Today's newspapers are interested in the reassurance of the Presidents of the Republic and the Prime Ministers that Iraq will not be an arena for conflict and are pursuing banking reform

The newspapers issued today, Tuesday, focused on the Presidents of the Republic and the Prime Ministers stressing that Iraq will not be an arena for conflict and followed up on banking reform.

Al-Sabah newspaper focused on the President of the Republic, Abdul Latif Jamal Rashid, and the Minister, Muhammad Shiaa Al-Sudani, yesterday, Monday, stressing the importance of Iraq not being an arena for conflict.

The Prime Minister's Media Office statement stated, "Al-Sudani received the President of the Republic, Abdul Latif Gamal Rashid."

He added, "The two presidents discussed the developments taking place in Iraq and the region," noting that they "stressed the importance of Iraq not being an arena for conflict, and the necessity of working to perpetuate everything that preserves the country's sovereignty, stability, and security."

During the discussion of the general conditions in the country and the progress of implementation of the government program, “government plans and projects for the next stage were reviewed, which aim to achieve development and improve the living and service conditions of our honorable people.”

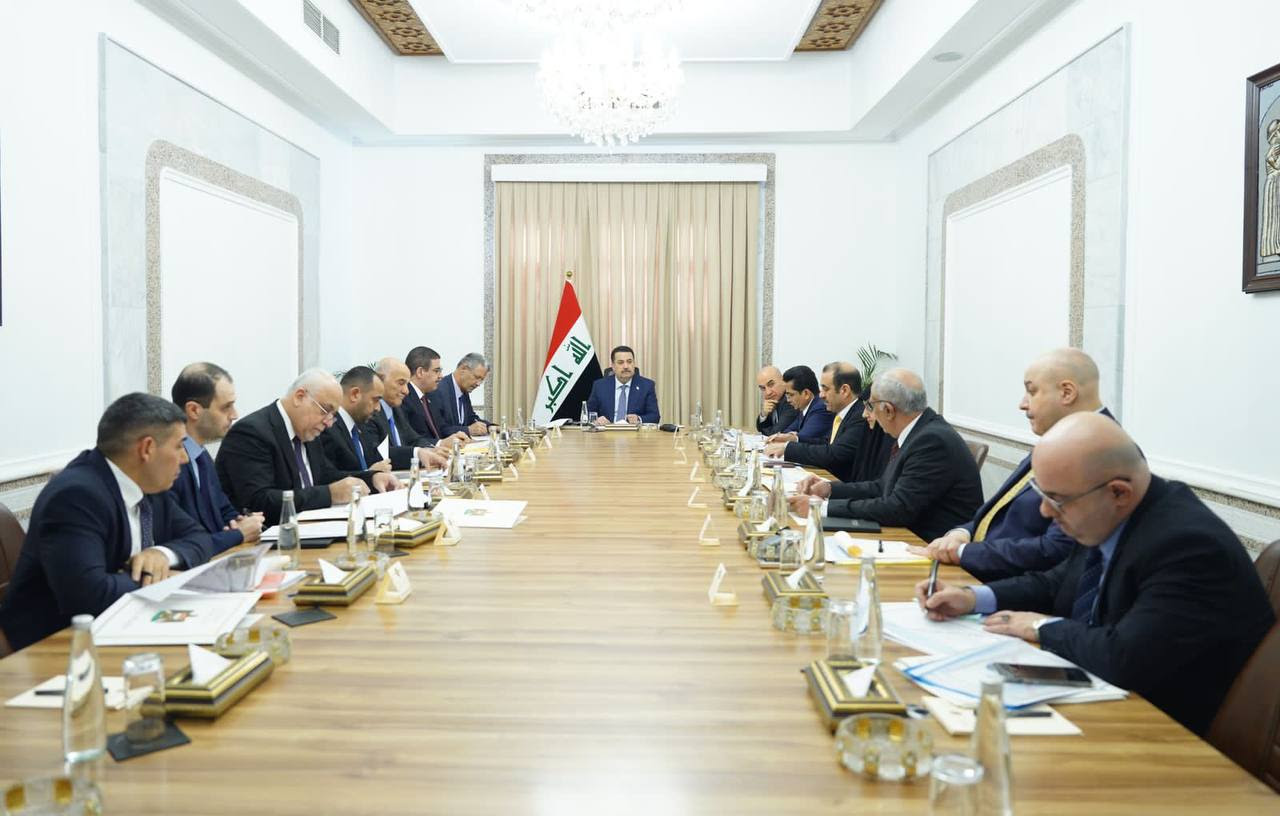

Meanwhile, the Prime Minister chaired a special meeting for the Riyada initiative, which included the directors of Al-Rafidain and Al-Rasheed banks, and the Prime Minister’s advisor for the Riyada initiative.

During the meeting, Al-Sudani directed the Al-Rafidain and Al-Rasheed Banks to “work to digitize the loans for the (Riyada) initiative for youth, and make them electronic, in order to ensure more transparency and speed in completion.”

He also directed, “to submit the necessary proposals to facilitate the procedures for establishing businesses and small or micro companies, to ensure their continuity and sustainability,” stressing “the necessity of following up on the projects of the Riyada initiative in order to ensure the success of these projects and contribute to their sustainability.”

He also stressed "the importance of providing adequate financial support for loans for youth projects participating in the (Riyada) initiative, and taking into consideration micro-projects in subsequent government budget schedules."

He pointed out that "the digitization of project loans will contribute to marketing their products, whether at the local level or exporting products abroad, in a manner consistent with the government's goals in activating the private sector."

Al-Zawraa newspaper, which is published by the Journalists Syndicate, focused on banking reform and quoted the government’s financial advisor, Mazhar Muhammad Saleh, as saying that the time limit for concrete banking reform will be six months.

Saleh added to the newspaper: “If we return to the government curriculum approved by the House of Representatives in October 2022, one of its priorities and goals is financial and banking reform, and therefore there is an insistence that reform can only be achieved through reforming the banking system, and a large part of this commercial and specialized government apparatus constitutes its assets.” About 88% of the assets of the banking system are in the hands of government banks, especially Al-Rafidain and part of Al-Rasheed, except for the TPI, which was created after 2003.

