Iran announces the start of settling its country's exports to Iraq in its national currency, the riyal

Iran announces the start of settling its country's exports to Iraq in its national currency, the riyal

The podcast that goes with this posting is below

The Governor of the Central Bank of Iran confirmed the start of a project to settle the country's exports abroad in the national currency, the riyal. On the sidelines of the meeting of the Government and Private Sector Council in Khorasan Razavi Province (northeastern Iran), Muhammad Reza Farzin explained that the issue of settling Iranian exports via the riyal currency outside the borders has been studied by the Central Bank for several months, and that its entry into force will address the requirements of exporters to Iraq and Afghanistan.

He added, "This issue is one of the demands of Mashhad's merchants for export to Afghanistan, and through the implementation of the 'Rial Offshore' project (riyals outside the borders), merchants will be able to benefit from it instead of foreign currency." The Governor of the Central Bank of Iran pointed out that “the regulations for the cross-border rial project have been formulated by the Central Bank, and in practice two banks have started this project, and soon it will be circulated to all the country’s banks.” It is noteworthy that the Federal Reserve Bank, the US central bank, imposed procedures and restrictions on external financial transfers from Iraq, to ensure that they do not reach Tehran.

A report issued by the International Center for Development Studies, headquartered in the British capital, London, previously warned that “the attempts of the Central Bank of Iraq to prevent the smuggling of the dollar have failed, as the price of the Iraqi dinar continues to decline against the dollar, which exacerbates the suffering of Iraqis and raises the prices of goods.” The report pointed out that "the Iraqi banking system, instead of contributing to the development of the Iraqi economy, has become a major obstacle to growth or attracting investments, in addition to becoming an essential accessory to money smuggling and money laundering networks.

There are a large number of banks that belong to figures close to politicians, parties and factions." Armed forces contribute significantly to dollar smuggling and financing foreign trade operations with neighboring countries in exchange for receiving commissions and political support.” The report estimates that two-thirds of the Central Bank of Iraq's sales in what is known as the "currency selling window", which ranges at levels of $250 million per day, did not benefit the Iraqi market over the past two decades, which led to the country losing sums of money of no less than $400 billion. The British report did not rule out that dollar smuggling operations would lead to the isolation and ban of more Iraqi banks because some of them contribute to violating international sanctions, noting that “the recent US Treasury decisions to impose a ban on a number of Iraqi banks and oblige the rest to comply with the platform for monitoring the movement of electronic funds is what... "It is only the beginning of more difficult, deeper and more painful steps."

Iraqi PM Says Baghdad Is ‘Heading Towards’ Ending the US Military Presence in the Country

Iraqi Prime Minister Mohammed Shia al-Sudani said his government is “heading towards” ending the presence of international forces in Iraq, which includes about 2,500 US troops, the largest foreign contingent.

Al-Sudani’s comments came after his government strongly condemned several rounds of US airstrikes in Iraq as a violation of sovereignty and a hostile act. In the latest strikes, the US said it targeted the Shia militia Kataib Hezbollah in retaliation for an attack on a US base, but al-Sudani’s government said civilians were also wounded in the US bombing.

“We are in the process of rearranging the relationship with the international coalition, as in light of the presence of capable Iraqi forces, the Iraqi government is moving towards ending the presence of the international coalition forces,” al-Sudani said at a press conference with Spanish Prime Minister Pedro Sanchez.

Spain has 300 troops stationed in Iraq as part of the US-led anti-ISIS coalition. “My country, always at the request of the Iraqi authorities, will support the unity, sovereignty and stability of Iraq,” Sanchez said at the press conference.

Al-Sudani first came into office at the end of 2022 and made his first public comments on US troops in Iraq in 2023, when he expressed support for the presence of foreign forces. But he’s been under increasing pressure to get them out, especially now as Iraq has become a battleground between Shia militias and the US due to President BIden’s full-throated support for Israel’s Gaza onslaught.

The US has been resisting Iraqi efforts to expel its forces from the country since 2020 when a US drone strike in Baghdad killed Iranian Gen. Qasem Soleimani and Iraqi militia leader Abu Mahdi al-Muhandis. In the wake of the killings, Iraq’s parliament voted to expel foreign forces, but the US refused to leave. The US formally changed its presence in Iraq from a combat role to an advisory one in December 2021, but it did not withdraw any troops at the time.

If al-Sudani tries to expel foreign forces from his country, Washington could make things difficult for him. The US has leverage over Iraq because, since the 2003 invasion, the country’s foreign reserves have been held by the US Federal Reserve, giving Washington control over Baghdad’s dollar supply and the ability to devalue the Iraqi dinar. The US also keeps tight control over Iraq’s ability to pay its neighbor Iran for much-needed electricity.

Foreign currency exchange now available at Philadelphia International Airport via Currency Exchange International

CXI launches location at PHL, offers foreign currency conversion services exclusively.

