An economist speaks passionately about the fate of the “ancient” Iraqi dinar against the dollar

Economic researcher, Ziyad Al-Hashemi, said on Tuesday that the Iraqi government and the central bank have exhausted and weakened the value of the Iraqi dinar in a difficult journey with the dollar.

podcast for this blogpost

Al-Hashemi stated in a post on the “X” platform, that “the currency that rebounds against the dollar due to a statement (a foreign ambassador), and then declines the next day due to (military strikes) here or there, cannot be considered a cohesive currency or capable of... Preserving value, but the problem is not with the currency, but rather with those who work in its name.”

He added: “The Iraqi government and the Central Bank exhausted the Iraqi dinar and weakened its value and reputation during a difficult journey with the dollar, during which the state drained tens of billions of dollars to prove the saying (the dinar is stronger than the dollar), and so far the official system has not been able to achieve that.”

He continued, “It is unfortunate that the fate and reputation of the (ancient) Iraqi dinar is in the hands of an official government group, which does not value its legal value as it should, and does not work properly to defend it or restore confidence in it locally and internationally.”

Christmas Day Articles

Kurdistan will prevent dealing in the dollar in 2024 if Baghdad wants - a special statement

The application started in airports

The Minister of Commerce in the Kurdistan Government, Kamal Muslim, confirmed in a statement to the 964 Network that the region only adopts the Iraqi dinar in transactions at the level of border crossings and airports, and said that measures to prevent the circulation of the dollar will include the real estate market, car trade, and other activities during the next year, if a decision is issued to do so by Central Bank of Iraq.

The Central Bank of Iraq decided earlier in 2023 to limit all local transactions to the Iraqi dinar, and after that the Ministry of Interior launched a campaign to prevent dealing in dollars in all governorates with the exception of the Kurdistan region, while indicating that the penalty for violating the law reaches 5 years in prison.

Kamal Muslim - Minister of Trade in the Kurdistan Region:

We are committed to all instructions and decisions regarding stabilizing the dollar exchange rate and increasing the value of the Iraqi dinar, as we deal in the Iraqi dinar exclusively at the level of border crossings and airports.

At the market level, we will also commit to imposing dealing in the dinar if a decision is issued by the Central Bank requiring it to be used in all market transactions, such as buying and selling goods, homes, and cars in the Kurdistan region.

Network:

Currency market experts say that the issue of “dinarising” local buying and selling operations in the Kurdistan region will have a major impact on the rise in the value of the dinar, because only merchants and tourists need the dollar, and they can obtain it from the Central Bank of Iraq.

after the measures...the dollar is gradually losing its dominance, and an expert expects prices to stabilize at 140,000

Economic expert Nabil Al-Tamimi confirmed today, Monday (December 25, 2023), that the steps taken by the Central Bank and the Iraqi government contributed to reducing the price of the dollar.

Al-Tamimi said in an interview with “Baghdad Today” that “the recent decline in the dollar exchange rate came due to government measures taken by the Central Bank, including dealing in the euro and the UAE dirham in trade and foreign transfers.”

He added, "The dollar will continue to decline, but it needs time to reach the official price. The government must continue these measures, provided that they are temporary measures. It is possible that it will stabilize at 140 thousand dinars during the coming period."

During the past few days, the dollar exchange rates witnessed a noticeable decline against the Iraqi dinar, as the decline reached its extent today, Monday (December 25, 2023), and prices recorded 149 thousand Iraqi dinars for every 100 US dollars in the Erbil and Baghdad markets.

Parliamentary Finance: We will reconsider interest rates on bank loans for three categories

Member of the Parliamentary Finance Committee, Representative Mudar Al-Karawi, confirmed on Monday that his committee intends to raise the issue of reconsidering the interest rates for loans in three tranches.

Al-Karawi said in an interview with Al-Maalouma, “Loans in all their forms constitute factors that revitalize the economy and open job horizons, especially since most of them lead to the creation of opportunities in the private sector in various forms.”

He added, "Loans granted to retirees, people with limited income, and others must be dealt with according to a different mechanism in terms of reducing the interest as much as possible, because the interest they bear now constitutes a major financial burden that burdens thousands of families."

He pointed out that "his committee will study with the relevant authorities the possibility of reconsidering the financial benefits in a way that gives high flexibility, especially to retirees, and the necessity of dealing with them according to a different vision in terms of reducing the interests as much as possible on the loans granted to them."

Iraqi banks grant financial loans in various forms, but they come with high interest rates that burden many people.”

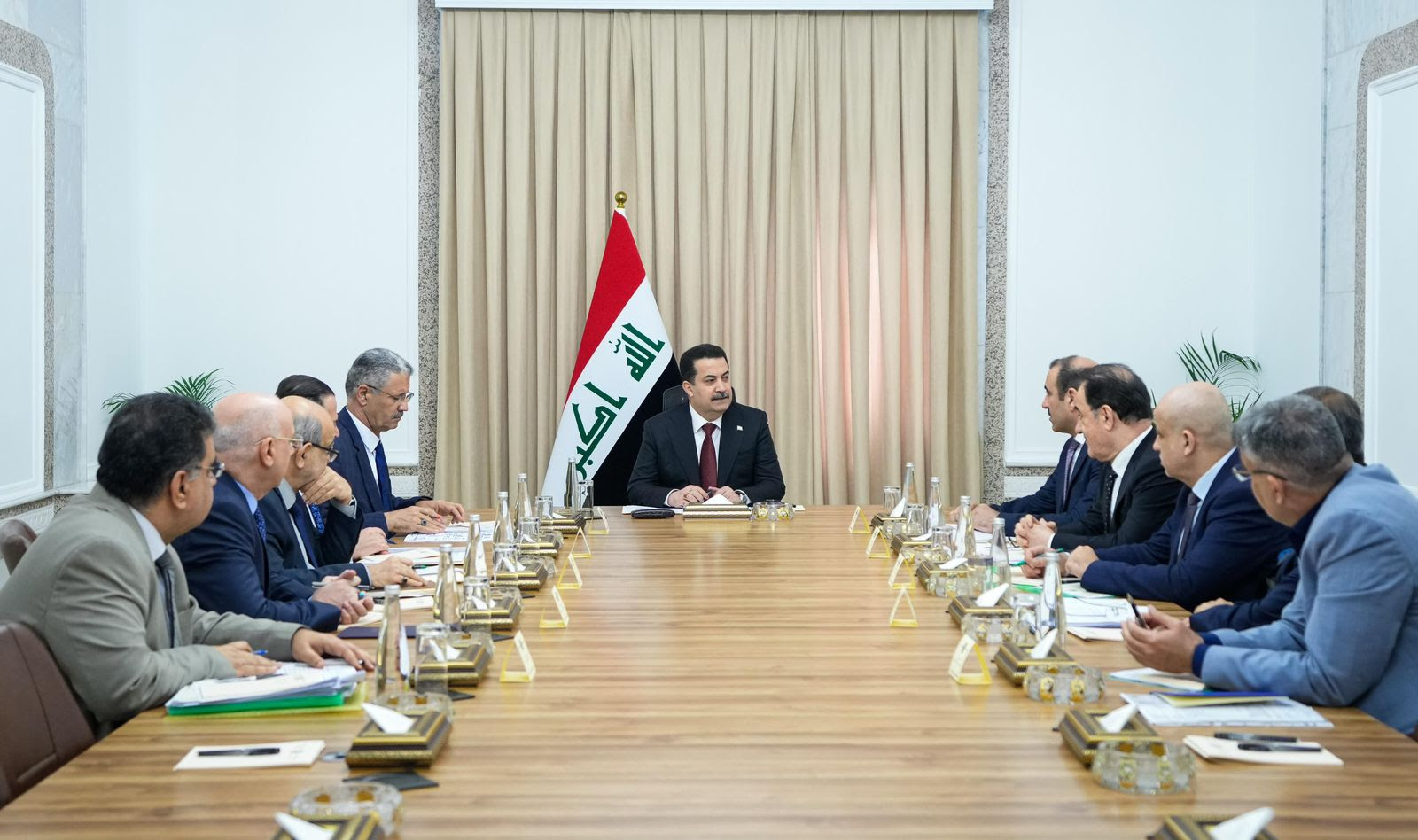

Al-Sudani directs his government to hold an urgent meeting with Shell to liquidate its belongings

On Monday, Prime Minister Muhammad Shiaa Al-Sudani directed the Ministers of Oil, Industry and Minerals, and the Prime Minister’s Advisor to hold an urgent meeting with the international company “Shell” to liquidate its belongings.

