From the dollar to the Iraqi dinar... Iraqis complain about the deterioration of their salaries

An economist reveals the date of the dollar's decline in Iraq

Economist Mahmoud Dagher set the date for the dollar exchange rate to decline in local markets, while pointing to alternatives for imports from sanctioned countries.

The economic expert, Mahmoud Dagher, said in a press interview, “There are powerful speculators who have a suitable amount of foreign currency and are able to move the market. They devalued the exchange rate and then bought at the low price, and then their ability to sell at the high price increased.”

Dagher added, “The government and the Central Bank made an effort to expand the range of foreign currencies other than the dollar, and trade became easy, but the remaining of some goods outside the banks, their dependence on cash and trade with the sanctioned countries (Iran and Syria) and the lack of control over border crossings are factors that made it difficult to control.” on the dollar exchange rate.

He stressed that "95% of trade is official and all merchants import at the official exchange rate of the dollar (1320), and sell to individual merchants at the market price," indicating that "all goods decreased, such as cars and foodstuffs, with the exception of some that remained dependent on the price of the dollar in the market."

He continued: “In the long term, the dollar exchange rate will return to 1320, and it remains how it will be possible to control speculators, the country’s borders, and trade with the sanctioned countries,” noting that “the merchant who wants to import alabaster from Iran, for example, will not be able to go to the bank because there is no Banking relations between Baghdad and Tehran due to sanctions imposed on it, while he can obtain any commodity from Turkey or any other country and go to the bank to obtain the dollar at the official exchange rate.”

He pointed out that "the government and the central bank are serious about restoring the official exchange rate to its normal status, and they have made great efforts to facilitate customs and taxes," explaining that "the matter requires patience and understanding."

Parliamentary Economy determines the features of the impact of “dollarization” in 2024

On Tuesday, member of the Parliamentary Economics Committee, Hussein Habib, identified the most prominent features of the impact of the continued dependence on the dollar on the country’s economy during 2024.

Habib said in an interview with Al-Maalouma, “Any decrease in the exchange rate of the dollar against the dinar is positive and will enhance the value of the latter and address the price pressure suffered by millions of people below the poverty line in the country, but on the other hand, any decrease cannot be achieved through wishes, but rather according to mechanisms.” An organization that adopts Ofoq addresses the reason for the demand to buy the dollar from the parallel market.”

He added, "Dollarization has created exceptional conditions for Iraq's economy in light of the import of approximately 90% of the market's needs from abroad. That is, we export the dollar in the absence of industry, not to mention the impact of other sectors, including hospitals, because large numbers of citizens are forced to travel for the purpose of treatment and spend large sums of money."

He pointed out that "dollarization, in reference to the parallel market, will remain influential in the economy as long as there is an absence of industry and production in large proportions, pointing to the necessity of openness to safe investment that attracts capital and restores its inflow in terms of rehabilitating services and opening horizons that contribute to expanding the circle of dependence of the dinar instead of the dollar in Internal financial transactions.

The dollar exchange market witnessed a gradual decline before it rose again in recent days amid uncertainty in its activity.

Approving the listing and trading of reconstruction bonds in the Iraqi market

The Iraq Financial Markets Market announced the approval of the Securities Commission for the listing and trading of Emaar bonds in the Iraqi market.

Al-Sudani: The implementation of electronic payment must be expedited, and the ministries must abandon cash payment.

Al-Sudani during the first regular cabinet session of the year:

We congratulate the Iraqi people on the occasion of the new Gregorian year

We launched the year of achievements as 2024

The five priorities will be the most important criteria for evaluating government work

Our governmental path chose to build confidence and fulfill promises to the people

Focusing on priorities is important and should be reviewed

We are preparing to launch the second semi-annual report this month

We have made important strides in financial, economic and agricultural reform

International institutions acknowledge that Iraq has laid the foundations for financial and banking reform

Public financing institutions gave the green light to invest in Iraq

We will not allow any project launched by the government to be delayed, and we will not allow any internal or external party to obstruct our work

There are those who are enraged by the country's progress and success

The Sudanese advisor details the government measures to curb the dollar

The financial and economic advisor to the Prime Minister, Mazhar Mohamed Saleh, detailed the government measures that contributed to curbing the dollar.

Saleh said in a press interview seen by “Taqaddam” that: “Credit cards, with their high flexibility in use, have provided a direct role in providing easy payments in foreign currency for travel purposes.”

He added, "The demand for foreign exchange was also met by withdrawing from citizens' dollar accounts after banks were allowed to import dollars from foreign foreign markets in cash for this purpose."