PHILADELPHIA – With the addition of Currency Exchange International (CXI) to PHL Food & Shops’ catalog of over 150 shops, eateries and service providers at Philadelphia International Airport (PHL), passengers can now exchange foreign currency right inside the airport in Terminal A-West.

CXI is North America’s premier and most trusted operator of foreign currency exchange services, with an expansive direct-to-consumer service network of retail branches, agent locations and affiliate retail locations. CXI has provided clients with the best, most reliable foreign exchange experiences for more than two decades and continuously extends its currency transfer offerings to new locations throughout the continent.

Founded in 1998, CXI has over 30 retail branch locations across the United States. In addition to providing currency exchange services to walk-up clients, CXI has a clientele that includes corporations and financial institutions. More than 1,600 financial institutions and corporations use CXI as their provider for foreign exchange technology and processing services in Canada and the United States.

“We’re delighted to announce the debut of CXI and to offer a convenient option for foreign currency conversions to our international passengers,” said Mel Hannah, Vice President and General Manager of MarketPlace PHL. “At MarketPlace PHL, we’re constantly curating and expanding service offerings at the airport to provide a frictionless and enjoyable travel experience.”

Al-Sudani Media Advisor: We will reach the official price of the dollar soon

Hisham Al-Rikabi, media advisor to Prime Minister Muhammad Shiaa Al-Sudani, said on Thursday that the exchange rates of the US dollar against the Iraqi dinar will reach the official rate soon. Al-Rikabi said, during a televised interview followed by Al-Mutala’, that: “American officials were surprised by the rapid economic steps taken by the government regarding the dollar exchange crisis.”

He added, "There is no American economic blockade on Iraq, and talk about the existence of an American blockade on Iraq is 'inaccurate'." He continued, "Many parties that practice money laundering have been neutralized," noting, "We will reach the official dollar rate soon."

this is being ran on social media:

Sudanese advisor Hisham Al-Rikabi: The exchange rate of the dollar against the Iraqi dinar will reach the official rate soon

Demands to provide POS devices in public places before citizens are forced to use them

Most markets and fuel filling stations lack POS devices, despite the Council of Ministers’ directives to implement the electronic payment system in state institutions, the private sector, commercial centers, stores, markets, and other entertainment facilities.

Citizens still lack the provision of POS devices, and there are demands from the Central Bank, banks, and electronic payment companies to provide POS points of sale and make them accessible to citizens for use with electronic cards when shopping and paying instead of cash.

Fuel filling stations are also suffering from the lack of POS machines at the stations, and citizens are confused about payment, especially with the Ministry of Oil’s calls for early next year to abandon cash and adopt electronic payment at filling stations.

Economic expert Durgham Muhammad Ali said, in an interview with Shafaq News Agency, that “there must be media campaigns to raise awareness about the benefit of the electronic card, the mechanism for obtaining it, and its cost, and dealing with it must be voluntary in the beginning, so that later there will be an understanding of its importance and advantages, and that it may spread and be obtained.” A goal for the citizen, not an obligation on him.”

He stated that “electronic payment has more advantages and security than cash dealing,” noting that “filling and withdrawing devices for these cards must be deployed in various markets, stores, and economic events. Therefore, withdrawal devices must be deployed in the streets and markets before they begin to impose them forcibly.”

The dollar continues to submit to the Iraqi dinar.. The exchange gap is shrinking and the federal government is defeated again

After the stifling crisis that embarrassed the government in light of the high numbers reached by the dollar exchange rates compared to the official price, some attribute the reasons for the recovery of the dinar to the success of the Central Bank’s procedures and its recent steps in providing the currency of some countries to finance the country’s foreign trade.

On the other hand, the decline of the dollar is due to the government’s ability to contain the Federal Reserve’s decisions that contributed to the rise in the exchange rate in the previous period, amid expectations that the decline will continue after the Central Bank translates the recent decisions and measures into reality.

*The results of the procedures

. Speaking about this file, a member of the House of Representatives, Suhaila Al-Sultani, explained the reasons for the decline in the dollar exchange rates after months of rise, while she confirmed that the results of the successful measures and decisions taken by the government and the Central Bank began to be translated into reality.

Al-Sultani said in an interview with the Maalouma Agency, “The dollar exchange rates will witness a significant decline in local markets compared to the rise that parallel prices reached in the previous period,” noting that “the government’s continued taking the right steps in this file will reduce the gap between the official and parallel rates soon.” ".

He continues, "The campaign of arrests and prosecution of currency speculators had an effective role in keeping the Iraqi dinar from collapsing," adding that "the Central Bank's decisions work to match the parallel and official dollar exchange rates."

The member of the House of Representatives added: “Controlling the dollar file, in light of the major violations in this file, will not be instantaneous and will need a period of time in order to impose it on the local markets,” pointing out that “the results of the successful measures and decisions taken by the central bank government have begun to be translated on the ground.” reality".

* Trade financing:

For his part, the economic expert, Abdul Rahman Al-Mashhadani, confirms that the central bank’s agreements with some countries to finance foreign trade in the local currency contributed to the decline in the dollar exchange rates, suggesting that the exchange rates will reach 145 thousand compared to 100 US dollars.