A statement from Al-Sudani’s office received by Shafaq News Agency stated, “The latter chaired a meeting devoted to following up on the implementation steps in the pioneering Nebras petrochemical project, and reviewed a summary of the stages of progress and completed steps, and the recommendations of the advisory body following the project’s paths, as he stressed the importance of the time factor, and that the project has been delayed.” It has suffered from delay since 2015, and the government is determined to proceed with its completion by employing its full capabilities and powers.”

During the meeting, Al-Sudani pointed out the need to remove any obstacle to completion efforts, as the Iraqi market needs petrochemical raw materials to support the national industry and move to producing them locally, and efforts to reform the economy will not be effective except by adopting development and proceeding with major strategic projects, such as "Nebras Project".

Al-Sudani directed that an urgent meeting be held for the Ministers of Oil, Industry and Minerals, the Advisor to the Prime Minister, and the Consultant Guinness with the international company Shell to liquidate all remaining belongings, in addition to directing His Excellency to hold a monthly meeting under his chairmanship to follow up on the achievement, activate solutions and remove obstacles.

Last February, the Council of Ministers decided to resolve the most important dilemma that had been pending for years, which is gas pricing, which was approved in accordance with Council of Ministers Resolution 80 of 2023, as well as the transfer of ownership of the lands allocated for the project to the Ministry of Industry and Minerals. In order to resolve the conflicts, an international consulting body was contracted to manage the project, ensuring its implementation in accordance with the economic and technical vision.

Long queues in front of the TBI Bank and chaos... Basra employees are subjected to “humiliation”

link' interesting wish I knew more

In long lines in front of the TBI Bank in Basra Governorate, a large number of employees stand; To receive their salaries in a way described as “humiliating,” while some Basra citizens complain about the absence of the Central Bank’s role in the midst of this “chaos.”

A Basra citizen, while documenting on his cell phone camera what he described as “humiliation,” said, “Citizens stand in long lines to receive their salaries at the TBI Bank in Basra Governorate in a humiliating manner.”

He wondered, "Who is responsible for this chaos? Where is the Central Bank of Iraq, and where is the Iraqi state regarding what is happening?"

He added, "There is fear among the citizens standing in line despite the security deployment, as most of them hold peace for fear of being deprived," indicating that"receiving salaries in this way is very shameful."

https://www.youtube.com/watch?

it would be nice to get that translated

Oil: Revenues last month amounted to more than $8 billion

The Iraqi Ministry of Oil announced, on Monday, the total oil exports and revenues achieved for the month of last November, according to the final statistics issued by the Marketing Company (SOMO).

The Ministry stated in a statement received by Al-Eqtisad News that the amount of crude oil exports amounted to 102 million, 975 thousand and 782 barrels (one hundred and two million nine hundred and seventy-five thousand, seven hundred and eighty-two barrels), with revenues amounting to 8 billion, 481 million and 558 thousand dollars ( Eight billion four hundred and eighty-one million five hundred and fifty-eight thousand dollars).

The statistics indicated that the total quantities exported of crude oil last November from the oil fields in central and southern Iraq amounted to 101 million and 764 thousand and 620 barrels, while the quantities exported from Qayyarah were one million and 1 million and 38 thousand and 779 barrels, while exports to Jordan were 172 thousand and 383 barrels, indicating that the average price of one barrel reached $82,365.

It indicated that the exported quantities were loaded by 33 international companies of several nationalities, from the ports of Basra, Khor Al-Zubair, and single buoys, from the Turkish port of Ceyhan, and the modern Kirkuk warehouse, by tanker trucks, and from the Qayyarah field.

Iraq is second on the list of major oil suppliers to India during the month of October

The energy platform specialized in economic affairs revealed on Monday that Iraq ranked second on the list of major suppliers of crude oil to India during the month of October 2023.

The platform stated in a report that Russian oil represented a third of India's total oil imports last October, which makes Moscow the largest supplier of crude to New Delhi.

It showed that the value of Iraqi oil exports to India amounted to $2.38 billion, a decrease of 7.18%, compared to $2.64 billion in the same period last year.

She added that the list of suppliers also included the Kingdom of Saudi Arabia, the United Arab Emirates and Nigeria, noting that the value of India’s imports of Saudi oil increased by 5.87% on an annual basis, to 1.72 billion dollars.

The value of Indian imports from the UAE decreased by 27.94%, to $1.23 billion, and the value of India’s oil imports from Nigeria also decreased by 24.97%, to $7.76 billion.

A financial expert points out the reasons for the continuous decline in the dollar exchange rate

On Monday, financial expert Nabil Al-Ali attributed the continued decline in the exchange rate of the US dollar towards the Iraqi dinar to several factors, the most important of which is the change in the attitudes of merchants and public opinion through their conviction of the strength and status of the dinar.

Al-Ali said in a statement to Al-Maalouma, “Government measures, pressure on merchants, and fighting rumors by some sick souls questioning the strength of the Iraqi dinar have contributed mainly to the decline in the dollar’s exchange rate against the Iraqi dinar.”

He added, "The main reason for the decline in the dollar's exchange rate against the dinar resulted from the change in the orientations of merchants and public opinion through their conviction of the strength and status of the dinar."

Al-Ali suggested, “The dollar exchange rates against the Iraqi dinar will continue to decline, thus touching the official rate specified by the Central Bank.”

It is noteworthy that the Iraqi dinar has achieved gains against the US dollar over the past few days on the Iraqi Stock Exchange, where the dinar exchange rate reached 150 for every 100 US dollars

Financial expert: There is a great reluctance in institutions to complete their final accounts

Nouri said {to Al-Furat News} that: “It is very important as it shows how the funds funded by the Ministry of Finance were spent in accordance with the budget law and the extent to which they achieved the goals allocated to them.”

He added, "As it is stated in the Federal Financial Management Law in Chapter Five about the dates when public expenditure units submit their financial statements {final accounts} to the Federal Financial Supervision Bureau for auditing, as well as auditing the final account of the Republic of Iraq and discussing the Bureau’s observations that it discovered.”

Nouri pointed out, “There is a great reluctance on the part of many institutions to complete their accounts and submit them to the Bureau for the purpose of auditing.”

Today, Monday (November 13, 2023), the Ministry of Finance announced the completion of the final accounts of the budgets before their legal dates.

The Ministry explained that, despite the complications that accompanied the process of issuing these accounts, the Ministry committed itself to exceptional efforts throughout the previous stage to complete the subject of the final accounts, in line with the provisions of the Iraqi Constitution, and the text of Article (62/First) of the Constitution, which stipulates that: “The Council of Ministers shall submit the general budget law and the final accounts to the House of Representatives for approval,” pursuant to the provisions of Article 34 of Financial Management Law No. 6 of 2019.

An economic expert calls for the "permanence" of the dollar's decline through economic measures

Bassem Jamil Antoine told Al-Furat News Agency, "The basic accountability in confronting and maintaining the rise in exchange rates lies in the sustainability of this decline. It must include new economic measures, operating the agricultural, industrial and tourism sectors, and creating job opportunities for the unemployed."

He stressed that "permanence cannot be maintained, and that these are basic indicators for the process of preserving the currency."

It is noteworthy that the local markets have been witnessing a noticeable decline in the dollar exchange rate for several days, as it fell for the first time in months to below 1,500 dinars per dollar.

The media advisor to the Prime Minister, Hisham Al-Rikabi, said yesterday that “the battle with the dollar is nearing its end,” referring to government measures to limit the rise of the currency in the parallel market and bring it close to the official rate at the Central Bank of 1,320 dinars to the dollar.

