The government of Iraq delivers the "tripartite budget" to the House of Representatives

Spokesman for the Iraqi government on behalf of Al-Awadi

In implementation of the provisions of the Constitution and the Federal Financial Management Law, yesterday evening, Thursday, the draft federal budget law of the Republic of Iraq for the fiscal years 2023, 2024, and 2025 was officially handed over to the House of Representatives.

We affirm that the draft budget law, with its new articles and paragraphs that were approved for the first time, is capable of facilitating the implementation of executive and development projects, plans and programs, and the provision of infrastructure and services to citizens.

The central bank governor announces a new step to reduce the exchange rate gap

On Thursday, the Governor of the Central Bank of Iraq, Ali Al-Alaq, revealed anticipated "legal steps" with the aim of reducing the gap in the exchange rate.

Al-Alaq said in a statement during the Seventh Sulaymaniyah Forum, followed by "NAS" (March 16, 2023), "We will take the necessary legal steps within the framework of the dinar being the main currency prevailing in the market, in cooperation with the government."

He added, "Buying and selling in a foreign currency is strange and a widespread phenomenon in the Iraqi markets, which is (the dollarization of the market)."

He continued, "Externally, we do not have a problem with remittances, and every day we open new outlets to sell dollars at the official rate."

He pointed out that "the currency is a symbol of sovereignty and a title for the country, and abandoning it is tantamount to lowering the flag."

Earlier, Al-Alaq confirmed that the exchange rate and inflation have witnessed an increase during the last two years, and that the price margin for the dollar exceeded 20%, while indicating that this phenomenon affects the economic and social reality and weakens the purchasing power of citizens.

Al-Alaq said, "Inflation and the exchange rate are high with factors, and we notice a growth in the money supply, and the currency export witnessed a storm, which is an abnormal growth in the absence of productive growth, and indicates an increase in import demand."

And he added, "The central bank law stipulates that it sells foreign currency without placing restrictions, and the text of the phrase in the article is (simple unconditional sale), which is the ideal case through which the central bank can maintain the exchange rate, that is, respond to every demand for the dollar."

He pointed out that "the problem is that there are more controls and standards in verifying the buying and selling of foreign currency, and with the increase in the international currency war, it makes the process of putting more controls and restrictions increasing."

He pointed out that "the central bank has become in a complex balancing process between achieving simple unconditional selling so that there is no room for price difference and speculation and the application of these standards that require a review of all operations, unfortunately the central bank bears additional burdens in applying these standards due to the absence of a role Other institutions that are supposed to help in the process of verifying operations, for example, if our border crossings are at a degree of organization and recording operations correctly, it will enable all parties to know the foreign dollar and match these operations .. There are large gaps in the border crossings, some of which are diagnosed From many years, and some of them beg for experience.

And he stated, “The central bank has the ability and desire to achieve its goal of responding to the dollar’s demand, whatever its size, and it is now able to offer the dollar at the level of demand; There is a shortage in the process of covering the demand, if we see that the existing rates of remittances and the demand for dollars and credits, as they cover only a small percentage of the real trade of Iraq, and we are trying to bridge this gap through various means to earn these and their entry into the process from its correct gate.

Central Bank Governor: We are working with the government to make the dinar the main currency in the Iraqi market

On Thursday, the Governor of the Central Bank, Ali Mohsen Al-Alaq, set the objectives of monetary policy in Iraq, pointing out that he would take the necessary legal steps within the framework of the dinar being a major currency prevailing in the market in cooperation with the government.

Al-Alaq said on the second day of the seventh Sulaymaniyah Forum, followed by "Al-Iqtisad News", that "the monetary policy includes two basic goals," noting that "one of these goals is to maintain the general level of prices, that is, the strength of the currency locally and the exchange rate, which represents the strength of the currency externally."

He added that he "will take the necessary legal steps in the context of the dinar being a major currency prevailing in the market, in cooperation with the government."

