The Minister of Finance reviews Iraq's economic situation and reform programs in Washington.

another headline

Iraq presents its economic vision for 2050 to the World.

Sudanese Advisor: Electronic financial inclusion has risen to more than 40%

Prime Minister Saleh Mahoud Salman's advisor confirmed on Friday that the government is continuing to implement comprehensive strategic banking reforms, noting that the government is committed to continuing to implement the economic and financial reform program

"The government is committed to continuing to implement the economic and financial reform program aimed at enhancing the efficiency of the banking system and supporting sustainable development in the country," Mahoud said in a speech he delivered during his participation as a government representative in the banking reform conference organized by the Central Bank of Iraq in cooperation with the international consulting firm (Oliver & Ayman) at the Ritz Carlton Hotel in Washington, DC, on the sidelines of the meetings of the International Monetary Fund and the World Bank.

He stressed that "the banking sector represents a fundamental pillar in the economic reform process," indicating that "the government is continuing to implement comprehensive strategic banking reforms in cooperation with the Central Bank of Iraq, aimed at raising banking standards and enhancing the competitiveness of the financial system."

He explained that "the government has prepared a three-year general budget for the first time, which allows for long-term financial planning, achieving stability in resource management, and enhancing the confidence of local and international investors."

In the context of diversifying revenues and reducing dependence on oil, he explained that "the government has achieved tangible progress in automating the customs system by implementing the United Nations (ASYCUDA) system, which has led to a clear increase in customs revenues in addition to a significant improvement in tax revenues," noting that "the government has implemented a program to restructure government banks (Al-Rafidain, Al-Rasheed, Industrial, and Agricultural) in cooperation with international consulting companies, With the aim of raising its efficiency and enhancing its ability to provide modern financial services.

He pointed out that "the government launched programs to expand the use of electronic payment and partnerships with financial technology companies, which contributed to raising the financial inclusion rate to more than 40% after it was less than 10% two years ago, which was praised by the World Bank and the International Monetary Fund," stressing "the government's support for small and medium enterprises by providing financing and resources to create new job opportunities and stimulate the local economy."

Salman stated that "the banking reforms currently being worked on constitute a turning point in the history of Iraq's economic development, and that the government is determined to support all local and international institutions working to develop the banking sector, as it is a pivotal part of the economic growth and financial stability plan."

He noted that "the government extended its appreciation to the Central Bank, banks, and international and local advisory teams working in this field".

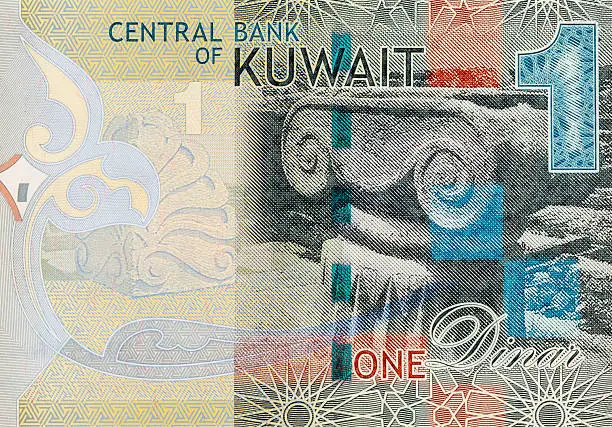

How did a Gulf nation barely bigger than Nagaland build the world’s most powerful currency?

Despite its modest size, Kuwait boasts the world's most valuable currency, the Kuwaiti Dinar (KWD), with an exchange rate of approximately 1 KWD = 3.26 USD.

1. Kuwait: A Tiny Powerhouse

Kuwait, a small nation of approximately 5 million people, occupies just 17,818 square kilometres, slightly larger than India's Nagaland. Despite its modest size, Kuwait boasts the world's most valuable currency, the Kuwaiti Dinar (KWD), with an exchange rate of approximately 1 KWD = 3.26 USD. Its compact geography and strategic Gulf location allow it to efficiently manage infrastructure and economic policies that reinforce its currency strength.

The Oil Wealth Advantage

Kuwait's economic strength stems from its vast oil reserves, ranking among the top globally. The country has a crude oil production capacity of 3.2 million barrels per day. Oil exports constitute a significant portion of its GDP, contributing to a nominal GDP of $160 billion. This concentrated resource wealth provides a continuous inflow of foreign currency, supporting both the dinar and government spending.

Strategic Currency Pegging

The Kuwaiti Dinar's high value is maintained through a strategic peg to a basket of international currencies, rather than a single currency like the US Dollar. This approach allows Kuwait to manage its currency's value more effectively, insulating it from fluctuations in any single foreign currency. The peg also provides predictability for trade, investment, and international contracts.

Fiscal Discipline and Sovereign Wealth Fund

Kuwait's government exercises fiscal discipline, with a low unemployment rate and moderate inflation. The country also manages a substantial sovereign wealth fund, the Kuwait Investment Authority, which invests globally, further bolstering its economic stability. These investments act as a buffer against oil market volatility and enhance the long-term strength of the dinar.

Limited Domestic Market

With a population of just over 5 million, Kuwait's domestic market is limited. However, this constraint is offset by its strategic location and strong trade relations, particularly in the oil sector, which drive economic growth and support the high value of its currency. The government also leverages free trade zones and international partnerships to expand its economic reach beyond domestic consumption.