Drone attack on Erbil International Airport

The Counter-Terrorism Service in the Kurdistan Region announced, on Monday, that Erbil International Airport was bombed by a drone.

The agency said in a brief statement received by Shafaq News Agency, "At 16:03, a bomb-laden drone targeted a base of the international coalition against ISIS inside Erbil International Airport."

A source expects the dollar price to fall to 145 thousand

An informed source suggested, on Monday, that the central bank’s agreements with some countries to finance foreign trade in local currency contributed to the decline in dollar exchange rates, suggesting that the exchange rates would reach 145 thousand compared to 100 US dollars.

The source said, in an interview with Mawazine News, that “the agreement with the banks of the Emirates, Turkey, India, and China to finance Iraq’s foreign trade is a step in the right direction,” noting that “proceeding with these measures will reduce the gap between the official and the parallel.”

He continued, "The measures taken by the government were practical, but the shock of the US Federal Reserve's punishment of banks prevented prices from falling in the previous period," noting that "the US sanctions were a painful blow to the local markets."

He added, "One of the factors why the dollar exchange rates did not decline in the previous period was the intervention of the external factor in the dollar issue," adding that "the central bank's agreements with some countries to finance trade in the local currency contributed to the decline in the dollar exchange rates."

New electronic payment cards... confusion for the Iraqi citizen

Specific parties dominate the electronic payment card system, which will be implemented at the beginning of next year, without providing a real infrastructure that takes into account the environment of the Iraqi citizen, which has become confusing.

The market “understands nothing” about the reasons for the rapid decline in the exchange rate.. What is the story of the “home dollar”? - urgent

The parallel market for selling the dollar has witnessed a remarkable decline in recent days, especially with its decline for the first time below 150,000 dinars per 100 dollars, amid expectations of a further decline in the coming weeks, according to the readings of some experts.

Muntadhar Ali, a money exchange owner, said in an interview with “Baghdad Today” that he “did not expect the dollar exchange rate to fall below 150 thousand dinars for every $100,” adding: “There is ambiguity in what is happening and the market was programmed to decline without knowing the real reasons.” .

He added, "The profits of speculators in the dollar market for 6 months were depleted in the recent decline," pointing out that "prices may reach 146 thousand dinars per $100 before the end of the week if the accelerating decline continues."

As for Ali Al-Tamimi, the owner of a banking office, he pointed out in an interview with “Baghdad Today” that “the house dollar, which is a name we give to some families that keep part of their liquidity in dollars, began selling the dollar after news of strong declines that the dollar market will witness,” pointing out that “ The turnout for sales increased by almost 100%.”

He added, "The demand for buying the dollar is currently low with the increase in supply," pointing out that "the dollar may fall below 140 thousand dinars per 100% during January if it remains at this pace."

He pointed out that "the comments of economists and officials prompted a reduction in the market, in addition to the import of the dollar by some private banks, which opened larger windows to obtain the currency."

As for the member of the Parliamentary Finance Committee, Mudar Al-Karawi, he acknowledged that “the decline in the price of the dollar came due to the actions of the Central Bank and the state by providing liquidity and reducing smuggling,” pointing out that “the decline is still far from the ambition that we hope it will reach, which is equivalent to the official price announced by the Central Bank of Iraq.” ".

He added, "The state's financial policies are good and we expect that the disturbances in the parallel market have become less in terms of speculation, but this does not mean that it may stabilize at certain limits, especially since we are in an unstable atmosphere in the Middle East that has a direct impact on the economic dimensions."

During the past few days, the dollar declined rapidly from 1,600 to 1,480 dinars per dollar, which means that it lost more than 8% of its value within 10 days.

Iranian official: The Iraqi market is witnessing change and we must realize the new circumstances

The Director General of West Asia of the Iranian Trade Development Organization announced that the transit file between Iran and Iraq has been resolved after years of problems .

Tasnim News Agency reported that Abdul Amir Rabie Hawi said on the sidelines of a meeting of the Iranian-Iraqi Cooperation Policy Council: We have resolved the transit file with Iraq after it faced many problems over the past few years, and merchants can now export their goods to other countries through this country .

He stressed that exports of engineering and technical services have taken a new form today after facing some problems in Iraq between 2012 and 2019. He explained: These exports constitute an important part of our revenues, and we look forward to their continuation and the development of exports in this sector .

The Director-General of West Asia for the Trade Development Organization added: The Iraqi market has taken a new form, and the entry of large Iranian companies and joint cooperation with Iraqi companies could be a good opportunity for joint production with this country .

He believed that companies that are aware of the Iraqi market conditions will be more successful in this country because they are looking for self-sufficiency in their production.

He continued: The policy of reducing imports in Iraq and banning the import of some agricultural and even industrial products created problems for Iranian exporters .

He added: In order for us to have a stronger presence in Iraq, Iran will hold many exhibitions in this country, so that we have 20 exhibitions in this country. Iranian business events are also held in Iraq, and business delegations from our country are sent there as well .

Rabie Hawi referred to the recent visit of the Iranian Minister of Industry to Iraq, and said: During this visit, negotiations took place with various Iraqi officials, and good results and solutions were reached to solve currency exchange problems with this country .

Regarding the current currency problems in Iraq due to US sanctions, he stated: The Iraqi private sector is strong and can play a role in decision-making and even protest the decisions taken by the government of this country .

He continued that the consultations taking place with the Iraqi private sector, including this country's Chamber of Commerce, could provide the necessary conditions to facilitate trade exchanges by protesting foreign exchange policies, so that Iraq's official currency could be allocated in trade exchanges with Iran .

He continued: Under Iraqi laws, which were caused by the sanctions policies followed by the United States, 5 countries subject to sanctions, including Iran, cannot obtain the official currency of this country .

He added: We held consultations with Iraqi officials, including the Prime Minister and the Minister of Commerce, and positive promises were made, but the Iraqi private sector, including the Chamber of Commerce, could be more effective in resolving this problem .

Rabie Hawi stated that sanctions were imposed on 15 Iraqi banks that cooperated with the countries subject to sanctions, and now the ability to exchange currencies has been withdrawn from them, so that they can only be dealt with in dinars .

He said: If we meet and negotiate with the Iraqi private sector, we hope that these problems will be resolved, warning of the facilities offered by competing countries to Iran, such as Turkey and Saudi Arabia, to replace Iran .

The Director General of West Asia for the Iranian Trade Development Organization explained: We plan to establish a joint fund for the export of technical and engineering services with the aim of solving export problems to Iraq. If the Iraqi side agrees to this, we can then issue guarantees and even create foreign exchange facilities .

Revealing the reasons for the decline in dollar exchange rates.. Will it continue?

Member of the House of Representatives, Suhaila Al-Sultani, on Monday explained the reasons for the decline in the dollar exchange rates after months of rise, while confirming that the results of the successful measures and decisions taken by the government and the Central Bank have begun to be translated into reality.

Al-Sultani said in an interview with the Maalouma Agency, “The dollar exchange rates will witness a significant decline in local markets compared to the rise that parallel prices reached in the previous period,” noting that “the government’s continued taking the right steps in this file will reduce the gap between the official and parallel rates soon.” ".

She continued, "The campaign of arrests and prosecution of currency speculators had an effective role in keeping the Iraqi dinar from collapsing," adding that "the Central Bank's decisions work to match the parallel and official dollar exchange rates."

The member of the House of Representatives added: “Controlling the dollar file, in light of the major violations in this file, will not be instantaneous and will need a period of time in order to impose it on the local markets,” pointing out that “the results of the successful measures and decisions taken by the central bank government have begun to be translated on the ground.” reality".

The dollar exchange rates in local markets witnessed a significant decline after months of rise that embarrassed the government and created severe economic repercussions for citizens after the exchange rates at one time reached 169,000 for every 100 dollars.

