What is meant by currency float? What are its advantages and disadvantages?

Disclosure of the date of the arrival of the budget to Parliament

Today, Tuesday, the representative of the State of Law coalition, Bahaa al-Din al-Nuri, revealed the date for the arrival of the general budget to the House of Representatives, while stressing that the budget is still in the corridors of the Ministry of Planning.

Al-Nouri said in an interview with "The Information" that "the general budget will reach the House of Representatives on the eighth of next January, after completing the legislative recess and the parliament resuming its sessions," noting that "the decision on the general budget law will need a month in Parliament to vote on it officially." .

And he continued, "The Ministry of Finance will send a committee to audit, in addition to the Parliamentary Finance Committee, in order to read and review all its paragraphs and details, so that they are ready to be passed under the dome of Parliament," noting that "the general budget is still in the corridors of the Ministry of Planning in order to complete the addition of some paragraphs."

And he indicated that "there is a serious desire from all political blocs to approve the general budget law as soon as it reaches parliament, because it contains many paragraphs on which most segments of society depend."

Earlier, the Ministry of Planning confirmed that "Prime Minister Muhammad Shia' al-Sudani assigned the Ministries of Planning and Finance to quickly prepare the general budget for the year 2023 and submit it within appropriate time periods to the House of Representatives in order to proceed with the procedures for its approval.

What is meant by currency float? What are its advantages and disadvantages?

link this is in Iraq's news hmmmm they want their people to understand a currency float!

The floating currency is intended to leave the value of a country's currency to supply and demand when compared to another currency. There are millions of traders around the world buying and selling currencies, which helps determine their value for others. The floating exchange rate is determined by these daily interactions between traders. If investors By buying the US dollar heavily, it is likely that its value will rise against other currencies, and this means that more dollars will be needed to purchase the same number of goods from abroad.

How does the currency float system work?

The basis of the currency floating system is supply and demand. If the supply is greater than the demand, the value of the currency will decrease. On the contrary, if the demand is greater than the supply, its value will increase.

1. Stability in the trade balance

A floating exchange rate allows for more stability in this region as the currency is volatile. When a currency depreciates it means that exports become cheaper to the rest of the world. This provides a boost to the balance of trade between countries as they can export more because they are relatively cheaper than their competitors.

One of the main drawbacks of a fixed exchange rate is that countries will naturally “import” higher prices, so the benefit of floating is that hyperinflationary countries will experience a depreciation of their currency, and this will then help offset the inflationary effect on other countries.

By working under a system of floating exchange rate, the central bank in the country no longer needs large reserve currencies to stabilize the exchange rate, under the system of fixed exchange rate central banks need a wide range of currencies, and this means that if Needed to strengthen its currency it will sell foreign reserves thus increasing other supply in the market and lowering the value.

Instead, under a system of floating exchange rates, that same money can be used in a way that benefits the broader economy.

under a fixed rate system shall operatecentral banksFor different countries in line with each other, for example: if a country raises interest rates to deal with inflation other central banks will need to respond, this is because what happens in one country is likely to affect monetary conditions in another country.

When currencies are linked to the dollar, changes in the value of the dollar will have an impact on the value of other currencies. In contrast, these countries are subject to the feelings of the US Federal Reserve Bank and its monetary policy. By contrast, the floating exchange rate allows countries to decide on their monetary policy. Without focusing only on other countries.

When a currency is artificially forced to stay at a fixed level, there is often bubbles in market activity. Investors know that a currency is undervalued, but with a fixed exchange rate central banks struggle to maintain the exchange rate. Constant.

There is a point where the countries currency remains stagnant, but the fundamentals appear to be undervalued or overvalued, this opens the door to speculative attacks on the currency as it seeks to make some easy money, and this in turn can lead to drastic shifts in the foreign exchange market which can cause great distress to national economies.

In contrast, a floating exchange rate is constantly changing reflecting a wide range of underlying conditions ranging from inflation to economic performance, so the exchange rate is largely in line with its underlying value.

may face economic difficulties at home, there may be excessive inflation rates, economic stagnation or poor job opportunities, all of which can play a role in the foreign exchange market.

As a result of the flotation, investors look at the basic features of the economy to determine its value, and these basics include economic indicators such as growth and inflation, so when these indicators perform poorly, they are likely to lose value against other currencies.

The float also has the potential to drive the economy down as a weak currency puts pricing pressures on its imports, so for countries that import heavily they may face higher prices that will likely reduce consumer demand.

One of the main problems with a flotation is that it can create volatile conditions for companies and countries, a sharp depreciation in the value of a currency can greatly affect the dynamics of its economy, imports become significantly more expensive which puts pressure on value-adding exporters, moreover Companies that import raw materials will see higher prices as a result.

If the economy is formed in such a way that imports are a major component, it may struggle more during periods of currency weakness. By contrast, countries such as export-led China may benefit, since most of their business is focused on exporting their goods become cheaper abroad and thus Increased demand and improved economic conditions at home.

excusesflotation systemThe central bank has the responsibility of maintaining its currency peg, instead, it has the autonomy to pursue its monetary policy and economic agenda.

This is a two-sided coin. On the one hand, a well-managed monetary system can take advantage of this freedom, and on the other hand, mismanagement can lead to hyperinflation and financial crisis.

Many countries have tried to work their way out of debt by floating the currency, but the result has always been excessive levels of inflation and a bad credit rating. Instead, countries that may struggle to manage their monetary policy are better off having a fixed exchange rate.

They are honest: Iraq's oil exports are controlled by the Americans

The representative of the Sadikoun Parliamentary Bloc, Ahmed Al-Musawi, affirmed today, Tuesday, that Iraq's oil exports are controlled by America, while he indicated that the obstacles and obstacles set by Washington are attempts to thwart the Sudanese government.

Al-Moussawi said, in an interview followed by Al-Malooma Agency, that "Iraqi oil exports are subject to US control," pointing out that "the US Federal Bank sent a small part of the oil money, which caused a rise in the exchange rate of the dollar."

He added, "The United States of America controls the Iraqi market, and this domination must be eliminated."

Al-Moussawi pointed out, "The Federal Bank's continuation in sending insufficient funds to the market makes the government have the option of reducing the quantities of exported oil."

He pointed out that "the government's decisions to reduce the exchange rate of the dollar are successful and are a message of reassurance to the Iraqi people."

Raed Fahmy on the dollar crisis: The Central Bank's capabilities are superior.. Powerful forces behind the issue

Secretary of the Iraqi Communist Party, Raed Fahmy, spoke on Monday about the dimensions of the crisis of the high dollar exchange rate in Iraq.

Fahmy said in a post followed by “Nass” (December 26, 2022), that “the rise in the exchange rate of the dollar and the inability of the monetary authorities and the government to reduce it and achieve the stability of the dinar, is a manifestation of a deeper crisis than just the control measures imposed by the US Treasury and the tracking system for the dollars transferred from Iraq.” The lack of confidence in the central bank and in Iraqi banks and transfers issued through them reflects the high percentage of transfers that do not go to the officially announced parties, which are indicators of currency smuggling and financing for external beneficiaries, and the failure to take any serious measures to control and stop them for complex reasons, including corruption, political loyalties, or bad faith. management, or all of these factors combined.

He added, "The US Federal Bank and the Treasury Department were aware of this and had previously sent warnings and alerts in this regard, but taking the last firm measures may have political dimensions to put pressure on the Iraqi government. On the other hand, there are influential Iraqi parties linked to banks and currency smuggling networks and circumventing Local and international controls in the monetary field are trying to exploit the crisis and its severe effects on the purchasing power of citizens and to confuse and paralyze economic life in order to resist any serious measures against corruption, its channels and networks.

And between, "It seems clear that the current crisis exceeds the capabilities of the Central Bank and the tools available to it to address and surround it, and talking about restoring confidence means that the required measures must be firm and radical to impose effective control on banks and mechanisms for transferring currency abroad, dismantling corruption systems and holding those behind them accountable, which is Influential forces that a government stemming from the womb of quotas cannot confront.

