An economic expert details the cash conversion cycle of the Iraqi dinar

Nouri said {to Al-Furat News} that: “The monetary cycle {the Iraqi dinar} exists between the Central Bank, as the monetary authority and the only authorized one to issue the national currency, and the Ministry of Finance, as the financial authority authorized to implement the federal budget in terms of spending and collection.”

He added, "The third party is the public, the financial institutions {governmental and private banks} and the trade, agriculture and industry sectors, meaning that the cash that is offered to the public when implementing the budget returns to the Central Bank and then to the Ministry of Finance."

Nouri explained, “What is happening is that the cash raised through the implementation of the budget will not return to the central bank at a high rate and therefore to the Ministry of Finance,” attributing the most prominent reasons for this to “the exclusion of private banks from the currency auction, which no longer deposit the Iraqi dinar with the central bank in exchange for the dollar.” “In addition to the tendency of the public and merchants towards hoarding and dealing in cash not through banks.”

He stated, "The exclusion of private banks from the auction is the main reason; but this does not mean that they have a positive role in the economy. Rather, they only practice speculation in dollars, and they are supposed to engage in economic activity by accepting deposits and lending to economic projects."

Nouri added, “Accepting deposits and keeping a percentage of them with the Central Bank also contributes a percentage to returning the dinar to the Central Bank. This is why the Central Bank’s decision was for banks that were punished by the US Federal Reserve from dealing in dollars to continue dealing in dinars in their economic activities that are not speculative in dollars.”

He stressed that "the Central Bank can provide liquidity to the Ministry of Finance by issuing a new monetary mass, despite its disadvantages."

Specialists in economic and financial affairs reported that despite the large size of the monetary supply, which amounts to (83) trillion dinars, there is a noticeable scarcity of cash liquidity from the Iraqi dinar in the commercial markets, explaining that this comes for several reasons, the first of which is mismanagement. The financial file in the country.

A deputy reveals the imminent establishment of the Federal Oil and Gas Council

Today, Monday, Representative Ali Shaddad revealed the imminent establishment of the Federal Oil and Gas Council.

Shadad stated in a statement received by Earth News Agency, “The Federal Oil and Gas Council will be established, which will be headed by Prime Minister Muhammad Shiaa Al-Sudani and whose membership includes the ministers of oil and finance, the governor of the Central Bank, and the governors of the oil-producing governorates.”

Shaddad pointed out that “Basra Governorate will have a permanent seat in the Federal Oil and Gas Council that cannot be replaced, in addition to that the governorates that produce around 250 thousand barrels or more of crude oil will also be represented in the council, and the Prime Minister has the right to cancel or change the representation of these governorates.”

Finance deposits 500 billion dinars in the Basra account for 2023 investment projects

Member of the Parliamentary Finance Committee, Uday Awad, confirmed today, Monday (October 2, 2023), that the Ministry of Finance deposited 500 billion dinars in the Basra account for 2023 investment projects.

Awad said in a statement received by "Baghdad Today", "The Ministry of Finance deposited (500) billion Iraqi dinars in the Basra Governorate account as a first payment for investment projects (2023) out of (2) trillion and (800) billion," noting that "the delay "It was due to mistakes by the governorate."

The committee member called on "the governorate to expedite the referral of projects to reputable companies and that there be a fair distribution for all districts and districts. Lagging projects from corrupt and failed companies must be withdrawn and referred to the judiciary."

Yesterday, Sunday (October 1, 2023), the Parliamentary Finance Committee criticized the delay in implementing the budget, while indicating that the Ministers of Planning and Finance will be hosted during the current week.

The committee’s media office stated in a statement received by “Baghdad Today” that, “The Chairman of the Parliamentary Finance Committee, Atwan Al-Atwani, confirmed while hosting the governors in the Finance Committee that we indicated that there was a clear shortcoming in the release of financial allocations to the governorates and ministries.”

He added: "We will host the Ministers of Planning and Finance this week to find out the reasons for the delay in implementing the budget," noting that "the current government has raised the slogan of a national service government and we will not allow the problem of delaying the disbursement of financial allocations to continue."

Al-Atwani continued, "Our insistence on approving the tripartite budget came to enable the governorates and ministries to implement their plans and programs and to avoid stopping funding at the end of the fiscal year," stressing that "the Ministry of Finance must adhere to the terms of the budget and release petrodollar allocations to the oil-producing governorates."