He stressed that the banking system “suffers from inherited problems, war losses, inherited debts, and branches that were looted during the time of ISIS, and it is burdened with very old mechanisms that are not compatible with the global ATM, and at the same time they are not integrated with the banking market.”

He explained that “the remaining banks, which are 70 banks or 73 private banks, have large capital, but their market share in banking assets constitutes 12-13%, and this is a major contradiction.”

He pointed out that “the government reform policy is to re-evaluate the specialized and commercial government banks, characterize them anew, evaluate their structures or operational systems, and evaluate their capital and activities in the hope of reforming them.”

He revealed that “the government has appointed an international company to conduct the evaluation, that is, the correction evaluation, and its work will be completed within the next four or five months, and it will submit a complete report on government banks, and what the foundations of their reform and reorganization are in a way that makes them more efficient and an integral part of an integrated Iraqi banking market.”

He stated, “The beginning will be the government banks, as they are the largest and broadest, and this issue is important. The private banks will also be subject to another evaluation basis, so that at least we get a group of them that operate according to global banking principles in terms of accounts, information technology, international compliance, anti-money laundering, and very important issues.”

He went on to say that “the private banking sector, whether in its traditional or Islamic form, is fully prepared to study their situations in cooperation and under the supervision of the Central Bank of Iraq, and the government also supports this issue.”

He continued, "Banks must work in accordance with financial inclusion and information technology and support digital and electronic payments that are newly emerging in the economy. We can call it a renaissance in re-working banks. In fact, bank accounts have begun and have increased to one million bank accounts within a few weeks due to the introduction of payment technology in cash management and circulation." And payments within the economy, and these are based on a bank account, and all of these operations strengthen the reality of banks and strengthen financial inclusion.”

He explained, “Financial inclusion is how banking services are delivered to the poorest or most disadvantaged segments, and these services require a bank account so that there is an opportunity to obtain an operational loan or grant, and that one deals with money correctly and is not cut off from it, and this is the reform policy that The state is working on it, and after four months we will see its results and take decisive decisions in this regard.”

He pointed out that “the function of the study is to discover opportunities and challenges, what are the possible opportunities, what are the challenges, and how to exploit the opportunities to build a new, modern banking system according to modern foundations and technology.”

The financial part ends there just fyi

Al-Zaman newspaper focused on the appeals of the session to elect a new Speaker of Parliament and said that the Federal Supreme Court postponed the decision on the lawsuit and appeals submitted regarding the session to elect the new Speaker of Parliament until the end of next February.

The court explained in a brief statement that it “postponed the decision on the appeals and lawsuits submitted regarding the president’s election session until the 5th and 6th of next month.”

Yesterday, the House of Representatives, headed by Mohsen Al-Mandalawi, voted on the draft legal aid law.

Yesterday’s statement said: “Parliament voted on the draft legal aid law, submitted by the Legal and Human Rights Committees, in order to spread the values of justice and law, and to help people who do not have the financial ability to bear the expenses of litigation and legal advice, and to complete the transactions of people whose transactions require legal assistance.” ,

He added that (the Parliamentary Transport Committee read a statement during the session, regarding the systematic targeting against the legislative institution by the executive departments and the media while exercising its supervisory role for Iraqi Airlines, in what called for taking all legal and accounting measures, in accordance with the powers guaranteed by the Constitution, where Al-Mandalawi directed the formation A committee to take legal measures against anyone who offends the legislative institution and parliamentary committees.”

The statement continued, “The Council completed the first reading of the draft law amending the Penal Code, with the aim of criminalizing a group of acts that fall under the concept of parental disobedience, which constitute a threat to the social order, and determines the party that Move the criminal case.

He pointed out that (the session witnessed the completion of the first reading of the draft law on Iraq’s ratification of the protocol amending Articles 50 and 56 of the International Civil Aviation Convention of 1944, signed in Montreal in 2016. The Council also completed the first reading of the law on private public university education, regarding the creation of a channel for accepting students in... Primary and postgraduate studies at private expense in the educational institution, to provide educational opportunities within Iraq, rationalize government spending, maintain scientific sobriety, and support financing of the educational process), stressing that (the Council adjourned its session and decided to hold it today, Tuesday).

this one is good too

Empowering the Iraqi economy: growth through strategic investments and banking excellence

In pictures: kiosks for issuing electronic payment cards in Baghdad

The oil products said in a brief statement, a copy of which was received by {Al-Furat News}, that "the kiosks come to ease procedures for citizens for the purpose of refueling."

It is noteworthy that the Ministry of Oil decided to end cash payment at fuel filling stations before the end of the first quarter of this year 2024.

Calls for an investigation into “Qi Card kiosks” at gas stations... Two pressing questions await an answer

Economic affairs expert, Ahmed Al-Tamimi, confirmed today, Monday (January 29, 2024), that opening QiCard applications to issue electronic payment cards at gas stations requires clarification from the petroleum products distribution company, whether there is a contract between the two parties, and the amount of money and commissions that will be made. On the basis of this partnership.

Al-Tamimi told "Baghdad Today", "The Qi Card company has many suspicions and previous question marks regarding the Qi Card issue, and the agreement with this company by the Petroleum Products Company raises doubts, and therefore the competent authorities must investigate it."

He stated, “This contract and agreement is in the interest of the Qi Card company, and the details of this contract or agreement must be known, on what basis it was made, and how much the citizen will pay for the issuance of any electronic payment card, and to prevent any additional deductions during payment operations, as this company does with the salaries of employees and retirees.” Without any accountability.”

Video clips recorded the opening of Qi Card kiosks to issue electronic refill cards inside gas stations, which opened the door to questions about why this company was approved and not others, especially since there is a lot of confusion and suspicion about it.

Starting the service of issuing electronic cards at gas stations

On Tuesday, the Petroleum Products Distribution Company, in cooperation with Rafidain Bank, launched the service of issuing electronic payment cards immediately at gas stations.

The company's general manager, Hussein Talib, said in a statement received by Al-Ma'louma, that "the company, in cooperation with Al-Rafidain Bank and electronic payment companies, has begun setting up kiosks at gas stations, specifically Al-Mansour filling station in Baghdad, to issue cards for free to those wishing."

He pointed out that "the required documents are limited to the national card and the residence card," calling on citizens to "issue cards and invest time for the purpose of obtaining electronic supplies."

He pointed out that "the service will be introduced successively throughout the capital, Baghdad, and the provinces."

