Oil exports from Kurdistan Region set to resume next week, confirms Iraqi parliament official

Speaking at a press conference, Halbousi highlighted the progress made in recent discussions, emphasizing that key amendments to the budget law and agreements on export routes through the port of Ceyhan are well underway.

In a significant development for Iraq’s energy sector, Haibat Halbousi, chairman of the Iraqi parliament's oil and gas committee, announced on Wednesday that oil exports from the Kurdistan Region will officially resume next week.

The video for this My FX Buddies Blogpost is below here:

Speaking at a press conference, Halbousi highlighted the progress made in recent discussions, emphasizing that key amendments to the budget law and agreements on export routes through the port of Ceyhan are well underway.

“Our meeting focused on amending the budget law and the resumption of oil exports from the Kurdistan Region through the port of Ceyhan. We will meet with the delegation next week,” he stated.

Officials from the Ministry of Oil, the State Organization for Marketing of Oil (SOMO), and the North Oil Company also confirmed the details, signaling a concrete step toward restoring oil exports from the region.

The Iraqi parliament convened on Wednesday to finalize the necessary measures, underscoring a collective commitment to economic stability and strengthening cooperation between the federal government and the Kurdistan Regional Government.

The long-anticipated resumption of oil exports is expected to bring positive economic impacts, reinforcing Iraq’s role as a key player in global energy markets.

News for MAr 19 25

A financial expert advises Iraqis to buy gold.

Financial and economic expert Mohammed al-Hasani called on Iraqi citizens on Wednesday to invest in gold, expecting its price to rise this year.

Al-Hasani told Shafaq News Agency, "All economic indicators indicate that gold prices will witness a rise during the current year," expecting that "an ounce of gold will reach more than $3,200 before the end of 2025."

He explained that "the trade wars waged by the United States, which imposes large tariffs on imported goods, and the corresponding measures taken by other countries, will increase demand for gold as a safe haven for investors," noting that "the inverse relationship between gold and oil causes gold prices to rise in light of these tensions."

Al-Hasani emphasized that "Iraqis can benefit from investing in gold by purchasing it now," predicting that "the price of a mithqal of 21-karat gold will reach 670,000 Iraqi dinars by the end of this year, if the dollar price in the local market remains at its current levels."

It's worth noting that an ounce of gold today reached $3,039, while the price of a mithqal of 21-karat gold in the local market reached 626,000 dinars.

The Central Bank of Iraq lists the reasons for the decline in foreign exchange reserves.

The Central Bank of Iraq announced on Wednesday a decline in its foreign exchange reserves during the third quarter of 2024, explaining the reasons behind this decline.

The bank stated in a report seen by Shafaq News Agency that "Iraq's foreign currency reserves decreased by 0.52% during the third quarter of 2024, reaching 143.35 trillion dinars, compared to the same period in 2023, when reserves reached 144.10 trillion dinars."

The bank attributed this decline to "the Central Bank's resort to withdrawing cash liquidity from the market through enhanced cash sterilization operations, as part of its efforts to maintain monetary stability."

The report added, "As a result of these measures, cash receipts increased from 18.46 trillion dinars to 20.09 trillion dinars during the same period."

He also pointed out that "the decline in oil prices from $82.2 to $77.3 during the same period was another factor in the decline in foreign reserves."

The bank explained that "the increase in receipts led to the depletion of a portion of net foreign reserves, and the issued currency increased from 100.06 trillion dinars to 104.13 trillion dinars, as a result of the increase in public spending, which in turn led to an increase in public debt."

The Central Bank emphasized that "despite this decline, it still possesses large net foreign reserves relative to the money supply, which makes it relatively secure, according to international financial standards that set a minimum of 20%."

It is worth noting that the internal monetary sterilization policy involves the central bank selling or buying financial assets in foreign currency with the aim of avoiding impacting the monetary base and limiting the effects of inflation resulting from cash flows.

The Prime Minister's advisor calls for encouraging investments and improving the business environment in Iraq.The Prime Minister's advisor for financial affairs, Mazhar Muhammad Salih, called for focusing on economic development programs and encouraging local and foreign investments by providing tax incentives and improving the business environment. Saleh also pointed out in a statement to Al Furat News Agency the importance of launching development projects that contribute to creating job opportunities, especially for young people, with the aim of reducing unemployment and poverty. These projects include the Riyada Project and Riyada Bank, in addition to activating the activities of the Iraq Development Fund and the Sovereign Guarantees Committee to finance strategic industrial projects. Saleh emphasized the need to strengthen social protection programs to mitigate the repercussions of economic crises on the poor. These programs are managed with high professionalism, contributing to building buffers that protect the national economy from regional influences and tensions. |

An economist sets a date for the 2025 budget tables to reach Parliament.

Economist Nabil Al-Marsoumi set the date for the 2025 budget tables to reach Parliament on Wednesday (March 19, 2025), indicating that these tables are likely to arrive next April.

In a Facebook post, followed by Baghdad Today, Al-Marsoumi confirmed that the budget will include new indirect taxes, increases to existing taxes, and increases in rental allowances for state-owned properties.