Sudanese Advisor: Iraq And Turkey Are Entering A New Phase In Trade Relations

The Prime Minister's Advisor for Financial Affairs, Mazhar Muhammad Salih, confirmed today, Monday, the beginning of the first step to organize the trade relationship between Iraq and Turkey using the two countries' currencies and with solid mechanisms, while indicating that the joint committee between the two countries will draw positive milestones in developing economic relations.

Saleh said in a statement followed by “Earth News”, that “Turkey is one of the three major trading partners from whose markets Iraq imports goods and services, and the volume of imports from it reaches 14 billion dollars annually, while Iraq currently occupies advanced ranks in Turkey’s exports to the world, as it does not “Only the United States, Germany, and Italy are ahead of him.”

He added, “Unfortunately, it was noted that the regulation of foreign trade financing and settlements between the two countries was mostly carried out through parallel exchange markets,” noting that “this matter has two negative repercussions. The first is the noise caused by this irregular and illegal parallel market on the stability of the exchange rate. Likewise, its operations are rare, subject to the risk of money laundering, which is categorically rejected by law in both countries, due to the unacceptable problems it causes that are rejected by the official authorities.”

He continued, “The first step in regulating the relationship between the regular markets of the two neighboring countries began through the desire of both parties to improve the means of commercial and economic transparency in a way that serves opportunities for stability and joint investment and to build vital and important strategic bridges between our two countries, including the start of the (Development Road) project that was announced by Prime Minister Mohamed.” “The Sudanese Shia Shia, which links the economies of Asia and the Gulf with Turkey and Europe together, in addition to what Iraq’s important geostrategic role represents in this major development project.”

He stressed that “based on the desire of the Turkish Exporters Union to find relations of understanding and build stable policies between market organizations in the two countries, the joint Iraqi-Turkish committee concerned with market forces has been formed, which will draw positive milestones on the path to stability and development of long-term economic relations, especially in the areas of contracting, trade and investment.” .

He stated that “the two countries’ national currencies will be a tool for direct exchange between the two countries, and through solid and stable mechanisms that the Central Bank of Iraq will draw up measures for, including the draft equal deal that supports the stability of commodity supply in Iraq, which the government statement mentioned in this regard,” according to the official agency.

A third party to Iraqi trade with Iran... and expectations of the dollar falling to 1,400

Economic expert Abdul Rahman Al-Mashhadani predicted, today, Monday, that the exchange rate of the dollar against the dollar will continue to decline in the coming period.

Al-Mashhadani said in a televised statement this evening, "The government has created a third party to finance Iraqi trade with Iran and avoid American sanctions."

He added, "We expect the dollar to fall to 1,450 dinars in the first stage and to stabilize at this price for about 4 to 5 months, and then to decline again to 1,400 dinars."

The Central Bank of Iraq’s measures to diversify currency dealings with Turkey, the Emirates, China and others contributed to reducing dealing in the dollar, as well as reducing the time for transfers to arrive via the electronic platform from 20 days to 4 days. This also contributed to a decrease in demand for the dollar in the parallel market and thus a decline in the exchange rate.

It is noteworthy that the dollar is in Local markets are witnessing a noticeable decline, as they reached 1,487 dinars to the dollar this evening, after touching 1,600 dinars in recent weeks.

The media advisor to the Prime Minister, Hisham Al-Rikabi, said yesterday, “The will of the Sudanese government to carry out reform within the financial institutions in Iraq and the insistence on correction were important factors in strengthening confidence between Baghdad and Washington, and constituted a positive step in achieving success within the banking sector. We said it previously and we confirm it.” Today, our battle with the dollar is nearing its end.”

With the "economic confusion"... a political opinion linking the decline of the dollar to the factions' attacks on the Americans!

Political analyst Ali Fadlallah considered today, Monday (December 25, 2023), that the decline in the dollar exchange rates in the local market came as a result of strikes by armed factions against American targets and interests.

Fadlallah told "Baghdad Today", "The armed factions have goals and a standard for targeting Americans and goals they seek to achieve through their operation against the American forces," noting that "the factions' operations against the Americans achieved many goals at the level of the home front."

He added, "These strikes achieved gains for the Sudanese government and the liberalization of restrictions. Thanks to these strikes, they prompted the American side to deal with the Sudanese and his government with great flexibility, especially in addition to the dollar crisis. This is why we witnessed a decline in exchange rates."

Press reports revealed that the American side issued warnings to the Iraqi government after targeting the American embassy, with the possibility of imposing economic sanctions as well as withdrawing American oil companies operating in Iraq, if the targeting of American interests did not stop.

The pace of military operations in Iraq has recently decreased towards sites and bases that house American forces, while the number of attacks has exceeded 105 since October 17 in Iraq and Syria.

On the other hand, the US Ambassador to Iraq, Elena Romanowski, expressed “American satisfaction” with the recent performance of Iraqi banks and their recent connection with international banks, stressing the American side’s commitment to the flow of dollars to Iraq.

For about two weeks, the dollar exchange rate has been witnessing a continuous decline, as it fell from 1600 to 1480 gradually, at a time when economic specialists expressed the lack of clarity of vision or the existence of a direct reason for the decline in exchange rates. Rather, they are many indicators and reasons accumulated and combined with each other that led to a lack of demand. On the dollar in the parallel market.

The recovery of Iraqi economic activity, will it repeat its role?

Most countries base their economic relations on international assessments of a specific country's economy, aiming to deal with it based on the strength of its economy, according to current custom.

By tracking the assessments of the International Monetary Fund missions through its teams of experts, we conclude that the Iraqi economy has begun to recover despite the impact of the cuts imposed on its oil production on overall growth. The important result is that inflation rates have declined during this year.

Despite all the criticism directed at the approach to the tripartite budget (the framework of the effective three-year budget law) and with the possibility of significant risks to the sustainability of the country’s public financial conditions in the medium term, the structural reforms pursued by the government are extremely important factors in ensuring the protection and stability of the macroeconomic.

In light of this vision, expectations of achieving growth by 5 percent during the year 2023, which is about to end, have been achieved. It is true that implementing the budget will help to continue non-oil growth in the next year 2024. However, the decline in oil production after the closure of the oil pipeline linking Iraq and Turkey, and reducing Production at the request of the OPEC+ group will work together to reduce gross domestic product growth in the years 2023 and 2024. The inflation rate has declined from its peak of 7 percent this year, and the most important thing is that it is expected to remain stable at this rate during the coming months. Perhaps the reason for the reduction in inflation rates is due to the Central Bank of Iraq adopting a more stringent monetary policy, the impact of raising the exchange rate of the Iraqi dinar, the decline in global food prices, and the return of trade financing operations to normal with improved compliance with the anti-money laundering and counter-terrorism financing framework.

It is useful to point out that adopting the three-year budget setting method may lead to improving the level of financial planning and the continuity of implementation of development projects in the medium term. Which is the most important thing.

However, the government faces another challenge, as the delay in starting to implement the budget this year may contribute to the shift from a large surplus achieved in 2022 to a larger deficit in 2024, reflecting the full annual impact of budget procedures.

Such a major expansion in public finances, including a fundamental increase in the numbers of public sector members and pensioners, will raise public spending rates, which will put pressure on funds.

In this case, the government must ensure the protection of extremely important needs, and this is done by examining more non-oil revenues. The government did well by paying attention to addressing this aspect by supporting these measures by moving to work on a more targeted social safety net, and working to provide better protection for groups. Fragile.

Hence, the most important role of the private sector is highlighted in achieving balance in reducing pressure on the government by stimulating economic diversification and creating job opportunities led by the private sector, which is a pivotal factor in achieving growth. This trend is credited to the government if support for the private sector continues to ensure the creation of equal opportunities for the private sector through reforms. In banking and the electricity sector, reducing distortions in the labor market, and continuing to make efforts to strengthen governance and limit the spread of corruption.

This evaluation of governance performance by international experts will require them to advance the reality of the Iraqi economy and sustain this recovery, so that Iraq can regain its pivotal role among emerging economies.