Its price is 125 thousand dollars.. A women's shoe shocks the Iraqis

Operating the first phase of the integrated Arab trade line between Egypt, Jordan and Iraq

The Egyptian Ministry of Transport has operated the first phase of the Arab Integrated Multimodal Logistics Trade Line between Egypt, Jordan and Iraq, to serve the transport of goods in the Gulf countries to the ports of European and American countries.

The goods pass through the link between the ports of Aqaba and Nuweiba on the Gulf of Aqaba, and from there by land - currently - through Sinai through the Nuweiba Tunnel Road, and from there to the ports of Al-Arish, East Port Said, Damietta and Alexandria Al-Kabeer, which is the route that represents the land part of the Taba Al-Arish logistical corridor, in order to be exploited for services. Direct sea ports between Egyptian, European and American ports, through the Egyptian Ministry of Transport in cooperation with the Iraqi and Jordanian Ministries of Transport.

The goods are transported via trucks from Iraq and Jordan to the port of Aqaba in Jordan, then the trucks cross by sea inside ships to the port of Nuweiba, then by land through the Nuweiba tunnel road passing through Sinai to reach the ports of East Port Said, Damietta, and Alexandria, then they are shipped on ships to European and American ports.

The Taba-Arish-Bir al-Abd-Al-Fardan railway line, with a length of 500 km, is being constructed to increase the volume of goods intended to be transported from the Gulf, Iraq and Jordan to Europe and America within the second phase of the integrated Arab trade line. Trucks in the ports of Nuweiba and Taba will be replaced by railway trains. This increases the volume of goods via railway lines, which connect with all Egyptian ports.

It was put into operation at the beginning of January 2024, as Egypt amended all the necessary customs legislation to facilitate and increase direct international transit movement through the Egyptian state through the infrastructure of ports, road and railway networks, and the Egyptian Ministry of Transport also joined the “TIR” and “VINA 1968” agreements. Which facilitates the entry of foreign trucks to cross within Egyptian territory in the shortest possible time.

The line is considered the fastest in arrival time, the least expensive, and the easiest in procedures and opportunities. It also contributed to linking Jordan, Iraq, and the Gulf states, through the Nuweiba sea port to the Egyptian ports overlooking the Mediterranean Sea and from there to the European market.

For his part, the Egyptian Minister of Transport, Lieutenant General Kamel Al-Wazir, confirmed, according to the Egyptian Youm Al-Sabea, that the operation of this line came based on coordination between the Egyptian Ministry of Transport and the Jordanian and Iraqi Ministries of Transport through the strategic partnership with the Arab Bridge Navigation Company, and its operation also comes in light of the directives of President Abdel Fattah El-Sisi. The President of the Republic transformed Egypt into a center for global trade and logistics, and the Ministry of Transport implemented an integrated plan to develop international multimodal transport hubs (land - rail - river - sea) and within the framework of the Taba - Al-Arish logistical corridor, which is currently being implemented within a number of 7 integrated international development logistical corridors.

The Bank of Jordan links Iraq through an electronic system with four Arab countries

The Bank of Jordan announced, today, Tuesday, the opening of its branch in Iraq, confirming that Iraq is linked to an electronic system with four Arab countries, while indicating that the Central Bank is making great efforts to develop the banking sector in Iraq.

The General Manager of the Bank of Jordan Group, Saleh Hammad, told the Iraqi News Agency (INA): “Iraq includes a strategic investment market that has all the elements of a successful investment, so we are keen to be present in this market that leads to joint investments between Iraq and Jordan.” .

He explained, "Joint investments need financial products and services that meet all the requirements of various segments of businessmen, investors, and companies. Therefore, the value that any external institution will add to Iraq is the new technology that it can introduce on the basis of providing financial services."

He continued, "Financial services are not limited to technological luxury, but have become one of the basics of financial institutions, to improve their services and digital transformation, to meet customers' needs around the clock."

He pointed out that "the Bank of Jordan seeks, through its presence in Iraq, to meet the needs of its customers, whether Iraqis or Jordanians, by exploiting its network and electronic systems in the region of the Arab countries in which it is located."

He stated, “The Bank of Jordan is present in many Arab countries, including Iraq, Palestine, Bahrain, and Syria, and now we are in the process of opening a branch in the Kingdom of Saudi Arabia. Therefore, we see that there is integration and trade exchange between these countries in an electronic system, where the customer or investor can view... This system and the exchange of his money very easily,” stressing that “there are continuous efforts to improve the system existing at the Bank of Jordan.”

Hammad stressed that "the Bank of Jordan can implement the electronic system in Iraq."

He pointed out that "there is joint cooperation with the Iraqi banking sector and the Governor of the Central Bank, and previous conferences were held between the Jordanian banking sector and the Iraqi banking sector, in order to improve the infrastructure and electronic services in Iraq."

He continued: "There were great joint efforts to provide support through existing expertise in Jordan, such as (Kalak) services, paying electronic bills, providing all requirements, and other services."

He pointed out that "the Central Bank of Iraq is making great efforts to develop the banking sector in Iraq, as it has taken a serious and strong approach to modify the system, and I believe that they are moving at a very good speed to shorten the time gap, to reach the ranks of developed countries with these services."

He believes that “one of the large, promising markets is the trade exchange between Iraq and Jordan, due to the geographical proximity between the two countries, so shipping and transportation operations are very easy, and this is what we seek in economic integration, which could generate a nucleus for investments that can compete in the Arab region.”

Kurdistan

235 ATMs to be installed in Erbil

The infrastructure is intended to enable Kurdistan Regional Government (KRG) civil servants to receive their salaries electronically.

About 80 service centers will be installed in Erbil to accommodate approximately 235 ATMs from various banks.

The infrastructure is intended to enable Kurdistan Regional Government (KRG) civil servants to receive their salaries electronically.

The establishment of ATM stations in banks and the redistribution of some civil servants to banks are indications of the expansion of the MyAccount Initiative.

The civil servants, who are employees of the KRG, can make withdrawals and deposits at the select ATMs.

Currently, the distribution of bank cards to employees is being carried out through 10 state-owned banks.

Marwan Ahmad, supervisor of the project, told Kurdistan24 on Monday that approximately 25,000 accounts have been successfully registered for their owners thus far.