Saleh pointed to “commercial organization with neighboring Turkey to finance trade in the Turkish lira through solid banking channels,” considering all of these factors as “positive that have contained the noise of the illegal parallel exchange market.”

He continued, "In addition to the role of economic policy in enabling the state's commercial arm to provide an additional commodity supply with a stable price, this is by adopting four additional baskets to provide basic commodities and market support supplies financed at the official exchange rate of 1,320 dinars per dollar."

Saleh described this policy as “price defense that led to a decline in annual inflation growth to 3.7% currently, after that annual price growth was about 7% in the accounts at the beginning of the year.”

The Council of Ministers decides to contract with Ernst & Young to restructure the Rafidain and Al-Rasheed banks

The Council of Ministers decided, on Tuesday, to contract with an international company to study the restructuring of Al-Rafidain and Al-Rasheed Banks.

The Office of the Chairman of the Council stated in a statement received by Al-Maalouma, that “in the field of banking sector reform, the Council of Ministers approved direct contracts with Ernst & Young to study the issue of restructuring the Rafidain and Al-Rashid banks, submit its recommendations regarding them, and propose a road map in this regard, during 6 months".

It also included “direct contracting from the Industrial Bank with the company (Ernst & Young) to study the issue of merging the banks (industrial, real estate, and agricultural) into one bank from its specialized experts, provide the appropriate recommendation regarding it, and determine the time period required for the merger and the mechanism for transferring the balances to the bank.” the new".

As well as “direct contracting from the National Insurance Company with Ernst & Young to study the issue of merging the National Insurance Company with the Iraqi Insurance Company, into one company from its experts and specialists, provide the appropriate recommendation regarding it, and determine the time period required for the merger and the mechanism for transferring its funds to a new company.” As an exception to the Instructions for Implementing Government Contracts (2 of 2014) and the controls issued pursuant thereto.”

The Council of Ministers also approved “the proposals to simplify government procedures presented by the Prime Minister’s Advisor for Human Development Affairs, within a comprehensive vision to simplify procedures that includes a clear guide, training and preparing employees regarding them.” The Prime Minister stressed, in this regard, the importance of the citizen seeing the results of these procedures. Real vision and actions.

As well as “approving the projects mentioned in paragraphs (first, second, third, fourth, fifth, sixth, eighth, eleven, and fifteen) of the recommendations of the minutes of the sixth meeting of the Iraqi-Chinese Framework Agreement, based on the provisions of Article (2/The Second Axis/The Iraqi Agreement.” Chinese) of the Federal General Budget Law (13 of 2023), and approval to extend the implementation of Council of Ministers Resolution (23035) of 2023, regarding postponing the collection of customs duties for imported goods and merchandise in the name of ministries and entities not affiliated with a ministry, unless the contract stipulates that the exporter will bear those duties. Until June 30, 2024.

The government decides to contract with a British company to restructure Al-Rafidain and Al-Rashid banks

An economist supports comprehensive banks: The era of specialization has ended

The National Bank of Kuwait increases its stake in the Credit Bank of Iraq

The Central Bank of Iraq agreed for the National Bank of Kuwait to pay an amount of 50 billion dinars as a first payment in order to bring the bank’s capital to 400 billion dinars.

According to a statement issued by the Credit Bank of Iraq, the National Bank of Kuwait paid an amount of 50 billion dinars on December 27, 2023, as a first payment under the capital increase account, on its own behalf and on behalf of all shareholders.

This increase comes within the framework of the National Bank of Kuwait's efforts to strengthen its position in the Iraqi market and support the growth process of the Credit Bank of Iraq.

It is noteworthy that the National Bank of Kuwait owns 91% of the Iraqi Credit Bank.

Immature decision"... Iran questions the possibility of Iraq implementing foreign currency restrictions

Member of the Board of Directors of the Joint Iranian-Iraqi Chamber of Commerce, Shaaban Foroutan, said on Tuesday that the Baghdad government’s decision to restrict the buying and selling of foreign currency in the country, and the restrictions that have been put in place, are immature and impractical.

Shaaban Fortoun said in a statement reported by Fars News Agency, and translated by Shafaq News Agency, regarding the approval of the new Iraqi government law regarding restrictions on the purchase and sale of currency in this country, this law is not considered a mature decision by Iraq because the political, governmental and administrative system in this country The country cannot limit the buying and selling of currency in this way.

He added: Of course, Iran may also face some problems in the export process at the beginning of implementing this law, but this problem can be solved with an appropriate solution, and it is not impossible.