Al-Marsoumi indicated that "Parliament will certainly ratify these schedules next May, following a meeting of the leaders of the political blocs."

In a previous statement, the Prime Minister's financial advisor, Mazhar Mohammed Saleh, announced that the 2025 budget schedules will be submitted to the House of Representatives in the coming days. He added that the total budget will reach 200 trillion dinars, with two-thirds of the budget allocated to employee and pensioner salaries, social welfare, and operating wages.

Saleh revealed that the hypothetical budget deficit would reach 64 trillion dinars, to be financed from domestic sources if oil prices fall below $70 per barrel or exports fall below 3.4 million barrels per day.

Spanish Fashion Chain to Open First Stores in Iraq

Spanish fashion retail chain Inditex has said it will launch its first stores in Iraq this year.

The announcement in the Group's FY 2024 results is part of a general worldwide expansion.

Inditex did not specify which brands will be introduced to Iraq, but the group includes Zara, Bershka, Massimo Dutti, Oysho, Pull&Bear and Stradivarius.

Is the Kurdistan Region turning into a "money exchange" for money smuggled to neighboring countries?

Economic expert Farman Hussein commented on Wednesday (March 19, 2025) on the possibility that the Kurdistan Region could become a "money exchange" for funds smuggled to certain countries, such as Iran, in light of the increasing US economic sanctions on the latter.

"All banks and money transfer companies in the region are currently under the control of the Central Bank of Iraq and linked to the electronic platform, so smuggling from the region is impossible," Hussein told Baghdad Today.

He added, "Kurdistan's banks cannot be a reliable alternative to Iraqi banks, which are subject to US sanctions. These banks are affiliated with political figures and most are dubious and vulnerable to bankruptcy, closure, and sanctions." He emphasized that these banks are not reliable for safekeeping funds.

He pointed out that "smuggling hard currency from the region's banks is difficult, as they, too, are subject to the electronic platform, and money can only be transferred and smuggled to any country through a complex process."

He pointed out that "public money thieves in the region suffer from their inability to transfer funds abroad, forcing them to invest the money in housing projects, commercial buildings, and gas stations instead of depositing it in banks."

The Trump administration has reimposed a "maximum pressure" policy on Iran. The US government says it "seeks to isolate Iran from the global economy and cut off its oil export revenues in order to slow Tehran's development of a nuclear weapon."

Iraq, in turn, was affected by Washington's decision to refuse to renew the temporary waiver granted to Baghdad to purchase gas and electricity from Iran, amid concerns that the Iraqi banking system could be subject to US sanctions.

Finance Committee: Budget tables will not include job grades

Committee member MP Hussein Mounes said in a press statement: "The budget schedules are still unclear in terms of timing," noting that "the budget items have frozen the issue of any addition to job grades, and therefore the budget schedules will not include job grades."

Mounes pointed out that "the three-year budget experiment is both new and good, but it has been plagued by delays," stressing that "we support the adoption of a three-year or five-year budget, provided it includes a government program for a five-year plan to manage the country."

Iranian official: Washington will be forced to grant Iraq a new gas waiver during the summer.

In an interview with the Iranian ILNA news agency, Hamid Hosseini addressed the cancellation of Iraq's exemption from importing electricity from Iran, explaining that Iraq has worked over the past years to rehabilitate its electricity generation infrastructure and has succeeded in establishing a production capacity of approximately 27,000 megawatts. However, not all of this capacity is usable due to fuel supply issues.

He pointed out that "even if full production capacity is operating, there will still be a shortage of between 5,000 and 7,000 megawatts. Under these circumstances, any potential halt to Iranian electricity exports, which range between 1,200 and 3,000 megawatts, will further exacerbate the electricity crisis in Iraq."

The spokesman for the Iranian Oil, Gas, and Petrochemical Products Exporters Union added that 8,000 megawatts of Iraqi power plants rely on Iranian gas. If this capacity declines—as happened this winter—Iraq's total electricity production will fall to 17,000 megawatts, equivalent to nearly half of its needs, leading to a severe crisis, especially during the summer.

Regarding Iraq's payment of Iranian debts and dues, the spokesman explained that the Iraqi Ministry of Electricity is committed, under contracts, to depositing electricity and gas dues into the accounts of the Gas and Twaneer companies at the Iraqi TBI Bank. He emphasized that Iraq typically honors its commitments and seeks alternatives for paying electricity bills to avoid any financial problems.

He pointed out that in recent years, thanks to certain measures, Iraq's debt to Iran has not increased, as Iraq has been able to obtain the necessary licenses annually to pay for imported electricity and gas, stressing that this situation continues to this day.

In conclusion, Husseini emphasized that the 2025 Iraqi elections make power outages a serious challenge for the Sudanese government and political parties, prompting them to exert intensive efforts to once again obtain a waiver from US sanctions.

Iraq forms economic workshop to study dealing with Trump administration

The Ministerial Economic Council decided on Monday to form a ministerial workshop to study how to deal with the new US administration regarding the Strategic Framework Agreement between Iraq and the United States.