Earlier, a member of the Parliamentary Finance Committee, Mueen Al-Kazemi, revealed new details regarding the "American ban on the four Iraqi banks."

Al-Kazemi said, in an interview conducted with him by colleague Saadoun Mohsen Damad, followed by "NAS" (December 26, 2022), that "the House of Representatives is on a legislative recess, and a large number of members of the House called for an extraordinary session to discuss the issue of the recent rise in dollar exchange rates."

He added, "The window for selling the currency is not new and has passed for more than 10 years, and there was supposed to be an understanding between the American side and the Iraqi government regarding it recently."

And he stated, “After the approval of the Sudanese government on October 27, 2022, specifically on November 2, there was a penalty or ban on 4 banks, and on November 15, the US Federal Reserve informed the Central Bank of Iraq of a new financial policy in money transfers and others, and the procedures were surprising.” ".

He pointed out that "a group of deputies demanded to host the Prime Minister, the Minister of Finance and the Governor of the Central Bank, and this procedure must be done, and the government should provide possible solutions by opening direct credits to merchants."

He concluded, "The general atmosphere may go towards understanding with the American side, which is trying to drag the Iraqi government to the negotiating table. There are files that America wants to be clear about with this government."

Earlier, the parliamentary national product bloc, the Iraqi government and the central bank, warned of the collapse of the Iraqi dinar and the rise in the exchange rate of the dollar to more than 160,000 dinars, while indicating that the collapse of the currency might push Iraq to be similar to the economic situation in the Republic of Iran and Lebanon.

The head of the bloc, Representative Ibtisam Al-Hilali, said in a press statement, of which “NAS” received a copy, (December 26, 2022), that “the exchange rate of 100 dollars in the market exceeded 157 thousand dinars, and it is constantly increasing and may arrive at the end of the week or at night.” New Year's Eve to 165,000 dinars, and this rise directly affected citizens through the rise in food prices.

Al-Hilali added, "Some private banks and merchants, with the support of some political parties, smuggle foreign currency abroad through unofficial outlets after buying the currency at the official price from the currency sale outlet in the Central Bank of Iraq, and this is a major reason for the high exchange rate of the dollar against the Iraqi dinar." ".

And she continued, "Prime Minister Muhammad Shia' al-Sudani is required today to hold an urgent meeting of the Council of Ministers for the economy to discuss the exchange rate and the collapse of the Iraqi dinar, control the window for buying and selling foreign currency, and take strict measures against banks and electronic outlets to restore the exchange rate to the official price."

And Al-Hilali indicated: "There are fears of the continued collapse of the Iraqi dinar and a continuous rise in the exchange rate of the dollar, exceeding 165,000 dinars on New Year's Eve, and that the economic situation in Iraq will be similar to the countries of Iran and Lebanon."

Economist: US restrictions caused a gap between demand and supply for the dollar

The economist Nabil Jabbar Al-Tamimi attributed, on Tuesday, the reason for the fluctuation of the dollar to the US restrictions towards Iraqi banks, noting that these restrictions led to creating a gap between demand and supply.

Al-Ali said, in an interview with Al-Maalouma, that "black transfers take place in isolation from the banking system, which is carried out through land transfers and Iraqi banks' lack of international standards in the money transfer process."

He added that "the US Federal Bank has placed many restrictions on banks until they comply with international standards," and pointed out that "some banks are smuggling hard currency in isolation from the banking system, which has led to an increase in the demand for buying dollars,"

and the head of the Parliamentary Rights Bloc, Saud Al-Saadi, had Earlier, he accused the United States of America of imposing guardianship on Iraqi sovereignty, the economy, and Iraqi money, with ulterior motives.

Washington's ambassador translates the struggle of the dinar and the dollar and imposes pressure on the Central Bank

As soon as the US Ambassador Elena Romansky started moving in Iraq, visiting officials and ministers, and meeting with Al-Sudani and a number of institutions, including the Central Bank, repercussions followed, most notably the rise in the exchange rate of the dollar against the dinar, as the curtain was revealed that this character imposed pressure On the Central Bank in order to implement Washington's policy and oblige Baghdad to proceed with its paragraphs, which faced a number of criticisms, especially after it became clear to everyone the results of these moves and what resulted from a significant drop in the value of the dinar and the ignition of local markets, and the most affected by this is the citizen.

The independent politician, Nassim Abdullah, told Al-Maalouma, that "the American ambassador deviated from the context of diplomatic work through her movements, carrying out work and visits to state institutions, where she worked to impose conditions and pressures on some institutions, including the Central Bank of Iraq, which reveals to everyone that these The personality has exceeded its powers and the diplomatic work it is supposed to do."

On the other hand, the representative of the coordination framework, Muhammad Al-Saihoud, confirmed to Al-Maalouma, that "the continued movements of the American ambassador represent a violation of the diplomatic contexts, which necessitates the government to take a position on these moves, which represent blatant interference in Iraq's affairs."

On the other hand, Fadel Mwat, a member of the State of Law Coalition, told Al-Maalouma that "Washington's ambassador is like a (spy) for America inside Iraq, and she is not entitled to conduct meetings directly with ministers or political parties."

In addition, political analyst Moayad Al-Ali warned, during his interview with Al-Malooma, that there are economic and terrorist motives at the same time for the movements of the American ambassador and her meeting with a number of ministers and officials, as America seeks to exert pressure on Iraq, destabilize security and push the terrorist ISIS elements present in Iraq. Syria heading towards Iraq to achieve its goals.

Economist: US restrictions caused a gap between demand and supply for the dollar

The economist Nabil Jabbar Al-Tamimi attributed, on Tuesday, the reason for the fluctuation of the dollar to the US restrictions towards Iraqi banks, noting that these restrictions led to creating a gap between demand and supply.

Al-Ali said, in an interview with Al-Maalouma, that "black transfers take place in isolation from the banking system, which is carried out through land transfers and Iraqi banks' lack of international standards in the money transfer process."

He added that "the US Federal Bank has placed many restrictions on banks until they comply with international standards," and pointed out that "some banks are smuggling hard currency in isolation from the banking system, which has led to an increase in the demand for buying dollars,"

and the head of the Parliamentary Rights Bloc, Saud Al-Saadi, had Earlier, he accused the United States of America of imposing guardianship on Iraqi sovereignty, the economy, and Iraqi money, with ulterior motives

Association of Banks: The government has taken several steps to limit the rise in the exchange rate

The Association of Iraqi Private Banks confirmed today, Tuesday, that the government and the Central Bank have taken several steps to limit the rise in the exchange rate of the dollar against the dinar.

The Association said in a statement received by (Iraqi Media News Agency / INA) that the Iraqi Private Banks Association and its member banks are monitoring the recent rise in the exchange rate and confirming that this rise is a result of modifying the mechanism of the foreign currency sale window in the Central Bank of Iraq and according to the requirements of international transactions. The Iraqi government has taken measures related to the method of collecting tax and customs fees at border crossings to encourage merchants to work directly with banks and to prevent double taxation.

The statement added, and that the Central Bank of Iraq has also taken several measures that would limit the rise in the exchange rate, and the Association affirms its support for government efforts and the efforts of the Central Bank and confirms the readiness of its banks to sell foreign currency to merchants wishing to open documentary credits at the official price for import purposes and invites merchants to benefit from that.

The Association stressed the need for the media to play a positive role in raising awareness and to stay away from undocumented news that contributes to undermining confidence in the Iraqi currency, financial and monetary policies, and Iraqi banks

Network: A "secret" deal between Al-Sudani and Tehran to provide it with $4 billion overthrew the dinar

Today, Monday, Iran International Network revealed the reasons behind the collapse of the Iraqi dinar against the dollar, expecting that the gap between the Iraqi dinar and the US dollar will soon increase, as a result of the Biden administration's "attention" to a deal and trade breach between Baghdad and Tehran.