The country's markets suffer from a scarcity of cash liquidity

Experts in economic and financial affairs stated that despite the large size of the monetary mass, which amounts to (83) trillion Iraqi dinars, there is a noticeable scarcity of cash liquidity from the Iraqi dinar in the commercial markets.

Professor of Political Economy, Jalil Al-Lami, said in an interview with “Al-Sabah”: “Despite the Iraqi government’s possession of a large monetary mass of no less than (83) trillion Iraqi dinars, and no less than (75%) of this mass in commercial markets, However, we find a significant shortage or scarcity in commercial markets, due to mismanagement of the financial and monetary file in Iraq.”

He pointed out that “Central Bank Law No. 56 of 2004 gave the bank the authority to formulate monetary and financial policy in Iraq and work to preserve the value of the Iraqi dinar, but we found the disappearance of the monetary mass from the commercial markets, because the Iraqi economy depends on imports and exports of crude oil, which are in dollars and which are denominated in dollars.” The Central Bank of Iraq needs to exchange them for Iraqi dinars in order to cover operational expenses.”

He explained that "the traditional sources that the Central Bank of Iraq relies on are the deposits of government banks and private sector banks, the deposits of government departments and institutions, currency sales window sales, and the issuance of new cash - if necessary - which are offset by operational expenses."

All public and private sector salaries will be in dinars. Central official

We will not be like Lebanon

The Assistant Director of Foreign Transfers at the Central Bank confirmed today, Monday, that all salaries in the government and private sectors must be in Iraqi dinars, and that the country is gradually moving to restrict transactions to the national currency, with exceptions for oil companies and the like.

Dr. said. Muhammad Younis, in an interview with journalist Karim Hammadi

The decision to ban dealing in dollars is not new. At the beginning of this year, the Prime Minister obligated all departments and the private and public sectors to deal in the Iraqi dinar, but there is an exception for companies and departments that have contracts in dollars, such as oil companies and others.

All contracts between companies and employees, or between the state and citizens, and the payment of salaries, etc., in the private and public sectors, must be in dinars.

Today we emphasized to the banks that the remaining red line is if the citizen deposits money in US dollars, then he must receive his deposit in US dollars as well.

The situation has changed today. We want to spare the Central Bank and Iraqi banks from sanctions, deprivation and problems, so we must comply with international laws and norms.

I am surprised by the word “crisis.” Today, Iraq is at a level of historical reserves that exceed 100 billion dollars, and we have the fourth largest Arab gold reserve. We do not have a crisis, and the price of a barrel of oil is 90 dollars, and we export 4 million barrels per day.

The dollar exists and is available to every person or entity that uses official channels to obtain it. How do I compare myself to Lebanon? Lebanon does not have the resources that we have, and price inflation is declining, despite the exchange rate situation.

Parliamentary Finance points out the provinces' problems as a result of not releasing budget funding and criticizes two ministries

Member of the Parliamentary Finance Committee, Ikhlas Al-Dulaimi, pointed out, on Monday, the problems facing the governorates as a result of not launching financial funding for the 2023 budget.

Al-Dulaimi told Shafaq News Agency, “The Parliamentary Finance Committee hosted many governors to discuss financing the governorates, and when the budget was prepared with a size of 197 trillion dinars, hopes were pinned that the budget would have a positive aspect in providing services in the governorates, but we have entered the tenth month and are still We suffer from not releasing any allocations to the governorates.”

She added, "The problems that the governorates are suffering from are very large, and the funding rate has not reached 2% so far. Rather, it was only notice and the amounts are very small," noting "complexities faced by the governorates. If there is an increase of one letter in the project, the project will be returned to the Ministry of Planning and then to the governorate." Unfortunately, there is no coordination between the Ministries of Finance and Planning regarding launching project financing for the governorates.”

Al-Dulaimi pointed out that "there are many projects in the governorates. We wonder how they will be reconstructed and infrastructure built, especially a large project such as water desalination, and this is included in the general budget, and the project has not been funded while we are in the final months of the year."

On June 12, the Iraqi Parliament voted on the financial budget for the three years (2023-2024-2025), with a value amounting to 198.9 trillion Iraqi dinars ($153 billion) for each year.