Al-Mashhadani said, in an interview with the Maalouma Agency, that “the agreement with the banks of the Emirates, Turkey, India, and China to finance Iraq’s foreign trade is a step in the right direction,” noting that “proceeding with these measures will reduce the gap between the official and the parallel.”

He continues, "The measures taken by the government were practical, but the shock of the US Federal Reserve's punishment of banks prevented prices from falling in the previous period," pointing out that "the US sanctions were a painful blow to the local markets."

He added, "One of the factors why the dollar exchange rates did not decline in the previous period was the intervention of the external factor in the dollar issue," adding that "the central bank's agreements with some countries to finance trade in the local currency contributed to the decline in the dollar exchange rates."

The dollar exchange rates in local markets witnessed a significant decline after months of rise, which created severe economic repercussions for citizens, after the exchange rates at one time reached 169,000 for every 100 dollars.

Identify two phenomena behind exchange rate depreciation

Member of the State of Law coalition, Saad Al-Muttalabi, on Thursday, identified two phenomena behind the decline in the exchange rate of the dollar against the Iraqi dinar, while confirming that the decline will continue until next week.

Al-Muttalabi said in a statement to Mawazine News, “The decline in the exchange rate of the US dollar against the Iraqi dinar is behind two phenomena. The first is the Central Bank’s measures to facilitate the trade exchange process by entering the platform for financial transfers, which led to a decrease in demand for the dollar from the parallel market.”

He added, "The second phenomenon is the arrival of large shipments of dollars to the Iraqi treasury from Iraqi funds located in the US Federal Bank, which contributed to saving the dollar significantly."

Al-Muttalabi expected, “The dollar will continue to decline against the dinar until next week, but it will take a while for it to reach the official price.

click the image below this is not a business

The most important economic events in Iraq for the year 2023

The year 2023 witnessed economic events in Iraq that greatly affected the markets, especially the rise of the dollar and other fluctuations, in addition to oil, whose revenues constitute 95% of the country’s budget.

central bank

January 23, 2023

Prime Minister Muhammad Shiaa Al-Sudani relieved the Governor of the Central Bank, Mustafa Ghaleb Makhif, and assigned Ali Mohsen Al-Alaq to manage it.

February 11, 2023

The bank agrees with the American bank, JP Morgan, to facilitate payments through the Iraqi banking system to China, with the aim of directly financing private sector imports.

May 30, 2023

The bank announces the purchase of new quantities of gold amounting to 2.3 tons, bringing its total possession to 132.74 tons, maintaining its 30th place in the world.

29 July 2023

The US Treasury Department imposed sanctions on 14 Iraqi banks as part of a comprehensive campaign against the transfer of US currency from Iraq to Iran and other countries subject to sanctions after revealing information indicating that the 14 banks were involved in money laundering and fraudulent transactions.

5 October 2023

The Central Bank confirmed that the country will ban cash withdrawals and transactions in US dollars starting from January 1, 2024, in order to limit the use of the country’s hard currency reserves in financial crimes and evade US sanctions.

October 2023

The Central Bank warns against dealing with entities that are not licensed by it and issue electronic payment cards in order to avoid cases of fraud and financial fraud.

December 12, 2023

The Central Bank of Iraq directed private banks to finance imports of small merchants from Turkey in the euro or Turkish lira, according to an official letter issued by it and appended with the signature of Ammar Hamad Khalaf, deputy governor of the bank.

December 13, 2023

The Central Bank agrees with First Abu Dhabi Bank to finance trade and imports in the dirham currency.

December 14, 2023

The Central Bank agrees with an American delegation to meet the bank’s needs for cash and dollar shipments for the coming year.

Oil

26 March 2023

Baghdad stops crude oil exports from the Kurdistan Region and Kirkuk fields after winning an arbitration case against Turkey.

Before stopping it, Iraq was pumping through the line up to 450,000 barrels per day, of which 370,000 barrels were extracted from the region’s oil and the remainder from the federal government’s oil.

1 April 2023

Opening of the Karbala oil refinery with a production capacity of 140 thousand barrels per day.

June 18, 2023

Oil Minister Hayyan Abdul-Ghani announced the launch of the sixth licensing round for 11 gas exploration blocks in Najaf, Anbar, and Nineveh governorates.

10 July 2023

Iraq signed a deferred agreement with the French company "Total Energy" with investments amounting to $27 billion through the implementation of four oil and gas projects for renewable energy.

21 July 2023

Signing a memorandum of understanding to supply Lebanon with fuel, oil and gas to meet its needs for oil, fuel and crude oil.

28 September 2023

The Ministry of Oil announces the production of high-quality octane 95 gasoline at the Karbala refinery for the first time in Iraq.

29 September 2023

Missan Oil Company and a coalition of international companies celebrated the inauguration of the gas investment and processing project in the Halfaya oil field in Nissan Governorate, with a capacity of 300 mqmq per day (million standard cubic feet).