The network stated, during a report translated by (Baghdad Today), that "US President Joe Biden's administration learned, through Iraqi officials, that the authorities in Baghdad exchanged trade with Iran using the dollar instead of the dinar, which it said was a "violation" of the US sanctions imposed on Tehran. , explaining that "the United States prevents the entry of the US dollar into Iran and imposes on Iraq to limit trade exchange with it in Iraqi dinars only."

The network said that the Biden administration finally "came aware" of the nature of trade exchange between the two countries and the breach of sanctions that Baghdad is doing by enabling Iran to obtain dollars, after Al-Sudani's visit to Tehran, and the two parties' agreement on a "vague commercial contract", according to which the latter obtained an amount Four billion US dollars, referring to the agreement, which included providing the amount to the Iranian authorities in exchange for "medical services, engineering and various expertise," the nature of which was not clarified.

Iran International also said, quoting Iraqi officials who told it confidentially, that the authorities in Baghdad and Washington "do not wish to disclose these details to the public, which kept the Iraqi and American media away from dealing with the real reasons for the dollar's rise," explaining that "the United States is trying to stop The dollar flowed into Iran through trade exchange with Iraq, and decided to put pressure on the Iraqi dinar and reduce its access to the foreign trade exchange market," she described.

The decision of the United States to "impose pressure on the Iraqi dinar and reduce its access to the commercial market to prevent its entry to Iran through trade exchange between the two countries," had negative effects on the Iraqi market, according to the network, as the exchange rates witnessed a significant rise of the dollar at the expense of the dinar due to the reduction in the amount of the dollar. available in the market.

Iraqi officials also revealed to the network that the United States “discovered a secret transaction” between a group of Iraqi banks and banks and the Iranian authorities with the aim of facilitating the entry of the US dollar into Iran within “vague contracts similar to the four billion dollar contract,” indicating to it that the names of banks and banks will be disclosed. Soon, if the US administration wishes to do so, as she put it.

High oil prices amid hopes of increased demand

Oil prices rose, in trading, on Tuesday, and the rise came with the support of China's taking steps towards easing its strict "zero Covid" policy, which raised hopes for an increase in demand for crude.

By 09:14 Moscow time, US West Texas Intermediate crude futures rose 0.85% to $80.24 a barrel.

While Brent crude futures rose by 0.81% to $84.60 a barrel, according to Bloomberg data.

And the Chinese authorities announced their intention to open the country's borders and abandon the quarantine period for the "Covid-19" virus, starting from January 8, 2023.

Thus, China ends the measures that were imposed for nearly three years under the "Zero Covid" policy

With a handful of dollars... secret information about Iraqis who worked with the American forces was leaked

The New York Times revealed today, Tuesday, that German security experts obtained a “biometric information device” used in Iraq by the United States of America through the eBay trading site, and it includes the eye and fingerprints of hundreds of Iraqis who worked with the American forces. in 2012 .

The newspaper stated in a report translated by (Baghdad Today), that "German experts, who are working to monitor equipment that may contain confidential information via the Internet, found a "biometric fingerprint scanning" device offered on eBay by an unknown person for $ 149. .

And she continued, "After trading with the selling party, the German team was able to obtain the device for only $68, and after arriving at the home of German researcher Matthias Marx last August, the team found an unexpected surprise in the device's internal memory."

And she indicated that "the device contains biometric information, including fingerprints and eye prints of 2,632 people, most of whom are of Iraqi nationality, and some of whom are Afghani," noting that "the device includes data of Iraqi employees who worked with the US forces before 2012, in addition to some information about terrorists and wanted persons." ".

She said, "The device is a very old type of primitive biometric fingerprint recognition device, and it was used by US forces in Iraq before it was transferred to Afghanistan," explaining, "Until this moment, no one knows how a device carrying such sensitive security information reached the second-hand goods exchange market online." eBay."

The newspaper added that "the device and the information on it are currently being held by the German team," noting that "US Department of Defense spokesman Patrick Rieder" refused to confirm whether the information found inside the device was real or not, requesting that it be returned to the US forces. To "verify" it, as she put it.

"Dollar Crisis".. An economist indicates positive aspects behind the rise

Manar Al-Obeidi said in a statement: “All Iraqis today are in great concern about the high price of the dollar against the dinar because of its great impact on the life of the citizen, but before we all get terrified and panicked, we must try to answer some questions economically and in a professional way before speaking to the media and raising the concern of society.” Who does not need, as a result of the many crises, to worry more."

He wondered about "what is the effect of the rise in the real dollar on inflation rates, and is there a direct and clear relationship between the rate of rise in the dollar and the rise in the rate of inflation, and the extent to which they are linked over time?"

He noted, "

Al-Obeidi also asked about "what sectors are most affected by the rise of the dollar and what is the extent of its direct impact on the life of the Iraqi citizen," noting that "for example, the increase in the price of the phone (iPhone) is not equivalent in importance to the increase in the price of a kilo of flour. Therefore, an extensive and clear study must be found on the impact of the rise on each sector and provide solutions to reduce its impact according to the importance of the sector instead of trying to find a general solution that may be impossible at this stage.

And he continued, "Is there any benefit to the rise of the dollar against the dinar? Certainly, the impact of the rise of the dollar has great negative effects on the life of the citizen, but some positive effects must be sought, including, for example, the ability of productive projects to compete as a result of the rise in product prices, as well as work to strengthen the banking system and adopt methods An official transfer through banks, which will encourage the banking sector to grow and contribute to the domestic product, and both matters will have repercussions on providing real job opportunities far from the government sector.

Al-Obeidi stressed, "The most important question is how long will we ignore the real risks of Iraq's dependence on the dollar in international trade, starting from oil sales and through imports, and when will we develop a financial economic strategy that works to diversify dependence on currencies to include other currencies of countries from which we depend on imports greatly, such as the Chinese yuan." The Turkish lira and the UAE dirham.

He explained, "Everyone sees that the rise in the price of the dollar is a collapse. In fact, the rise came as a result of measures and not as a result of economic factors. Perhaps this rise will have important positive results for the Iraqi economy, especially in the matter of work and reducing unemployment and poverty rates if they are accompanied by correct government measures that encourage various sectors."

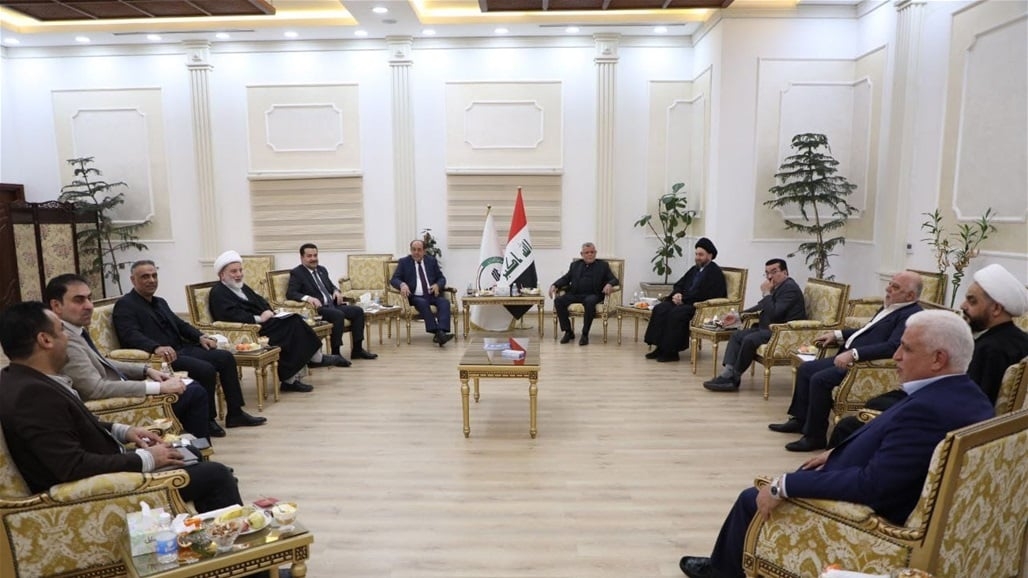

An expanded meeting attended by Al-Sudani..and the government is about to issue a "decisive" statement on the dollar crisis

The leader in the coordination framework, Turki Al-Atbi, revealed today, Tuesday, that an expanded meeting of the coordination framework will be held within the next 48 hours to discuss the crisis of the high dollar exchange rate.