On 8/7/2023, the Director General of the Iraqi Facts Department in the Ministry of Justice, Hanan Munther Nassif, announced on Monday the publication of Instructions No. (1) of 2023, related to facilitating the implementation of the Federal General Budget Law of the Republic of Iraq for the fiscal years (2023-2024-2025). ) No. (13) of 2023” in Al-Waqa’i newspaper.

The Central Bank denies the scarcity of cash liquidity and describes its currency and gold reserves as “historic”

A source in the Central Bank of Iraq denied that there was a “scarcity” of cash liquidity in the country’s markets.

The source confirmed to Al-Furat News Agency: “There is no scarcity of cash, and cash is available despite the current policy, which is a contractionary policy, but cash is available.”

He pointed out that "the foreign reserves and gold at the Central Bank are at historical levels, and the electronic platform is open to anyone who wants to officially enter into buying the dollar at the official price."

Specialists in economic and financial affairs reported that despite the large size of the monetary supply, which amounts to (83) trillion dinars, there is a noticeable scarcity of cash liquidity from the Iraqi dinar in the commercial markets, explaining that this comes for several reasons, the first of which is mismanagement. The financial file in the country.

Professor of Economic Affairs, Jaafar Alloush, said in a press statement that “the problem of liquidity scarcity - if it exists - is linked to a number of factors, including the economy’s lack of monetary flexibility in managing public money, while official monetary indicators do not indicate the existence of a liquidity scarcity.”

He explained, "The problem is that the largest portion of the issued currency is with the public, which accounts for 91.3% of the issued currency, amounting to more than 90.070 trillion Iraqi dinars of that currency outside the banking system, and despite the fact that this (huge) monetary mass is used for transaction purposes from... before the public and to carry out its daily economic activity, but it is outside the control of the monetary authorities.”

Al-Araji confirms from Tehran that Iraq is continuing to implement all provisions of the security agreement

The Supreme Committee for Implementing the Joint Security Agreement between Iraq and Iran met with its Iranian counterpart in Tehran.

The National Security Advisory stated in a statement: “The committee, under the guidance of the Commander-in-Chief of the Armed Forces, Muhammad Shiaa Al-Sudani, held an important meeting with its Iranian counterpart, where the National Security Advisor, Qasim Al-Araji, chaired the Iraqi side in the meeting, while the Secretary-General of the Iranian National Security Council chaired, Dr. Ahmadian, the Iranian side, in the presence of all members of the committee.”

The meeting reviewed the stages of implementing the security agreement between the two countries on the ground, what has been achieved and what remains to be accomplished.

National Security Advisor Qasim Al-Araji, Chairman of the Supreme Committee for Implementing the Security Agreement between Iraq and Iran, conveyed the greetings of Prime Minister Muhammad Shia Al-Sudani to the Iranian side.

He summarized the stages of work carried out by Iraq in the area that was identified and which was occupied by the Iranian opposition, which was all evacuated and the Iranian opposition elements were disarmed, in accordance with the agreement, and federal forces were deployed in it and placed far from the border, indicating: “The Kurdistan Regional Government was serious about Implementing the obligations you have set forth.

Al-Araji stressed to the Iranian side the importance of high coordination between the two countries, noting that the results achieved after the security agreement have not occurred since 1991, and that these groups remained for decades without the presence of official federal forces.

He also stressed: “The Sudanese is closely following the path of implementation of this agreement, and that Iraq is keen on Iran’s security and will not allow its territory to be a starting point for destabilizing the security of any neighboring country,” stressing the importance of Iranian officials informing the Iraqi side if any developments arise. The necessary action will be taken.”

The National Security Advisor pointed out during the meeting: “Iraq is proceeding with implementing all the provisions of the joint security agreement between Iraq and Iran, and that the partnership, historical depth and growing relations between the two countries became clear during the Arba’een visit after Iraq embraced the Iranian visitors and provided services, cooperation and facilitation to them, which is evidence of The depth of ties between the two countries and the two neighboring peoples.”

For his part, Ahmadian thanked the federal government, the regional government, and the Iraqi people for the facilities provided to the Arbaeen visitors, stressing the depth of the historical relationship between the two countries, noting: “The implementation of the joint security agreement came to achieve the common interest of the two countries, and what was achieved from it reflects the will of the two countries, to achieve this.” “Important progress,” stressing continued coordination and exchange of information between the two countries, and not allowing armed groups to threaten the security and stability of the two countries and the region.