Ahmad also mentioned that they are currently working on coordinating with banks to install the ATMs at the stations.

The pilot project is expected to be finalized in 2025 to integrate all civil servants into the digital payment system.

The government’s Department of Information Technology (DIT) designed, tested, piloted, and implemented a secure application for onboarding KRG employees into the program in line with the Central Bank of Iraq’s Know-Your-Customer (KYC) needs, according to a press release previously shared with Kurdistan24.

It is believed that there are four banks offering services for the program: Ashur, BBAC, Cihan, and RT.

Erbil currently has ATMs from five private banks, namely RT Bank, Cihan Bank, Ashur International Bank, National Bank of Iraq, and BBAC Bank, all of which are synchronized with MyAccount, except for the National Bank of Iraq.

17% of investors are foreigners.. Investment Authority: The Kurdistan Region is a region with endless opportunities

To date, 17% of all investment licenses in the Kurdistan Region are owned by foreign investors.

The head of the Kurdistan Region Investment Authority, Muhammad Shukri, said on Sunday that 17 percent of investors in the region are foreigners.

During his hosting of a dialogue session on the sidelines of the third annual conference of Kurdistan Regional Government representatives, Shukri added that the region is a region “with countless investment opportunities (..) and for this we need foreign representatives and offices, who can play an effective role and also introduce the Kurdistan Investment brand.” Well".

At the end of last month, the spokesman for the Kurdistan Region Investment Authority, Berkashet Akiri, previously announced the granting of an investment license for 154 projects with a capital of about four billion and 300 million dollars.

Akrie pointed out that “the license was granted to 50 projects in Erbil, 43 projects in Sulaymaniyah, 29 projects in Dohuk, three projects in Halabja, 12 projects in Garmian, five projects in Raparin, four projects in Soran, and eight projects in "Zakho."

He also pointed out that "most of the licenses issued in 2023 were in the residential sector, followed by the commercial sector, and in third place comes the industrial sector, and then the health, educational, agricultural, artistic and sports sectors."

In addition, Shukri stressed that it is important for representatives to help us introduce the chambers of commerce and investor associations in the countries, so that there are opportunities for foreign investment in Kurdistan, adding that to date, 17% of all investment licenses in the Kurdistan Region are owned by foreign investors.

Although these numbers are impressive, they do not reflect the full volume of investment, because they exclude oil and gas extraction and production sectors that fall outside the scope of the investment law.

The Kurdistan Region has come a long way in record time. While the region's Board of Investment is proud of the progress achieved, it still has the future of this sector in mind. Today, after benefiting from continuous improvements in the investment climate and business environment, the Kurdistan Region is more attractive for investment than ever before. For potential investors, the region offers exciting opportunities in many diverse sectors.

Zebari: Baghdad does not adhere to the provisions related to oil and the Kurds’ share of the budget

A member of the political bureau of the Kurdistan Democratic Party, Hoshyar Zebari, confirmed on Sunday that the federal government in Baghdad does not adhere to the constitution upon which the new Iraq was founded, especially in the items related to oil, the regional guard, the Peshmerga, and the Kurds’ share in the budget.

Zebari said during his participation in a dialogue symposium within the third edition of the Kurdistan Regional Government Representatives Conference, which began today in Erbil and will continue for five days, that “the federal government does not adhere to the constitution on which the new Iraq was founded, especially in the items related to oil, the regional guard, the Peshmerga, and the Kurds’ share in the budget.” "

He pointed to "attempts to prevent the development of the region, in addition to the practice of security threats, including exposing airports and economic interests to attacks, and the attack that occurred on the Kormor gas field in Sulaymaniyah, in which the United States invested $250 million, but the crowd targeted it."

He pointed out that "the Kurdistan region is exposed to a lot of pressure, and it is necessary to prepare to do everything necessary to perpetuate the experience of governance in the region, put the Kurdish house in order, and increase alliances and diplomatic relations, given that Kurdistan is a model region in a region inflamed with conflicts, and there are attempts to prevent the development of the region, in addition to exercising security threats, including exposing Airports and economic interests are at risk, stressing that “we must feel the magnitude of the threats.”

He stressed that “we do not want Kurdistan to be an arena for settling scores between the conflicting poles in the Middle East, but there are attempts to impose this and drag us into siding with one party over another, even though we have a policy "The Kurdistan Region has never been a threat to security."

Talabani hints at the possibility of the international coalition forces remaining and confirms: ISIS still

poses a threat to Iraq

Qubad Talabani, Deputy Prime Minister of the Kurdistan Regional Government, said today, Sunday, that ISIS has not yet ended and still poses a threat to the region and all of Iraq, in his comment on the start of a bilateral dialogue between the federal government and the United States of America to end the presence of the international coalition in The country.

Talabani's speech came during his hosting of a dialogue session on the sidelines of the third annual conference of representatives of the Kurdistan Regional Government, held in the city of Erbil, which continues for five days.

The Deputy Prime Minister of the region said during the hosting, "I see that we are not in the post-ISIS phase, and the organization remains and poses a threat, and most of the countries that have representation in Iraq and the Kurdistan region have this belief."

He noted that ISIS is a real danger threatening Iraq and the Kurdistan region, and that this matter is the reason for the presence of countries that have military representation in the region and Iraq, stressing that one of the main points in the survival of the international coalition forces during the current stage is primarily to confront terrorism.

Talabani added that a serious dialogue has already begun between the federal government and the United States of America regarding the foreign military presence in the country, adding that there is another fact that we must keep in mind, which is that ISIS has not yet disappeared and remains a threat and danger to Iraq and the Kurdistan region.

Parliamentary Oil: Kurdish obstacles prevent the resolution of the “Oil and Gas” law

Kazem Al-Touki, a member of the Parliamentary Oil and Gas Committee, confirmed on Monday that the Kurds have placed obstacles to resolving and ending the oil and gas law and handing it over to Parliament for reading and voting on it.

Don’t leave money on the table. ($75, to be exact.)

A 5 Star bank is offering a free online bank account with a debit card that pays $25 to the enrollee and $75 "commission" to everyone that refers someone to the account.

So YOU set up your account and receive your OWN $25 and then you will set up your family and friends and THEY will all get the same $25 and YOU get $75 for everyone that gets the $25.

