which did not neglect the idea of partnership between state activity and market activity in sustainable development."

The Central Bank of Iraq announces the success of its monetary policy.. the extent of the main objectives

Today, Monday (December 30, 2024), the international economics specialist, Nawar Al-Saadi, commented on the Central Bank of Iraq’s announcement of “the success of monetary policy during the year 2024.”

Al-Saadi told Baghdad Today that "regarding the Central Bank of Iraq's announcement of the success of its monetary policy during 2024, the measurement was based on multiple indicators, including the growth of bank deposits and credit granted by banks, in addition to the rise in gold reserves and the stability of inflation rates. These results indicate positive steps in enhancing economic stability and stimulating growth in the financial sector." He added: "This means that deposits have witnessed a significant growth, and inevitably reflects increased customer confidence in the banking system. Also, the rise in credit indicates greater support for economic sectors, which contributes to improving the overall performance of the economy."

He added, "Also, the Central Bank succeeded in strengthening its gold reserves, which is an indicator of the strength of monetary policy and its ability to deal with economic challenges. As for inflation rates, I believe they remained within an acceptable range, which indicates relative stability in prices."

“Despite all the positives mentioned above, we must address the challenges and stop at them, such as the rise in domestic debt and the continued reliance on oil revenues to cover the budget needs, which pose a threat to financial sustainability. In addition, there are questions about the extent to which citizens benefit from these policies, if some social and economic indicators, such as unemployment and poverty levels, still show high rates, and the private sector faces difficulties in accessing financing despite the increase in total credit,” he continued.

The international economics expert concluded by saying, “Overall, it can be said that the monetary policy for 2024 has achieved relative successes, but it has not reached a level that guarantees real economic sustainability, and still needs comprehensive reviews to overcome existing challenges and ensure a more equitable distribution of the fruits of these policies.”

The Central Bank of Iraq revealed the positive indicators achieved by the bank for the third quarter of 2024 compared to the same quarter of 2022 and 2023, stressing that this reflects the success of the monetary policy adopted by the bank during 2024.

40 trillion dinars is Iraq's internal debt.. Does the government have the "key" to repay it?

Kocher told {Euphrates News} that: "Regarding Iraq's internal debts, the numbers speak of more than 40 trillion, and the majority of the debts belong to the government banks, Rafidain, and TBI."

He added, "The government is now able to pay these debts if it opts for withdrawing them from the bank reserve.

" Kocher stressed "the need to schedule debt repayment as a result of the banks' role parallel to the government's role in providing job opportunities and supporting the private sector."

The financial advisor to the Prime Minister, Mazhar Muhammad Salih, announced that Iraq has exited the risks of external debts, and that (Iraq) is a well-fortified country.

He stressed that the ratio of debts to the gross domestic product does not constitute a burden on the state, as it amounts to (5) percent of the gross domestic product, and is confined within the (government banking) system.

Al-Sudani authorizes Taif Sami to sign the loan agreement to support Kirkuk gas station

Guaranteed by the American Import Bank

On Monday, the Council of Ministers authorized the Minister of Finance, Taif Sami, to sign the loan agreement to finance the implementation of combined cycle projects for the benefit of the Ministry of Electricity, for the Kirkuk gas station, with a guarantee from the US Export-Import Bank (US EXIMBANK).

Part of the Prime Minister’s statement:

As part of the follow-up of the Ministry of Electricity’s projects, the Council of Ministers approved the authorization of the Minister of Finance, or her authorized representative, to sign the financing loan agreement to implement combined cycle projects for the Ministry of Electricity, for the Kirkuk gas station, with the guarantee of the US Export-Import Bank, based on the Federal General Budget Law for the three years, the article related to the principles of cooperation on energy in Iraq, and approval of the financing terms established by the Ministry of Finance.