Froten added, "There is no doubt that, given the governmental and administrative system in Iraq, solutions will soon be found for currency conversion because Iraqis do not have a great desire to use the banking system due to their tribal and ethnic beliefs and lifestyle."

He referred to the good diplomacy of the (Iranian) government and the Central Bank, and said: Given the performance of the 13 (Iranian) government, we have always seen positive international and diplomatic movements and consultations by the Central Bank, and this time we can rely on this potential. The (Iranian) Central Bank has so far taken valuable measures in discussing facilitating currency exchanges with countries in the region, which I believe can provide a suitable platform for currency relations by engaging in this issue.”

Fortin saw the Iraqi government's new law as "immature and ill-considered," and said: "While we are witnessing such an immature decision by the Iraqis, we must send our experienced and capable employees in the Ministry of Foreign Affairs and the Central Bank, to this country in the form of a delegation," So they can reduce restrictions and interact with the neighboring country.

He continued, of course, Iranian representatives have always shown that they have great strength in the field of diplomacy and can facilitate the export process to Iraq this time as well.

The Central Bank of Iraq specified the entities covered by receiving its external transfers in cash in the US dollar, as of January 2, 2024, and this included:

- All diplomatic missions, organizations and international agencies operating in Iraq.

- Non-governmental civil society organizations registered in the General Secretariat of the Council of Ministers, in the event that the foreign donor party stipulates that the amounts of incoming foreign transfers be paid in the dollar currency inside Iraq.

- Government contracts in effect in the US dollar, and ongoing contracts for grants, loans, and foreign agreements.

- 40% of the remittances received by Iraqi exporters resulting from their exports abroad.

The Central Bank of Iraq, according to a statement, stresses the implementation of the decisions of the Council of Ministers to prevent internal transactions in foreign currency and to enhance confidence in the Iraqi dinar.

Iran: Iraqi restrictions on controlling the dollar do not mean the end of trade exchanges between the two countries

Member of the Iranian-Iraqi Chamber of Commerce, Hamid Hosseini, confirmed that the Iraqi Central Bank’s law to control the dollar and the announced restrictions do not mean the end of trade exchanges between the two countries or create problems in trade.

Hosseini said, in an interview withTasnim News Agency, in reference to the recent measures of the Central Bank of Iraq to deal with foreign currencies: The restrictions imposed after the adoption of this law were in no way a new or unprecedented event in the face of Iranian-Iraqi trade, as they existed from Before in many ways.

He added: Naturally, this law made it difficult to exchange dollars in the markets of this country, which will naturally affect the process of commercial and international exchanges. These restrictions are very similar to the laws of buying and selling currencies inIranIt cannot be considered a complete ban on currency exchange.

Member notedIran-Iraq Chamber of CommerceTo the consequences of applying this law on the foreign exchange process for Iranian merchants and businessmen inIraqHe said: Nothing new will happen after this law, especially in a country like thisIraq, as such issues can be resolved easily. Of course, perhaps export and import expenditures will rise slightly for a short period of time and the business process will face some risks, but it is unlikely that there will be a major problem in trade exchanges.

Referring to the political developments and events in the region and their impact on similar restrictions, this economic activist added: Such issues are generally related to political situations, relations and regional tensions, especially sinceIraqHe is always under pressure from the United States and is often forced to surrender to US demands.

Hosseini expressed his hope that the positive trend in foreign exchange and trade between...IranAndIraqAnd he said: InIraqMany people still do not want to transfer, buy and sell dollars via financial and banking networks, letter of credit and the like, and Iraqi exchange offices are still the main currency exchange agent in this country.

He continued: Given the circumstances you are going throughIraqThere has always been a way to buy and sell currencies in this country, and people can ...IranContinue its trade exchanges with this country in various ways. There is no doubt that despite the adoption of the new law in this country, the window is open to foreign exchange between...IranAndIraqThe export process should continue in this manner.

He believed that Iranian businessmen and merchants should not worry too much about the consequences of the lawCentral Bank of IraqNew, because other countries such as Russia, Syria, Venezuela, and others also face similar problems, but they were able to solve them.

In conclusion, Hosseini stressed that the Iranian government and the Central Bank are taking effective steps in this regard by providing more support and solutions for export operations and currency exchange with...Iraq.

urgentSource for Al-Furat News: Distribution of pensioners’ salaries this evening

An informed source revealed the date of launching and distributing retirees’ salaries for the current month of January.