He noted that "buying and selling in a foreign currency is a strange matter and a widespread phenomenon in the Iraqi markets, which is (the dollarization of the market)," pointing out that "the currency is a symbol of sovereignty and a title for the country, and abandoning it is tantamount to lowering the flag."

He pointed out that "externally we do not have a problem with remittances, and every day we open new outlets to sell the dollar at the official rate."

Al-Alaq pointed out that "inflation and the exchange rate are high factors, and we note a growth in the money supply, and the currency export witnessed a storm, which is an abnormal growth in the absence of productive growth, and indicates an increase in import demand."

And he explained, "The central bank law stipulates that it sells foreign currency without placing restrictions, and the text of the phrase in the article is (simple unconditional sale), which is the ideal case through which the central bank can maintain the exchange rate, that is, respond to every demand for the dollar."

And that "the problem is that there are more controls and standards in verifying the buying and selling of foreign currency, and with the increase in the international currency war, it makes the process of setting more controls and restrictions increasing."

And the governor continues, "The central bank has become in a complex balancing act between achieving a simple unconditional sale so that there is no room for the price difference and speculation, and the application of these standards that require a review of all operations."

He expressed his regret, saying, "The central bank bears additional burdens in applying these standards due to the absence of the role of other institutions that are supposed to help in the process of verifying operations. For example, if our border crossings were at a degree of organization and recording operations correctly, it would enable all parties." From the knowledge of the foreign dollar and its conformity in these operations .. There are large gaps in the border crossings, some of which have been diagnosed for many years, and some of which are new with experience.

And he warned that "the central bank has the ability and desire to achieve its goal of responding to the demand for the dollar, whatever its size, and it is now able to offer the dollar at the level of demand; but what reduces this supply is a group of merchants and others, who are not ready to enter into these processes and controls; so there is A deficiency in the process of covering the demand, if we see that the existing rates of remittances and the demand for dollars and credits do not cover only a small percentage of the real trade of Iraq, and we are trying to bridge this gap through various means to earn these and their entry into the process from its correct gate.

Al-Rafidain: Travelers can use the MasterCard for withdrawals and deposits

Al-Rafidain Bank confirms that the issued MasterCard contains many advantages for its holders, including its use while traveling in terms of withdrawals and deposits, or in promotion and electronic shopping via the Internet, international websites and stores.

In addition, the card allows its owner to use it locally and internationally for shopping through POS points, ATMs, and online purchases. The card can also be filled in Iraqi dinars for travelers, shopping, or withdrawing cash using the currency of the country in which it is located while traveling. Al-Rafidain Bank also encourages its valued customers to use the card for shopping instead

. From cash withdrawals to avoid paying any additional commissions added through ATMs outside Iraq.

The Media Office

of Al-Rafidain Bank

UN's Guterres: Window of Opportunity to Achieve Progress in Iraq

The following is the text of UN Secretary-General António Guterres' video message to the Sulaimani Forum on Wednesday:

I am pleased to greet the Sulaimani Forum, and thank you for advancing dialogue on the complex challenges facing Iraq and the broader Middle East region.

We all recognize that these challenges did not arise overnight. They are the product of decades of oppression, war, terrorism, sectarianism, and foreign interference. And no one can expect these challenges to be resolved overnight, least of all at a time of escalating geopolitical tensions, economic uncertainty, and proliferating conflicts.

But I have just come back from Iraq - with a real sense that a window of opportunity has opened to achieve progress. Progress on improving public services, diversifying the economy, and creating decent work opportunities for young people.

Progress in strengthening human rights, in the fight against corruption, and in the pursuit of domestic and regional stability through diplomacy and dialogue. And progress in building resilience to climate shocks and water scarcity that threaten lives and livelihoods.

Mesopotamia is the ancient land between the rivers. It cannot become the modern land without rivers. In all of this and more, national unity, regional cooperation, and multilateral action are essential.

The United Nations is proud to continue to support Iraq in tackling the challenges of today and tomorrow. Together, let us keep working towards sustainable, inclusive solutions for the benefit of all people across Iraq and the wider Middle East. Thank you. Shukran.