The decision was made during the 19th session of the Ministerial Economic Council, held at the Council's building. The meeting was chaired by the Minister of Foreign Affairs and attended by the Ministers of Planning, Trade, Agriculture, and Industry, the Secretary-General of the Council of Ministers, the Governor of the Central Bank, the Chairman of the Securities Commission, the Undersecretary of the Ministry of Oil, the Deputy Chairman of the National Investment Commission, and the Prime Minister's Advisor for Economic Affairs.

According to an official statement, the Council discussed the items on its agenda and took the necessary decisions regarding them. It decided to task the Ministry of Health with submitting a report on claims made by some Turkish companies regarding financial dues owed to them by the Ministry. The Council will coordinate with the Ministry of Finance regarding these claims, with the dues to be based on work completed and supported by the Ministry of Health.

As part of the annual review of the decision to ban the import of juices, soft drinks, and pastries, the Ministerial Council for the Economy recommended to the Cabinet to extend the ban for an additional six months.

He also called on local producers to submit applications to protect the covered national products, in accordance with the Iraqi Products Protection Law No. (11) of 2010, as amended, and directed the Ministry of Trade to follow up on the registration of companies importing food products, and to ensure that suppliers from outside Iraq are “certified and committed to health standards, with the application of strict inspection and control systems.”

The Council also decided to hold a workshop, including the Economic Department of the Ministries of Foreign Affairs and Trade, as well as relevant ministries, to study the TIFA Agreement and discuss "mechanisms for dealing with the new US administration, taking into account the national interest and within the framework of shared interests, particularly with regard to the Strategic Framework Agreement between Iraq and the United States of America."

Urgent | Al-Sadr visits Sistani

Sayyid Muqtada al-Sadr, leader of the Shiite National Movement, visited the highest religious authority, Sayyid Ali al-Sistani, in Najaf.

The outcome or reasons for the visit are not yet known, and no official statement has been issued about the meeting.

#الصدر يزور #السيستاني#عراق_اوبزيرفر #العراق #النجف_الاشرف pic.twitter.com/GE1tXaLU4O

— عراق اوبزيرفر 2 (@iraqobserver2) March 19, 2025

Rashid Bank announces the launch of electronic loans

Rashid Bank announced, today, Thursday, the launch of personal loans for employees, members of the security forces and retirees whose salaries are domiciled with the bank, as well as leadership loans.

The bank explained: "The application is exclusively through the electronic application of Rashid Bank."

Looming monetary problems: Delays in submitting budget schedules to exacerbate Iraq's financial crisis

Iraq is experiencing a deepening financial crisis due to the federal government's delay in submitting its budget proposals to the House of Representatives. The delay has exceeded three months, hindering the implementation of numerous service and economic projects.

A number of MPs called for the speedy submission of the agendas to ensure their passage before the end of the current legislative term, especially with the approaching parliamentary elections, which could lead to an unofficial shutdown of the House of Representatives due to MPs' preoccupation with election campaigning.

In this context, Parliamentary Legal Committee member Aref Al-Hamami stressed that delaying the submission of schedules directly impacts project implementation, disrupts vital sectors, and negatively impacts the national economy and services provided to citizens.

Al-Hamami told Al-Maalouma, “The government is legally obligated to adhere to the constitutional deadlines and submit the schedules as quickly as possible to avoid legal repercussions and ensure they are voted on before the end of the current legislative term.” He warned that "any further delay could exacerbate financial problems and disrupt public spending plans."

For his part, Jamal Koujar, a member of the Parliamentary Finance Committee, explained that the government has confirmed its intention to submit the 2025 budget schedules within the next few days.

Kocher told Al-Maalouma, “The main reason behind the delay is making amendments to the schedules after the House of Representatives voted to amend Paragraph (12A, Second) of the Triennial Budget Law (2023-2024-2025), which relates to increasing the costs of producing and transporting a barrel of oil in the Kurdistan Region from $6 to $16.”

Koger considered that "this reason does not justify the long delay, stressing that this delay constitutes a violation of the Financial Management Law."

For his part, Finance Committee member Mustafa Al-Karawi pointed out that the failure to submit the schedules has led to the suspension of the operating budget, delaying the disbursement of employee benefits, including bonuses, promotions, and certificate calculations, in addition to disrupting many other financial activities.

Al-Karawi told Al-Maalouma, “The government’s delay in submitting the schedules after the end of the fiscal year constitutes a legal violation that negatively impacts the financial activity of government institutions.”

Al-Karawi called on the government to "expedite the dispatch of the schedules to avoid further delays and ensure the continuity of financial operations in the country."

The Prime Minister's Financial Advisor, Mazhar Muhammad Salih, had previously stated that Article (77/Second) of the Federal General Budget Law No. 13 of 2023, which regulates the preparation of the three-year budget, stipulates that the government must send the budget tables for the years 2024 and 2025 to the House of Representatives for approval before the end of the previous fiscal year.

With the continued delay in submitting budget schedules, fears are growing of worsening financial crises and the disruption of government projects, which could significantly impact services provided to citizens.