During the meeting, issues and files of common interest were also discussed, as well as important topics related to protecting the borders and security of the two neighboring countries, and continuing joint coordination to complete all paragraphs of the security agreement./

they won't be street vendors anymore

Document: The Central Bank sets a deadline for exchange companies to end “hiding in buildings”

A document issued by the Central Bank of Iraq, today, Monday, showed instructions for exchange companies to end their presence on floors inside buildings, and a period of 6 months for the purpose of moving the headquarters to places appropriate to the nature of the activity, for the purpose of ensuring that customers can identify the companies.

text of the document

Which companies?

Date: 1/2/2003

Exchange companies under Elephantine (13)

Uncles

In view of the presence of a number of your companies’ headquarters and branches on floors inside Al-Sabani, and for the purpose of ensuring that customers can identify your companies, it was decided to give you a period of (6) working months for the purpose of moving your companies’ headquarters to headquarters that suit the nature of your activity, and to provide services that require them to be in known locations that are easily accessible. to her . with respect.

good greeting ..

Mr. Dr. Ammar Hamad Khalaf, Deputy Governor, Agency

2/1/2023

A representative reveals the reason for delaying the disbursement of budget funds despite its approval

Member of the Parliamentary Finance Committee, Representative Mustafa Al-Karawi, revealed today, Monday, the reason for delaying the disbursement of budget funds despite their approval

Al-Karaawi said in an interview with:Alsumaria News“The disbursement of the budget and the delay in its release are due to administrative problems and also the failure to complete data by the relevant ministries and departments.”

He added, "Today there was a hosting for the Minister of Planning, and before that for all governors, and it was decided to disburse dues for the costs of ongoing projects, and we are in the process of increasing disbursement in the coming days after the availability of cash in the budget."

He continued, "With regard to investment projects, the governorates have begun preparing their plans according to planning standards and sending them to the ministry for approval."

Yesterday, the Finance Committee hosted all governors to discuss the plans drawn up to distribute financial allocations and follow up on the projects included withinFederal General Budget LawInstructions for its implementation, draft food security law, as well as the actual expenditure for each governorate.

The House of Representatives voted earlier on the budget law for the three years (2023-2024-2025),

and at the beginning of the seventh month, it was announced.Iraqi Facts DepartmentIn the Ministry of Justice, regarding the issuance of Instructions No. (1) of 2023 related to facilitating the implementation of the federal budget, the Law of the Republic of Iraq for the Fiscal Years (2023-2024-2025) No. (13) in the Al-Waqa’i newspaper.

Despite the vote on it, the budget has not yet been paid to the ministries, which has disrupted project financing.

Famous Bank: The Middle East is going through a golden age

link This is a bloomberg article https://www.

JP Morgan's European head, Viswas Raghavan, said the Middle East is enjoying a "golden age" as global tensions drive money and talent to the region.

Speaking in an interview with Bloomberg TV, Raghavan said that there has been a jump in deal making and capital market opportunities in many countries in the past few quarters.

He added that most of the Middle East oil countries are in a very good position, whether to attract money managers and hedge funds, or also to their local economies, which have become dominant. This is a golden age for Middle Eastern companies and the Middle East in general. "I think it's here to stay."

Raghavan, who is CEO of JP Morgan in Europe, the Middle East and Africa, said that the global outlook for investment banking shows “some green shoots”, especially in the technology space, although the number of opportunities is not yet a flood.” He added that it is expected Total banking fees across the industry will reach $65 billion this year, compared to a typical year of about $80 billion.

Discussions between Iraq and Russia regarding the memorandum of understanding to be concluded in the field of combating corruption

The head of the Federal Integrity Commission, Judge Haider Hanoun, received on Monday the Assistant to the Russian President, Igor Levitin. To finalize the memorandum of understanding to be concluded between the Federal Integrity Commission and the Public Prosecution Office concerned with combating corruption in the Russian Federation.

The judge confirmed, during his meeting at the Commission’s headquarters (Igor Levitin), Assistant to the Russian President, and the Russian Ambassador to Iraq, Elbrus Kutrashev, and their accompanying delegation, according to a statement received by Earth News, that “concluding the memorandum of understanding with the Russian Federation comes within the field of the Commission’s interaction with the government program in the field of combating Corruption, preventing its spread, and recovering wanted persons and looted funds from outside Iraq,” pointing to “the obstacles and difficulties facing the Iraqi regulatory agencies in the field of recovering defendants of other nationalities that can be overcome by concluding bilateral memorandums of understanding with counterpart agencies in those countries.”