High GDP Per Capita

Kuwait's GDP per capita stands at approximately $32,000 (nominal) and $51,000 (purchasing power parity). These figures place Kuwait among the wealthiest nations globally, reflecting its economic prosperity and the strength of its currency. High per capita income allows for significant domestic savings and investment, which further stabilises the dinar.

Political Stability Amid Challenges

Despite facing political challenges, including parliamentary dissolutions, Kuwait maintains a relatively stable political environment compared to many of its regional counterparts. This stability contributes to investor confidence and supports the strength of the Kuwaiti Dinar. Strong institutions and consistent regulatory frameworks also encourage foreign capital inflows.

Diversification Efforts

Recognising the volatility of oil prices, Kuwait is actively pursuing economic diversification. Investments in sectors such as finance, real estate, and infrastructure aim to reduce dependency on oil revenues and ensure long-term economic stability. These initiatives also create employment opportunities and stimulate private-sector growth.

Kuwait's economic strength and strategic location enhance its influence in the Middle East. It plays a significant role in regional organisations and maintains strong diplomatic relations, further supporting the value of its currency. The country’s reputation for stability makes it a hub for regional banking, finance, and investment.

Comparison with India

In contrast, India's currency, the Indian Rupee (INR), is valued at approximately 1 USD = 87.9 INR in 2025. Factors such as a large population, trade deficits, and inflation contribute to the lower value of the INR compared to the Kuwaiti Dinar. While India’s economy is rapidly growing, structural challenges and fiscal pressures limit the rupee’s global strength. Kuwait's rise to having the world's most powerful currency is a testament to the effective management of its oil wealth, strategic fiscal policies, and efforts towards economic diversification.

Government advisor: The Central Bank is leading a comprehensive shift towards reform.

The Prime Minister's financial advisor, Mazhar Mohammed Salih, affirmed on Thursday that Iraq's commitment to international standards paves the way for the return of dollar transactions, attracting foreign investment, and expanding financial inclusion. He emphasized that the banking reform process is ongoing and irreversible.

"Iraq's commitment to international standards and banking transparency means the Iraqi financial system is entering a phase of radical reform, which will enhance international confidence and qualify it to be an active player in the global economy," Saleh said in an interview with the Iraqi News Agency, followed by "Al-Eqtisad News." He pointed out that "the most notable gains are not limited to the return of dollar transactions to national banks, but also include attracting investments and expanding financial inclusion."

He explained that "adherence to international standards requires banking institutions to adhere to anti-money laundering and counter-terrorism financing rules, implement transparent accounting and oversight systems, and digitally transform the banking infrastructure, including electronic payment systems and unified financial reporting."

He continued, "This also includes opening up to reputable international financial services, by contracting with global companies to develop banking systems, particularly financial auditing and fintech firms." He added, "This commitment places Iraq on the map of the global financial system and gives it the opportunity to integrate with international correspondent banks."

He added, "The gains that will benefit Iraq will also lead to the restoration of dollar transactions with international banks, after some Iraqi banks were deprived of them due to poor compliance issues. They will also attract foreign investment, as investors seek a transparent and secure financial environment. They will also enhance financial inclusion by integrating broad segments of citizens into the banking system through digital services. They will also improve Iraq's credit rating, which will positively impact its ability to obtain international financing on better terms."

He pointed out that "enhancing confidence in the Iraqi banking system is achieved through the confidence of international banks that will deal with the modernized banking system, which is compatible with international standards, which opens the door for Iraq to deal with correspondent banks in Europe and America. The confidence of the Iraqi citizen in the modernized banks is also increasing, and he begins to feel safe dealing with them, especially with the development of electronic services and the reduction of risks, in addition to the confidence of international companies contracting with Iraq, which are looking for a transparent financial environment that guarantees the integrity of transfers and contracts."

He pointed out that "the level of progress in the field of banking reform, sponsored by Prime Minister Mohammed Shia al-Sudani within the government's program and its implementation, and in cooperation with the Central Bank of Iraq, came in accordance with the 2025 Banking Reform Document."

He added, "The Central Bank of Iraq is leading a comprehensive shift toward reform, including increasing capital in consultation with the banking system and implementing comprehensive governance."

He explained that "the development of modern digital systems is no longer an option, but a necessity, and this has already begun in some leading banks, despite ongoing challenges, such as historically weak trust and varying levels of preparedness among banks." He emphasized that "the reform path is clear and irreversible."

Al-Maliki, US diplomat discuss bilateral ties, November vote

State of Law Coalition head Nouri Al-Maliki met with U.S. Embassy Chargé d’Affaires Joshua Harris on Wednesday in Baghdad to discuss bilateral ties and regional developments, including efforts to halt the war in Gaza.

According to a statement from Al-Maliki’s office, the two discussed “ways to strengthen bilateral relations between the two countries.”

Al-Maliki reiterated Iraq’s intention to deepen cooperation with the United States and said Iraqis are ready to “participate in the electoral process and choose their representatives… to form an elected government that represents the aspirations of the Iraqi people.” Upcoming parliamentary elections arre set to take place on Nov. 11.

Al-Maliki remains an influential figure in Iraqi politics a decade after his premiership ended.