6 October 2023

The Minister of Oil signs a memorandum of understanding to supply gas from Turkmenistan to Iraq.

29 October 2023

The Minister of Oil announces the operation of the Baiji refinery with a capacity of 150 thousand barrels per day.

Finance

February 2023

The price of the US dollar against the Iraqi dinar rose on the Baghdad Stock Exchange to 170,000 Iraqi dinars against 100 US dollars.

12 March 2023

The Ministry of Finance announces the completion of the preparation of the draft federal budget law for the year 2023 and sending it to the Council of Ministers for the purpose of discussing it for a vote.

June 6, 2023

The House of Representatives votes on the draft law on the tripartite federal general budget for the fiscal years 2023, 2024, and 2025. The budget included 66 articles, and is considered the largest in the country’s history, as its value amounted to approximately 153 billion dollars for each of the three years.

commerce

August 2023

The Ministry of Commerce begins distributing electronic ration cards to citizens to receive food basket items and flour.

April 2023

The Ministry of Commerce will replace the flour in the ration with bread or “samoon” from bakeries and ovens, and it will be optional for citizens, not compulsory. Areas in Baghdad will be chosen to conduct a preliminary experiment in, which are Al-Daoudi, Al-Mansour, and Al-Harithiya.

Iraq Stock Exchange

December 28, 2023

The stock market will trade shares with a financial value of about 700 billion dinars during the year 2023.

Today, stores are open on Al-Rashid and Al-Nahr Streets until 12 p.m

The Baghdad Chamber of Commerce directed merchants on Al-Rashid and Al-Nahr Streets to open until 12 p.m. every day.

A source in the Baghdad Chamber of Commerce told Al-Eqtisad News that the chamber asked merchants and shop owners on Al-Rashid and Al-Nahr Streets to open their shops until 12 o’clock at night every day.

He confirmed that a ceremony will be held today in the presence of a number of government figures, and will include a festival and discount offers from stores in order to attract people to Al-Rashid and Al-Nahr Streets.

Parliament is awaiting the 2024 budget schedules... preparing for major changes in numbers

The Parliamentary Finance Committee confirmed today, Friday, that the 2024 budget schedules have not yet reached Parliament, but the total revenues and expenditures must be reconsidered.

Committee member, Mustafa Al-Karawi, said, “The Prime Minister has not sent any letter regarding the 2024 budget yet, but in general it is assumed that the issue of revenues and total expenditures and the percentage of the deficit achieved in the new budget will be reconsidered, based on expectations of oil prices and quantities exported according to the OPEC decision.” , indicating that “if changes occur to these three numbers, there will be a major change to the rest of the budget schedules,” according to the Iraqi News Agency.

Al-Karaawi explained that “the volume of expenditures distributed across the spending lines, and according to the available amounts and expected revenues, there will be a redistribution of the budget schedules, and as a result there will be a major change in the schedules,” noting that “what the political forces aspire to are the budget items. Especially in the Kurdistan region, with regard to actual expenses and others.”

He stressed that "the committee is determined that there be social justice between the governorates, and that everyone is obligated to pay the actual expenses," noting that "these points are the sum of the differences that we will witness in the budget during the coming period."

He added, "We hope to send its data for the 2024 budget after the legislative recess, so that it can be amended quickly."

Al-Karaawi confirmed, "There is no increase in fuel prices. Rather, it is regulating the process of processing fuel by converting it to electronic form and using payment cards, but there is not yet any official decision regarding fuel prices."

Trade: One thousand companies from 21 countries will participate in the Baghdad International Fair

The Ministry of Commerce announced today, Friday, the completion of all preparations for the opening of the 47th session of the Baghdad International Fair, while indicating that the number of participants reached 21 countries and 1,000 companies.

Ministry spokesman, Muthanna Jabbar, told the Iraqi News Agency (INA): “The General Company for Iraqi Exhibitions has completed all preparations for the opening of the 47th session of the Baghdad International Fair, both at the level of exhibition spaces and the completion of designs and posters, to display goods and commodities for participating companies, as well as for the pavilions.” It will be according to the participating countries.”

Jabbar added, "There are aesthetic measures, such as paying attention to green spaces and open spaces, in addition to creating new health facilities, musical fountains, and interactive lighting," stressing that "all procedures, preparations, and ceremonies have been completed to receive participants and visitors."

He pointed out that "the number of participating countries reached 21 countries, while the number of participating companies is approximately 1,000 companies," considering it "a qualitative leap, when compared to the exhibitions that were held during the past years."

He stated, "The opening will be in the evening, and will witness multiple activities for visitors and visitors."

The Ministry of Commerce announced earlier the launch date of the 47th Baghdad International Fair, which will be for the period from 10-19/1/2024 on the grounds of the Baghdad International Fair.