It does take $10 to sign up for the account, and it has to come from a debit card (checking account) connected to you, but the $10 is available immediately in your account to use. So it's actually free to get your $25 but you need to have $10 available to set it up.

Yes it's true and it works and I have done it MYSELF!

A Sudanese meeting recommends structuring government companies and reforming them financially and economically

A meeting held by Prime Minister Muhammad Shiaa Al-Sudani, on Sunday, came out with decisions to carry out comprehensive reforms to government companies and structure them to strengthen the Iraqi economy.

The Sudanese media office stated in a statement received by Shafaq News Agency, that the latter chaired the second meeting to follow up on the process of structuring and organizing government companies.

At the beginning of the meeting, Al-Sudani pointed out the importance of this process and the role it represents in the essence of economic reform, subjecting companies to correct economic foundations and standards, stressing that this step lies at the core of the strategic goal of increasing the contribution of non-oil revenues to national output and income.

The meeting came up with a number of decisions that included general principles for proceeding with the financial and economic reform and structuring of companies, in a way that strengthens the national economy and its stability.

The judiciary discusses with Washington Treasury sanctions on Iraqi people and companies

The Iraqi Oil Marketing Company "SOMO" announced on Monday that Chinese oil companies were the largest in number of purchases of Iraqi oil during the month of December last year.

"SOMO" stated in statistics published on its official website and viewed by Shafaq News Agency, that "Chinese companies were the largest in number among other international companies in purchasing Iraqi oil, with 12 companies out of 44 companies purchasing oil during the month of last December."

She added, "Indian companies came second with 7 companies, South Korean companies came third with 4 companies, then Turkish companies came third with 3 companies, and American, Italian, Japanese, UAE and Greek companies came fourth with 2 companies each, while the rest were distributed among Spanish companies." And (Dutch - British), Jordanian, Kuwaiti, Russian, Malaysian, Azerbaijan and French, with one company for each.”

SOMO stated that, in its sale of Iraqi oil, it “depends on the main criteria for contracting with large and medium-sized independent and vertically integrated international oil companies,” noting that the most prominent international companies that bought Iraqi oil are the Chinese company “Al-Waha”, the Indian company “Nayara”, the American Exxon Mobil, the Dutch-British Shell, and Eni. Italian".

Central Bank of Iraq: Sanctions on Al-Huda Bank due to its activities in 2022

The Central Bank of Iraq revealed that the US Treasury Department imposed sanctions on Al-Huda Bank of Iraq, attributing the reason to its activities in 2022.

The Central Bank of Iraq stated that the bank did not participate in the foreign currency buying and selling window during the year 2023, stressing that it is continuing to provide its services. Banking without dealing in US dollars and is allowed to deal in other foreign currencies.

Central Bank of Iraq

Information Office

30 - January - 2024

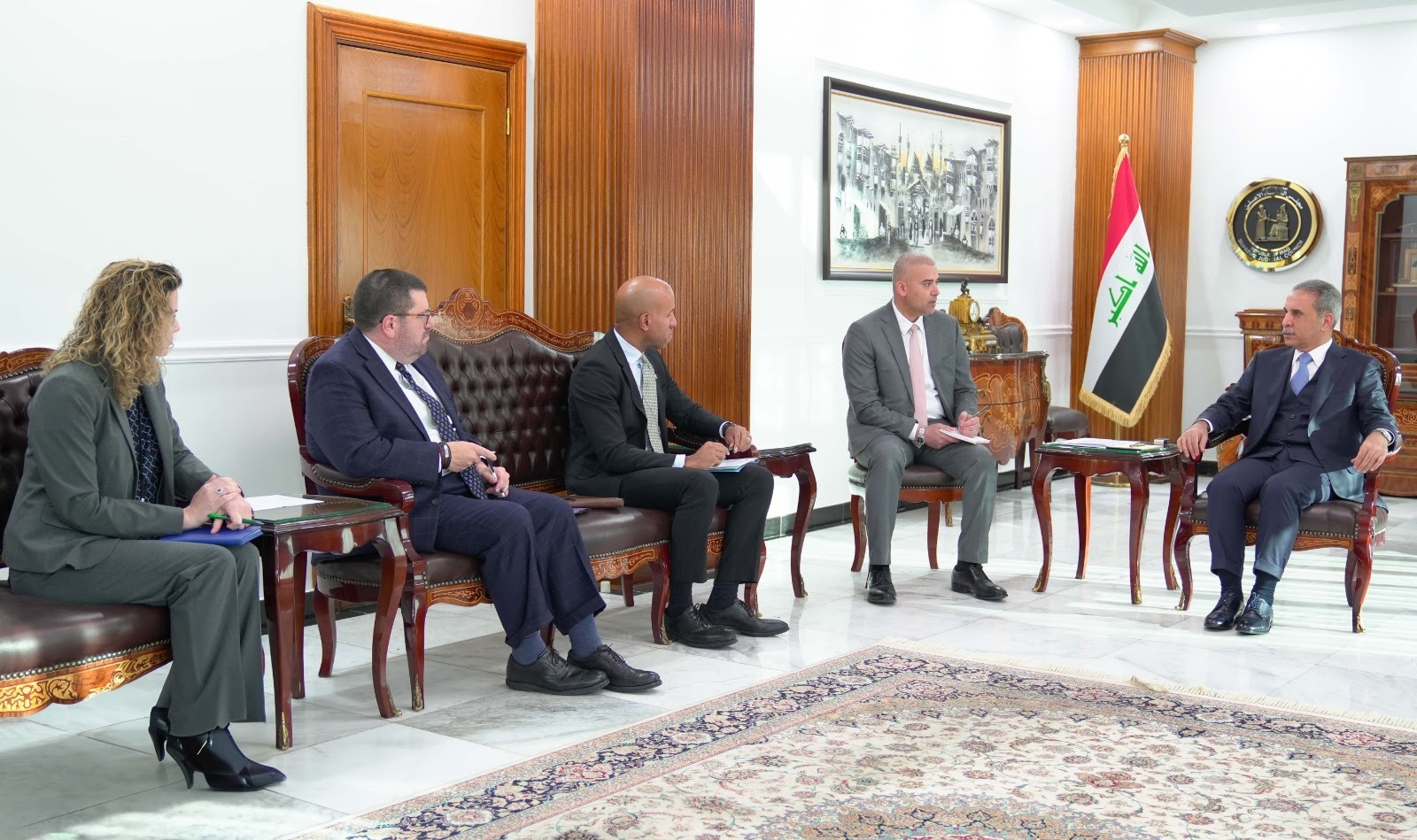

The chief US sanctions official is in Baghdad to curb dollar smuggling to Iran

Washington seeks to dry up Iran's sources of funding for the militias

A senior official in the US Treasury Department in Iraq discussed the issue of Iran’s evasion of sanctions and forced the country’s financial sector to be compatible with international standards, referring to efforts to curb the smuggling of dollars to Tehran. This comes amid great tension in the region, especially the incident of the killing of American soldiers near... The Jordanian-Syrian border as a result of attacks believed to be from militias loyal to Tehran.