The State of Law Coalition, with 38 seats, is a key member of the governing Coordination Framework.

Statement from Al-Maliki’s media office:

The head of the State of Law Coalition, Mr. Nouri Al-Maliki, received the Chargé d’Affaires of the United States Embassy in Iraq, Mr. Joshua Harris, at his office today.

During the meeting, they discussed ways to strengthen bilateral relations between the two countries in order to serve the interests of both friendly peoples. The two sides also reviewed regional and international developments, as well as recent international efforts and the role of the United States in helping to halt the war in the Gaza Strip.

Mr. Nouri Al-Maliki emphasized Iraq’s desire to continue cooperation and establish strong relations and partnership with the United States through the activation of the Strategic Framework Agreement signed between the two countries.

He also noted the Iraqi people’s readiness to play their role in participating in the electoral process and choosing their representatives in the Council of Representatives, paving the way for forming an elected government that represents the aspirations of the Iraqi people.

For his part, Mr. Joshua Harris expressed hope for enhancing cooperation between Baghdad and Washington in a way that supports security and stability in Iraq and the region.

Al-Maliki: We want all of Iraq's money to be spent on the well-being of the people!

A speech at an election conference"

The head of the State of Law Coalition, Nouri al-Maliki, stressed the importance of broad and conscious participation in the upcoming elections as part of strengthening the democratic process in Iraq, stressing that the elections are what determine the features of the political process and give Parliament the ability to legislate laws and hold the government accountable. He also pointed out that the people are the ones who make governments and determine the political path of Iraq, stressing that Parliament contributes to protecting Iraq's sovereignty and independence. Al-Maliki called for the need to emphasize Iraq's unity and reject any partition projects, warning against foreign interference that threatens the country's sovereignty.

Al-Maliki said in a speech during the electoral conference of the candidate of the State of Law, Bushra Murad Juwaid Al-Janahi, who followed :

We wish Iraq the success of the elections and continued giving to the political process, and that Iraq will continue on the path of confrontation, success, and transition from one success to another.

Elections are what shape the political process, and they give us the House of Representatives, through which the three presidencies proceed.

Parliament legislates laws, approves the government's program, supports it, and holds it accountable, and the political process will not succeed unless there is a parliament in which there are men and women who carry the concern of the homeland.

The House of Representatives monitors the state, corrects the course, establishes and changes the government, legislates and amends laws, and Parliament affirms the important and central strategic political principle of the peaceful transfer of power, which is the spirit of the democratic process.

He pointed out that the peaceful transfer of power today takes place through elections and not through tanks and military coups, and everyone must believe in Iraq, the constitution and the law.

The people are the ones who will create governments and create the path, and they are the ones who will enjoy Iraq's bounties, explaining that Parliament is the one that gives us a strong and impregnable political Iraq in which no conspirator can distort Iraq's path or bring down the political process.

Parliament gives us an Iraq that is good at dealing with neighboring countries. The senseless wars, the use of chemical weapons, and mass graves are all crimes produced by the mentality of the buried Baath Party.

Elections give us an Iraq that protects its sovereignty from foreign interference, and we will not allow anyone to interfere in our political affairs or affect our status and sovereignty.

What Parliament produces gives us a unified Iraq under the Constitution and the law, and we affirm the unity of the people and the unity of the nation in order to prevent any project of division.

Iraq, with its components, will remain strong and impregnable against partition projects. Iraq's strength lies in the harmony of its components. Wars, mass graves, chemical weapons, deprivation, and the execution of scholars and authorities are all negative effects left behind by the buried Baath regime.

We must participate widely and consciously in the elections, which is a sincere position, expression, and sense of responsibility, and the success of the elections is a message of reassurance to the interior and exterior that Iraq is fine.

Iraqis have paid a high price to participate in the elections and the democratic process, and we in the State of Law Coalition want the good for our people, stability and prosperity, to benefit from the country's wealth and a decent life, and for Iraq's money to be spent entirely on the well-being of its people.

It is not permissible to demolish the homes of the poor except by providing an alternative, and no official has the right to demolish people's homes. Our position is firm in defending Iraq politically, security-wise, and economically.

Government Advisor: We will switch to the Financial Management Law in the absence of the 2026 budget

Government Financial Advisor Mazhar Muhammad Saleh said, ”The delay in budget schedules has many reasons, as the budget is approved in accordance with Law No. 13 of 2023, and the House of Representatives is informed of the financial situation, and there is a broad consultation circle between the House of Representatives and the Ministry of Finance, and there is information about everything and daily deliberations”.

Saleh added in a press statement: ”The fiscal year will end, but things are going normally, spending, salaries, projects are going well, some things, and this is normal because there is no budget that is implemented 100%“.

The financial advisor explained: ”The budget was affected by fluctuations in oil prices, and the oil markets are unstable due to the war in Ukraine, the war in the region in Gaza, and the targeting of Iran, i.e. geopolitical tensions”.

He continued, ”If we enter the year 2026 and there is no budget, we will move to work on Financial Management Law No. 6 of 2019, as amended, and the disbursement will be 1/12 of the actual current expenditures for the previous year, i.e. 2025, until a new parliament is elected and a new budget law is approved, and the matter depends on the elections and what they produce”.

Want to Support My FX Buddies?