The Americans were surprised by the rapid economic steps and the government’s relationship with the factions “good”

Al-Masala publishes the most prominent interactions of television dialogues:

Media Advisor to Prime Minister Hisham Al-Rikabi during a televised interview:

- The year 2024 will be the year of “achievements” and the government has set many priorities

- The residential “Jawahiri City” is among other cities that will be launched soon

- The government is racing against time to provide services to citizens

- Services have stopped in Iraq since the end of the Maliki government in 2014

- The Sudanese government is a “service” government “With distinction

- the government has solved the problem of those with advanced degrees and the unemployed since its formation

- the year 2024 will be the year of “achievements” and the government has set many priorities

- the residential “Jawahiri City” is among other cities that will be launched soon

- the government is racing against time to provide services to citizens

- services have stopped in Iraq since the end of the Maliki government in 2014

- The Sudanese government is a “service” government par excellence

- The government has solved the problem of those with advanced degrees and the unemployed since its formation

- The political parties have full confidence in the Sudanese

- The Sudanese is following and racing against time to resolve the outstanding files

- Projects to relieve traffic congestion have become a reality Status

- The citizen began to feel the work that the government is doing

- Taming and eliminating the “dollar crisis” began with strong steps

- The battle with the dollar is nearing the end

- American officials were surprised by the rapid economic steps taken by the government

- There is no economic “American blockade” on Iraq

- Al-Hadith Regarding the existence of an American blockade on Iraq that is “inaccurate”

- many entities that practice money laundering have been neutralized

- the “market for speculators” has become very limited

- we will reach the official price of the “dollar” soon

- the government has provided service projects and addressed many problems for the citizen

- the government is taking hold It is present day after day and is accepted in the street

- The government is continuing to end the presence of the “International Coalition” forces

- Iraq has obligations and pacts with the world that stipulate the protection of diplomatic missions

- Attacking “diplomatic missions” introduces Iraq into many problems

- Iraq is committed to international law and its position is clear regarding The attacks carried out by the American side

- The American attacks are clear “contempt” and a blatant violation of Iraq’s sovereignty

- The government distances itself from the political conflict

- The government does not want to turn Iraq into an arena of conflict

- Iraq does not need foreign combat forces today

- The government rejected the American approach and expressed its Its denunciation of the recent aggression

- Targeting Iraqi territory is contrary to international law

- The government took explicit steps in response to the American aggression

- The government’s relationship with the resistance factions is “good”

- The government is obligated to end the presence of international coalition forces

- The government is keen to listen to political viewpoints to submit a draft law to the Federal Court

Former MP Alaa Talabani during a televised interview:

- The majority formula does not work in Kirkuk and the governorate must be managed by everyone

- There is no understanding between the Parti and the Yekti on the management of Kirkuk

- The tense rhetoric caused a decline in the seats of the Democratic Party and the National Union

- The policies of the Democratic Party caused a decline in its votes in Kirkuk

- We were certain that the results of the October elections were tampered with Among those who challenged the results

- the results of the current elections revealed the manipulation that took place in the October 2021 elections

- members of the Democratic Party explained the decline of their votes in Sinjar to the electoral mechanism

- current data indicate that there are efforts to postpone the Kurdistan Parliament elections

- there must be true representatives of the Turkmen and Christians In the parliaments of Baghdad and Erbil

- all the employees of the region receive late salaries, and the demonstrations take place in Sulaymaniyah only because of the existing convenience

- Baghdad and Erbil have not yet reached an agreement regarding the budget

- the price of a barrel of white oil in Sulaymaniyah reached 270 thousand dinars in the absence of salaries

- the regional government has not agreed to link Salaries of employees in Baghdad for political reasons

- Parliament has more than one draft of the oil and gas law since 2007 and there is still disagreement over it

- The oil and gas law will solve the problems between Baghdad and Erbil

- We support the government’s position rejecting the American attacks on Iraqi sovereignty

- The regional government will not condemn any Turkish bombing that occurs on its lands Northern Iraq

- The martyr leader Abu Mahdi Al-Muhandis was close to everyone and no one filled his void

- The visit of the martyr Hajj Qassem Soleimani to the late President Jalal Talabani took place during the treatment period in Tehran

- If it had not been for Abu Mahdi Al-Muhandis and Soleimani, Erbil would have been in the hands of ISIS

Association of Banks: The dollar will continue to decline thanks to the actions of the Central Bank

Iraqi government to allow electronic financial transactions in 2024: Official

link this is from Kurdish news

Iraq is set to allow electronic financial transactions within government institutions and offices starting in the new year, an Iraqi government official told Rudaw on Thursday.

“Starting in 2024, all financial transactions in all government institutions will be electronic, via electronic payment cards,” Haider Majid, the spokesperson for the Iraqi government’s secretariat told Rudaw’s Hastyar Qadir.

Majid said that the Iraqi government’s secretariat has issued a “general notice” to all government institutions, employees, and citizens who own electronic cards to avoid using them in untrustworthy transactions over the internet, adding the cards must not be used by individuals whose name they are not registered under, and their numbers must not be shared.

The decision to turn most of the transactions electronic constitutes an attempt by the government to prevent money laundering and smuggling of dollars outside of Iraq.