The source told Al-Furat News Agency, "The salaries of retirees will be distributed this evening, Wednesday, after enhancing private financial funding."

The source attributed "the delay in disbursement due to some financial procedures and the entry of all banks into vacation."

Expert: The IMF report was “positive” but included economic warnings

The economic expert, Dr. Nabil Al-Marsoumi, confirmed that the indicators included in the report of the International Monetary Fund experts on Iraq, especially related to the decline in inflation rates, the tightening of the Central Bank’s procedures, and the increase in growth indicators, are all positive, but those indicators were accompanied by “some” warnings about the significant expansion in... Public finances, the possibility of a budget deficit, as well as fears related to the decline in oil production.

Al-Marsoumi pointed out that “the report pointed to some risks facing the Iraqi economy, including the significant expansion of public finances within the framework of the three-year budget law in force,” indicating that the IMF believes that this matter could impose large and important risks on the sustainability of the conditions of public finances and the external sector. In the medium term.

Al-Marsoumi pointed out that the other warning expressed by the Fund related to the decline in oil production after the closure of the oil pipeline linking Iraq and Turkey, and the reduction in production at the request of the OPEC+ group, stressing that the report believes that these measures will lead to a reduction in the growth of the gross domestic product in the country. The years 2023 and 2024.

The economist also explained that among the other risks mentioned by the International Monetary Fund in its report is its expectation that the public finance balance will shift from a large surplus achieved in 2022 to a budget deficit, in addition to the Fund’s experts’ expectation that the size of the fiscal deficit will expand to a greater extent in the current year. 2024, reflecting the full annual impact of budget actions.

The economist explained that the IMF called for the necessity of “mobilizing more non-oil revenues, containing the wage bill of government employees, and reforming the government retirement system,” stressing the importance of supporting these measures by moving to work on a more targeted social safety net that works to Providing better protection for vulnerable groups.

The report also recommended the need to create equal opportunities for the private sector, through reforms in banking and the electricity sector, reducing distortions in the labor market, and continuing efforts to strengthen governance and limit the spread of corruption.

An International Monetary Fund report, issued at the end of last month, reviewed the most prominent positives achieved by Iraq at various economic and development levels, suggesting “non-oil GDP growth of 5 percent in light of the significant expansion in public finances within the framework of the effective three-year budget law.” Pointing out that “to continue implementing the budget, strong non-oil growth should continue in the current year 2024.” However, the Fund expressed its fear of a decline in oil production after the closure of the oil pipeline linking Iraq and Turkey, and reducing production based on the request of the OPEC + group, likely to lead to This will reduce the growth of the gross domestic product in the years 2023 and 2024.”

According to a team of International Monetary Fund experts, led by Jean-Guillaume Poulain, “the inflation rate has declined from the peak it reached by 7 percent in January of last year, and inflation is expected to stabilize in the coming months, thanks to the Central Bank of Iraq’s policy of Tighter monetary policy, the impact of the rise in the Iraqi dinar exchange rate, lower global food prices, and the return of trade finance operations to normal with improved compliance with the anti-money laundering and counter-terrorism financing framework.”

For his part, the economic affairs specialist, Ali Karim Al-Diffai, pointed out that the economic achievements achieved by the government during the past year are very important and positive, stressing that these achievements will be reflected positively during the current year 2024 through increased development rates and a decline in inflation, poverty and unemployment rates, pointing out at the same time In the same way, government support for the private sector will enhance the economic recovery, and will lead to the employment of many workers and move the wheel of industry.

Al-Diffai also praised the decisions of the monetary authority that contributed to undermining the dollar and reducing its frightening rises, indicating that this policy led to the stability of the prices of goods and materials in the local markets, and thus the recovery of the purchasing power of the individual and the increase in the volume of local production, calling on government agencies to issue more decisions that This will achieve positive results at the economic level in the country, explaining that the World Bank report mentioned many positive points that Iraq has achieved as a result of those decisions taken by the government, which are in the interest of supporting various productive sectors, agricultural, industrial, and even tourism.

Dollar traps” are approaching the end... Parliament reveals those involved in the fluctuations of the parallel market

Today, Wednesday (January 3, 2024), the Parliamentary Economics Committee revealed those involved in the fluctuation of the parallel market in Iraq, while indicating that the “dollar traps” are nearing their end.

Committee member Representative Yasser Al-Husseini told “Baghdad Today” that “we are closely following the issue of fluctuations in the parallel market in Iraq, especially after the move to the electronic platform prepared by the Central Bank to regulate dollar liquidity and prevent smuggling, but on the other hand, there are those whose reconciliation with any organization was attacked because He loses his ability to smuggle and manipulate, which prompts him to try to disrupt the markets by various means.”