Al-Atbi told (Baghdad Today) that "the dollar crisis and the rise in its exchange rate in recent days generated strong pressure on the Iraqi markets and began to push material prices up, which constitutes additional burdens on the shoulders of millions who are below the poverty line and the middle classes."

He added, "The coordination framework will discuss in an upcoming meeting during the next 48 hours the file of the dollar crisis, and Prime Minister Muhammad Shia' al-Sudani may attend to clarify the government's position on what is happening and what solutions are currently being proposed to contain the situation," stressing that "the situation cannot become more difficult with the continuation of the rise."

The leader in the framework expected that "a government statement will be issued in the coming days giving a detailed explanation of the reasons for the high dollar exchange rate and answering all the questions raised."

Yesterday, the Parliamentary Finance Committee warned of "economic stagnation" in Iraq due to the large rise in dollar exchange in the local market.

Committee member Jamal Cougar told (Baghdad Today) that "the continuation of the large rise in dollar exchange in the local market has great and serious repercussions on the Iraqi economic situation, especially since this rise will lead to stagnation of the economy due to the instability of the currency, and this will have an impact even on The issue of foreign companies working in various fields of investment.

And Cougar stated, "The Parliamentary Finance Committee will work, during the next few days, to host the relevant executive authorities to discuss the repercussions of this large and continuous rise in the dollar exchange rate, and work to find real solutions to control this rise."

And the price of the dollar accelerated in the local markets and stock exchanges yesterday, about 160 thousand dinars for every 100 dollars, in a rapid development of the rise that the markets have been witnessing for days.

And the price of the dollar, even before the closing of the stock exchanges yesterday, reached 158,250 dinars, for every 100 dollars, and it was heading towards 159,000 dinars, in an unprecedented excess of dollar prices since its change in late 2020.

The rise came due to the increasing demand of banks that were deprived of the currency sale auction to go to buy the dollar from the local markets, according to experts and specialists.

On the other hand, Kurdish politician Latif Al-Sheikh warned, yesterday, Monday, of a major crisis as a result of the high price of the dollar throughout the country.

The Sheikh told (Baghdad Today) that "the high dollar prices have led to an insane rise in the price of foodstuffs in the markets, and this will lead to a major crisis."

He added, "The Kurdish citizen bears great burdens, and the rise in the price of the dollar increased his worries, especially in light of the delayed payment of salaries, the high price of fuel, taxes, and others."

Law: The problem of delaying the budget is political and administrative and has nothing to do with the exchange rate

The leader of the State of Law Coalition, Jassem Muhammad Jaafar, confirmed, on Tuesday, that the delay in sending the budget to Parliament is due to administrative and political problems and has nothing to do with the delay in raising the dollar exchange rate, indicating that the government does not want the value of budget funds to exceed $100 billion. Equivalent to 150 trillion dinars.

Jaafar said in a statement to Al-Maalouma, "The delay in the budget was not due to the high exchange rate of the dollar, because the government will spend the money according to the central bank rate of 1465."

He added, "The delay is related to political and administrative problems, especially regarding the ministries' claims to pay off their debts to complete the projects, as the ministry's dogs amount to 240 billion, and this is impossible to achieve," noting that "the government does not want the value of budget funds to exceed $100 billion, equivalent to 150 trillion dinars." .

Jaafar pointed out that "the investment budget for the next year is estimated at 40% of the total allocation of the general budget, and this is the first time that this percentage is allocated."

Finance: Appointments, transfers, placements, promotions, bonuses and promotions are suspended as of this date

The Ministry of Finance:

- Stopping appointments, transfers, placements, promotions, bonuses and promotions, as of January 1, 2023

- Regulating financial and legal matters according to the exchange rate 12/1 until the budget law for the year 2023 is enacted.

Al-Jubouri: American practices will reach the exchange rate of the dollar to 1,700 dinars next week

The head of the Rafd Center for Strategic Studies confirmed that the American practices imposed on Iraq will reach the exchange rate of the dollar to 1700 dinars next week, indicating that some outlets selling currency have the upper hand in implementing the American project in Iraq.

Al-Jubouri told Al-Maalouma, that "there are question marks about the rise in the exchange rate of the dollar, as this matter occurred during the era of the Sudanese government and did not happen during the Al-Kazemi era, noting that the US ambassador, Elena Romansky, visited the government 7 times during a period of 40 days."

He added, "America imposed on Iraq to pay its debts to Iran in dinars, and this is what happened so that the government worked to pay about 6 trillion dinars to Tehran."

And he indicated that "America has placed more than 14 Iraqi banks under the sanctions of the US Treasury, but it retracted and punished only 4 banks," pointing out that "Iraq's money and oil revenues go to the US Federal Bank, where Washington is arguing to put Iraqi money in this bank in order to prevent countries which asks Iraq to claim its debts.

He pointed out that "America is manipulating the market, and the government must take steps to control the currency selling windows belonging to parties in the country," explaining that "these outlets have the upper hand in implementing the American project in Iraq, as the dollar will reach 1700 next week.

The Central Bank determines the main reason behind the rise in the dollar - Urgent

Today, Tuesday, the Central Bank of Iraq held a meeting to discuss the repercussions and indicators of the rise in exchange rates in the local markets, while identifying the main reason behind the rise in the exchange rate.

A bank statement received by (Baghdad Today) stated that " the Board of Directors of the Central Bank of Iraq met today and discussed the repercussions and indicators of the rise in exchange rates in the local markets and the temporary pressures the foreign currency exchange rate has been exposed to for days resulting from internal and external factors, given the adoption of mechanisms to protect the banking sector." And customers and the financial system, and since all foreign trade requirements (for the purposes of documentary credits or remittances) are fully covered by the official price (1465) dinars to the dollar for documentary credits and (1470) dinars to the dollar for remittances.

And he continued, "Therefore, we call upon the merchants to review the banks directly and not resort to brokers and speculators to avoid charging their imports with undue commissions and expenses, referring in this regard to what was issued by the Council of Ministers in its Resolution No. (351) for the year 2022 regarding non-payment of customs duties and amounts of tax secretariats in advance. This will reduce redundant loops, ease procedures, and remove costs resulting from pre-demarcation problems.”

And he added, "At the same time, we call on banks to assume their responsibilities in facilitating and accelerating procedures for their customers to ensure their access to financing with the best banking practices and with the least amount of loops, taking into account the established legal requirements."

Al-Sudani issues a package of "necessary" directives to end the dollar crisis - Urgent

The Prime Minister, Mr. Muhammad Shia'a Al-Sudani, met today, Tuesday morning, with the Governor of the Central Bank of Iraq, Mr. Mustafa Ghaleb Makhaif.

His Excellency listened to a detailed presentation by the Governor of the Bank regarding the rise in the exchange rate of foreign currency, and the most important measures taken by the Bank in this field.

The Prime Minister urged the Central Bank to achieve general stability of prices and the exchange rate, in accordance with the tasks stipulated in Articles (3 and 4) of the Central Bank of Iraq Law, which stipulate that the Central Bank aims to achieve stability in the local exchange rate, organize and monitor the work of banks and enhance the safety of The efficiency of payment systems and the development of the payments system.

The Prime Minister stressed the need for the bank to take the necessary measures to prevent illegal speculation and everything that harms the local market and leads to higher prices.

He also urged His Excellency to activate the steps of selling foreign currency at official prices to citizens through purchasing with electronic cards, opening sales outlets for travelers, or clients outside Iraq, or financing foreign trade, in accordance with the fundamentalist contexts and international standards for opening documentary credits and remittances.

The Governor of the Bank presented to the Prime Minister the positive position of the financial situation, stressing that the crisis regarding foreign currency is an emergency crisis for technical reasons, and coincided with the work of the new electronic platform and the delay in transfers due to the Christmas holidays.