Support My FX Buddies Big or Small I appreciate it all

BuyMeACoffee CashApp:$tishwash

https://paypal.me/tishwash

dollar alternative

The government is out of the equation. Gold swallows the Iraqi dinar and turns into a currency for "money laundering"

Iraq is witnessing an unprecedented wave of rise in gold prices, in light of the decline in the state's monetary instruments, and increasing indications of the expansion of the influence of parallel financial networks that exploit market and legal loopholes. This crisis, which began in a market affected by the London and New York stock exchanges, has turned into a mirror of the comprehensive crisis of confidence that the Iraqi economy is experiencing. Experts believe that the yellow metal is no longer just a commodity linked to supply and demand, but has become an accurate indicator of the depth of the imbalance in the relationship between monetary policy and the real economy, and of the government's failure to protect the market from waves of speculation and currency smuggling.

Economic expert Nasser Al-Kanani explained to «Baghdad Today» that “the continuous rise in gold prices in the local market is directly due to global price fluctuations, as Iraq does not have the tools to intervene or the ability to control this market, which is governed by the centers of the global stock exchange”. He pointed out that “the absence of local gold production has made the country hostage to fluctuations in foreign markets, as every rise in London or New York is immediately reflected in Baghdad, Najaf and Basra, without any government ability to mitigate its severity”. Economic observers confirm that the continuation of this situation means that Iraqi monetary policy operates in a completely exposed environment, and that the Central Bank has lost the ability to manage the price balance after markets began to operate according to the logic of global supply and uncontrolled domestic demand.

Al-Kanani adds that “geopolitical factors and decisions related to interest rates in the United States, in addition to the dollar's movements in the markets, are the main drivers of gold prices currently, while the Iraqi government is content with the regulatory role through the Central Bank and the Tax Authority, without any real tools for control”. Financial researchers point out that this reality reflects the fragility of the structure of the Iraqi economy, which depends on full imports and lacks internal protection strategies or monetary budget policies that allow it to absorb shocks, which has made the local market operate on the principle of absolute freedom of trade, without a balance between economic freedom and the requirements of financial stability.

In light of this scene, citizens are increasingly buying gold as a means of saving, with confidence in the dinar declining and its exchange rate fluctuating against the dollar. Al-Kanani warned that “random speculation on gold exacerbates the crisis, because it raises domestic demand to unrealistic levels and increases pressure on prices”, adding that “the government has lost the ability to control this wave, at a time when prices move on a daily basis based on the general mood of speculators and not on well-thought-out economic decisions”. Financial market observers confirm that citizens' behavior towards gold has become a direct reaction to the weakness of financial and banking institutions, and that the loss of confidence in the national currency has prompted the popular economy to search for alternatives that preserve value even if they are outside the control of the state.

On the other hand, the gold crisis intersects with what anti-corruption specialist Yassin Al-Taie calls “the economy of prestige”, that is, the use of illicit funds to build a new social image known as “reputation laundering”, a phenomenon that has become associated with money laundering in recent years. Al-Taie told «Baghdad Today» that “there is a close connection between money laundering and reputation laundering, as both are part of a single strategy practiced by influential parties in the black economy, aiming to circumvent the law and obtain social cover that allows them to expand in the economic and political fields”. Observers point out that this shift in the behavior of owners of illicit capital reflects a change in the form of corruption itself, as its goal is no longer only illegal enrichment, but rather building a network of influence that fortifies corruption within societal institutions.

Al-Taie explains that “these parties resort to establishing commercial companies that appear to be legitimate, or financing cultural and charitable events, to gain the trust of society and grant themselves moral immunity that prevents them from being held accountable”. Oversight specialists say that these practices have distorted the local economic environment and eroded confidence in public institutions, because corruption is no longer hidden or confined to government agencies, but has begun to penetrate the public space under the banners of charitable work and civil investment. Al-Taie adds that “some entities benefit from loopholes in the laws and their relationships with some influential circles to expand their activities without oversight”, which observers see as a clear threat to the principle of institutional justice and equal economic opportunities.

Economists believe that the combination of loss of monetary control and money and reputation laundering represents a dangerous model of what is known as the “dual economy”, where the formal economy operates according to the rules of the state, while the parallel economy operates according to the rules of interests. Observers confirm that “today's gold market is the legal front for the parallel economy, through which money is recycled and its sources are hidden, while all operations on paper appear legitimate”, noting that this phenomenon “keeps the state in a position of spectator while informal money moves freely within institutions”.

Economic researchers believe that addressing the crisis requires rebuilding control mechanisms for gold trade and imports, and linking them to a unified financial tracking system supervised by the Central Bank and the Anti-Money Laundering Authority, similar to what is applied by European Union countries. Economists point out that “the existence of a national registry for gold traders that requires them to disclose sources of financing will contribute to blocking smuggling and money laundering networks”, adding that “the absence of this type of transparency makes the market an ideal place to pass illegal capital under the cover of legitimate trade”.

Observers agree that continuing this path will deepen the loss of confidence in the national currency, and transform gold into an alternative currency outside the banking system, which will restrict the central bank's ability to manage liquidity, and increase the possibility of Iraq being exposed to new international financial pressures. Economists believe that “the country needs a flexible and integrated monetary policy that links financial stability with security control over the movement of funds”, while anti-corruption specialists confirm that “any reform that does not confront reputation laundering with the same level of seriousness with which money laundering is confronted will remain a formal reform”.