He added, "Despite the fluctuation in prices, the coming days will bring greater reassurance for merchants and all dealers in the financial market in terms of the stability of the exchange rate at good levels, especially with the central bank's oversight procedures, which we hope will increase in their aspects."

Al-Husseini pointed out that what he called dollar traps - in reference to the attempt of some to manipulate exchange rates in the parallel market - are almost over, pointing out that “there are corrupt people who live off market chaos in addition to the trade in contraband, including drugs, which also constitutes a competitor in the parallel market.” Stressing that "the Central Bank's measures will combat the most important liquidity threads of these people."

He continued, "The stability of the dollar exchange rate will lead to a decrease in prices in the markets, and this needs some time, indicating that the government's entry into the file of securing materials in the markets will lead to a greater wave of decline in the coming period."

Since the announcement of raising the value of the Iraqi dinar against the dollar by the Central Bank, local markets have witnessed trading at a rate other than the official rate of the dollar, with a difference that sometimes reached 30 points, which necessitated the government and the Central Bank to intervene with measures to reduce this phenomenon, but to no avail so far, as... The dollar exchange rate remained high to more than 150 thousand dinars for every 100 dollars in the markets and exchange offices of Baghdad and the provinces.

Qi Card Company specifies the age group included in issuing the MasterCard

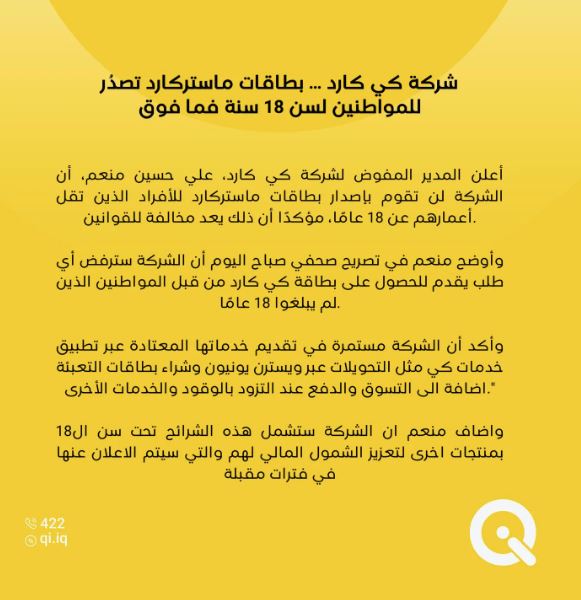

Qi Card Company... MasterCard cards are issued to citizens aged 18 years and above

The authorized director of Qi Card, Ali Hussein Moneim, announced that the company will not issue MasterCard cards to individuals under the age of 18, stressing that this is a violation of the laws.

Menem explained in a press statement this morning that the company will reject any application submitted to obtain a Qi Card by citizens who have not reached 18 years of age.

He stressed that the company continues to provide its usual services through the Ki services application, such as transfers via Western Union and purchasing recharge cards, in addition to shopping and paying when refueling and other services.

Moneim added that the company will include these segments under the age of 18 with other products to enhance their financial inclusion, which will be announced in the coming periods.

Terrorist attack.. New details about two bombings near Soleimani's grave

Iranian state television reported, on Wednesday, that an explosion had occurred near the grave of the commander of the Quds Force of the Revolutionary Guard, Qassem Soleimani, in Kerman Governorate, leaving at least 15 injured.

In a later development, the Iranian "Tasnim" agency reported that two terrorist bombings occurred on the road leading to Soleimani's tomb in Kerman, southern Iran, causing a state of panic among the crowds present at the place.

The Public Relations of the Emergency Department in Iran spoke to Tasnim Agency about the number of people injured in the explosion accident on Rawdat al-Shuhada Road in Kerman, and said: “A few minutes ago, an explosion occurred in the (Kanbad Jabaliyah) tunnel, where 15 people were injured and were transferred to... Medical centers.

She added: “Minutes after this incident, a second explosion occurred at the (Goli Beg) gate, and in this incident 20 people were injured due to the crowding,” adding: “Most of the injured were caused by the crowding and people fleeing when they heard the strong sound.”

According to the Iranian Tasnim Agency, the number of wounded and victims in these two bombings is high, with the number of victims likely to be more than 50 people and at least 50 to 60 others injured.