Rafidain Bank Development - Faleh Dawood Salman

The Central Bank of Iraq, through what the bank’s media office nominates, has announced that meetings were held between the Governor of the Central Bank of Iraq and the working group responsible for developing Rafidain Bank and the consulting firm contracted with, Ernst & Young, without clarifying what was inquired about or the information provided. We state the following:

1- Rafidain Bank is the oldest Iraqi banking institution that provides services to the government and the public under the Bank Law issued in 1941, i.e. before the establishment of the Central Bank of Iraq in 1947. By referring to its Board of Directors, it is noted that it was not limited to government employees, but rather the Board included representatives of the main economic sectors at that time.

2- The bank was responsible for the internal banking process for all sectors and meeting the requests of external operations to pay internal instructions for all sectors and meet the requests of external operations in accordance with the prevailing instructions issued by the Monetary Authority, which was later replaced by the Central Bank of Iraq.

External branches

3- Rafidain Bank was the first Arab bank to open a branch in London at that time, in the year 1952.

4- Rafidain Bank had opened external branches in neighboring countries to cover external operations between Iraq and the beneficiaries in those countries.

5- The travelers’ checks issued by the bank competed with travelers’ checks issued by foreign banks and companies all over the world.

6- Rafidain Bank was carrying out internal clearing operations in the governorates (districts) throughout Iraq before the establishment of branches of the Central Bank of Iraq.

7- Rafidain Bank is responsible for supplying ministries, general directorates and their departments throughout Iraq with the allocated amounts according to an approved mechanism between the bank and the Ministry of Finance.

8- Rafidain Bank was tasked with paying retirement salaries in the early 1970s after the branches of the Retirement Department were abolished.

9- Rafidain Bank bears the burden of merging the nationalized banks and the Mortgage Bank.

10- The number of Rafidain Bank branches throughout Iraq before the development and establishment of Rashid Bank reached 157 branches.

11- Rafidain Bank approved expanding the scope of services with the powers granted to some branches in the main areas of Iraq to facilitate the completion of transactions with the speed required at that time.

12- Adopting a monitoring and follow-up system for all completed operations within an audit and control approach that facilitates the bank’s general management’s knowledge of the financial position and the bank’s internal and external obligations.

13- Developing work by creating departments and sections to undertake tasks and complete work without crowding it in the main departments of the bank.

14- Expanding globally through mutual banking relationships in a manner that serves the local need to use these relationships to complete transactions for all sectors.

15- Importing gold to meet the local market’s need for gold jewelry manufacturing.

16- Providing small loans to employees and those with a specific income within the deposit investment policy.

17- Encouraging the public at that time to invest their savings and assets and monitoring interest rates to encourage the public in addition to enhancing public confidence in the bank and deposits.

18- Expanding the opening of branches in foreign countries according to business requirements.

19- Contribution to some international joint banks.

20- Lending to the government when needed without announcing this, in accordance with the procedures and policies followed and in coordination with the Central Bank of Iraq.

21- Providing the bank's branches spread across Iraq with the payment of salaries in all their forms, by adopting a monthly and annual plan for this purpose, to enable the responsible departments to receive the amounts due to them for distribution to employees and other beneficiaries.

22- Adopting fast methods at that time to complete internal transfer transactions.

Special monitoring

23- Providing foreign currencies to cover the required amounts for specific purposes according to the applicable instructions.

24- Coordination with the Central Bank of Iraq regarding monitoring operations related to funds and requirements for controlling foreign transfers.

25- It is clear from the clarifications referred to that Ernst & Young has approved an authorized Iraqi auditing firm to carry out the work required of the company within Iraq.

Here we want to show the following:

1- The control and auditing of accounts depends on data provided by the competent authorities in the entity subject to auditing, in accordance with auditing norms and auditing regulations, taking into account the rules approved in auditing based on documents.

2- The development process by comparison requires knowledge of the basis of the accounting entry and the requirements for the purpose of making the entry and the documents transferred to it when creating the accounting entry and the mechanism for collecting daily entries to prepare the data and statements required for the work, which are mainly relied upon in the auditing operations.

3- The distribution of powers, competence and experience and their gradation is the basis for completing the work and in accordance with the mechanism approved by senior management, which usually requires the availability of competence and experience.

4- The bank’s operations, in addition to being audited by the responsible supervisory authority in the bank, are audited by the Financial Supervision Bureau, in addition to being audited by the Central Bank of Iraq and the Ministry of Finance, as a basis for their approval.

5- It is assumed that the development proposals submitted are evaluated by banking specialists and practitioners of the aforementioned work in order to fill the gaps in the proposals so that the development process can reach its desired scope.

For this purpose, you can use:

A- Former employees of Rafidain Bank who are known for their competence.

B- Some former employees of the Central Bank of Iraq who were involved in banking supervision, including Rafidain Bank.

C- Some employees of the Ministry of Finance who are related to the bank’s work

D- Former bank customers to share their suggestions. We apologize for the length, but banking requires coordinated attention from all professionals.

banking expert

Al-Maliki: The dollar's rise confirms the government's failure to control the exchange rate

Representative Raed Al-Maliki confirmed, on Thursday, that the rise of the dollar confirms the government's failure to control the exchange rate.

Al-Maliki said, in a statement to / Al-Maalouma / agency, that “the continued rise in the dollar exchange rate reflects the government’s failure to control the monetary market during the past period.”