According to economic observers, “the crisis has gone beyond the market stage to become a crisis of national confidence”, indicating that gold today is no longer only a measure of wealth, but “an indicator of the extent of the state's weakness in the face of unregulated money”. Researchers stress that regaining control of the gold market is not only a matter of prices, but also a test of the government's ability to restore discipline to its financial system, prevent wealth from becoming a means of influence, and the economy from becoming an area of penetration for organized corruption.

Oil is faltering and religion is rising.. An expert warns of a financial crisis and calls for bold decisions that protect the poor

Economist Nabil Al-Marsoumi warned today, Thursday (October 16, 2025), of a looming financial crisis, against the backdrop of the sharp decline in global oil prices, noting that current indicators portend a difficult economic phase if bold and thoughtful decisions are not taken.

Al-Marsoumi said in a post followed by "Baghdad Today" that "Brent crude prices have fallen to about $61 per barrel, with expectations that they will fall below $60 in the coming period," indicating that "the current price is not even enough to cover the salaries of state employees."

He added, "The continuation of this decline may lead to internal debt rising to dangerous levels by the end of the year, reaching three decimal places, which constitutes great pressure on the general budget".

Al-Marsoumi stressed that "Iraq is facing a real economic challenge today," calling on the government to "show courage and boldness in confronting the crisis, while being careful not to harm the poor and low-income groups, who will be the first to be affected by any uncontrolled austerity measures."

Washington sanctions expose Iraq’s shadow economy

Just five days after I warned in my article, “The Dark Side of Iraq’s Economic Boom,” that Baghdad’s skyline was rising on a foundation of dirty money, Washington confirmed it. Before the announcement, a senior US official had told me privately: “The networks behind these projects are already on our radar, and the administration is prepared to act.” I knew what was coming. That private conversation made one thing clear: enforcement was not a question of if, but when. Days later, it happened. On October 9, the US Treasury imposed sweeping sanctions on Iraq’s militia-linked business networks, exposing a financial web long hiding in plain sight. These sanctions did not just target individuals; they revealed an entire economic architecture built on militia finance, sanctioned capital and a shadow economy now embedded within the Iraqi state.

Over the past year, Iraq has presented the world with the image of renewal, a skyline rising, cranes crowding Baghdad’s horizon, and foreign investors testing the waters of a once-closed market. But beneath that narrative runs a different reality: an economy dominated by political patrons, militia financiers and networks tied to Iran’s Revolutionary Guard. Washington’s latest move exposes that reality and places Iraq squarely at the centre of a larger contest, the financial front in Washington’s campaign to dismantle Tehran’s proxy networks.

Iraq is no longer merely influenced by militias, it is being run like one. A silent merger has taken place between the state and its shadows, where ministries award contracts to frontmen and banks launder millions for Iran’s most dangerous proxies. Entire sectors, from construction to commerce, fuel the militia economy. The US Treasury’s latest sanctions offer a rare X-ray: an economy rewired for corruption, powered by militia capital and cloaked in the language of reconstruction. What began as insurgency has become infrastructure.

Iran’s proxies have learned that cement and steel can do what rockets never could: embed themselves within the machinery of the Iraqi state. And their reach does not stop at government contracts or construction sites. It stretches into hotels, restaurants, cafés, fast food outlets, fashion outlets, retail businesses and Western franchises, businesses that appear ordinary, but often serve as fronts for laundering money, building influence, and normalising control.

According to the Treasury statement: “The Iranian regime relies on various Iraqi militia proxies, including US-sanctioned foreign terrorist organisation Katai’b Hezbollah, to penetrate Iraq’s security forces and economy.

“These Iran-backed groups are not only responsible for the deaths of US personnel but also conduct attacks against US interests and those of our allies across the Middle East.

“The militias actively undermine the Iraqi economy, monopolising resources through graft and corruption, and hinder the formation of a functioning Iraqi government that would make the region safer.”

The Treasury identified specific commanders accused of intelligence gathering for Iran, including Hasan Qahtan Al-Sa’idi and his son Muhammad Qahtan Al-Sa’idi, as well as Haytham Sabih Sa’id: “Commanders from Kataib Hezbollah and the IRGC coordinated operations targeting US interests in Iraq earlier this year.”

Deputy State Department spokesman Tommy Pigott summed up the sanctions rationale on X (Twitter): “The United States is pursuing maximum pressure on Iran. We are targeting the IRGC-Qods Force, which supports Iran’s regional terrorist partners and proxies, and two Iraq-based groups, Katai’b Hezbollah and Asaib Ahl al-Haq. These militias actively undermine Iraq’s sovereignty, weaken Iraq’s economy, and conduct attacks against US personnel and interests across the Middle East.”

In a related post, Congressman Joe Wilson urged further sanctions: “Iraq must be freed from Iran’s grip.”

Treasury’s October 9 designations now also provide documentary proof of that pattern. Muhandis General Company’s “undisclosed real-estate projects,” cited in the sanctions release, mirror the very examples outlined in my earlier reporting, projects that international hotel groups quietly rejected over reputational concerns.