The governor praised Cabinet Resolution No. 352 of 2022 to stop the pre-collection of taxes and customs duties on goods entering government ports, prevent double taxation, and collect them according to the approved contexts at border crossings.

•••••

Prime Minister's Media Office

27-December-2022

Food prices in the Iraqi market after the rise in the dollar

shafaq News Agency publishes the prices of the main foodstuffs for the consumer, according to wholesale market traders in the capital, Baghdad, today, Tuesday

According to wholesalers in the Jamila central market in Baghdad, the price of Mahmoud rice (30 kilos) amounted to 65 thousand dinars, and the weight of (1 kilo) in 20 bags at a price of 41 thousand dinars.

The price of sugar (25 kilos) amounted to 28 thousand dinars, while a box of Zeer paste (weight 825 grams), consisting of 12 boxes, amounted to 33 thousand dinars.

The price of a liter box of "Zeer" oil, consisting of (20 cans), amounted to 49,000 dinars, while the price of Iraqi red eggs per box (12 layers) amounted to 72,000 dinars.

According to these figures, a significant increase in food prices appeared in the wholesale markets, coinciding with the continued rise in the exchange rates of the dollar.

And the exchange rates of the US dollar continued to rise against the Iraqi dinar, today, Tuesday, in the main stock exchange in the capital, Baghdad, and in the Kurdistan Region, to approach 159 thousand dinars, for the first time since its price was officially approved in the state budget at an amount of 146 thousand dinars in the year 2020.

In a statement issued today, the Central Bank of Iraq attributed the reasons for the dollar’s rise to what it described as “temporary pressures” resulting from “internal and external” factors, and confirmed that the official exchange rate is 146 thousand dinars, and called on merchants not to deal with speculators.

Prime Minister Muhammad Shia'a al-Sudani stressed, during a meeting with the governor of the Central Bank, the need for the bank to take the necessary measures to prevent illegal speculation, and everything that harms the local market and leads to higher prices.

Al-Sudani meets with the governor of the Central Bank and issues directives to reduce the exchange rates of the dollar

Prime Minister Muhammad Shia al-Sudani urged, on Tuesday, the Central Bank of Iraq to activate steps to sell foreign currency at official rates, with the aim of curbing the rise in the exchange rate of the dollar against the local currency.

Al-Sudani's office stated, in a statement received by "Tigris", that "Al-Sudani met with the Governor of the Central Bank of Iraq, Mustafa Ghaleb Makhaif, and listened to a detailed presentation from the bank's governor regarding the rise in the foreign exchange rate, and the most important measures taken by the bank in this field."

He added, "Al-Sudani urged the Central Bank to achieve general stability of prices and the exchange rate, in accordance with the tasks stipulated in Articles (3 and 4) of the Central Bank of Iraq Law, which stipulate that the Central Bank aims to achieve stability in the local exchange rate, organize and monitor the work of banks and strengthen The safety and efficiency of payment systems and the development of the payment system.

Al-Sudani stressed, according to the statement, the need for "the bank to take the necessary measures to prevent illegal speculation, and everything that harms the local market and leads to higher prices."

He also called for "activating steps to sell foreign currency at official prices to citizens through purchasing with electronic cards, opening sales outlets for travelers, or clients outside Iraq, or financing foreign trade, in accordance with the fundamentalist contexts and international standards for opening documentary credits and remittances."

For his part, the governor of the bank presented to Al-Sudani the positive position of the financial situation, stressing that "the crisis over foreign currency is an emergency crisis for technical reasons, and coincided with the work on the new electronic platform and the delay in transfers due to the Christmas holidays."

He pointed out that "the governor praised Cabinet Resolution No. 352 of 2022 to stop the work of pre-collection of taxes and customs for goods entering through government outlets and to prevent double taxation, and to collect them in accordance with the approved contexts at border crossings."

Rights: America imposes guardianship over the Iraqi people

link

The head of the Parliamentary Rights Bloc, Saud Al-Saadi, accused, on Tuesday, the United States of America of imposing guardianship on Iraqi sovereignty, the Iraqi economy and money.

Al-Saadi said in a statement to Al-Maalouma, "What is happening is the imposition of American tutelage on Iraqi sovereignty and on the Iraqi economy and money," noting that "Iraq came out of Chapter VII, and no one can impose any tutelage on it, and therefore we demanded the restoration and transfer of Iraqi funds in full to Treasury of the Iraqi state.

He added, "Our position is firm, which is not to transfer money from Iraqi oil sold to the US Federal Bank, which controls, together with the US Treasury Department, the procedures for transferring dollars into Iraq."

Al-Saadi pointed out that "America recently put in place procedures and restrictions that caused a decrease in the percentage of Iraqi funds transferred to Iraq, which caused a shortage in supply and an increase in demand, and thus led to a rise in the exchange rate of the dollar against the Iraqi dinar.

A deputy warns the Presidency of Parliament of the consequences of ignoring the “extraordinary dollar session” request

Today, Tuesday, the representative of the Sadiqoon bloc, Suhaila Al-Sultani, warned the Presidency of Parliament against ignoring the request submitted to it regarding holding an extraordinary session to discuss the repercussions of the high dollar exchange rates in the local markets.

Al-Sultani said in a statement to "Tigris": "We hold the Presidency of Parliament responsible for not answering the request to hold an extraordinary session to discuss the high exchange rate of the dollar against the Iraqi dinar."

Today, Tuesday, the Sudanese Prime Minister, Muhammad Shia'a, urged the Central Bank to activate steps to sell foreign currency at official rates, with the aim of curbing the rise in the dollar exchange rate against the local currency.

Today, the central bank revealed the reasons for the rise in dollar exchange rates in the Iraqi markets, attributing this to "temporary pressures resulting from internal and external factors."

Syrian deputy to Al-Malooma: America is waging an economic war through the dollar

A member of the Syrian People's Assembly, Mahmoud Jokhadar, accused, on Tuesday, the United States of America of practicing an economic war to suffocate the Syrian people through the price of the dollar, indicating that America persists in imposing its siege on the country.

Jokhadar said in a statement to Al-Maalouma, "In order for America to ensure the continuation of the bloodshed of the steadfast Syrian people and to continue plundering Syria's oil and wheat resources, it persists in imposing its siege on the people."

He added, "The American blockade is on the Syrian people, who are living in their worst conditions these days, from a winter without fuel and an outrageous price hike, and its attempts to destroy the exchange rate and raise the price of its dollar. "

Jokhadar pointed out that "Syria considers America a permanent enemy, but what can we say about our Arab brothers who participate in strangling us, starving us, and continuing our bleeding to strangle the Syrian people financially and economically?"

The leader of the Al-Fateh Alliance, Ali Al-Fatlawi, had called earlier on the government of Prime Minister Muhammad Shia'a Al-Sudani to reveal to the Iraqi people the new conspiracy that the United States of America is weaving by reducing financial transfers to Iraq, which led to raising the exchange rate of the dollar against the Iraqi dinar

Central Bank: The exchange rate of the dollar is exposed to internal and external pressures

The Central Bank of Iraq confirmed, today, Tuesday, that the foreign exchange rate is subject to temporary pressures resulting from internal and external factors.

The media office of the bank stated in a statement received by (Iraqi Media News Agency / INA) that the Board of Directors of the Central Bank of Iraq held a meeting and discussed the repercussions and indicators of the rise in exchange rates in the local markets and what the foreign currency exchange rate has been exposed to for days from temporary pressures resulting from internal and external factors.

He added that due to the adoption of mechanisms to protect the banking sector, customers and the financial system, as all foreign trade requirements (for the purposes of documentary credits or transfers) are fully covered by the official price (1465) dinars to the dollar for documentary credits and (1470) dinars to the dollar for transfers.

The Central Bank called on merchants to review banks directly and not resort to brokers and speculators to avoid charging their imports with undue commissions and expenses, referring in this regard to what was issued by the Council of Ministers in its Resolution No. (351) of 2022 regarding non-payment of customs duties and amounts of tax secretariats in advance, as This will reduce redundant loops, ease procedures, and eliminate costs caused by pre-demarcation problems.