For his part, (Igor Levitin) expressed “his country’s readiness to cooperate with Iraq in confronting corruption, prosecuting its perpetrators, returning wanted persons and looted funds to Iraq, exchanging experiences and providing legal assistance,” indicating that “oversight work - especially the work of the Federal Integrity Commission - is difficult and requires support.” Pointing out that “the nature of oversight work makes the corrupt harbor hostility toward these agencies and try to obstruct their work.”

The two parties agreed to “extend the bonds of cooperation, joint coordination, exchange experiences, learn about the Russian experience in the field of preventing and combating corruption, and expedite the conclusion of the aforementioned memorandum of understanding.”

Parliamentary Finance will host the Minister of Finance in the coming days to discuss the delay in financing projects

The Governor of the Central Bank discusses with his Jordanian counterpart ways to enhance cooperation and improve banking relations between the two countries

link from Kurdish News

An economic expert proposes a "magic solution" to avoid the crisis of the high price of the dollar

Al-Haidari said {to Al-Furat News} that: “The Iraqi economy is a rentier economy that depends on the sale of oil, and its revenues are mortgaged to foreign countries, especially the United States of America, in exchange for a small share that does not cover the country’s needs and projects.”

He added, "The Iraqi economy has exhausted the citizen, especially with regard to the issue of the rise in dollar prices, and there are magic solutions that are applicable with the presence of self-financing companies that sell oil in foreign currency, including the Basra Oil Company," proposing "a 20% deduction from employees' salaries in dollars, which will lead to a significant decline in exchange rates."

Al-Haidari pointed out, “The possibility of advancing the industrial sector through the rehabilitation of stalled factories and plants. The private sector in Basra suffers from a number of problems, including in transferring investment and allocating land due to bureaucracy, especially with regard to food factories.”

He stressed, "Basra Governorate is devoid of a factory for making tomato paste, and most farmers throw away their goods if the season ends or the prices of the crop drop, knowing that this factory will cover all governorates with this material without the need for imports."

Dollar prices recorded, with the closure of the main Kifah and Harithiya stock exchanges in Baghdad, today, Monday, 156,800 Iraqi dinars against 100 dollars, while dollar prices recorded this morning 156,150 dinars against 100 dollars.

Until the selling prices in the exchange shops in the local markets in Baghdad rose, as the selling price reached 157,750 dinars for 100 dollars, while the purchase price reached 155,750 dinars for 100 dollars.

The US State Department calls on Türkiye to coordinate with Baghdad in combating terrorism

US State Department spokesman Matthew Miller said Monday in New York, "We call on Turkey to coordinate with the Iraqi government in combating terrorism, in a way that supports and respects Iraqi sovereignty."

He added: "We take Turkey's legitimate security concerns posed by the Kurdistan Workers' Party against the country into account."