Among those named in Washington’s latest round were Katai’b Hezbollah’s commercial arm, Muhandis General Company, and its agricultural front, Baladna Investments, both accused of diverting Iraqi government contracts, laundering funds and supporting weapons smuggling under the guise of reconstruction. The Treasury also sanctioned Aqeel Meften, head of Iraq’s National Olympic Committee and his brother Ali Meften, for using a commercial bank to move money for the IRGC’s Quds Force.

“For decades, the Meften brothers have laundered tens of millions of dollars for Iran, and smuggled oil and drugs and abused Aqeel Meften’s position as president of Iraq’s National Olympic Committee to engage in corruption.” the Treasury Department said.

In addition to the Meften brothers, the Treasury also sanctioned Iraqi banker Ali Mohammed Ghulam Hussein Al Anssari, better known as Ali Ghulam, a pivotal player in the financial architecture supporting Iran’s militia proxies in Iraq. As a top executive at several Iraqi commercial banks, Ali Ghulam has leveraged his positions to enrich his family and provide direct financial services to the IRGC-Quds Force, Katai’b Hezbollah, and Asa’ib Ahl al-Haq. He managed Katai’b Hezbollah’s complex financial operations, including the strategic investment of the group’s wealth abroad, effectively safeguarding millions in illicit profits. Ali Ghulam also orchestrated sophisticated money-laundering schemes involving counterfeit documents, fake receipts and the use of unauthorised US dollars, evading Iraqi regulatory oversight. Despite these activities, he has avoided accountability in Iraq through systematic bribery of judicial officials.

These new actions build on the 2024 sanctioning of Hamad al-Moussawi, and his Al-Huda Bank, identified by the US Treasury as a primary money-laundering hub for the IRGC in Iraq. Their blacklisting foreshadowed this broader crackdown. Together, the Meften, Ghulam, and Moussawi networks form the architecture of Iraq’s militia finance.

In language unusually blunt for a Treasury release, US officials described these militias as “responsible for the deaths of US personnel” and accused them of “monopolising resources through graft and corruption.” The message was clear: Iraq’s supposed economic revival, its towers, malls and banks, was being built atop a structure of illicit finance.

The economic web that funds Tehran’s proxies has become indistinguishable from Iraq’s formal economy. What began as covert financing has now been institutionalised. Iran’s proxies no longer operate at the margins of Iraq’s economy, they are woven into its machinery. Contracts are awarded through ministries, funds are laundered through licensed banks and influence is legitimised through official titles. The very systems meant to regulate commerce and governance have been absorbed into the same networks they were built to restrain.

Regional intelligence assessments also point to the other side of the equation: goods moving the opposite direction. A substantial portion of Iraq’s imports, smartphones, electronics, car parts, heavy machinery, even luxury appliances, are rerouted across the border into Iran. These transfers allow Iranian entities to obtain US- or EU-restricted goods indirectly while militias inside Iraq profit from the arbitrage.

“It’s not just money-laundering any more,” said a regional security official. “It’s a full-spectrum sanctions-evasion economy.”

- Restricted banks

Since 2023, Central Bank of Iraq regulators, under US pressure, have steadily moved to blacklist and restrict dozens of domestic banks and financial companies from dealing in US dollars, citing suspected money-laundering and terror-finance violations. What began as a handful of institutions has become a downward slide.

While some smaller institutions folded or faded quietly under restriction, others tried to weather the storm, including some of Iraq’s most prominent banks.

But not all restricted banks appear on the Central Bank’s public lists and their absence does not mean they are untouched.

In a private conversation, the owner of a major Iraqi bank confirmed:

“International Development Bank is restricted by the federal, but the Central Bank didn’t name it on its website.”

This quiet admission reveals a deeper pattern: silent blacklisting. Banks are being cut off from US dollar access behind closed doors, without official record, without public explanation, and without legal transparency. In Iraq’s shadow economy, even enforcement is negotiated.

Once considered one of Iraq’s largest and best-connected private banks, the International Development Bank (IDB) was not immune. Despite its infrastructure, manpower and market presence, the bank has come under serious scrutiny.

According to an Iraqi security source, the Central Bank has been pressuring IDB chairman Ziad Khalaf Abed Kareem to relinquish his majority stake in the bank. What makes the situation more sensitive, the source added, is that intelligence suggests the true beneficial owner may be Ziad’s maternal uncle, a figure based in Iran, with long-standing financial and political networks.

“The structure raises red flags on multiple levels,” the security source said. “There’s a growing belief that Ziad is not the one really in control, and that makes the bank a serious exposure risk.”

Among the very few Iraqi-owned banks still operating outside formal US restrictions, the Iraqi Islamic Bank for Investment and Development—owned on paper by Ahmad Walid Ahmad, better known as “Ahmad Abu al-Fawz”—has become a lightning rod. “He was an employee making three thousand dollars a month, and suddenly he’s buying more than fifty percent of a bank. Let him show where the wealth came from,” said one rival restricted bank owner, adding that “that guy should be with the rest—no one better than the others.” The remark reflects both resentment and rivalry within Iraq’s banking elite, many of whom see little difference between those sanctioned and those spared. Ahmad Walid Ahmad (Abu al-Fawz) did not respond to requests for comment.

And when a bank is formally blacklisted or restricted for laundering and illicit activity tied to Iran, that designation is effectively an end. No serious counterparty or international institution will risk touching it. The label itself destroys credibility. But in Iraq’s opaque financial ecosystem, credibility is not required to survive, only connections are.