A US State Department spokesman said that the Under Secretary of the Treasury for Terrorism and Financial Intelligence, Brian Nelson, who is the most senior sanctions official in the ministry, traveled to Iraq on a visit that began yesterday, Sunday, and continued until Monday, where he met with senior Iraqi officials, including Prime Minister Muhammad Shia al-Sudani, as part of the ongoing work to combat financing. illegal.

He added that during the visit, Nelson discussed with his counterparts ways to protect the Iraqi and international financial systems from criminal, corrupt and terrorist entities, noting that Washington will cooperate to protect the Iraqi financial sector “from (any) misuse by Iran or any other evil party.”

The Iraqi government came to power with the support of powerful Iranian-backed parties and armed factions with interests in the largely informal Iraqi economy, as the United States revealed that Tehran sought to evade sanctions by smuggling dollars from Iraq through a complex financial system controlled by political forces and loyalist militias. to the Iranian regime.

Nelson said on Monday that the meetings he held were productive, including his meeting with the Prime Minister and the Governor of the Central Bank of Iraq, adding, “From the perspective of the Treasury Department, I think we feel really comfortable about the transparency tools that the Central Bank of Iraq has put in place to identify illicit financial flows that pass through the Iraqi financial system.” ". But he warned that Iraq must always keep in mind the risks of sanctions.

Iraq must always keep in mind the risks of sanctions

He added, "We will continue to monitor Iraqi individuals, companies, and Iraqi banks that work for or on behalf of groups designated by the United States as terrorist."

On Monday, the United States designated the Iraqi Al-Huda Bank as a foreign financial institution of major concern regarding money laundering and accused it of acting as a channel for financing terrorism.

The Treasury Department's Financial Crimes Enforcement Agency also proposed issuing a decision to separate the bank from the American financial system. Washington also imposed sanctions on the bank's owner.

“Al-Huda Bank and its foreign sponsors, including Iran and its agents, are diverting funds that could have supported the legitimate businesses and economic aspirations of the Iraqi people,” the Treasury Department said in a statement. “These bad actors are fueling violence that threatens the stability of Iraq and the lives of Americans and Iraqis alike.”

Nelson's visit to Iraq comes at a time when the United States seeks to take strict measures against a group of Iranian-backed proxies at a time when attacks are occurring on Israeli and American targets and other interests, in light of the situation in Gaza, Iraq, Lebanon, Syria and Yemen.

Washington asked Iraq to address the continuing risks resulting from the misuse of the US currency in Iraqi commercial banks, and in July it prevented 14 Iraqi banks from conducting transactions in dollars as part of a major campaign targeting the illicit use of the dollar.

With reserves of more than $100 billion in the United States, Iraq relies heavily on Washington's good faith to ensure that its oil revenues and funds are not subject to US sanctions.

The Governor of the Central Bank of Iraq said that Iraq is committed to implementing stricter financial regulations and combating dollar smuggling. Nelson is scheduled to travel from Iraq to the UAE, where Washington has also expressed concerns about evading sanctions.

Parliament expects more: Treasury sanctions will not stop or affect the dollar exchange rate

Today, Tuesday (January 30, 2024), the Parliamentary Finance Committee commented on the continued imposition of US sanctions on banks in Iraq, while indicating that these sanctions will not have a significant impact on the dollar exchange rates.

Committee member Jamal Kujar said in an interview with “Baghdad Today” that “the imposition of American sanctions on banks in Iraq may continue during the coming period, as there is no confirmation that these measures will stop in light of the presence of smuggling and money laundering operations.”

Cougar stated that “the fluctuation of the dollar exchange rates in the local market is affected by any economic or security event, and for this reason we see prices are not fixed and are variable due to the nature of the variables, and we do not believe that imposing sanctions on specific banks in Iraq will have significant effects on the dollar exchange rates, and the effects may "Be immediate."

Today, Tuesday (January 30, 2024), the Central Bank of Iraq revealed the reason for the US Treasury Department imposing sanctions on Al-Huda Bank of Iraq.

The bank explained in a statement received by “Baghdad Today” that “the reason for imposing sanctions on Al-Huda Bank of Iraq was due to its activities in the year 2022.”

He added, "The bank did not participate in the window for buying and selling foreign currency during the year 2023, stressing that it continues to provide its banking services without dealing in US dollars and is allowed to deal in other foreign currencies."

Yesterday, Monday (January 29, 2024), the US Treasury Department announced the imposition of sanctions on Al-Huda Bank and its owner, Hamad Al-Moussawi, for their involvement in “financing terrorism and money laundering for the benefit of Iran and its proxy groups,” according to the Treasury.

The Treasury said in a statement, seen by Baghdad Today, that it "today uses powerful tools to protect the Iraqi and international financial system from the abuse of terrorist financiers, fraudsters, and money launderers."

She added, “Al-Huda Bank, an Iraqi bank that acts as a conduit for terrorist financing, as a foreign financial institution raises a major concern about money laundering, and in addition to the Treasury’s findings, the Financial Crimes Enforcement Network ( FinCEN ) has proposed a rule that would separate the bank from the financial system.” The United States by prohibiting local financial institutions and agencies from opening or maintaining a correspondent account for or on behalf of Al-Huda Bank, and in addition, the Office of Foreign Assets Control ( OFAC ) imposes sanctions on the bank’s owner.”