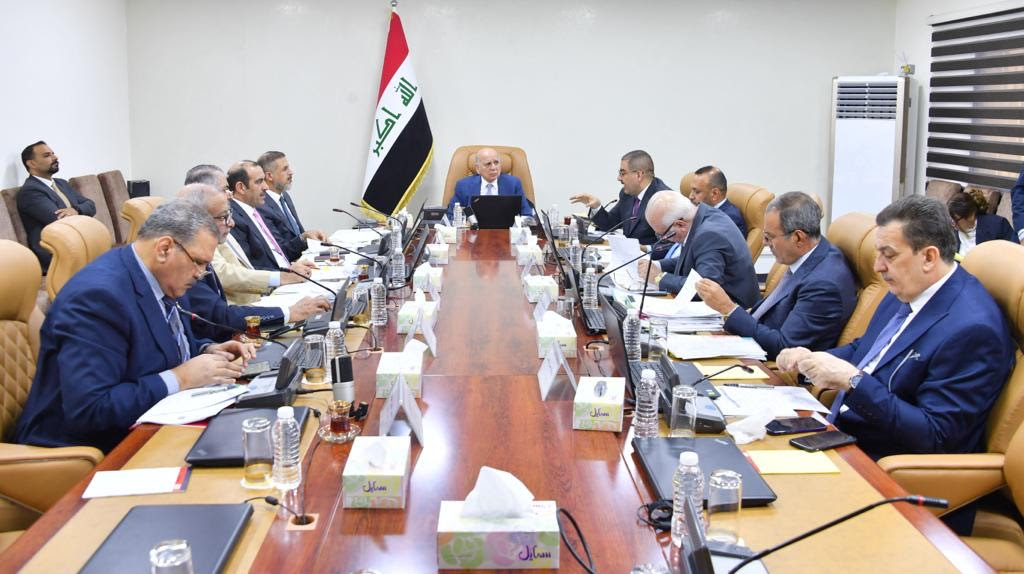

Decisions of the 29th session of the Ministerial Council for the Economy

On Monday, Deputy Prime Minister and Minister of Foreign Affairs, Fouad Hussein, chaired the 29th session of the Ministerial Council for the Economy, in the presence of the Deputy Prime Minister and Minister of Planning, the Ministers of Industry, Trade, Labor and Social Affairs, the Deputy Chairman of the National Investment Authority, the Undersecretary of the Ministry of Oil, and the Prime Minister’s advisors for economic and legal affairs.

A statement by the Ministry of Foreign Affairs said, “The Council discussed the items on its agenda and took the following decisions:

- Not granting new approvals and licenses to mills for a period of 5 years from the date of issuance of the decision.

- Do not promote ownership transfer transactions for approvals and licenses until after completion of establishment and operation.

- Forming a joint committee from the Ministries of Industry and Trade that will conduct an on-site inspection of the approvals granted to mills by the Ministry of Commerce to ensure that they initiate implementation.

The Council also approved increasing the cost of the project to establish the Suez Bridge Interchange in the center of Mosul, as well as increasing the total cost of the project to rehabilitate and expand Imam Ali (peace be upon him) Hospital in Sadr City.

Analysis: Dollar smuggling loses the international regulator’s confidence in the Sudanese government!

Political observer, Rafid Al-Atwani, confirmed on Monday that the Iraqi government’s decisions did not limit dollar smuggling operations despite the pledges it made to the US Treasury, which may lose the international regulator’s confidence in the Sudanese government, in addition to issuing new sanctions on private banks or even the central bank.

Al-Atwani told “Despite the pledges made by the Sudanese government to the US Treasury and the change of the governor of the Central Bank to address the dollar smuggling file, correct the course of banking and financial work, and issue a number of decisions, they did not limit smuggling operations and speculators in the Iraqi markets, let alone inflation.” Which harmed the largest segment of the people, small banking companies, and contractors with the private sector in dollars.”

He added, “International support will not last indefinitely, especially since the United States considers the dollar a part of its national security, and one of its economic weapons to weaken its opponents, and the latter indicated the tendency of some banks to have ideologies opposed to it, and this matter causes the international regulator to lose confidence in the Sudanese government, in addition to issuing sanctions.” New to private banks or even the central bank.”

Warnings against ignoring the demands of exchange companies as their demonstrations approach.. What will happen to the dollar?

On Monday, economic researcher Ahmed Abd Rabbo called on the Central Bank to reach an understanding with the exchange companies that are preparing to demonstrate next Thursday, warning against ignoring the demands of company owners because of its negative impact on the dollar market.

Abd Rabbo told “Any demonstration by money exchangers may reflect negatively on the parallel market and on the dollar market in general.”

He added, “Monetary policy needs stability, and finding a formula of understanding between the central bank, exchange companies, and banks, in order to stabilize the dollar’s position.”

He explained, “The Central Bank is supposed to reach an understanding with these companies that are preparing to demonstrate, and study their problems properly, in order to address any new rise in the exchange rate in the markets.”

He stressed, “Any new rise may greatly confuse the markets in light of the current situation.”

Why do “Iraqis” not occupy a place on the list of the world’s richest people?

Global rich lists are always an interesting topic, as they reveal the wide disparities in wealth between individuals in different parts of the world. However, it notes an underrepresentation of billionaire men from Iraq on these lists despite the country's rich natural resources and great economic potential. In this article, we will look at some factors that may explain this fact.

1. Political and security turmoil:

Iraq has long been plagued by political and security turmoil, starting with the 2003 US invasion and subsequent internal conflicts and terrorist attacks. These conditions make it difficult to build successful businesses and stabilize investments in the country, reducing businessmen's opportunities to achieve great fortunes.