He pointed out that "the continuation of the crisis may require questioning the governor of the Central Bank or any responsible party related to the rise in the exchange rate."

He stressed "the need to find radical and real solutions to limit this continued rise," stressing the importance of "taking effective measures to control local markets and protect the national economy."

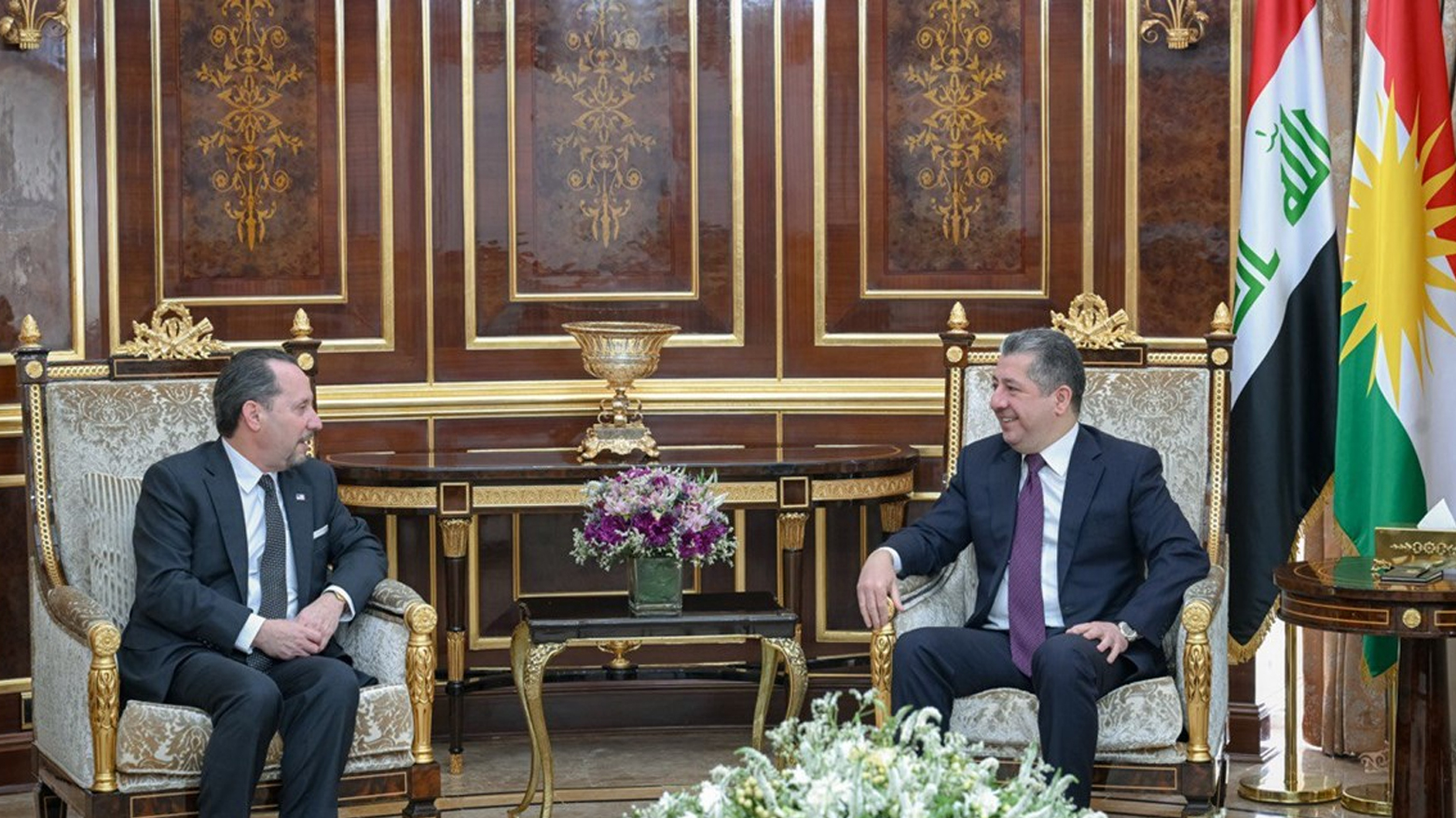

The Prime Minister receives the Chargé d'Affaires of the US Embassy in Iraq.

Kurdistan Regional Government Prime Minister Masrour Barzani on Thursday received the US Chargé d'Affaires to Iraq, Ambassador Daniel Rubinstein.

The meeting, attended by US Consul General to the Kurdistan Region Steve Bittner, discussed the procedures, steps, and ongoing discussions regarding the formation of the new ministerial cabinet of the regional government.

For his part, the Prime Minister confirmed that the process was progressing well and positively, noting that an agreement had been reached on the government's work program.

In another part of the discussions, the importance of resolving the contentious issues between the Kurdistan Region and the federal government and securing the region's share of the general budget was emphasized.

The two sides also agreed on the necessity of resuming the export of Kurdistan Region's oil and removing all obstacles to this process.

Sheikh Janab: Banks should not create obstacles for citizens.

The Minister of Finance and Economy in the Kurdistan Regional Government, Awat Sheikh Janab, stressed the removal of all obstacles facing banks in Sulaymaniyah.