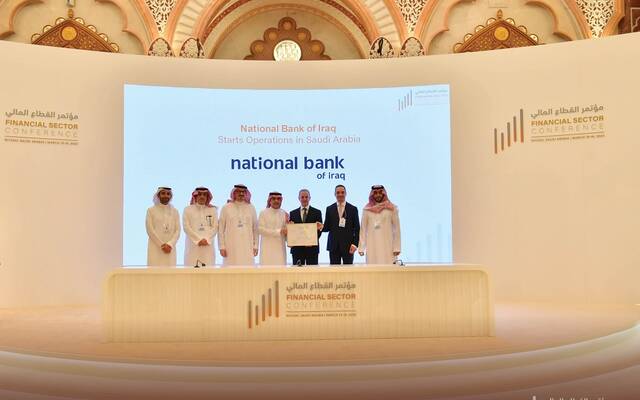

The Central Governor sponsors the inauguration of the National Bank of Iraq branch in Saudi Arabia

The Governor of the Saudi Central Bank, “Sama”, Ayman Al-Sayyari, sponsored today, Thursday, the inauguration of the National Bank of Iraq branch in the Kingdom, on the sidelines of the closing day of the financial sector conference in Riyadh.

On August 28, 2022, the Iraqi National Banker affiliated with the Capital Bank Group announced the start of providing its banking and financial services in the Saudi market, after completing all procedures related to licensing by opening its first branch in Riyadh, and starting banking business in the Saudi market.

It is noteworthy that the Financial Sector Conference 2023 is the second edition of this conference, which is organized by the partners of the Financial Sector Development Program, which are the Ministry of Finance, the Saudi Central Bank and the Capital Market Authority.

A large group of decision makers, investors, international investment companies and international banks participated in the conference.

In its dialogue sessions, the conference focused on 4 main axes: the global economy, challenges and opportunities, financial institutions in the new financial reality, flexibility and coping, safe investment for tomorrow, and the future of the financial sector in light of digitization

March 17th, 2023

Parliamentary legal: The budget law arrived in parliament yesterday, and there were intensive meetings around it

The Parliamentary Legal Committee announced that the draft budget law from the government had reached the House of Representatives yesterday, Thursday.

Committee member Muhammad al-Khafaji told {Euphrates News} agency: "The budget law officially arrived in the House of Representatives yesterday," noting that "any meetings on the law did not take place, and starting next week there will be intensive meetings regarding it."

He explained, "The budget for this parliamentary session is special and different, as it is for three years," noting, "The start of studying the budget and reviewing it will be early next week.

Parliamentary Legal: We will proceed to pass the budget and other legislation during the current month

The Parliamentary Legal Committee confirmed, on Thursday, its intention to pass the federal budget law and several other laws during the current month, indicating that Parliament is obligated not to enjoy any holiday without passing the budget.

Member of the committee, Representative Bassem Khashan, said in a statement to Al-Maalouma, “The legislation of the budget law is one of the most important laws that the Iraqi parliament and the constitution entrust to it due to its direct relationship to the sustainability of the state and the movement of society. Adoption of the law.

He added, "The arrival of the draft federal budget law to the House of Representatives does not mean stopping the inclusion of other laws. Rather, the Presidency of the Council, heads of political blocs, and representatives may practice their work as usual by including discussion of new draft laws and voting on them or hosting as well as interrogations."

It is noteworthy that the Council of Ministers approved last Monday, the draft federal budget law for the years (23, 23 and 25), announcing that the Council will solve it to Parliament for the purpose of discussion and approval.

Kurdish leader: Al-Sudani will visit Washington and inform it about the conditions of the Iraqi house and the resolution of crises

The leader of the Patriotic Union of Kurdistan, Ahmed Al-Harki, revealed the message of Prime Minister Muhammad Shia Al-Sudani during his visit to Washington, which is to put the Iraqi house in order and resolve the crises.