She continued, “Al-Huda Bank and its foreign sponsors, including Iran and its proxy groups, transfer funds that can support the legitimate businesses and economic aspirations of the Iraqi people, and Al-Huda Bank has for years exploited its access to US dollars to support designated foreign terrorist organizations including the Iranian Revolutionary Guard, as well as Iraqi militia groups allied with Iran, including Kataib Hezbollah and Asaib Ahl al-Haq,” explaining that “the Chairman of the Board of Directors of Al-Huda Bank is complicit in the illicit financial activities of Al-Huda Bank, including money laundering through front companies that hide the true nature of the parties involved in the illicit transactions.” legitimate, which ultimately enables the financing of terrorism.”

The Treasury stated, “Since its establishment, Al-Huda Bank has been subject to the control and operation of the Iranian Revolutionary Guard and the Quds Force of the Iranian Revolutionary Guard, and after the establishment of the bank, the head of Al-Huda Bank operates money laundering operations on behalf of the Quds Force of the Iranian Revolutionary Guard and the Hezbollah Brigades. In addition, it allows... Al-Huda Bank provides access to the US financial system to known actors using fraudulent documents, fake deposits, identity documents of the deceased, fake companies, and counterfeit Iraqi dinars, providing opportunities to hide the identities of counterparties in the transaction to correspondents, banking relationship providers, and it should be noted that the Chairman of the Board of Directors of Al-Huda Bank is Also the owner of the bank and Chairman of its Board of Directors.

Last week, OFAC designated the Iraqi airline Fly Baghdad and its CEO for providing assistance to the Iranian Revolutionary Guard Corps-Qods Force ( IRGC-QF ) and its regional groups by transferring fighters and weapons. By including three leaders and supporters of Kataib Hezbollah and a company that served as a cover for Kataib Hezbollah to transfer and launder money, according to the statement.

The US Treasury confirms its commitment to joint work with the Iraqi government

Today, Tuesday, the US Treasury Department affirmed its commitment to “long-term joint action” with the Iraqi government, a day after it imposed sanctions on an Iraqi bank for “financing terrorism.”

The US Treasury said in a statement that the Under Secretary for Terrorism and Financial Intelligence, Brian E. Nelson visited Baghdad on January 28 and 29 to "continue work between the two countries on combating illicit financing and strengthening the Iraqi financial system."

She pointed out that Nelson met during the visit with senior government officials, including Prime Minister Muhammad Shia al-Sudani, the Governor of the Central Bank of Iraq, Ali al-Alaq, the President of the Supreme Judicial Council, Faiq Zaidan, and the Minister of Transport, Razzaq Muhaibas, to “discuss the recent measures taken by the United States and ways to enhance cooperation between the two countries.” ".

The US Treasury Undersecretary also met with representatives of the financial sector, including Chairman of the Board of Directors of the Iraqi Trade Bank, Bilal Al-Hamdani, and representatives of private sector-owned banks to discuss ways in which bilateral efforts could provide “new opportunities for communication between Iraqi banks and the international financial system, which will benefit It includes the Iraqi economy and the Iraqi people, while protecting the international financial system from misuse.”

The US Treasury Department renewed its commitment to "its long-term joint work with the government of Iraq to strengthen the Iraqi economy and protect the US and Iraqi financial systems from misuse."

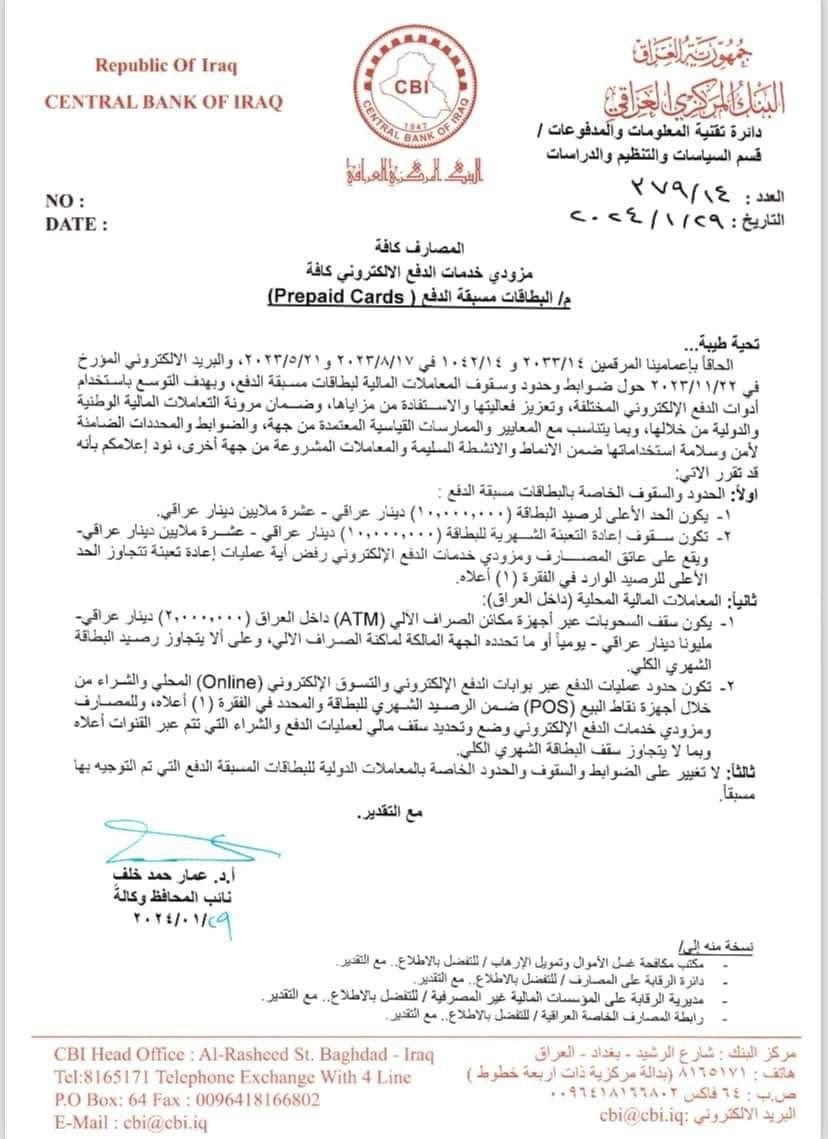

In the document.. The Central Bank issues new instructions regarding prepaid cards

Today, Monday, the Central Bank of Iraq issued new instructions regarding prepaid cards by raising the daily and monthly limits inside Iraq while keeping the same limits outside Iraq.