This came during a meeting between the Minister of Finance and Economy and bank managers in Sulaymaniyah Governorate.

The Sheikh directed all banks in the province not to create any obstacles for citizens, offices, or contractors.

Noting that the Ministry will pursue bank managers legally if it is confirmed that problems and obstacles facing citizens exist outside the framework of the law and applicable regulations.

During his meeting with bank directors in Sulaymaniyah, Sheikh Janab emphasized that employees' salary funds should not be used for any business, under penalty of legal prosecution.

The Kurdistan Regional Government's Minister of Finance and Economy stressed that no bank violations would be tolerated.

Kurds renew the constitutionality of Article 140 and warn of plans to kill it politically.

The Kurds renewed their demands for governments and political forces to implement the provisions of Article 140, which represents the key to comprehensive solutions to all the country's problems and ethnic and demographic conflicts over more than 20 years.

The 2005 constitution defined Article 140 as a solution to the Kirkuk issue and the so-called disputed areas between the Kurdistan Region and its neighboring governorates (Nineveh, Diyala, and Salah al-Din).

The Committee for the Implementation of Article 140 of the Constitution defines the disputed areas in Iraq as those subjected to demographic changes and Arabization policies by Saddam Hussein's regime, during his rule from 1968 until his overthrow during the US invasion in April 2003.

The article stipulates a three-stage mechanism: the first is normalization, which addresses the demographic changes that occurred in Kirkuk and the disputed areas during and after Saddam's regime; the second is a census in those areas; and the final stage is a referendum to determine the wishes of their residents, both before December 31, 2007.

The implementation stages of the article were scheduled to be completed by the end of 2007, but security and political problems prevented this.

In 2019, the Federal Supreme Court ruled that Article 140 of the Constitution of the Republic of Iraq would remain in effect until its requirements are implemented and the objective of its legislation is achieved.

Yassin Mohammed Ali, a member of the Salahuddin Council for the Patriotic Union of Kurdistan (

PUK), summarized the reasons for suspending Article 140 as political fabrication and its exploitation as a bargaining chip to form previous governments that paid no attention to its implementation throughout the past cabinets. Ali pointed out in his interview with Al-Mada the existence of regional interventions and pressures to obstruct the implementation of Article 140 as it conflicts with their interests and agendas in the Iraqi state, despite the fact that Article 140 has become almost a dead article due to political neglect and the lack of commitment to the Iraqi constitution, whose provisions cannot be circumvented or its implementation and application neglected.

Ali pointed to the lack of financial allocations and budgets necessary for the implementation of Article 140 throughout successive governments, the normalization of the situation, and the abolition of Baathist decisions (exclusion, deportation, and the change of administrative units) from districts to sub-districts and the transfer of their affiliation from one governorate to another. These problems and practices that affected the components of the people, especially the Kurds, from 1975 until the fall of the previous regime were supposed to be resolved, and they remain without any treatment or solutions.

He added, "Successive governments have not prioritized Article 140, turning it into a dead and inactive article. It will remain ink on paper and will continue to be marginalized in the coming periods."

MP for the Kurdistan Democratic Party, Mahma Khalil, held the federal government responsible for freezing Article 140 and violating Iraqi law and constitution, considering Article 140 a way to restore rights usurped by the former regime and return them to their rightful owners.

In his interview with Al-Madah, Khalil attributed the reasons for neglecting Article 140 by the executive and legislative authorities to the lack of financial cover for foreigners seeking political favors at the expense of people's rights, and the lack of desire and seriousness on the part of political forces to implement Article 140, which has caused dire problems resulting in the continuation of property disputes and the remaining of usurped lands at the disposal of usurpers, which were legalized by the former regime.

Mirwis indicated in his interview with Al-Mada that the problems of Article 140 exist and are not limited to the disputed areas, but extend to the central and southern governorates, and everyone must defend and revive it and stay away from narrow national and political interests.

Murad Kirkuki, a researcher in political affairs, said that Article 140 is constitutionally alive and cannot be circumvented, even by continuing The political obstruction refusing to implement it by the Arab forces and other components rules out any serious steps to resolve Article 140 in the coming years in light of the current circumstances, the exacerbation of financial problems between Baghdad and Erbil, and the freezing of dozens of laws affecting the relationship between the central government and the regional government.

He continued his talk to (Al-Mada) that some see it as "expired" according to its term in the 2008 constitution, wondering how it could be terminated without being implemented? He considered the existence of Article 140 and its inclusion in the constitution in 2005 to have occurred in the absence of the political component, which the aforementioned component considered an act of unilateralism and a crushing of wills at a time when the country was experiencing political chaos, unrest, and near-international isolation.

Salem Al-Obaidi Bari, a member of the Arab Council in Kirkuk, said that Article 140 has expired and is dead, and there is no room for its implementation in the conflict areas that have come under state administration and are on the correct administrative path in Kirkuk, Diyala, Salah al-Din, and the outskirts of Nineveh.