A dollar’s worth is fluctuating between 1,500 to 1,600 dinars in the market but the Iraqi Central Bank rate for a dollar is 1,320 dinars.

The Iraqi dinar has been losing value against the US dollar for several months, leading to a surge in prices of basic goods and consequent outcry from the Iraqi public. The depreciation has been attributed to the smuggling of dollars out of Iraq, mainly to neighboring Iran.

According to Majid, the government’s vision is to make all financial transactions within government institutions electronic.

In September, the Central Bank of Iraq announced that all transactions inside Iraq would be made in dinars starting in 2024.

Many banks across Iraq have started preventing customers from withdrawing their money in dollars and only allowing them to withdraw in Iraqi dinars at the value set in the budget. The move has drawn strong public outcry as the value of the Iraqi dinar against the US dollar in the markets is much lower than the one set out in the budget.

Iran: Beginning to settle exports to Iraq in the riyal currency

The Governor of the Central Bank of Iran, Mohammad Reza Farzin, announced today, Saturday, the start of an export project to Iraq in the Iranian rial currency.

The Iranian Fars News Agency, followed by Al-Eqtisad News, quoted Farzin as saying, on the sidelines of a meeting of the government and private sector council, that “the issue of settling Iranian exports via the riyal currency outside the borders has been studied by the Central Bank for several months, and that its entry into force will address the requirements of exporters to Iraq and Afghanistan.” ".

He added, "This issue is one of the demands of Mashhad's merchants for export to Afghanistan, and through the implementation of the Riyal Offshore Project (riyals outside the borders), merchants will be able to benefit from it instead of foreign currency."

The Governor of the Central Bank of Iran pointed out that “the regulations for the cross-border rial project have been formulated by the Central Bank, and in practice two banks have started this project, and soon it will be circulated to all the country’s banks.”

A government advisor identifies the most prominent features of the economic reform bill

the financial advisor to the Prime Minister, Mazhar Muhammad Salih, today, Saturday, identified the most prominent features of the draft economic reform law, while noting that the draft law is consistent with the private sector development strategy.

Saleh said, “The economic philosophy framed by the draft economic reform law presented on its way to legislation in the House of Representatives is based on the vision of the government’s approach to reform and reorganization of the national economy.”

He added, "The government curriculum, which was approved by the House of Representatives in October 2022, is responsible for implementing a reform vision based on the principle of partnership between the state and the private sector (in financing, investment and production), starting with investing in natural resources and manufacturing industries and ending with digital and other services, and generating... High value-added chains enhance growth factors in GDP.”

Saleh explained, “The draft economic reform law is also consistent with the principles of the (National Strategy for Private Sector Development) and the principles of the new formation of the Private Sector Council headed by Prime Minister Muhammad Shiaa Al-Sudani.”

He pointed out that "the draft reform law, which is in the process of legislation, is consistent with the national strategy for developing the private sector. They are undoubtedly a realistic embodiment and a central syndrome in building the rules of the (social market) through the vision of partnership between the state and the private sector that we mentioned earlier."

He continued: “They are also two economic forces that will contribute to their cohesion by diversifying the sources of income in the national economy and dismantling it from the rentier unilateralism on whose ruins coexisted with emergency profit-making liberal capitalisms devoid of any idea of building market institutions. Rather, they remained fleeting to sustainable development or even the tendency to build the foundations of the real investment desired throughout. past decades.

Saleh stressed that "Iraq is advancing the vision of partnership between the state and the social market, through the implementation of the economic reform law immediately upon its enactment, to establish coherent guarantees for a promising economic future that will eliminate the rentier phenomenon and the problems of unilateralism."

He stated that "implementing the economic reform law will achieve for our country optimal use of all available resources (material and human), and at the same time guarantee a level of prosperity that results in sustainable growth in a diversified economic climate that guarantees development."

Iran announces the start of settling its country's exports to Iraq in its national currency, the riyal

The Governor of the Central Bank of Iran confirmed the start of a project to settle the country's exports abroad in the national currency, the riyal. On the sidelines of the meeting of the Government and Private Sector Council in Khorasan Razavi Province (northeastern Iran), Muhammad Reza Farzin explained that the issue of settling Iranian exports via the riyal currency outside the borders has been studied by the Central Bank for several months, and that its entry into force will address the requirements of exporters to Iraq and Afghanistan.

He added, "This issue is one of the demands of Mashhad's merchants for export to Afghanistan, and through the implementation of the 'Rial Offshore' project (riyals outside the borders), merchants will be able to benefit from it instead of foreign currency." The Governor of the Central Bank of Iran pointed out that “the regulations for the cross-border rial project have been formulated by the Central Bank, and in practice two banks have started this project, and soon it will be circulated to all the country’s banks.” It is noteworthy that the Federal Reserve Bank, the US central bank, imposed procedures and restrictions on external financial transfers from Iraq, to ensure that they do not reach Tehran.