Parliamentary Finance reveals that the dollar will soon fall to 1,400 dinars

The Parliamentary Finance Committee confirmed that the dollar exchange rates in local markets will fall to 140 thousand dinars due to the measures taken by the government and the Central Bank.

A member of the committee, Moeen Al-Kazemi, said in a press interview, “There are many reasons for the decline in the dollar exchange rates to 148 thousand dinars, including the procedures of the Central Bank and the Iraqi government to allow the import of cash blocks through airports, in addition to the coordination taking place with the US Federal Reserve regarding simplifying procedures for issuing... Remittances and sending them, and Iraq deals in multiple currencies, including the Chinese yuan, the European euro, the Indian rupee, and the UAE dirham, in addition to the decrease in demand for the dollar at the end of 2023, because most merchants are in a state of inventorying their business and developing a plan for 2024.”

He added, "The dollar exchange rates will fall to 140 thousand dinars because the central bank provides what Iraqi merchants need from 150 to 200 million dollars."

| It literally pays to make referrals.* |

| Land a $75 bonus when you refer a friend, a family member, or your neighbor with the yappy dog |

I forgot to tell you someone finally put the use your dinar ad on youtube so it's easy to share

An economist speaks passionately about the fate of the “ancient” Iraqi dinar against the dollar

Economic researcher, Ziyad Al-Hashemi, said on Tuesday that the Iraqi government and the central bank have exhausted and weakened the value of the Iraqi dinar in a difficult journey with the dollar.

Al-Hashemi stated in a post on the “X” platform, that “the currency that rebounds against the dollar due to a statement (a foreign ambassador), and then declines the next day due to (military strikes) here or there, cannot be considered a cohesive currency or capable of... Preserving value, but the problem is not with the currency, but rather with those who work in its name.”

He added: “The Iraqi government and the Central Bank exhausted the Iraqi dinar and weakened its value and reputation during a difficult journey with the dollar, during which the state drained tens of billions of dollars to prove the saying (the dinar is stronger than the dollar), and so far the official system has not been able to achieve that.”

He continued, “It is unfortunate that the fate and reputation of the (ancient) Iraqi dinar is in the hands of an official government group, which does not value its legal value as it should, and does not work properly to defend it or restore confidence in it locally and internationally.”

Government media announces the measures taken to adopt electronic payment

Today, Tuesday, the government media team announced the measures taken to adopt the electronic payment system, and while confirming that the file receives direct attention from the Prime Minister, it pointed to the implementation of electronic payment in the departments and institutions of the Ministry of Health early next year, 2024.

The team’s spokesman, Haider Majeed, told the Iraqi News Agency (INA), followed by “Al-Eqtisad News,” that “the file of electronic payment and the use of electronic point-of-sale (BOS) devices is one of the files that receives direct attention from Prime Minister Muhammad Shiaa Al-Sudani, who directed the importance of adopting This file will be discussed during the next stage.”

He pointed out, "There are many procedures regarding adopting the electronic payment system, as the government media team held meetings with the relevant authorities, including the Ministries of Finance and Oil, as well as the Central Bank of Iraq, to develop a specific mechanism."

Majeed added, "The first entity to implement the electronic payment system was the Ministry of Oil regarding government gas stations, then the rest of the ministries and departments such as the Ministries of Health, Interior, Labor, Social Affairs, and a number of ministries that have direct contact with the lives of citizens, and for which collection is required."

He pointed out that "the Ministry of Oil issued a decision to use electronic payment for all government and private gas stations throughout the governorates, and special cards will also be issued for government vehicles."

He continued: "The Ministry of Health will also implement the electronic sales system in public departments, clinics, and health insurance at the beginning of next year, 2024, in addition to the measures taken now in the Passports Directorate to collect funds for issuing and renewing passports from citizens."

Finance: Training about 5,000 employees annually in the financial and accounting field

The Financial and Accounting Training Center in the Ministry of Finance announced today, Tuesday, the training of approximately 5,000 employees annually, while explaining the details of its work.

The Center's Director General, Ahmed Al-Dahlaki, told the Iraqi News Agency (INA): "The Financial and Accounting Training Center is the training center responsible for primarily training employees of the Ministry of Finance, as well as training state employees in all ministries and entities not affiliated with the Ministry in the financial and accounting field."

Al-Dahlaki added, “The training center is concerned with the annual training plan, and it also has strategic plans over three and five years, in addition to keeping pace with all existing government programs and reform programs in the financial and accounting field.”

He pointed out that "the annual plan includes training about 5,000 employees," noting that "the center keeps pace with new matters and works to train them, including the ASYCUDA system that was implemented in the General Authority of Customs, and the POS system that was adopted by the government."

He explained, "The center is not only concerned with the training field, but there is another aspect of its specialization, which is the research aspect, including insurance, banking, and public finance."

The Iraqi government denounces the recent American bombing and announces the death toll

On Tuesday, the Iraqi government condemned the American air strike that targeted the headquarters of factions under the umbrella of the Popular Mobilization Forces, resulting in the fall of a member and the wounding of 18 others, including civilians. This was in response to the attack that targeted a military base in the city of Erbil, which led to the death of... Casualties among the ranks of the US Army.

A statement issued by the Prime Minister's Media Office stated that the Iraqi government confirms that it, through all its security forces, all its constitutional institutions and all its legal authorities, is dealing firmly with the attacks by some elements on the headquarters of foreign diplomatic missions or the places where military advisors from friendly countries are present. These attacks have previously been diagnosed as hostile acts that affect the sovereignty of the Iraqi state, and it is unacceptable for them to be committed under any circumstances or under any name or justification.”

The statement added, "The Iraqi government condemns what happened at dawn today, Tuesday, December 26, 2023, of targeting Iraqi military sites by the American side under the pretext of response, which led to the martyrdom of a member and the injury of 18 others, including civilians. It is a clear and unconstructive hostile act." It does not serve the path of long-term common interests, in establishing security and stability, and works contrary to the declared desire of the American side to strengthen relations with Iraq.”

The statement also considered that "this step harms bilateral relations between the two countries, and will complicate ways to reach understandings through joint dialogue to end the presence of the international coalition, and, above all, it represents an unacceptable violation of Iraqi sovereignty."

The statement continued, "Our security forces have succeeded in extending security and stability throughout our country, and achieved victory over the terrorist ISIS gangs, which no longer pose a threat to Iraqi national security. Therefore, preserving the fruits of this victory is at the core of our security and strategic priorities, and we will not allow any party to compromise what has been achieved." And it was consolidated through thousands of precious sacrifices.”

The White House had announced earlier today at dawn that United States President Joe Biden had directed air strikes on three sites belonging to Kataib Hezbollah and its affiliated groups in Iraq, in response to the attack that targeted a military base in Erbil and resulted in the injury of three soldiers. Americans.

The White House said in a statement that US Secretary of Defense, Lloyd Austin, briefed President Biden in a phone call on Monday afternoon about the incident, and several options were presented to the president, and Biden ordered the strikes during that call.

The statement added that the strikes focused on "drones activities," indicating that groups affiliated with the Iraqi Hezbollah Brigades focused in particular on drone activities.

US Defense Secretary Lloyd Austin announced this morning that US forces launched strikes on three facilities used by Kataib Hezbollah and its affiliated groups in Iraq.

Austin said, in a statement, “These precision strikes are a response to a series of attacks against American personnel in Iraq and Syria by Iranian-sponsored militias, including an attack by Iran’s Kataib Hezbollah Brigades and its affiliated groups on the Erbil air base that resulted in one casualty.” 3 Americans, one of whom is in critical condition.”

He added, "We will not hesitate to take the necessary measures to defend the United States, our forces, and our interests, and there is no higher priority than that."

The US Secretary of Defense continued by saying, "While we do not seek to escalate the conflict in the region, we are fully committed and prepared to take further measures necessary to protect our people and our facilities."

The armed Shiite factions escalated their attacks on the military bases of the international coalition forces led by the United States of America in Iraq and Syria after the events of October 7 in Palestine (the Al-Aqsa flood).