Al-Obaidi told Al-Mada that talk about implementing Article 140 would spark new conflicts and crises that would re-divide the country and cause administrative and security chaos, the price of which would be paid by the disputed areas. He considered that Article 140 had lost its legitimacy and legality due to the difficulty of holding a popular referendum to determine the desires of the residents of the disputed areas to join the region or be under the administration of the central government. At the same time, he added, "Conducting a population census is the first positive step towards implementing Article 140 by the coming governments, in addition to the initial initiatives after the approval of the law to return seized properties to their owners.

The head of the parliamentary regions committee, Khaled Hassan Al-Daraji, downplayed the importance of Article 140 and the consequences of neglecting and freezing it, saying, "Those concerned no longer ask about Article 140 and have forgotten it, and you are asking," referring to Al-Mada's correspondent.

Al-Daraji declined to make any statement on the matter, saying only, "There have been no developments or changes that require discussing Article 140. There are more important issues and laws that are being discussed and debated politically within the halls of the Iraqi parliament.

France and Britain at the forefront... A government advisor reveals the map of international investments in Iraq.

On Thursday, the Prime Minister's Advisor for Investment Affairs, Mohamed El-Naggar, identified the sectors most attractive to local and foreign investors, while pointing out the challenges they face. He emphasized that most international agreements have been implemented, while others are on their way to implementation.

Al-Najjar told the Iraqi News Agency (INA): "There are two main sectors for attracting investment: the energy sector and real estate development, which attract large sums of money. While the focus was on the industrial, services, and agricultural sectors by domestic investments, foreign investments did not enter in the way we had hoped for, and there are some investments in the energy sector, but they are modest."

Al-Najjar explained that “there is a real exploratory movement in this market, some of which has reached the decision-making stage, while others are studying the matter. However, the main obstacles are the lack of a legal environment that allows foreign investors to operate transparently in this field.” He indicated that “the laws need to be amended and adapted to the requirements of the twenty-first century.”

He pointed out that "the largest investing countries in the country are France, given its Total contract, and Britain, which holds the BP contract, followed by other countries," noting that "there are some Saudi investments, but they are contingent on the protection of Saudi investment, which has not yet been approved by Parliament."

He pointed out that "there are some diverse Gulf investments, along with a significant amount of Egyptian investments, but a large portion of them are under study."

Al-Najjar emphasized that “there is a strong desire to implement international agreements, but some of them are subject to problems related to subsidiary laws, as the war that occurred on October 7th affected the movement.” He explained that “most of these agreements are between two countries, and they need time to be implemented. Some of them are being implemented, while others are on the way.”

Final accounts saga threatens 2025 budget schedules

Despite governmental and parliamentary efforts to address this issue, disagreements persist over the mechanism for settling actual spending for previous years, threatening to disrupt next year's financial plans.

Economic expert Salah Nouri told Furat News that: "The failure to submit the state's final accounts with the draft budget law constitutes a violation of constitutional Article 62-First, which stipulates: The Council of Ministers shall submit the draft general budget law and the final accounts to the House of Representatives for approval.

" He added, "It is very important to study the draft general budget law in comparison with the implementation of the previous budget and implementation rates, and to identify the reasons for deviations and shortcomings in the investment budget projects."

Nouri explained that "the final accounts are audited by the Federal Board of Supreme Audit, thus enabling the House of Representatives to compare the final accounts and the observations contained in the Board of Supreme Audit's report with the draft general budget law and correct the allocation of resources to the current and investment budgets."

EXCLUSIVE: Iran's Qaani in Baghdad for high-level talks

Iran’s Quds Force Commander Esmail Qaani made an unannounced visit to Baghdad for high-level discussions with Iraqi political and military leaders, a senior source told Shafaq News.

Qaani met with leaders of the Coordination Framework, commanders of armed factions, the Popular Mobilization Forces (PMF), and Iran’s ambassador to Iraq. Talks focused on Iraq’s neutrality in regional conflicts, particularly in Syria, and the need to keep security control under state authority.

The meeting also addressed the fallout from recent US airstrikes on Yemen’s Houthis (Ansarallah) and broader regional developments. According to the source, Qaani conveyed Tehran’s position, urging Iraq to maintain its balanced stance and avoid aligning with any party. However, he warned that “Iran would not remain silent if Iraq were targeted by Israeli strikes,” pledging support for “any response” from the Iraqi government or allied factions.

Qaani’s visit comes amid growing US pressure on Baghdad. Sources revealed that US Defense Secretary Pete Hegseth, in a call with Iraqi Prime Minister Mohammed Shia al-Sudani on Sunday, issued a strong warning. He cautioned that any intervention by Iraqi armed factions against US operations targeting the Houthis in Yemen would trigger an American military response inside Iraq.

Hegseth also urged al-Sudani to accelerate efforts to disarm and dismantle these factions, a key priority for President Donald Trump’s administration. In response, al-Sudani reportedly affirmed that his government is in dialogue with armed groups to find a resolution.

The warnings come as Israel resumes airstrikes on Gaza, ending a fragile ceasefire that had been in place since January. They also coincide with US strikes on Houthi targets in Yemen following threats to maritime navigation, as new Iraqi armed factions emerge, vowing "jihad" to defend Iraq and Yemen against US military operations.