The Central Bank stressed on banks to assume their responsibilities in facilitating and expediting procedures for their customers to ensure their access to financing with the best banking practices and with the least amount of loops, taking into account the established legal requirements.

The Central Bank issues recommendations to merchants and banks regarding exchange rates

Today, Tuesday, the Central Bank of Iraq issued recommendations to merchants and banks about exchange rates .

The bank's media office stated, in a statement received by the Iraqi News Agency (INA), that "the board of directors of the Central Bank of Iraq held a meeting and discussed the repercussions and indicators of the rise in exchange rates in the local markets and the temporary pressures that the foreign currency exchange rate has been exposed to for days, resulting from internal and external factors."

He added that "given the adoption of mechanisms to protect the banking sector, customers and the financial system, as all foreign trade requirements (for the purposes of documentary credits or transfers) are fully covered by the official price (1465) dinars to the dollar for documentary credits and (1470) dinars to the dollar for transfers."

The Central Bank called on “merchants to review banks directly and not resort to brokers and speculators to avoid charging their imports with undue commissions and expenses, referring in this regard to what was issued by the Council of Ministers in its decision No. (351) for the year 2022 regarding non-payment of customs duties and amounts of tax secretariats in advance. This will reduce redundant loops, ease procedures, and remove costs resulting from pre-demarcation problems.”

The Central Bank stressed, "Banks must shoulder their responsibilities in facilitating and expediting procedures for their customers to ensure their access to financing with the best banking practices and with the least amount of loops, taking into account the established legal requirements."

Chinese companies account for the largest share of Iraq's oil exports in November

The Iraqi Oil Marketing Company "SOMO" announced today, Tuesday, that the Chinese oil companies were the most numerous to buy Iraqi oil during the month of November.

"Sumo" stated in a statistic published on its official website and viewed by "Al-Iqtisad News", that "Chinese companies were the most numerous among other international companies in purchasing Iraqi oil, with 10 companies out of 38 companies that purchased oil during the month of November."

The statement added that "Indian companies came second with 7 companies, American companies came third with four companies, then South Korean and Italian companies came with 3 companies, and Greek companies came fourth with two companies, while the rest were distributed among Spanish and (Dutch-British) companies." Turkish, Russian, Emirati, Japanese, French, Jordanian and Azerbaijani, with one company for each.

"SOMO" indicated that it "depends on the sale of Iraqi oil on the main criteria for contracting with large, medium, independent and vertically integrated governmental global oil companies," noting that "the most prominent international companies that bought Iraqi oil are the Indian Hindustan Company, the Korean Cocas, the Chinese Petrogyna, the American Exxon Mobil and Shell." British Dutch and Italian Eni.

The price of the dollar in Iraq decreased by 3% after the rapid escalation

The exchange rates of the dollar returned to a gradual decline in the Iraqi stock exchanges and markets, after it completed today, Tuesday, its rapid jumps that it witnessed yesterday, Monday, to complement the gradual rise during the past weeks.

In its latest update in the capital, Baghdad, dollar prices recorded 155,750 thousand dinars per 100 dollars, while the purchase amounted to 154,750 thousand dinars per 100 dollars.

And the dollar prices had reached this morning, Tuesday, to 160,000 thousand dinars per 100 dollars, which means that the rate of decline amounted to 3%.

The price of the dollar rose from the beginning of last November until now by 10%, after it was stable around 148 thousand dinars per 100 dollars.

The European Union supports Iraq with 4 million euros to face the crisis

link

The European Union issued a decision to provide a financial grant to Iraq in the amount of four million euros to meet the high cost of living and prices inside the country. The federation said on its official website that "the high food prices, the absence of political stability, climate change and drought, in addition to the Russian invasion of Ukraine, have cast a shadow on many Iraqis, some of whom have become unable to meet their basic needs," as he put it. "Many Iraqis, especially the displaced, have been greatly affected by the deterioration of food security inside the country.

Those who are already facing difficulties in providing it are now suffering more," said the European Union's Commissioner for Crisis Response, Janis Lunsrik. He added, "The European Union is committed to helping Iraqis from the weaker classes, and for this purpose we have allocated four million euros to help them pass through these difficult times." The statement stated that

A traveler reveals the mechanism for buying dollars from banks at the official rate, describing it as "useless" - Urgent

A citizen who tried to benefit from what was announced by the Central Bank and government banks to provide travelers with dollars at the official price of 1465 dinars per dollar, revealed the mechanism of buying dollars from banks and the extent of their feasibility, indicating that buying dollars from the parallel market and its high prices may be more feasible.

And government banks had previously announced the possibility of providing citizens wishing to travel at a price of 1465 dinars per dollar, in an attempt to reduce pressure and demand for dollars in the market, and not to affect citizens with the high prices recorded by the parallel market for days.

The citizen told (Baghdad Today), that "today I went to the Rafidain Bank and told them that I wanted to travel and I wanted to buy dollars."

He explained that they told him that "the procedure includes opening a Master Card account, then he deposits the amount in dinars, which is equivalent to 14 million and 650 thousand dinars, and then he is handed a Master Card containing 10 thousand dollars, which is used and withdrawn from it in the country to which he will travel."

He added that they informed him that "there will be deductions, including the commission for transferring the amount of 10 thousand dollars abroad, in addition to deducting withdrawal commissions, which do not allow the card holder to withdraw more than 400 dollars in each withdrawal, which means that 12 thousand dinars will be deducted in each withdrawal."

He explained that these deductions make buying the dollar from the parallel market at the high price equal to the cost of buying the dollar at the official price with deductions by government banks, so this measure is "useless" and will not change anything.

Reassurances about the rise of the dollar .. "No fear or anxiety"

The Iraqi dinar continues to decline slightly against the dollar on Tuesday, while the authorities of this oil-rich country confirm that the decline is "temporary", at a time when the country's reserves of foreign currency have reached an unprecedented level.

The exchange rate on Tuesday was 1,580 dinars against one dollar, while the exchange rate set by the Central Bank was 1,460 dinars against one dollar.

This decline in the value of the Iraqi currency against the US dollar began about two weeks ago, and discussing its causes has become a major concern of the Iraqi media.

On Tuesday, the Iraqi Prime Minister, Muhammad Shia'a al-Sudani, met with the Governor of the Central Bank, Mustafa Ghaleb Makhaif, to discuss this issue. Representatives collected signatures for a request to hold an extraordinary parliamentary session on the issue.

The Association of Iraqi Banks indicated in a statement that the high exchange rate resulted from "modifying the mechanism of the foreign currency sale window in the Central Bank of Iraq, according to the requirements of international transactions."

Meanwhile, the Central Bank indicated, on Tuesday, that this rise in the dollar exchange rate was due to “temporary pressures resulting from internal and external factors, given the adoption of mechanisms to protect the banking sector, customers, and the financial system.”

Iraq, a country rich in oil but plagued by corruption and money laundering, ranks 157th (out of 180) in Transparency International's Corruption Perceptions Index.

On Sunday, Mazhar Saleh, the Prime Minister's Advisor for Financial Affairs, spoke of the existence of "objections" from an international supervisory authority "regarding some transfers with incomplete information submitted by private banks."

At the same time, Salih reminded that the financial reserves of foreign currency are currently "the strongest in Iraq's financial history, and its balance may have exceeded one hundred billion dollars," considering that "there is no fear or concern about Iraq's financial capabilities in imposing stability in the exchange rates of the dinar."

In an attempt to control this rise, the authorities launched a series of measures that have not yielded results so far, including facilitating the financing of private sector trade in dollars through Iraqi banks, and opening outlets for selling foreign currency in government banks to the public for travel purposes.

Analyst, financial and economic expert, Safwan Qusay, talked about "shaking confidence in the Iraqi dinar" following corruption scandals linked to banks.

He added, in an interview with Agence France-Presse, that there are also reasons related to "the US treasury, which restricted the movement of financial transfers towards some countries."

He said that when a trader is unable to obtain dollars through official methods, "he is forced to buy dollars from the parallel market."