And in that space, the illusion of reform thrives. Under pressure from Baghdad and Washington, restricted banks have discovered a new survival tactic: appearances. They do not change how they operate, they change how they look.

Where there is desperation, there is always someone ready to sell a solution—especially when no solution is required.

For some of Iraq’s most exposed banks, sanctions didn’t just bring scrutiny—they opened the door to a new kind of exploitation.

Since the 2023 US dollar sanctions intensified scrutiny on Iraq’s restricted banks, a troubling trend has emerged among some US and international firms hired by these institutions. Many entered into contracts, took substantial upfront payments, and then simply failed to do any actual work.

A notable example is Washington DC-based lobbying firm BGR Group, hired by Elaf Islamic Bank. After receiving payment, BGR abruptly cancelled the contract without delivering any services, or even engaging with the US government as intended, and never returned the funds. What is more, BGR never registered under the Foreign Agents Registration Act (FARA), which would have been a legal requirement for any legitimate lobbying on behalf of a foreign bank.

The original contract was supposedly to help Elaf Bank navigate regulatory issues with the US government. But without FARA registration, it is highly unlikely BGR did anything beyond cashing the cheque. This case reveals a disturbing pattern of firms exploiting the sanctions-driven rush for quick money, signing contracts they never intended to fulfil, while avoiding transparency and accountability.

Sanctions turned vulnerable banks into easy prey, and firms lined up to cash in.

A senior Central Bank official told me: “Since the 2023 US dollar sanctions on banks, we’ve seen many firms like BGR Group, as well as lawyers and law firms, take payments from banks and disappear without delivering anything. We’ve had to warn the whole banking sector to beware of this scheme.”

The quote captures more than one firm’s failure, it reflects a wider game.

In Iraq’s shadow economy, even compliance has become a racket.

- Cosmetic compliance

If Iraq’s restricted banks have learned one lesson, it is this: perception buys time.

When sanctions bite and dollar access dries up, they do not reform, they rebrand. Modern, compliant, internationally-aligned, on paper.

The shift is from concealment to cosmetics: auditors, consultants, lawyers and lobbyists are brought in to build a paper trail of reform, not a real one.

In a rush to salvage credibility, restricted banks turned to an expanding market of consultants, auditors, and lobbyists offering quick reputational makeovers. Some promised access in Washington, others offered glossy compliance programs—but the results were often the same: little substance, high fees, and no real change. What emerged wasn’t reform, but the commodification of its appearance.

The Union Bank of Iraq, chaired by Ali Muften, offers a case in point. Just months before the US Treasury’s October 9 action, the bank announced a high-profile partnership with BDO Iraq, the local affiliate of the global accounting and advisory network BDO International, promoting the move as a milestone in compliance and transparency. But US officials call such “cosmetic compliance”, part of a wider strategy by restricted banks to hire international auditors, compliance consultants and public-relations advisers in an attempt to burnish their reputations.

The strategy is straightforward: dress up risk as reform. The message to regulators and foreign partners is that Iraq’s banks are modernising, professionalising and aligning with global standards. The reality, however, is that even if ownership changes on paper the same men still control the boards, the loans and the flows of money, they have simply learned how to frame it for Western eyes.

US officials are not fooled. One senior Treasury official told me: “You can hire auditors, swap boards, or repaint the façade, but once a bank is on Washington’s radar, it’s treated like a crime scene: cordoned off, evidence catalogued and there is no coming back.”

Washington the official added “could care less what’s on paper.” What matters is who directs the deals and controls the flow of money, and on that score, the Treasury’s intelligence is exhaustive.

That sentence captures the underlying flaw of Iraq’s financial “reforms”: the façades evolve, but the fate is sealed. The US government knows exactly who controls these banks and where the money truly flows. Behind every reshuffled board and repainted branch lies the same network of beneficiaries.

The illusion of reform has evolved beyond paperwork, Iraq’s banks have entered a new phase of image-laundering, one that swaps not just auditors but identities. When the façade of compliance is not enough, they begin to reconstruct the institutions themselves, replacing visible figures while the real power remains hidden.

Al-Janoob Islamic Bank and Ashur International Bank illustrate a different kind of laundering, not of money, but of image. Both institutions have been restricted from dealing in US dollars, they have resorted to a subtler strategy: repackaging themselves through new faces.

At Al-Janoob Islamic Bank, the chairman, Dr Mazin Ahmed, previously served as Director General of the Investment and Foreign Remittances Directorate at the Central Bank of Iraq (CBI), a role that gave him oversight of the very mechanisms now accused of enabling dollar smuggling and sanctions evasion. Before that, he also sat on the Board of Directors of the Arab Monetary Fund in Abu Dhabi.

At Ashur International Bank, Mohammed al-Delaimy, now CEO, built his career through senior positions at Standard Chartered, Byblos Bank, and as President of the Trade Bank of Iraq, one of the country’s most politically sensitive institutions.

In both cases, these are not random appointments, they are calculated moves. Each man brings the aura of respectability, the language of compliance and the illusion of reform.

It is a pattern increasingly visible across Iraq’s blacklisted and restricted banks: when the system comes under pressure, they do not change the practices, they change the people. They bring in frontmen with polished résumés and Western credentials, betting that titles and LinkedIn profiles can buy what sanctions have taken away: credibility.