900 American soldiers are stationed in Syria and 2,500 in Iraq on a mission that the United States says aims to advise local forces and assist them in trying to prevent ISIS from re-emerging after it seized vast areas in Iraq and Syria in 2014 before being defeated.

Pentagon: 3 American soldiers were injured in the attack on Erbil base

Today, Tuesday, the White House announced the toll of the bombing that targeted American forces at Erbil Airport.

The White House stated, in a statement, that "United States President Joe Biden directed air strikes on three sites belonging to Kataib Hezbollah and its affiliated groups in Iraq, in response to the attack that targeted a military base in Erbil and resulted in the injury of three American soldiers."

He added, "US Secretary of Defense, Lloyd Austin, briefed President Biden in a phone call on Monday afternoon about the incident. Several options were presented to the president, and Biden ordered the strikes during that call."

The statement continued, "The strikes focused on" drone activities, noting that "the Iraqi Hezbollah Brigades focused specifically on drone activities."

Before the eyes of the Honorable Prime Minister is a vision to activate the achievement of economic reform (2024-2026)

Through an analysis of what was stated in the government curriculum of the government of the Sudanese President, which is the ninth government after the change in 2003, and which has been in charge for a year and two months, and which was called the services government, it was able to accomplish an acceptable percentage of the goals specified in the government curriculum in accordance with the vision of the Prime Minister, which included many Of the economic sectors and fields, which occupied nearly most of the aspects of the government curriculum, because without achieving comprehensive and radical economic reform, which begins with financial and banking reform, the full goals and visions of the government cannot be achieved. Therefore, the government curriculum, as I see it, is a four-year strategy to achieve the economic reform revolution.

The reason for launching this strategy is “because Iraq, after 19 years of economic failures, mismanagement, and mismanagement of public funds due to administrative and financial corruption, the loss of the sound economic approach, political tensions, and instability in the business environment, has led to dependence on oil as a primary resource of public budget revenues, which constitutes up to 93% of total resources, up to 60% of gross domestic product, and failure to activate productive sectors that generate national income.” Which led to "ambiguity of the vision and lack of clarity in the decisions of the reform process of previous governments, except for some achievements achieved by the Central Bank of Iraq during the past years, in which it overcame the challenges of monetary policy in proportions that enabled it to maintain the stability of the dinar exchange rate during the years (2017-2020) and build foreign currency reserves." Excellent, maintaining the general level of prices and the annual rate of inflation around 2%. This contributed to overcoming the economic and security crises in 2014 and addressing the decline in global oil prices by more than 70%.

This confirms that the government and the Central Bank have reviewed the previous reform policies in 2023 through diagnosis and analysis and have concluded that economic problems are the cause of most of Iraq’s crises and that “the real solution to Iraq’s crises is to work in the manner of comprehensive change, and here I mean drawing a strategy for a road map for the economic, administrative and legislative revolution by adopting the change.” radically for the coming years, while benefiting from the experience of institutions and individuals in charge who have achieved previous success experiences in confronting crises. On the occasion of the Prime Minister’s announcement that the year 2024 will be a year of achievements, it is an affirmation of the insistence on implementing the road map set out in the government curriculum in a way that supports economic, financial and banking reform, and it will be accomplished. All investment, service, administrative, technical and structural projects to support the national economy and maintain the stability of the Iraqi dinar exchange rate in the monetary trading market. For the purpose of activating the reform measures for the years (2024-2026), the following was proposed before the attention of the Prime Minister:

Firstly, starting a systematic movement to draw a road map for administrative, legal and economic reform carried out by the Iraqi economic, financial and banking elites and competencies (governmental and private sector) by creating the Supreme Economic Council and representing the private banking sector in its membership as the financing sector which must contribute to investment. The movement should be based on The reform system relies on several important economic pillars, adopts a new methodology for managing the economy, and achieves the central goal of moving the economy from rentier to productive, from cash to digital, and activating productive sectors other than oil to reach 50% of general budget revenues in 2026, creating sustainable development, and achieving diversity in... Resources and the development of economic and human structures in order to properly build the national economy and build the foundations for the transition to a social market economy, provided that its recommendations, after approval by the Council of Ministers, are binding for implementation by the ministries, agencies and concerned parties.

Second - Forming a (Central Follow-up Committee) linked to the Prime Minister’s Office to follow up on the implementation of decisions and having the authority to monitor and evaluate. It is formed under the chairmanship of the Prime Minister and the membership of an elite group of advisors, government experts, and private sector experts.

Third - Moving to the central administration of the economy so that the principle of (centralized planning and decentralized implementation) is implemented. This means that the Supreme Council of the Economy is responsible for drawing up plans and policies centrally and distributing their implementation to the ministries and specialized bodies within the government structure after the approval of the Council of Ministers.

Fourth - Providing soft loans to finance small, medium and large projects and establishing a legal and institutional system to manage, grow and develop them, and issuing a special law for them. As well as issuing and amending the laws of the legal environment to regulate the economic process, and here this means issuing new laws instead of the laws that were issued in 2004. Due to the changes that occurred. in the national economy during the past two decades.

Fifth - Activating investment in the agricultural, industrial, energy, tourism, services and housing sectors, as well as working to reform, develop and grow the banking sector through monetary policy applications and regulating the relationship and restrictions that govern financial and monetary policies, as well as a serious approach to reforming the tax, financial and customs system. Addressing cases of failure to achieve the required growth rates in national income and exceeding the rise in unemployment and poverty rates.

Sixth - Developing a new methodology to overcome the challenges of instability in the financial system and the monetary system. This means developing coordinated and balanced plans to overcome the challenges of monetary policy and the challenges of the non-oil revenue deficit and the deficit in the balance of payments and the trade balance. Seventh - Accelerating the implementation of the e-government program and coordinating it with the electronic payment system. Focusing on following up on the decisions issued by the government regarding the use of electronic payment in commercial exchanges and banking operations and activating the establishment of the National Electronic Payment Company, which the Central Bank recently announced.

Moeen Al-Kazemi: If the government continues its measures, the dollar will reach 145 or less

Activating the “Private Sector Development” Council

Specialists see the reactivation of the Private Sector Development Council as a positive step that will restore some of its effectiveness to the private sector.

Alaa Sukkar, a member of the Parliamentary Services Committee, explained in an interview with “Al-Sabah” that “reactivating the council is one of the promising steps to revitalize the private sector and restore life to it.”

He added, "The Prime Minister's interest in this council and monitoring its development is evidence of its importance in revitalizing the private sector, and thus the results will reflect positively on the country, including employing the workforce, reducing unemployment, and reviving investment," indicating that "it is in line with amending a group of laws such as investment and taxes, and it will have a positive impact." in the local market.

In turn, economic expert Mustafa Hantoush told Al-Sabah: “The council has been established since 2018, but it has been ineffective and unable to manage the private sector and is managed with a bureaucratic mentality.”

Hantoush added, "The Prime Minister restored the spirit of the Council by assuming its presidency personally to ensure the presence of personalities with capital, because they can convey the image and reality of investment."

Meanwhile, the economic expert, Osama Al-Tamimi, stated that “the issue of developing the private sector is important, and the state’s intervention in developing it is a must. This is done through visits and accompanying delegations to developed countries and participating in exhibitions and development courses to pave the way for the private sector to carry out new activities that the state does not interfere in establishing.”

The dollar’s decline is “temporary” due to traders’ preoccupation with New Year’s Day.. Finance Committee

Statement from Jamal Cougar

Member of the Finance Committee in Parliament, Jamal Koger, said that the reason for the decline in the dollar exchange rate was; It is a decline in demand for it following the usual cessation of commercial deals and financial exchanges at the end of the year, the celebrations taking place in the country, and the preoccupation of businessmen with travel.

Cougar confirmed in an interview with Al-Arabi Al-Jadeed, followed by the 964 network , that “the decline is not guaranteed, and is due to reasons related to the decline in demand for it for commercial deals and financial exchanges, as countries witness New Year’s celebrations.”

He added that “the Iraqi financial market is controlled by groups of speculators, and they are the ones who set prices according to what the nature of their work in the market requires,” stressing that “the Iraqi government does not control these speculators.”