This coincides with the fourth anniversary of the killing of Soleimani and the Deputy Head of the Popular Mobilization Forces, Abu Mahdi Al-Muhandis, in an American raid near Baghdad International Airport on January 3, 2020.

Bloggers shared video clips of transporting the injured and injured at the site of the explosion, which Iranian television said was caused by the explosion of gas cylinders near the road leading to Soleimani's grave.

From Iran.. An Iraqi faction leader threatens the Americans and calls on Sudanese for a “bold” stance

The leader of the “Al-Nujaba” movement, one of the most prominent Shiite armed factions, called on Wednesday, Prime Minister Muhammad Shiaa Al-Sudani, to take a “bold” and clear position by sending a report to Washington ending the American presence in Iraq, threatening the United States with an “unprecedented escalation.” If you refuse to withdraw.

Al-Kaabi said in a speech he delivered in Iran on the occasion of the fourth anniversary of the assassination of Abu Mahdi Al-Muhandis and Qasem Soleimani, which was followed by Shafaq News Agency, “There is nothing between us and the treacherous killer, the arrogant occupier, except the logic of weapons and revenge,” noting that “the ambassador of the American occupation seeks to export herself as a guardian of Iraq".

He added, "Let the American enemy know that the Iraqi resistance is proceeding according to a well-thought-out strategy and tactics with calculated steps, and that if the American occupation does not leave Iraq willingly, it will leave rotting corpses against its will."

Al-Kaabi pointed out that “Paragraph 3 of the notorious agreement between Iraq and America allows for sending a communication ending the American presence,” calling on the Iraqi government to take a bold and clear position and send this communication that will restore sovereignty to Iraq and preserve its security and its people.

He continued, "If the government requests and the occupation does not leave, the resistance will undertake an unprecedented escalation of operations and expel them against their will."

Sources reported by the British newspaper The Guardian say that Prime Minister Muhammad Shiaa al-Sudani is under increasing pressure to work to remove American forces from the country.

Recently, the armed Shiite factions escalated their attacks on the military bases of the international coalition forces led by the United States of America in Iraq and Syria after the events of October 7 in Palestine (Al-Aqsa Flood).

It is noteworthy that the Iraqi Parliament had voted on January 5, 2020, on a resolution demanding that the Iraqi government work to remove foreign forces from the country.

Parliament's decision came at the time, two days after Washington assassinated the commander of the Iranian Quds Force, Qassem Soleimani, and the leader of the Iraqi Popular Mobilization Forces, Abu Mahdi al-Muhandis, in an air strike near Baghdad airport.

Al-Nusairi: My expectations in 2024 are to overcome the challenges of stability in the financial and monetary systems to ambitious proportions

The US Embassy reviews its role in "the growth of banking culture" in Iraq

Today, Wednesday (January 3, 2024), the American Ambassador to Baghdad, Elena Romanowski, touched on the extent of the weakness of the banking culture in Iraq, as part of the series she publishes entitled “Did You Know,” which focuses on American contributions to Iraq in various sectors.

Romanowski said in a tweet seen by Baghdad Today, “Did you know that less than a quarter of all Iraqi adults have an official bank account in 2021?”

She added, "Modern banking services contribute to increasing foreign investment, providing loans to Iraqis, and protecting them from financial crimes, theft, and loss," noting that "informal money transfer services harm the local economy."

She pointed out that “according to the World Bank, in 2021, the percentage of Iraqis over the age of 15 who owned an account in a financial institution was only 18.57%,” indicating that “this represents one of the lowest rates in the Middle East and North Africa region, which is “It averages about 53%.”

She stressed that "Iraq's reliance on cash and informal money transfer services harms the economy because it reduces the opportunities for financial regulation necessary to convince prestigious international companies to operate in Iraq."

She explained, "Over the past two years, the United States government has worked with Iraq to restore confidence in the banking sector and reform transfer mechanisms related to imports financed by Iraqi banks. The new reforms encourage the proper registration of companies and increase the use of official banking outlets. According to the Central Bank of Iraq, they have Total deposits with Iraqi commercial banks increased in the past two years by approximately 37%, and from 2021 to 2022, the total number of accounts in Iraqi banks increased by 31%.

The United States urges Iraqis to have bank accounts

The American Embassy in Baghdad announced on Wednesday that Iraqis are among the lowest countries in the region in possessing bank accounts, urging them to possess these accounts.

The embassy mentioned in a publication seen by Shafaq News Agency, entitled, “Did you know that less than a quarter of all Iraqi adults have an official bank account for the year 2021?”