In the case of Al-Janoob Islamic Bank, ownership traces back to Ali Zaidi, a businessman best known for securing multimillion-dollar government contracts. Likewise, Ashur International Bank is controlled by Wadih Nouri al-Hanzal and his family. As the head of Iraq’s Private Banks League, al-Hanzal holds significant interests across multiple companies, consolidating considerable economic influence. The concentration of financial authority within these powerful familial dynasties underscores a broader pattern of corruption and collusion that the US government has flagged as a serious threat to Iraq’s economic stability. Both Al-Janoob Islamic Bank and Ashur International Bank are controlled by figures deeply linked to the Popular Mobilisation Forces (PMF).

Both Zaidi and al-Hanzal have sought to shield their interests by bringing in public-facing executives with regulatory credibility. But according to an Iraqi security source, it is the owners themselves who have now disappeared, at least on paper.

“They haven’t sold. They’ve reshuffled,” the source said. “When pressure mounts, they rotate shares, rename directors and bury control behind layers of straw men. The ownership never really changes, it just hides.”

In both cases, these appointments are not reform, they are defence. The men serve as high-profile frontmen, brought in to polish reputations rather than cleanse systems. Each lends credibility without consequence.

Across Baghdad’s banking sector, this pattern has become familiar. When scrutiny intensifies, boards reshuffle. Former regulators or Western-trained executives are brought in to signal reform. Compliance departments expand, not to enforce oversight, but to perform it.

Public-relations firms draft English-language statements about “international best practices,” while the institutions quietly maintain the same opaque ownership structures and patronage networks that triggered restrictions in the first place.

Al-Janoob, Ashur and Union Bank represent three faces of the same strategy: the laundering of image, not income. Each hires credibility the way others hire security, to protect the institution from consequence.

As one US official told me, “With the October 9th designations They’re learning that you can’t audit your way out of sanctions. The façade has become part of the evidence.”

- Washington’s Turn

Under Secretary of the Treasury for Terrorism and Financial Intelligence John Hurley framed the October 9 sanctions as a defence of US national security:“Cutting off their financial flows is essential to protecting American lives.”

But the move signals something larger than a counter-terrorism measure. It’s the most significant US attempt to disrupt the broader financial ecosystem sustaining Iraq’s PMF, not just their armed wings, but the commercial networks behind them.

A senior US official involved in the sanctions process put it bluntly: “We’ve never been fooled by the cosmetic compliance moves. They can hire auditors, rebrand, bring in consultants, but it’s the same dirty money flowing through the same illicit networks.Nothing Changes”.

That now reflects the Treasury’s evolving view: the problem is not just corrupt banks, but the entire system that launders and legitimises militia wealth. From fuel contracts and construction deals to real estate developments and import businesses, much of Iraq’s formal economy is fused with informal power structures. Every tower, every mall, every logistics contract potentially runs through militia-linked capital.

Hurley later clarified the broader strategy: Treasury’s aim is to dismantle the financial architecture enabling these groups to operate with impunity. Future sanctions, officials say, will likely target the so-called “clean hands”, the bankers, contractors, business partners and intermediaries who provide the legal and financial cover for illicit networks.

What is emerging is a new phase in US financial warfare, not just chasing bad actors, but unravelling the systems that allow them to appear legitimate. For Iraq, that means a reckoning with the uncomfortable reality that shadow networks no longer live in the margins; they hace moved into the centre of the economy.

And unless that centre is challenged, any firewall between licit and illicit capital will remain dangerously thin.

Iraq’s government continues to present reconstruction as a national priority. But the Treasury’s latest designations expose the price of building without transparency. Every tower financed through front companies, every contract funnelled to PMF affiliates, and every bank shielding sanctioned money is now a potential liability under US law.

With its latest designations, Washington is no longer distinguishing between rogue militias and the state structures that enable them. By sanctioning figures like Aqeel Meften, a senior sports official with quasi-governmental status, and companies like Muhandis General that operate through official channels and government contracts, the US is now signalling that state-linked entities are fair game. This marks a significant escalation: the shadow economy is no longer treated as existing alongside the Iraqi state, but operating from within it.

For Washington, the message is clear: legitimacy cannot be laundered. And this is just the beginning. More sanctions and designations are expected to come, toppling these networks one by one.

For Iraq, this could mark the start of a new chapter, one where the economy begins to free itself from the shadows of illicit influence.

And for Baghdad’s power brokers, it is a warning, the cranes may still be moving, but the ground beneath them is beginning to shift. Judgment day is coming.

Al-Sudani: From Babylon, we renew the pledge that "Iraq First"

https://www.youtube.com/watch?v=WTNro-O4Z2Q

From Babylon, the Mahdi of civilization and will

0:04

Today we announce the renewal of the pledge that Iraq will remain

0:11

First

0:13

This is our slogan

0:16

This is our approach

0:18

And these are our priorities

0:21

Iraq First

0:23

In construction, in services, in security

0:28

Stability

0:30

In our relations with all countries of the world, Iraq First

0:38

Yes, yes to Iraq, yes to Iraq

0:41

Yes, yes to Iraq

0:48

God

.png)

.jpeg)

No comments:

Post a Comment