Koger pointed out that “the basic problem that Iraq is suffering from in the economic and financial structure, including the dollar crisis, is caused by the imbalance in the economic structure resulting from total dependence on oil exports, while the country remains in constant need of the dollar to cover foreign expenses because the country is still hostage to imports in light of the lack of... The presence of effective national production.”

Iraq Expectations 2024: Will mobile phones eliminate “cash”... and what do we know about FIB Bank?

More technologists, less accountants

Bankers and financial experts say that a noticeable jump in the number of Iraqis holding electronic payment cards during the past months encourages expectations of major reforms in the type of commercial transactions and financial services, and also prompts optimism about the success of the “digital banking” experience, especially after the “first bank” “Electronic” in Iraq FIB obtained a license from the Central Bank, to promote financial transactions via an application within mobile phones.

More than two million Iraqis issued electronic bank cards during the past ten months, according to the Iraqi Banks Association.

The government says that it is working to move towards electronic transactions with the aim of reducing corruption and money laundering and controlling the work of banks, instead of paying in paper currency, but the process is moving slowly for various reasons, most notably the reluctance of citizens to adopt the card system, in addition to the failure of some commercial centers to deal with points of sale. Electronic POS.

Earlier this year, the government obligated commercial centers, restaurants, private schools, universities, private colleges, and fuel processing stations of all types and locations, and throughout Iraq, to open bank accounts and provide points of sale for electronic payment.

In addition to this path, which seems faltering despite its promising steps so far, local banks have dared to propose a digital bank model that manages all its financial operations through mobile phones, according to specific standards.

FIB Bank says that it is the first “Iraqi electronic bank” that provides financial services (online) via the Internet, without the need to visit the bank’s headquarters.

According to data published on its website, the bank relies more on technical experts than accountants, and its required jobs focus on programmers and technology engineers.

It is not clear yet the general indicators of the success of such banks in a country that has been accustomed to paper currency for decades, and is now struggling to move to card payment later than all the countries of the region, but the experts who spoke with the 964 network said that the experience will constitute a qualitative shift in the Iraqi banking sector, Although customers need to overcome their fears of digital transactions, which are still new to the country.

Mahmoud Dagher, banker and financial expert for 964 Network :

An electronic bank is a bank, like any traditional bank we deal with, but it does not use routine methods that require meeting people in person to complete and complete transactions.

The electronic bank carries out all its steps via the Internet, relying on digital tools in a special system.

Any citizen (or resident) can open accounts online, to withdraw and deposit funds through easy and secure steps.

Opening accounts and obtaining electronic cards is a good phenomenon, but an Iraqi gap in this area must be addressed, which has been exploited to withdraw cash dollars outside Iraq and benefit from the price difference in the parallel market.

The electronic bank's step is a success for the banking sector by relying on electronic payment, but the dollar exchange rates have not been affected by this issue so far.

Aland Saif Al-Din, Technical Director at FIB Bank:

FIB is the first digital bank in Iraq, operating with a license from the Central Bank.

The financial services we provide are exactly similar to what other banks offer, but through an application within a mobile phone.

In addition to the digital service, there are branches of the bank in all governorates that provide their services to customers normally.

Anyone can open a bank account in the phone application, through easy and quick steps, and the customer can transfer or receive amounts from his home, within a very short time.

Customers' rights are preserved because the Central Bank supervises the bank's work and monitors the measures taken, as it does with other traditional banks.

Ali Tariq, Executive Director of the Association of Banks:

The private banking sector has worked greatly on developing the infrastructure with regard to technology, and many banking services are now available that are performed via electronic applications, such as opening an account, issuing a bank card, transferring funds, applying for loans, and others.

The use of technology contributes to the access of banking services to all segments of society, and leads to increased financial inclusion.

Nabil Jabbar Al-Tamimi, financial expert:

The Iraqi government is trying with the Central Bank of Iraq to expand work using electronic cards as one of the steps to localize funds in Iraqi government and private banks.

The government's first economic goal is to provide cash liquidity primarily with banks to achieve development goals, followed by other goals that contribute to the process of paying in the commercial market, codifying complications, and providing public facilities.

Iraqis rushed intensively to acquire electronic cards after government decisions that stipulated the expansion of work with electronic cards, including restricting payment for gas stations to electronic payment cards, which may extend to exclusive means of payment for services provided by the government in general in the near future.

Electronic payment has several benefits, including the stability of the national currency, stimulating trade, tax discipline, ease of transactions, speed of trade and services, and controlling state revenues.

Electronic payment requires the provision of appropriate infrastructure for such cash operations, such as servers, databases, control and protection programs, and automatic payment and withdrawal ports.

Modify controls

Amending Paragraph (T) of Article (11/Third) of the Regulations for Regulating the Work of Exchange and Brokerage Companies in the Buying and Selling of Foreign Currencies No. (1) of 2022 .. For more, click here

Central Bank of Iraq

Financial institutions supervise non-banking

Department of Supervision of Exchange Companies, Studies, Registration and Licensing Division

Al-Ayyafi Central Bank

Issue: 2/19/22

Date: 12/25/2023

To / exchange companies, two categories) A

I opened a branch

To / exchange companies two categories (A and B) m opening a branch

good greeting

Based on the decision of the Board of Directors of this bank No. (192) of 2023, the following was decided: 1- Amending Paragraph (T) of Article (11) Third) of the Regulations for Regulating the Work of Exchange and Brokerage Companies in the Buying and Selling of Foreign Currencies No. (1) of 2022 amended to be as follows: According to the following formula: Exchange companies of categories (A and B) are allowed to open a new branch provided that the company’s capital is increased by an amount of (250,000,000) dinars (two

2- Article (11) Third) of the aforementioned controls applies to licensed exchange companies that are older than fifty million dinars) for each branch. Licensed for a period of (3) years or more

with respect.

Answer. Ammar Hamad Khalaf, Deputy Governor, Agency

Chambers of Commerce: The dollar exchange rate may reach 140 thousand

On Tuesday, the Chambers of Commerce expected the dollar exchange rate to reach 140,000 per $100 within a month.

The head of the Diyala Chambers of Commerce, Muhammad Al-Tamimi, said in an interview with “Al-Ma’louma” that “the compass of the parallel market leads towards the gradual and continuous decline for 18 days of the dollar exchange rate,” pointing out that “today it approached the barrier of 147 thousand dinars for every $100, and it may witness another decline in the round.” Evening, whether in Baghdad or Erbil.

He added, "The exchange rate may reach 140,000 dinars for every $100, especially with an abundance of supply offset by a reduction in purchasing, which created pressure that led to a decline in prices in the past days."

He pointed out that “state institutions are about to launch more than 1,300 projects in the governorates in early 2024, which may contribute to increasing the demand for the dollar, but the Central Bank’s measures, through the electronic platform, may contribute to limiting any strong increases that exceed the barrier of 150 thousand for every $100.” .

The dollar exchange markets are witnessing a gradual decline in exchange rates, which approached 147 thousand dinars per $100.

The Iraqi dinar recovered against the dollar amid government measures to confront speculators

Today, Tuesday, the currency exchange in the Iraqi capital, Baghdad, recorded new gains achieved by the Iraqi dinar against the dollar , as the monetary authorities and the Iraqi government continue to implement measures to combat the parallel market and pursue currency speculators.

Today, Tuesday, the Al-Kifah and Al-Harithiya Stock Exchanges in Baghdad, along with the Erbil Stock Exchange, recorded an increase in the value of the Iraqi dinar against the dollar, by 1,490 dinars to one dollar, which is the best value the dinar has reached in more than 8 months, but it remains far from the official value that it has reached. Set by the Central Bank of Iraq, it is 1,320 dinars per dollar.

Experts suggest that the exchange rate of the dinar will gradually rise against the dollar for several reasons, including the recent agreement between the Iraqi Central Bank and the US Federal Reserve for the gradual transfer of operations to enhance the advance balance of the dollar in the accounts of a number of Iraqi banks.