She explained that "modern banking services contribute to increasing foreign investment, providing loans to Iraqis, and protecting them from financial crimes, theft and loss," indicating that "informal money transfer services harm the local economy."

She continued, "According to the World Bank, in 2021, the percentage of Iraqis over the age of 15 who owned an account in a financial institution was only 18.57%. This represents one of the lowest rates in the Middle East and North Africa region, which averages about 53%."

She said, "Iraq's reliance on cash and informal money transfer services is harmful to the economy because it reduces the opportunities for financial regulation necessary to convince prestigious international companies to operate in Iraq."

The US embassy continued, "Over the past two years, the United States government has worked with Iraq to restore confidence in the banking sector and reform transfer mechanisms related to imports financed by Iraqi banks. The new reforms encourage the correct registration of companies and increase the use of official banking outlets."

She explained, "According to the Central Bank of Iraq, the total deposits in Iraqi commercial banks have increased in the past two years by approximately 37%, and from 2021 to 2022, the total number of accounts in Iraqi banks has increased by 31%."

Comment from the US Embassy on financial stability in Iraq

Today, Wednesday, the US Embassy in Baghdad stressed the importance of shifting towards formal banking services for Iraqis, as less than a quarter of adults in Iraq have official bank accounts in 2021, which is one of the lowest in the Middle East and North Africa region.

In a statement received by “Earth News,” the embassy pointed to “the vital role that modern banking services play in increasing foreign investment and providing loans to Iraqis, in addition to protecting them from financial crimes.” According to the World Bank, only 18.57% of Iraqis over the age of 15 have bank accounts, which is much lower than the region average of about 53%.

The embassy stressed that “the serious work by the United States with the Iraqi government contributed to restoring confidence in the banking sector and reforming transfer mechanisms related to imports financed by Iraqi banks.” The new reforms encourage proper registration of companies and increase the use of official banking outlets.”

According to the Central Bank of Iraq, total deposits with Iraqi commercial banks have increased by approximately 37% over the past two years, and last year saw a 31% rise in the total number of accounts in Iraqi banks.

Parliamentarian: America controls international courts to pass their decisions

A member of the House of Representatives, Thaer Makhif, considered, on Wednesday, that the international courts and the UN Security Council are an American creation to pass Washington’s decisions, while he stressed that it is impossible to convict the United States of America in the case of the assassination of Al-Nasr leaders through them.

In an interview with the Maalouma Agency, Makhif said, “The goal of this policy is to continue the abuse and condemnation of the Arab countries, while it turns a blind eye to the violations of Washington and the Zionist entity,” noting that “the American policy has drawn a hostile map to weaken Iraq to infinity.”

He continued, "There are many decisions that Washington is pushing for in order to serve the Zionist entity and its goals inside the country," pointing out that "weakening Iraq directly is tantamount to weakening all Arab countries."

He added, fearfully during his speech: “One of the dual decisions passed by the UN Security Council is to condemn Iraq for its war on Kuwait, and not to condemn America for the occupation of the country until now,” pointing out that “the international courts and the UN Security Council are an American creation to pass Washington’s decisions that serve their own interests."

The UN Security Council continues not to condemn Washington for its violations and the continued systematic bombing against security forces and civilians, in addition to not condemning it for the bombing of Al-Nasr leaders, despite the presence of much evidence and admission by its former president of carrying out the operation.

From the dollar to the dinar... Iraqis complain about the deterioration of their salaries

“I have been waiting for about four months to receive my full salary from the bank, but every time I receive half of it and have to wait two or three weeks until I receive another payment,” says Sakar Mustafa, an Iraqi journalist who works independently with international institutions.

She explains to “ Raise Your Voice ” that “her salary ranges between 1,500 and 2,000 US dollars, depending on the work she performs, but what the bank disburses to her does not exceed 1,000 dollars, which is a very small amount that is not sufficient for all of her monthly expenses, represented by house rent and school tuition.” Bills and transportation.

“I spoke to the bank, and they informed me that they had received instructions to disburse salaries according to their capabilities, and currently they do not have the full liquidity to disburse it in full in dollars,” Mustafa continues.

She confirms that "her salary either arrives incomplete, or is transferred to the Iraqi dinar at the official rate set by the government (1,320 dinars per dollar), at a time when the exchange rate in the parallel market is 1,520 dinars per dollar."

On December 31, the Central Bank of Iraq announced the identification of the categories that receive their transfers in US dollars, which are: diplomatic missions, all international organizations and agencies operating in Iraq, and non-governmental civil society organizations registered in the General Secretariat of the Council of Ministers, in the event that the foreign donor stipulates that they pay sums of money. Foreign transfers received in the dollar currency inside Iraq.