He added, "The additional audit process showed that parties were transferring money, but they do not check who is the supplier, what is the value of the invoice, and what is the value of the materials that enter Iraq."

International agencies: The Iraqi dinar is a victim of mysterious transfers, money laundering and bank corruption

The Iraqi dinar continues to decline slightly against the dollar on Tuesday, while the authorities of this oil-rich country confirm that the decline is "temporary" at a time when the country's reserves of foreign currency have reached an unprecedented level.

The exchange rate on Tuesday was 1,580 dinars against one dollar, while the exchange rate set by the Central Bank was 1,460 dinars against one dollar.

This decline in the value of the Iraqi currency against the US dollar began about two weeks ago, and discussing its causes has become a major concern of the Iraqi media.

On Tuesday, Iraqi Prime Minister Muhammad Shia al-Sudani met with the governor of the Central Bank, Mustafa Ghaleb Makhaif, to discuss the issue. Representatives collected signatures for a request to hold an extraordinary parliamentary session on the issue.

The Association of Iraqi Banks indicated in a statement that the high exchange rate resulted from “modifying the mechanism of the foreign currency sale window in the Central Bank of Iraq, according to the requirements of international transactions.”

The Iraqi researcher residing in London, Adnan Abu Zaid, said that the dollar is a ruler in the hands of the United States to calculate distances of loyalty to countries, and that the Iraqi dinar will be surrounded like the Syrian and Lebanese currencies because Iraq is punished within calculated limits.

Meanwhile, the Central Bank indicated, on Tuesday, that this rise in the dollar exchange rate resulted from “temporary pressures resulting from internal and external factors, given the adoption of mechanisms to protect the banking sector, customers, and the financial system.”

Iraq, a country rich in oil but plagued by corruption and money laundering, ranks 157 (out of 180) in Transparency International's Corruption Perceptions Index.

Sunday, Adviser to the Prime Minister for Financial Affairs, Mazhar Salih, spoke of the existence of “objections” from an international supervisory authority, “regarding some transfers with incomplete information submitted by private banks.”

At the same time, Salih reminded that the financial reserves of foreign currency are currently "the strongest in Iraq's financial history, and its balance may have exceeded one hundred billion dollars," considering that "there is no fear or concern about Iraq's financial capabilities in imposing stability in the exchange rates of the dinar."

In an attempt to control this rise, the authorities launched a series of measures that have not yielded results so far, including facilitating the financing of private sector trade in dollars through Iraqi banks, and opening outlets for selling foreign currency in government banks to the public for travel purposes.

Analyst, financial and economic expert, Safwan Qusai, talked about “shaking confidence in the Iraqi dinar,” following corruption scandals linked to banks.

He added that there are also reasons related to “the US treasury, which restricted the movement of financial transfers towards some countries.” He said that when a trader is unable to obtain dollars through official methods, "he is forced to buy dollars from the parallel market."

He added, "The additional audit process showed that parties were transferring money, but they do not check who is the supplier, what is the value of the invoice, and what is the value of the materials that enter Iraq."

The representative of the Kurdistan Democratic Party, Majid Shankali, said that the government of the State Administration coalition headed by Muhammad al-Sudani has not yet found a solution to the problem of the high price of the dollar, which today reached 1541 dinars per 100 dollars.

Shankali asked: Where is the governor of the Central Bank, who was chosen as the best Iraqi financial figure in a recent referendum, and who is unable to provide any idea or solution to reduce the price of the dollar.

Citizens complain about the high prices of food and consumer goods in the Iraqi market, due to the high value of the dollar against the dinar, which resulted in a significant decrease in purchasing power.

Citizen Musa Abu Alaa says that the new wave of high prices has negatively affected our living conditions, and the wholesale markets are almost empty of buyers.

Traders and economists believe that the reason for the decline in purchasing power in the markets is the high exchange rate of the dollar.

And the exchange rates of the dollar in the Iraqi market rose to more than 153 thousand dinars for every 100 dollars, at a time when the central bank sells one dollar for 1460 dinars.

Abu Alaa adds that many citizens are unable to meet the needs of their families due to the sudden rise in the prices of food and consumer goods in the Iraqi local markets.

Indignation increased among the Iraqi street because of the failure of the government of Muhammad Shia' al-Sudani to fulfill its promises through its government program and to restore balance in the financial market.

Among them are Gulf 25.. The Council of Ministers approves service, economic and sports decisions

The Council of Ministers voted, on Tuesday, on several service, political and sports decisions.

The media office of the Prime Minister, Muhammad Shia' al-Sudani, stated in a statement, which Mawazine News received a copy of, that "in the context of government support for the 25th Gulf Championship in Basra, and with the aim of facilitating the smooth entry of sports fans into Iraq, and in a manner that guarantees the success of the tournament technically, organizationally and publicly, it has decided The following Cabinet:

1- Approving the approval of the entry stamp for holders of valid passports of the Arab Gulf countries and Yemen for the period from (December 28, 2022) until (January 20, 2023), to allow the masses to enter through air, land and sea ports, to attend the World Cup Gulf 25 football club, to meet entry visa requirements.

2- Postponing the collection of the amounts collected for granting entry visas, and they are waived according to the powers of the Council of Ministers stipulated in Article (46) of the Federal Financial Management Law (6 of 2019 as amended), and item (First / 1) of Cabinet Resolution 28 of the year 2020.

3- The Ministries of Finance and Transport exempt all vehicles that enter exclusively with delegations and fans of the 25 Gulf Championship from customs and tax fees, insurance premiums, and guarantees from December 28, 2022, until January 20, 2023, and enter exclusively from the Safwan and Arar border crossings.

And he added, “In the health file, the Council of Ministers recommended excluding the Ministry of Health from the Prime Minister’s Office book (2218077) on November 13, 2022, in order to contract with doctors and retirees for voluntary work, and the Council also voted to cancel Cabinet Resolution (62 of 2020). ) regarding combating the Corona virus and preventing its spread, and limiting the exceptions granted to the Ministry of Health to the purchase of vaccines and life-saving medicines related to the Corona pandemic exclusively, in a manner that guarantees the implementation of the instructions for implementing government contracts (2 of 2014) and the controls attached to them in concluding contracts in light of the relative stability of the epidemiological situation in Iraq, according to what is proven in the book of the Federal Office of Financial Supervision No. (6/20/1/23159) dated October 20, 2022.

He pointed out that "the cabinet discussed other issues on the agenda, and issued the following decisions in their regard:

First / Approval of amending paragraph (1) of Cabinet Resolution (343 of 2022) regarding the project to complete the financing of the FCC catalyst cracking unit project in the Basra refinery - the fourth loan, to become according to the following:

- Approval of the financing conditions stated in the letter The Ministry of Finance No. (11518) dated December 11, 2022, authorizing the Minister of Finance to sign the loan agreement for the financing of the Basra Refinery project - cracking by catalysts (FCC) stage four, mutual deposits, written memorandums and minutes of discussions for the aforementioned loan, which is funded by the agency Japan International Cooperation (JICA), based on the provisions of Article (5/First) of the Emergency Support for Food Security and Development Law (2 of 2022)

Second / Approval of the draft law on the accession of the Republic of Iraq to the 1990 European Bank for Reconstruction and Development (EBRD) agreement, which entered into force on March 28, 1991, and referring it to the House of Representatives based on the provisions of Articles (61/item first, and 80/item second) from the constitution.

Third / Approving the secondment of the services of (Muhammad Turki Abbas Nassif Al-Obeidi), Director of the Human Rights Department at the Ministry of Justice, to work in the Permanent Mission of the Republic of Iraq to the United Nations in New York / the International Investigation Team on ISIS Crimes (UNITAD), for a period of three years that cannot be extended, based on Provisions of Article (38) of the Civil Service Law (24 of 1960), as amended, and Resolution (1626 of 1982).

Fourth: Approval of the following:

1- Deleting the quantities of local wheat suitable for consumption as animal feed, which are in the stores of the General Company for Grain Trade, one of the formations of the Ministry of Commerce, and selling them at public auction during a working month.