In addition to imports from some countries sanctioned by the United States with their local currency, such as Iran, Syria, and Lebanon, which now have common financial systems that reduce the demand for the dollar from the Iraqi market.

While others believe that this period, at the end of each year, witnesses a stagnation in trade exchange operations and a temporary cessation of a number of deals due to the end-of-year holiday.

The recovery of the Iraqi dinar

Economic expert Abdul Rahman Al-Sheikhli confirmed that the continued decline in the exchange rate may reach 1,450 dinars to one dollar during the coming period in light of the means of intervention currently available to Iraq.

Al-Sheikhli explained, during an interview with Al-Arabi Al-Jadeed, that the dollar may fall below this price if the sources of diversification of Iraqi income grow when there is a tangible development in industry, agriculture, trade, and investment of other wealth.

He pointed out that investing these wealth and using modern and advanced means in management, work, industry and agriculture reduces the rate of imports from abroad and the national economy begins to recover, which reflects positively on the gross domestic product in Iraq.

For his part, Jamal Kujar, a member of the Finance Committee in the Iraqi Parliament, confirmed that the decline in the dollar exchange rate is not guaranteed

In an interview with Al-Araby Al-Jadeed, Cougar explained that the reason for the decline in the exchange rate these days is due to reasons related to the decline in demand for it for commercial deals and financial exchange operations, as countries witness New Year’s celebrations.

He added that the Iraqi financial market is controlled by groups of speculators, and they are the ones who set prices according to what is required by the nature of their work in the market, stressing that the Iraqi government does not control these speculators.

Koger pointed out that the basic problem that Iraq suffers from in the economic and financial structure, including the dollar crisis, is caused by the imbalance in the economic structure resulting from total dependence on oil exports, while the country remains in constant need of the dollar to cover foreign expenses because the country is still hostage to imports in the absence of... Effective national production.

In this context, economic researcher Ali Jassim Al-Hayani expected that despite the relative demand for buying the dollar by the end of 2023, due to the travel of a significant number of Iraqis abroad to spend the end-of-year vacation, and the cessation of many commercial events and operations, the exchange rate may decline again in a significant way. Gradual if the Iraqi government takes strict measures against speculators.

He added, in an interview with Al-Arabi Al-Jadeed, that the reasons for this decline were linked to the reduction in black transfers, after the recent Iraqi agreement to finance foreign trade with non-dollar means, especially with the Turkish side.

He warned against the exploitation of money laundering networks and influential parties in an attempt to directly control the dollar in the market after the decline in prices, calling on the government to activate economic security and spread it in the market to limit fraud and price manipulation.

Government actions

Media Advisor to the Presidency of the Government, Hisham Al-Rikabi, said that the Iraqi government is serious about solving the dollar problem through several legal means and government decisions related to confronting manipulation of the exchange rate and reducing currency smuggling operations.

Al-Rikabi explained in a press statement that the government's battle with the dollar is "near the end," as he described it, and that the government's measures to reform the financial system contributed to strengthening confidence between Baghdad and Washington.

He added that the Iraqi government's measures related to reforming financial institutions and correcting the course of monetary systems were important and effective factors in restoring balance and enhancing confidence between Iraq and the United States, which contributed to forming positive steps to work towards achieving success within the Iraqi banking sector.

He pointed out that the coming days will witness a tangible change in the nature of the currency market, in accordance with the measures taken by the government, as well as the instructions issued by it to the Central Bank to deal decisively in order to address the problem of manipulation and smuggling.

The US Ambassador to Iraq, Alina Romanowski, said last Sunday that her country continues to provide dollar services to Iraq in the interest of economic stability.

She added on her account on the "X" platform that many Iraqi banks have established relationships with international banks, in a step she described as positive towards making progress in reforming the Iraqi banking sector.

Including "Baghdad Metro and electricity contracts"... The Sudanese government takes economic and service decisions

Today, Tuesday, Iraqi Prime Minister Muhammad Shiaa Al-Sudani chaired the fifty-second regular session of the Council of Ministers.

His media office said, in a statement received by Shafaq News Agency, during which the general situation in the country was discussed, the most prominent economic and service files included in the government program were discussed, topics on the agenda were discussed, and directives and decisions were taken regarding them.

As part of the government’s support for the sports sector, and with the aim of supporting the national team’s journey in the Asian Cup, which will begin next month in Qatar, the Prime Minister directed the Ministry of Transport to operate discounted flights for Iraqis wishing to attend the tournament, who have official cards approved by the organizing committee. He also directed The Ministry of Foreign Affairs to communicate with the Qatari side in order to facilitate obtaining entry visas for them.

In the context of the session, the Council of Ministers agreed to grant ownership to the displaced and displaced families from the (Salin) area in Basra Governorate, which number (250) families. The lands previously allocated to them outside the borders of the municipality of Basra at the real price, as an exception to the public bidding procedures stipulated in the amended Law on the Sale and Rent of State Funds (21 of 2013).

In the context of continued government support for youth, the Council of Ministers agreed to amend Paragraph (29) of Council of Ministers Resolution (23465 of 2023) regarding youth proposals, to become as follows:

-Grant funding for the winning programs will be from the amount of 5 billion dinars, allocated to the Department of Non-Governmental Organizations, in the General Secretariat of the Council of Ministers; To support organizations and volunteer teams.

As part of the Prime Minister’s directives to proceed with the completion of projects whose commencement was delayed, including the Baghdad Metro Project, the Council agreed to include (preparing designs and supervising the implementation of the Baghdad Metro Project) in the investment budget schedules of the Baghdad Municipality for the year 2023, at a total cost of (913804000000) dinars, only nine hundred dinars. Thirteen billion, eight hundred and four million dinars, after completing the listing requirements by the Baghdad Municipality and confirming that the investor will subsequently bear the full cost of the project.

In the energy file, the recommendation of the Ministerial Council for Energy (23101 T) for the year 2023 regarding approving the recommendation of the opinion committee in the Ministry of Electricity was approved, according to the following:

Authorizing the Minister of Electricity, or his authorized representative, to sign a memorandum of principles of cooperation between the Ministry of Electricity and Toyota Tsusho Corporation, in line with the Ministry’s plan and the available financial allocations.

Also in the energy file, the Ministerial Council for Energy’s recommendation (23098) for the year 2023 was approved, according to the following:

1. The Ministry of Oil/Basra Oil Company’s share in the West Qurna/1 field will be financed in operation, based on what was stated in Council of Ministers Resolution (2 of 2022) in the amount of $250 million, through the allocation of quantities of crude oil exported by the Oil Marketing Company. Their amounts are deposited in a bank account opened for this purpose (outside Iraq), and this is regulated by a special agreement with the new main operator of the field (Basra Oil Company).

2. Because the field is one of the components of the petroleum licensing rounds project included in the investment plan, which is financed in kind with crude oil, therefore, the restrictive settlement for the amount indicated in Paragraph (1) mentioned above is organized from the project allocations included in the Federal General Budget Law (13 of 2023) and in the same manner. The mechanism used by the Ministry of Finance in conducting settlement entries for other oil fields.

3. The profit wages, administrative charges, and benefits resulting from its participation in the service contract for the West Qurna/1 field will be for the benefit of the Basra Oil Company, similar to the company’s share in the Zubair oil field.

4. Signing a share sale agreement between ExxonMobil and Basra Oil Company, which entails paying the share sale price after making the final settlement in kind with crude oil.

The Council of Ministers approved an increase in the capital of the General Company for Private Transport Management to (30301762716) dinars, only thirty billion three hundred and one million seven hundred and sixty-two thousand seven hundred and sixteen dinars, instead of its current capital of (675) million dinars, with an increase of (29626762716) dinars. Only twenty-nine billion, six hundred and twenty-six million, seven hundred and sixty-two thousand, seven hundred and sixteen dinars, based on the amended Public Companies Law (22 of 1997), and the Ministry of Transport is responsible for taking the necessary measures to implement what was stated in Paragraph (1) mentioned above.