2. Lack of transparency and corruption:

Corruption and lack of transparency in Iraq are two major challenges facing businessmen. Building significant wealth may require cooperation with the government or government officials, and this can cause legal complications and difficulties that make things more difficult.

3. Lack of economic diversification:

The Iraqi economy relies heavily on the oil industry, which means that economic opportunities may be limited for those working in this sector. The lack of diversity in the economy reduces the opportunities for businessmen to choose other areas to invest and build diversified wealth.

4. Educational and training challenges:

There may be a lack of education and training necessary for businessmen in Iraq, which affects their ability to develop businesses and achieve success in global markets that require advanced skills and knowledge.

In conclusion, the lack of billionaires in Iraq shows that there are major challenges facing the country in the field of economics and business. If focus is placed on resolving these challenges and providing a more stable and transparent environment for business, opportunities for entrepreneurs to build significant wealth and increase their representation on global wealthy lists may be enhanced.

Parliamentarian: 11 countries want to invest in the path of development

MP Baqir Al-Saadi confirmed on Monday that 11 countries want to invest in Iraqi development road projects.

Al-Saadi said in an interview followed by Mawazine News, “The development path is not a paper project, but rather a reality. The Sudanese government seeks to put the first phase in the axes of direct implementation within a short period not exceeding months,” pointing out that “the project is strategic for Iraq’s economic future.”

He added, "11 countries have expressed their desire to invest in Iraqi development road projects, and the number may reach 50 if they are initiated," stressing that "the world is facing the birth of an exceptional transportation line that will connect the countries of Southeast Asia and the Indian Ocean to Europe via Iraq."

He pointed out that "the benefits of the project can be summarized in 15 points, the most prominent of which are the financial returns and the volume of investments in building industrial cities and other logistical support, in addition to creating job opportunities and charting a new transportation route in Iraq that attracts various world goods."

Securities: There is a foreign investment portfolio within the market amounting to $250 million

The Executive Director of the Iraq Stock Exchange, Taha Abdul Salam, confirmed today, Monday, that banks are encouraged to activate the custodian system to support investments.

Abdul Salam said during the World Investor Day conference organized by the Iraqi Securities Commission and followed by Al-Eqtisad News, “There is a conviction that since 2008, investment began in direct trading in the Iraqi market through the foreign investor through the formation of foreign investment portfolios.”

He added, "One of the portfolios exceeded $250 million in the Iraqi market," noting, "encouraging banks to activate the custodian."

Behind the scenes of the meeting of the Ministries of Finance and Planning with the governors: The Central Bank is in danger

On Monday, informed sources revealed the scenes of the meeting of the Ministries of Finance and Planning with the governors, noting that it was a frank meeting and indicated a “danger” facing the Central Bank of Iraq.

The sources said in an interview that “the real problem is the problem of a dinar, not a dollar, because the government sells oil in dollars and delivers it to the central bank, and the latter sells dollars to importers (merchants) so that they can import their goods on the one hand and in order to withdraw the Iraqi dinar from them.”

She added, “The Central Bank hands over the Iraqi currency resulting from the sale of the dollar to the government represented by the Ministry of Finance in order to spend its budget, and when the Ministry of Finance spends salaries and projects, money will accumulate with merchants and their demand for the dollar will begin, and so the economic cycle will continue.”

She pointed out that “what happened now is that the government owns the dollar (in the central bank) resulting from the sale of oil... but the central bank cannot sell it to merchants due to American restrictions.”

She continued, “If we track the volume of the Central Bank’s dollar sales during the current year from its beginning until now, we find that the total of what was sold does not cover the salaries item only in the budget, and this means a number of things, the most important of which is that the Central Bank has purchased the dollar and covered the difference from its cash stock of The dinar, which is about to expire.

The sources warned, saying, “During the coming period, the Central Bank will be faced with a difficult and dangerous choice, which is to print more Iraqi dinars and pump them into the market. This will increase the money supply, leading to an increase in inflation and prices.”

She continued, “The other matter is that the government will not be able to implement its (explosive) budget by financing projects in all governorates due to the lack of liquidity, and this matter is clear from the governorates’ complaints about the lack of funding, which is best confirmed by the Finance Committee’s meeting with the governors.”

The Haqq Al-Rada newspaper platform allows government agencies to clarify the narratives circulating regarding the budget file.

No comments:

Post a Comment