Parliamentary Finance: Parliament will need 30-45 days to pass the budget

The Parliamentary Committee confirmed, on Tuesday, the need for 30-45 days to discuss the budget in Parliament before voting on it, indicating that there is a political consensus to pass it, while indicating that the adoption of $ 70 per barrel in the budget is realistic and does not cause concern.

Committee member Mueen Al-Kadhimi said, "It is expected that the draft budget approved by the government will reach the House of Representatives next week, and the House will start discussing it by the Finance Committee, and we believe that bringing it to the voting stage requires between a month and a half."

He added, "The Parliamentary Committee will discuss the issue of the deficit established in the budget, amounting to 64 trillion dinars, and how to cover it, and there is political consensus to pass the budget and after examining its items and doors to start implementing what was stated in the ministerial program of the government of Prime Minister Muhammad Shia'a al-Sudani."

And he continued, "The Financial Management Law allowed the government to present a budget for (3) years, provided that the first year is obligatory, meaning that it is approved, while it is possible to make amendments to the 2024-2025 budget, with a proposal from the Ministries of Finance and Planning and the approval of the House of Representatives."

He pointed out that "the adoption of the budget on the price of $ 70 per barrel of oil is realistic and was determined by specialists and does not cause concern, because global expectations indicate that oil prices will stabilize within these limits or more during the current year."

The Central Bank of Iraq issues the third package to facilitate procedures for obtaining the US dollar

1. With the aim of facilitating obtaining the dollar for citizens wishing to travel abroad, the official exchange rate of “1320” dinars per dollar will be calculated through the electronic payment card issued by the authorized authorities when used abroad, as follows:

A- Prepaid cards, whether they are in dollars or dinars, and they are not linked to a bank account, which makes them accessible, with a ceiling of (10,000) dollars that can be refilled, and the bank and licensed electronic payment companies have the right to issue them.

B- Credit cards, and the ceiling determined by the bank according to its classification of the customer (Gold, Silver, Platinum), with the possibility of reinforcing what was used from it later.

C- Debit Cards, which are linked to the customer’s account with the bank (including the nationalized salaries) and which can be used to pay in dollars according to the customer’s balance with the bank, and on the basis of the official dollar exchange rate.

Dr-The traveler’s share of cash dollars will be (2000) dollars, starting from Sunday 3/19/2023, with the possibility of using the aforementioned cards to allow citizens to cover their dollar requests, and to avoid the citizen carrying large amounts of cash, and in line with the directions of countries of the world to leave the use of cash Except in a narrow range.

E- The Central Bank of Iraq’s daily sales of cash dollars will continue at their levels, without reduction, to banks, exchange companies, and mediation companies by selling and buying authorized foreign currency, for the purpose of securing citizens’ requests for the purposes reported.

2. The Central Bank of Iraq calls on all banks and exchange companies to communicate with money transfer companies (Western Union, Money Gram, etc.) to obtain a license to work in Iraq to meet the growing demands for personal transfers, with the commitment of the Central Bank of Iraq to settle their accounts with those companies at the official rate, and the bank will The Central Bank urged these companies to expand the base of their agents in Iraq, and it is possible that these transfers will include some types of simple commercial transfers later.

3. Transfers of gold importers and their credits to companies registered with the Central Agency for Standardization and Quality Control at the Ministry of Planning will be covered.

Central Bank of Iraq

Media Office

3/14/2023

The government delivers the "tripartite budget" to the House of Representatives

Spokesman for the Iraqi government on behalf of Al-Awadi

In implementation of the provisions of the Constitution and the Federal Financial Management Law, yesterday evening, Thursday, the draft federal budget law of the Republic of Iraq for the fiscal years 2023, 2024, and 2025 was officially handed over to the House of Representatives.

We affirm that the draft budget law, with its new articles and paragraphs that were approved for the first time, is capable of facilitating the implementation of executive and development projects, plans and programs, and the provision of infrastructure and services to citizens.

The House of Representatives announces receipt of the draft federal budget law - Urgent

Deputy Speaker of the House of Representatives, Shakhwan Abdullah, announces the arrival of the draft federal budget law to Parliament last night

No comments:

Post a Comment