2- Deleting and destroying quantities of local wheat that are not suitable for consumption as animal feed, which are in the stores of the General Company for Grain Trade, one of the formations of the Ministry of Commerce, based on the provisions of Article (46) of the Federal Financial Management Law (6 of 2019), and the decision of the Council of Ministers (28 of the year 2020), the formation of an investigative committee and the transfer of funds to the Ministry of Finance.

Fifth / Approving the recommendations of the accompanying investigative committee, linking the letter of the Prime Minister’s office on December 27, 2022, and relieving Amir Firas Kazem, Director General of the Directorate of Travel and Border Affairs, from his post, based on Resolution (880 of 1988).

Sixth: Approving the amendment of Paragraph (2) of Cabinet Resolution (291 of 2022) to become as follows:

- The Ministry of Interior took the necessary measures to implement the requirements and expenses of the service and engineering effort team, which was formed according to Cabinet Resolution (286 of 2022), from the funds mentioned in Paragraph (1) of Resolution (291 of 2022), as it is mainly allocated within the Emergency Support for Food Security and Development Law. (2 of 2022), and based on Paragraph (19) of Schedule (B).”

American drones flying over Baghdad International Airport!

Today, Tuesday, a security source said that American drones flew over the Camp Cropper base at Baghdad International Civil Airport, while confirming that the Iraqi airspace is controlled by British Serco companies, which allows foreign planes to use the airspace comfortably.

In an interview with Al-Maalouma agency, the source said, "Today, Tuesday, Baghdad International Airport witnessed the flight of American drones over its airspace, which directly threatens the country's sovereignty," noting that "the planes were flying over the American Camp Cropper base."

He added, "The Iraqi airspace is controlled by the British company Serco, which allows the country's airspace to foreign warplanes, except those belonging to Washington or the so-called international coalition in all its countries," pointing out that "the number of aircraft reached two and is similar to the aircraft that targeted the leaders of victory (Abu Mahdi). The engineer, Qassem Soleimani) in the airport crime.

The source explained, "Washington's continuation of the policy of violating Iraq's sovereignty and penetrating its private security joints is a dangerous matter, which requires a government move to end the American presence in all its forms in the country."

He asked, "What are warplanes doing over a civilian airport, and who is the victim that Washington wants to get rid of this time?", expressing his astonishment at the "governmental and parliamentary silence over the ongoing US violations."

An economist on the central bank's solutions to the dollar's rise: patchwork and warning of danger

Today, Tuesday, the economic expert, Diaa Al-Mohsen, warned of the Iraqi economy moving to a more dangerous situation than the one it is currently going through, while the Central Bank called for finding real solutions to reduce the exchange rates of the dollar.

Al-Mohsen said in an interview with Al-Maalouma Agency, "The Prime Minister, Muhammad Shia'a Al-Sudani, met today with the governor of the bank to discuss the causes, but the reasons are known, but the most important question remains, what are the solutions?"

He added, "We know very well that there are private banks and offices affected by the measures of the US Treasury, which is obsessed with currency smuggling to countries such as Turkey, which in turn led to a decrease in central bank sales, which decreased to 60 percent, but where are the central bank's solutions?"

The economist explained, "The central bank is required to find real solutions, not prosthetic, so that it takes into account the interest of the Iraqi economy, and this is what is required, but the measures taken now, such as canceling the tax and buying from private banks, are not solutions."

And Al-Mohsen said: "The need to know the radical solution because temporary solutions do not work economically, and we may move to a step or a problem that is more dangerous than the step we are facing now."

The former deputy, Wael Abdel Latif, had accused the Central Bank of failing to control the rise in dollar prices, while stressing that the measures taken by the Central Bank did not limit the rise that occurred in the local markets.

Earlier in the day, the Prime Minister, Muhammad Shia'a al-Sudani, met with the governor of the Central Bank to learn about the reasons for the rise in dollar exchange rates and to find real solutions.

America is waging an economic war through the dollar

Today, Tuesday, a member of the Syrian People's Assembly, Mahmoud Jokhadar, accused the United States of practicing an economic war to stifle the Syrian people through the price of the dollar, indicating that America persists in imposing its siege on the country.

Jokhadar said, in a statement followed by (Iraqi Media News Agency / INA), that "in order for America to ensure the continuation of the bloodshed of the steadfast Syrian people and to continue plundering Syria's wealth of oil and wheat, it persists in imposing its siege on the people."

He added, “The American blockade is on the Syrian people, who are living in their worst conditions these days, from a winter without fuel and an exorbitant price hike, and its attempts to destroy the exchange rate and raise the price of its dollar, and this is all not only under the eyes of Syria’s Arab brothers, but also with its support and support from some of them in implementing this unjust siege.” ".

Jokhadar pointed out that "Syria considers America a permanent enemy, but what can we say about our Arab brothers who participate in strangling us, starving us, and continuing our bleeding to strangle the Syrian people financially and economically?"

The leader of the Al-Fateh Alliance, Ali Al-Fatlawi, called earlier on the government of Prime Minister Muhammad Shia'a Al-Sudani to reveal to the Iraqi people the new conspiracy that the United States of America is weaving by reducing financial transfers to Iraq, which led to raising the exchange rate of the dollar against the Iraqi dinar.

The exchange rate of the dollar is rising in Iraq, and the authorities are trying to limit the decline of the dinar

link this is in French news

The Iraqi dinar continues to decline slightly against the dollar on Tuesday, while the authorities of this oil-rich country confirm that the decline is "temporary" at a time when the country's reserves of foreign currency have reached an unprecedented level.

The exchange rate on Tuesday reached 1,580 dinars against one dollar, as reported by the official Iraqi News Agency, while the exchange rate set by the Central Bank is 1,460 dinars against one dollar.

This decline in the value of the Iraqi currency against the US dollar began about two weeks ago, and discussing its causes has become a major concern of the Iraqi media.

On Tuesday, Iraqi Prime Minister Muhammad Shia al-Sudani met with the governor of the Central Bank, Mustafa Ghaleb Makhaif, to discuss the issue. Representatives collected signatures for a request to hold an extraordinary parliamentary session on the issue.

The Association of Iraqi Banks indicated in a statement that the high exchange rate resulted from "modifying the mechanism of the foreign currency sale window in the Central Bank of Iraq, according to the requirements of international transactions

Meanwhile, the Central Bank indicated, on Tuesday, that this rise in the dollar exchange rate resulted from “temporary pressures resulting from internal and external factors, given the adoption of mechanisms to protect the banking sector, customers, and the financial system.”

Iraq, an oil-rich country but plagued by corruption and money laundering, ranks 157 (out of 180) in Transparency International's Corruption Perceptions Index.

Sunday, Adviser to the Prime Minister for Financial Affairs, Mazhar Salih, spoke of the existence of "objections" from an international supervisory authority, "regarding some transfers with incomplete information submitted by private banks."

At the same time, Salih reminded that the financial reserves of foreign currency are currently "the strongest in Iraq's financial history, and its balance may have exceeded one hundred billion dollars," considering that "there is no fear or concern about Iraq's financial capabilities in imposing stability in the exchange rates of the dinar."

In an attempt to control this rise, the authorities launched a series of measures that have not yielded results so far, including facilitating the financing of private sector trade in dollars through Iraqi banks, and opening outlets for selling foreign currency in government banks to the public for travel purposes.

Analyst, financial and economic expert, Safwan Qusay, talked about "shaking confidence in the Iraqi dinar" following corruption scandals linked to banks.

He added, in an interview with Agence France-Presse, that there are also reasons related to "the US treasury, which restricted the movement of financial transfers towards some countries." He said that when a trader is unable to obtain dollars through official methods, "he is forced to buy dollars from the parallel market."

He added, "The additional audit process showed that parties were transferring money, but they do not check who is the supplier, what is the value of the invoice, and what is the value of the materials that enter Iraq."

Deputy: Movements to negotiate with Washington and the dollar may return to 120 thousand dinars within 3 months