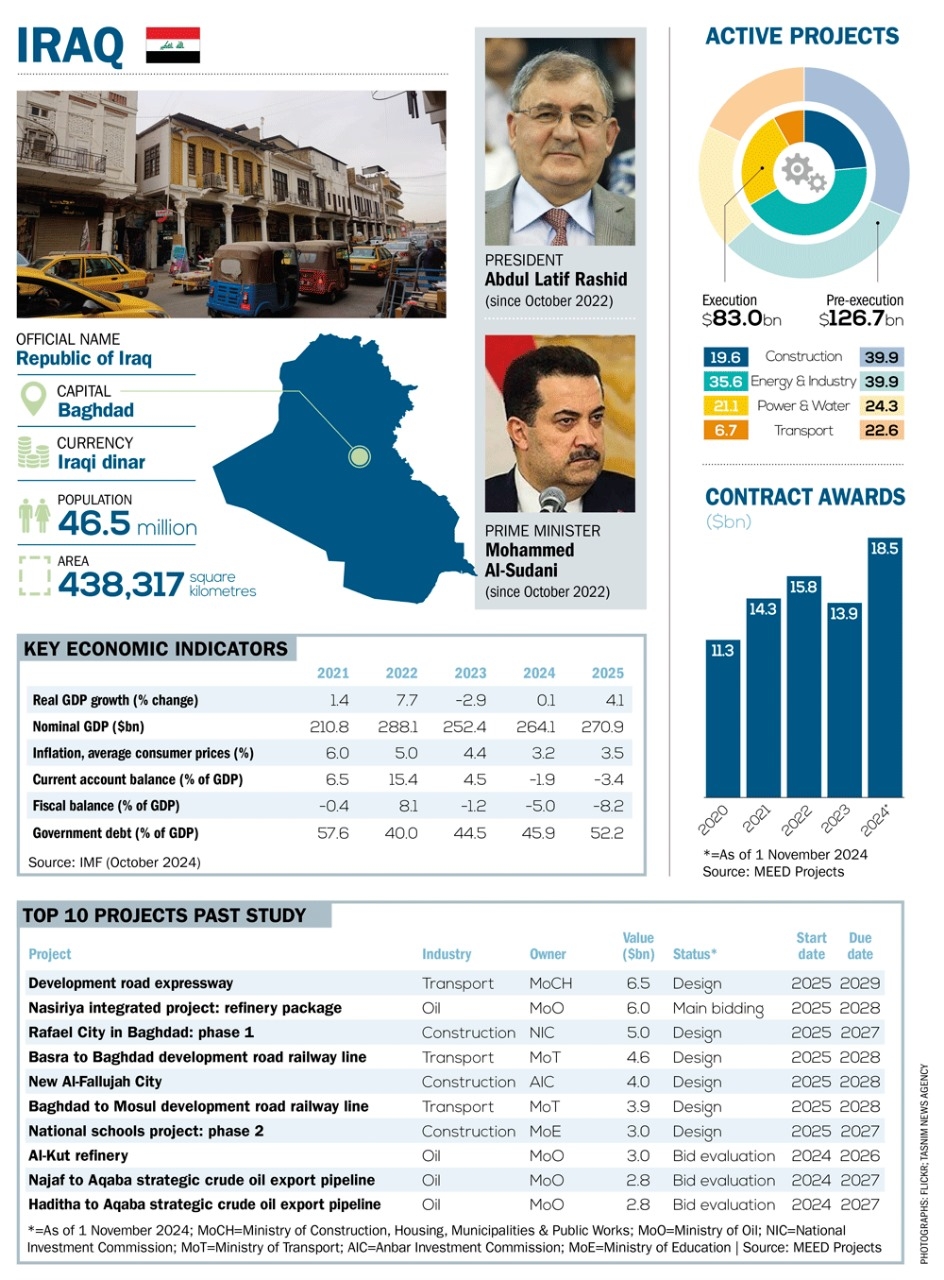

International Report: 2025 will be the largest year for projects inside Iraq

The International Data Bank, one of the international organizations concerned with monitoring the internal affairs of the countries of the world, issued its annual report for the year 2024, accompanied by estimates for the coming year 2025, confirming that the current year witnessed the issuance of the largest number of investment and service contracts inside Iraq.

The bank said, according to its report, which was translated by "Baghdad Today", that "Iraq spent $83 billion during the year 2024 on infrastructure and reconstruction projects, and awarded contracts to implement other projects during the year 2025 worth $126 billion," expecting that "this will lead to a doubling of the growth rate of the national GDP to about 4.1% during the next year."

The bank also explained that the largest projects were the share of the country's main roads for the Ministry of Transport, which are expected to be fully completed in 2029, noting also that oil investment projects and the construction of residential complexes in Baghdad, specifically (the integrated Nasiriyah oil project and the city of Al-Rufail in Baghdad) came in second and third place as the largest government projects for the year 2024.

The information issued by the World Bank also confirmed that the contracts awarded for the coming year were distributed as follows (39.9% allocated to construction, 39.9% allocated to energy and industry, 24.3% allocated to electricity and water service projects, while 22.6% was allocated to road and transportation projects).

Al-Surji: The people of the region were economically harmed by the problems between Baghdad and Erbil

Member of the Patriotic Union of Kurdistan, Ghiath Al-Surji, confirmed that the people of the Kurdistan Region were economically harmed due to the problems between Baghdad and Erbil over the issue of employees' salaries, calling on the federal government to put the problems aside and pay attention to the living conditions of the citizen, as he was greatly harmed by these differences.

Al-Surji told Al-Maalouma, “The citizen in Kurdistan is living in a deteriorating economic situation, and this is reflected in the individual’s standard of living, in addition to the fact that this deterioration has stopped the movement of markets in the region. "

He added, "The deterioration in the economic situation of the citizen in Kurdistan is due to the policies followed between Baghdad and Erbil and the disagreements over the issue of salaries, funding and the settlement process."

He pointed out that "the Baghdad government is required to find solutions to the salary problem and put the problems between Baghdad and Erbil aside, as they have greatly affected the citizen and his living conditions within the region due to the delay in the arrival of salaries And their disbursement to employees, especially since the disbursement will move the markets in general and everyone will benefit from this movement.”

.png)

.png)