Central Bank Governor: We are working to establish a data center that will be a success factor for digital transformation

link

The Governor of the Central Bank of Iraq, Ali Al-Alaq, confirmed on Thursday that the digital currency the bank intends to launch will enhance transparency and limit the flow of cash out of banks. He also revealed plans to establish a data center that will serve as a successful foundation for digital transformation.

Al-Alaq told the Iraqi News Agency (INA): “Financial technologies are developing rapidly, in line with the requirements of the financial and banking sector in terms of speed, accuracy, and economic efficiency, in addition to transparency and oversight. The reality of the digital revolution is imposing itself on all sectors, including the financial and banking sector, which stands to benefit most from the major transformations taking place.”

He added, “Digital currency can serve many purposes, limit the flow of cash outside banks, and achieve a high degree of transparency, as funds can be tracked, whether in the areas of consumption, investment, savings, or even in legitimate and illegitimate businesses. It also provides important databases for analysis purposes, not just for the movement of paper money, in addition to the economics that digital currency offers through printing and tracking currency.”

Al-Alaq confirmed that “we have begun taking steps in coordination with international organizations to review initial experiments in the digital currency file, which we do not wish to be late in,” explaining that “there are existing experiments in some countries in the region, and we are also following up with the Arab Monetary Fund to develop appropriate steps in this direction, and what is required is infrastructure.”

He continued, "The Central Bank possesses advanced infrastructure. The new bank building houses a sophisticated data center, and we are working to establish a data center that will represent a successful foundation for digital transformation."

Sudanese advisor: Digital transformation of the national currency is a step towards financial system stability.

The Prime Minister's Advisor, Mazhar Mohammed Saleh, stated on Thursday that the digital transformation of the national currency is an important step towards enhancing the stability of the national financial system.

In a statement to Al-Sa'a Network, Saleh stated that "the digital transformation of the national currency represents a stable and transparent payment instrument that contributes to improving the efficiency of the national economic system ."

He explained that "digital currency differs from paper currency only in terms of improved transaction speed and system quality, which reduces costs and provides greater control over payment flows ."

He added that "this transformation provides the Central Bank with a greater opportunity to implement its regulatory and supervisory policies, while ensuring high confidentiality in citizens' financial transactions." He noted that "the digital currency will become part of global payment systems while maintaining its exchange value as paper currency," in addition to its "role in settling payments and transferring funds into foreign currencies in a transparent manner ."

He stressed that "this step will contribute to enhancing financial inclusion, especially for the most vulnerable segments of society, by facilitating their access to the banking system, and that digital transformation contributes to combating financial crimes such as money laundering ."

He explained that "Iraq will gradually enter the era of digital financial technology, in cooperation with the global financial and technical community," noting that "this process requires two basic conditions: a high level of digital monetary culture among the public, and an advanced infrastructure, both electronically and legally ."

He pointed out that "the exchange rate system in Iraq, for more than six decades, has been based on pegging the Iraqi dinar to the US dollar," stressing that "the transition to the digital dinar will not affect the value of transactions or financial transfers ."

Central Bank: Digital currency reduces cash flow outside banks

On Thursday, March 20, 2025, the Governor of the Central Bank of Iraq, Ali Al-Alaq, described digital currency as "limiting the flow of cash outside banks." He also spoke of a plan to establish a data center that would serve as a foundation for digital transformation.

The Iraqi government faces challenges in managing dinar liquidity, as it suffers from a chronic shortage of this currency, affecting its ability to meet its financial obligations to pay employee salaries, repay debts, and finance projects.

Al-Alaq said in a press statement followed by Al-Jabal, "Financial technologies are developing rapidly, in line with the requirements of the financial and banking sector in terms of speed, accuracy, and economic efficiency, in addition to transparency and oversight. The reality of the digital revolution is imposing itself on all sectors, including the financial and banking sector, which stands to benefit most from the major transformations taking place."

He added, "Digital currency can serve many purposes, limiting the flow of cash outside banks and achieving a high degree of transparency, as funds can be tracked, whether in consumption, investment, savings, or even in legitimate and illegitimate businesses. It also provides important databases for analytical purposes, not just for the movement of paper money. In addition, digital currency offers economies of scale, including the ability to print and track currency."

Al-Alaq explained, "We have begun taking steps in coordination with international organizations to review initial experiments in the digital currency file, which we do not wish to delay." He noted, "There are existing experiments in some countries in the region, and we are also following up with the Arab Monetary Fund to develop appropriate steps in this direction, and what is required is infrastructure."

He continued, "The Central Bank possesses advanced infrastructure. The new bank building houses a sophisticated data center, and we are working to establish a data center that will represent a successful foundation for digital transformation."

The Central Bank of Iraq previously announced its move to issue a digital currency as an alternative to paper currency, a shift that could reshape the payments landscape and the national economy entirely.

This move comes in response to "increasing challenges in managing traditional cash," amid a global trend toward financial digitization.

Al-Alaq said, "The financial and banking system will witness fundamental transformations, including the decline of paper currencies and their replacement by digital payments by central banks." He explained that "the Central Bank is moving to create its own digital currency to gradually replace paper transactions, as is happening at some central banks around the world

.png)

No comments:

Post a Comment