All banks

as Hussein Dartash

All electronic payment service providers (Prepaid Cards).

Kind regards... Following up on our circulars No. 14/2033 and 14/1042 on 8/17/2023 and 3/21/2071, and the relevant email 11/22/2023 regarding the controls, limits and ceilings of financial transactions for prepaid cards, with the aim of expanding the

In various electronic payment tools, enhancing their effectiveness and benefiting from their advantages, and ensuring the flexibility of international and international financial transactions through them, in a manner consistent with the approved standards and standard practices on the one hand, and the controls and determinants that guarantee the security and safety of their use within the proper patterns and activities and legitimate transactions on the other hand, we would like to inform you, God willing.

You may decide the following:

First: The limits and ceilings for prepaid cards: The maximum limit for the card balance is (10,000,000) Iraqi dinars - ten million Iraqi dinars. The ceilings for monthly refilling of the card are (10,000,000 Iraqi dinars - ten million Iraqi dinars, and it is the responsibility of banks and electronic payment service providers to refuse any recharging operations exceeding the limit.

The highest for the balance mentioned in paragraph (1) is flags

Second: Local financial transactions inside Iraq) - 1- The ceiling for withdrawals via automated teller machine (ATM) machines inside Iraq will be (2,000,000) Iraqi dinars - two million Iraqi dinars - per day, or what is determined by the entity that owns the ATM, provided that the card balance does not exceed

WebTV

Total monthly. (Online) - The limits for payment operations are through electronic payment gateways, local online shopping, and purchasing from

(1) Through point-of-sale (POS) devices within the card’s monthly balance specified in the paragraph above, and banks and electronic payment service providers may set and determine a financial ceiling for payment and purchase operations that take place through the above channels. Third: There is no change to the controls, ceilings, and limits for international prepaid card transactions. which was directed

Not exceeding the total monthly card limit. pre.

with respect.

Speculators manipulate dollar exchange rates

link this is definitely one they want the citizens to see

after a period of “semi-stability” that dominated the market during the recent period; Volatility returned once again to dominate the dollar exchange rates on local stock exchanges with a “limited rise,” and experts and specialists warned that what is happening is a temporary exploitation by some speculators who took advantage of the events of regional tensions in the region to benefit from buying and selling in the parallel market.

The exchange rates of the US dollar against the Iraqi dinar rose “limitedly” yesterday, Monday, in the markets of Baghdad and in Erbil in the Kurdistan region.

Advisor to the Prime Minister for Financial and Economic Affairs, Dr. Mazhar Muhammad Saleh, said in an interview with “Al-Sabah”: “The issue is related to regional security tensions, which give colorful or ambiguous information that affects the decisions of speculators in the secondary exchange market when buying and selling, which prompts them to hedge with a point.” Or two points above the current market trading prices or trading prices in such cases that people are accustomed to.”

He explained that it is “behavior practiced by speculative forces to achieve emergency or estimated profits under the pretext of misfortune and fear, because the decisions of this market are based on various information as inputs that influence the decisions of those dealing with it. Therefore, these markets are considered among the most sensitive financial markets and live in their daily speculation on news, rumors, and conflicting information.” To determine prices, which is a cost that disappears when the influencer disappears.

While the rapporteur of the Parliamentary Finance Committee for the fourth session, Dr. Ahmed Al-Saffar, stated in an interview with “Al-Sabah”: “The exchange rate of the dollar against the dinar will not stabilize as long as Iraq remains as a country that does not possess a productive apparatus, as the country depends for most of its needs on imports, which depend on In turn, it depends mainly on the dollar,” stressing that “this price will remain fluctuating and changing according to political events and the forces of supply and demand.”

He pointed out that “this small change during these two days may be due to the attack on the American base in Jordan and the threat of the American side to carry out a military operation,” and added, “Therefore, the central bank and the government cannot control the stability of the exchange rate if they do not resort to revitalizing the Iraqi economy and moving the apparatus.” "productive." For his part, economic affairs expert, Nabil Jabbar Al-Ali, indicated in an interview with “Al-Sabah” that “there are now no major changes in exchange rates that could affect the market and its desires.”

He pointed out that "what is happening now in the local market falls within the framework of the natural fluctuation of prices, and there is not a large percentage of rise and fall that can be pointed out, so I believe that the issue has not departed from the normal situation."

shorter version

Saleh reveals the reason for the limited rise and fluctuation of the dollar exchange rate recently

The Prime Minister’s Advisor for Financial and Economic Affairs, Mazhar Muhammad Saleh, revealed the limited rise and fluctuation of the dollar’s exchange rates recently.

Saleh said in a press statement, “The issue is related to regional security tensions, which provide colored or ambiguous information that affects the decisions of speculators in the secondary exchange market when buying and selling, which prompts them to hedge by a point or two above the current market transaction prices or trading prices in such cases.” People are used to it."

He explained that it is “behavior practiced by speculative forces to achieve emergency or estimated profits under the pretext of misfortune and fear, because the decisions of this market are based on various information as inputs that influence the decisions of those dealing with it. Therefore, these markets are considered among the most sensitive financial markets and live in their daily speculation on news, rumors, and conflicting information.” To determine prices, which is a cost that disappears when the influencer disappears.

Speculators took advantage of the region's tensions to make profits in the dollar markets - Sudanese Advisor

“The fluctuation disappears when the influencer disappears.”

Mazhar Saleh, financial advisor to the Prime Minister, confirmed that the rise in dollar prices these days is linked to regional security tensions, indicating that speculators have exploited these conditions to achieve profits under the pretext of fear and misfortune.

Saleh said in an interview with the official newspaper, that “the issue is linked to regional security tensions, which provide colorful or ambiguous information that affects the decisions of speculators in the secondary exchange market when buying and selling, which prompts them to hedge by a point or two above the current market trading prices or prices.” Trading in it in such cases people are accustomed to it.”

He explained that it is “behavior practiced by speculative forces to achieve emergency or estimated profits under the pretext of misfortune and fear, because the decisions of this market are based on various information as inputs that influence the decisions of those dealing in it. Therefore, these markets are considered among the most sensitive financial markets and live in their daily speculation on news, rumors, and conflicting information.” To determine prices, which is a cost that disappears when the influencer disappears.”

No comments:

Post a Comment