A report issued by the International Center for Development Studies, headquartered in the British capital, London, previously warned that “the attempts of the Central Bank of Iraq to prevent the smuggling of the dollar have failed, as the price of the Iraqi dinar continues to decline against the dollar, which exacerbates the suffering of Iraqis and raises the prices of goods.” The report pointed out that "the Iraqi banking system, instead of contributing to the development of the Iraqi economy, has become a major obstacle to growth or attracting investments, in addition to becoming an essential accessory to money smuggling and money laundering networks.

There are a large number of banks that belong to figures close to politicians, parties and factions." Armed forces contribute significantly to dollar smuggling and financing foreign trade operations with neighboring countries in exchange for receiving commissions and political support.” The report estimates that two-thirds of the Central Bank of Iraq's sales in what is known as the "currency selling window", which ranges at levels of $250 million per day, did not benefit the Iraqi market over the past two decades, which led to the country losing sums of money of no less than $400 billion. The British report did not rule out that dollar smuggling operations would lead to the isolation and ban of more Iraqi banks because some of them contribute to violating international sanctions, noting that “the recent US Treasury decisions to impose a ban on a number of Iraqi banks and oblige the rest to comply with the platform for monitoring the movement of electronic funds is what... "It is only the beginning of more difficult, deeper and more painful steps."

Iran and Iraq discuss using the Isomer platform to finance the two countries' trade

Iraq and Iran have reached an agreement to finance private sector trade, by adopting a new platform called Isomer, away from using the dollar.

The Governor of the Central Bank of Iran, Mohammad Reza Farzin, said, “The issue of settling Iranian exports via the rial currency outside the borders has been studied by the Central Bank for several months, and that its entry into force will address the requirements of exporters to Iraq and Afghanistan.”

He added, "This issue is one of the demands of Mashhad's merchants for export to Afghanistan, and through the implementation of the Riyal Offshore Project (riyals outside the borders), merchants will be able to benefit from it instead of foreign currency."

The Governor of the Central Bank of Iran pointed out that “the regulations for the cross-border riyal project have been formulated by the Central Bank, and in practice two banks have started this project, and soon it will be circulated to all the country’s banks.”

Meanwhile, Prime Minister Muhammad Shia’ al-Sudani revealed that the Iranian side suggested that Iraq deal in currencies other than The dollar, including the Chinese yuan, is used in commercial transactions between the two countries, due to the Western economic sanctions that Tehran faces.

Trade between Iraq and Iran was damaged, after the rise in the exchange rate of the dollar in the parallel market, as traders in the private sector depend on buying the dollar from the parallel market to finance their imports from Iran.

On the other hand, an informed source revealed to Al-Iqtisad News that Iraq and Iran held discussions about financing private sector trade away from the dollar, through the Asian Clearing Union, which is headed by Iran and includes the countries of China, India, Afghanistan, Pakistan, Bangladesh, and others.

He added that The settlement will be in the currencies of the Indian rupee or the Chinese yuan, indicating that the Iraqi merchant will pay and receive in dinars and the Iranian merchant will pay and receive in Iranian riyals.

The Asian Clearing Union (ACU) confirmed the adoption of the currencies of the yuan, ruble and rupee and the development of an electronic platform to carry out commercial transactions between member states independently of the dollar and the "SWIFT" Association. "

In an interview with the Iranian “Jam Jam” TV channel, the Secretary General of the Asian Clearing Union (ACU), Farhad Morsali, indicated that the ACU meeting in Tehran recently adopted 12 decisions, as officials of the Indian and Pakistani central banks confirmed that these decisions are in the interest of Iran and the country’s merchants in comparison. With the rest of the members.

Morsali stated that one of the most important decisions taken is the exchange between Iranian merchants and the rest of the member states’ merchants via the rupee currency, so that Iranian merchants can open accounts in rupees in specific banks, noting that the decision will come into effect next month.

He added that Iranian merchants will be able to obtain financing in the currencies of the rupee, yuan and ruble, in addition to other national currencies of member states, and get rid of the ban on the dollar and the SWIFT platform.

He stated that a new platform will be launched called “Esomer”, which is similar to the local “SPAM” platform for electronic financial transactions.

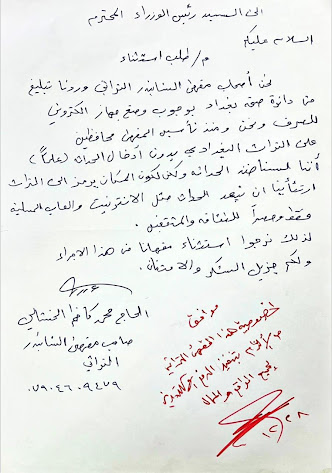

Al-Sudani excludes a famous cafe in Baghdad from electronic payment... document

Prime Minister Muhammad Shiaa Al-Sudani approved a request from the management of the famous “Al-Shabandar” Café in central Baghdad, to exclude the café from placing an electronic payment device (pos), due to the privacy of the heritage place.

The request received by Shafaq News Agency, and signed by the café’s owner, Hajj Muhammad Kadhim Al-Khashali, stated, “We are the owners of the traditional Shabandar Café. We received a notification from the Baghdad Health Department that an electronic payment device (pos) must be installed, and since the founding of the café we have been preserving the Baghdadi heritage.” Without introducing modernity, knowing that we are not against modernity, but because the place symbolizes heritage, we decided to exclude modernity, such as the Internet and entertaining games, only and exclusively for culture and intellectuals, so we hope that our café will be exempt from this procedure.”

The Prime Minister's marginal response to the request was, "In agreement with the privacy of this heritage café, with a commitment to implementing electronic payment in all locations."

At the beginning of last June, the Central Bank of Iraq announced that Council of Ministers Resolution No. (23044) for the year 2023 had entered into force, which was to increase the number of electronic payment devices (POS) in government institutions and the private sector to enhance the culture of electronic payment and collection, and reduce the use of paper money in collections and transactions. Commercial.

Al-Shabandar Cafe, one of the most famous old cafes in Baghdad, is located at the end of Al-Mutanabbi Street near the Al-Qashla Building.

Al-Moussawi: The resistance will continue targeting American bases until the war on Gaza is stopped

Political analyst, Haider al-Moussawi, confirmed today, Sunday, that the Iraqi Islamic Resistance's strikes will continue targeting American military bases until the war on Gaza is stopped, adding that one of the most prominent pressure cards in the region is the resistance's targeting of American bases.

Al-Moussawi said in an interview with the Maalouma Agency, “Expanding the war on more than one front against the Zionist entity puts America in the embarrassment of its inability to enter a comprehensive war in the region,” noting that “opening a comprehensive war With all fronts will be the beginning of the end of the American occupation and the entity.” Zionists in the region.

He continued, "The United States of America fears entering a comprehensive war to ensure that it does not lose the economic resources it controls in the West Asian region," pointing out that "there is a clear decline in the American occupation forces and the movements they were taking on the Syrian border and the region in general.”

He added, "Washington is aware of the strength of the Iraqi decision and its position on the issue of the continuation of the Israeli aggression in the war against Gaza," adding that "the strikes of the Iraqi Islamic resistance will continue to target American military bases until the war on Gaza is stopped."

The Iraqi Islamic resistance continues to target American bases in Iraq since the start of the barbaric Israeli war on Gaza until now in order to stop the war on children, civilians and women from the Gaza Strip, in addition to the clear message that the country does do not need the presence of American combat forces inside the country.

The Jordan Kuwait Bank buys 60% of the shares of the Bank of Baghdad and begins its structure

Representative Alia Nassif wrote...

The Jordan Kuwait Bank bought 60 percent of the shares of the Bank of Baghdad and began amending its structure.

What is happening today is a clear legal violation, as foreign banks are not entitled to have a share of shares greater than the Iraqi share so that they do not control the Iraqi decision and plunder money from the currency auction...

Note that the countries of the region have done this thing so far with 5 Iraqi banks... We call on the Prime Minister to intervene.

Positive government steps to attract major international merchants and companies

The Federation of Iraqi Chambers of Commerce revealed the existence of positive government steps that will attract major merchants and international companies.

The president of the union, Abdul Razzaq Al-Zuhairi, told the Iraqi News Agency (INA): “Entering the electronic platform to pay taxes has become inevitable, and will be implemented within the time frame set by the General Tax Authority, but there is a major problem represented by small merchants who now represent the majority. They are forced to... To go to the parallel market,” noting that “there has been an old fear for decades, between the merchant and the government.”

He pointed out that “a positive tax system has been launched, but we need to restore trust between the merchant and the government.”

He added, "The majority of the Iraqi market is made up of small merchants, due to the circumstances that Iraq went through," adding, "The equation will change during the coming period, and large international companies and labels and large merchants will enter the Iraqi market, while small merchants will be shoppers."

He stated that “taxes created a kind of gap and problems for many Iraqis, including the loss of files, the similarity of names, taking deposits without refunding them, calculating the tax twice, and other problems.”

He stressed that “the recent decision by Prime Minister Muhammad Shiaa Al-Sudani will change many of those problems mentioned above, but implementation needs to be strict.”

He pointed out that “Iraq deals with white money with countries around the world, so the issue of the electronic platform is positive, and it is a global step.”

The most important of which is security... Al-Rafidain lists seven advantages of electronic payment

link

Today, Monday, Rafidain Bank indicated 7 features of the electronic payment system in Iraq. The bank stated, in a statement received by Al-Mutala’, that: “Electronic payment consists of:

1- Switching from dealing in manual cash to electronic cash.

2- Moving from a cash society to a cashless society and leaving cash payment to electronic card payment.

3- Collecting and collecting funds electronically.

4- Using POS devices in financial and commercial transactions.

5- Proceeding with plans for financial inclusion and digitization in banking transactions.

6- Establishing a culture of bank financial accounts instead of using direct cash.

7- Adopting an electronic card is safer than carrying cash and moving around in markets and other places.

No comments:

Post a Comment