In addition to government contracts in effect in the US dollar currency, ongoing contracts for grants, loans, and foreign agreements, and 40% of the remittances received by Iraqi exporters resulting from their exports abroad.

Since the end of 2022, Iraq has been witnessing an exchange rate crisis, represented by the fluctuation of dinar prices against the dollar and other foreign currencies, and inflation in the prices of goods and services in local markets.

The crisis deepened in 2023, with a significant decline in the price of the dinar against the dollar in the parallel market.

One of the solutions developed by the government is to force merchants to deal in the Iraqi dinar in their local transactions, so that the Central Bank of Iraq adopted the electronic platform in the currency auction to limit the smuggling of the dollar from the country and increase the value of the dinar.

The Central Bank activated the second phase of adopting the platform, with the aim of subjecting individual financial transfers and credit cards, activating electronic payment, reducing dependence on cash, and allowing Iraqi banks to import all currencies, including the dollar, to meet the needs of their customers.

But these solutions did not end the crisis in salaries for Iraqi employees working with foreign institutions.

"arbitrary action"

From the beginning of last December until the 20th of December, Iraqi banks, both governmental and private, have imported 255 million US dollars to meet the needs of their customers, according to the latest Central Bank statistics, published by the official news agency .

Economist Hammam Al-Shamaa told “Raise Your Voice,” saying, “Reducing the exchange rate in the parallel market to the official exchange rate will not be achieved in the short or even long term. There are many obstacles that prevent this.”

He wonders: “Does Iraq have enough foreign currencies and dollars if oil prices fall? Can it pump into the markets an amount of dollars that would lead to equality or matching between the official and parallel prices?”

“The answers are left to the future,” adds Al-Shamaa, who considered that “the Central Bank’s insistence on dealing with employee salaries paid in dollars based on the official exchange rate is an arbitrary and unfair measure for employees who receive US currency. This measure will not have a significant impact on the markets, as there will be a decline.” In remittances, resort to banking offices or black money transfers.”

Economist Nabil Jabbar Al-Tamimi points out that “there is a defect in the Central Bank’s dealings with external transfers from oil companies and institutions, media institutions, diplomatic bodies and oil companies, as well as other employee beneficiaries, who receive their salaries in dollars, and complain about the large difference between the price of... Official and parallel exchange if their salaries are converted into dinars.”

He told “Raise Your Voice”: “The cases you mentioned are exceptional, and are not an excuse to stop the campaign to end dollarization represented by the excessive use of the dollar in the local market, and the fate of the dollar exchange rate in the end is to stabilize at the official rate or something close to it within months.”

At the same time, Al-Tamimi believes that “the public interest requires acceptance of the state’s decisions, despite their problems.”

The Baghdad dollar fluctuated, so selling was stopped and then settled at 153 on Wednesday evening

Price list of metropolitan areas

The main stock exchanges in Baghdad witnessed, this evening, Wednesday, a significant fluctuation in the exchange rates of the US dollar, which prompted some exchange offices to suspend buying and selling for temporary periods, to avoid price movement, before later stabilizing at levels approaching 153, amid expectations that the price of the dollar will decline within the two weeks. The current and future levels reach the level of the forties.

The last price offered on the Kifah Stock Exchange, this afternoon, was 152,500 dinars per $100 note.

A government advisor announces the entry into force of the 2024 budget

Saleh said {to Al-Furat News} that: “The federal general budget issued pursuant to Law No. 13 of 2023 is a tripartite budget, that is, it was enacted for three years, and therefore the entry into the new fiscal year 2024 has been automatic from today.”

He explained, "This is based on the adoption of the federal general budget for the year 2024, and the 12/1 exchange rule does not currently exist in accordance with the amended Financial Management Law No. 6 of 2019 until the beginning of the year 2026 if the financial situation at that time requires its application."

Saleh added, "This rule, i.e. disbursement 12/1, also depends on the timing of the 2026 budget legislation."

Parliamentary Finance: The current year’s budget will change significantly

The Parliamentary Finance Committee announced that the 2024 budget will witness changes in its operational and investment parts.

Committee member Jamal Cougar said in an interview with Al-Sabah: “The 2024 budget will make many changes and it will be something different in terms of resources and estimates of oil prices and disbursements, as is the case with its plans as it is a new year that will carry new projects.” Stating that "amounts have been determined for some projects, and either they have been spent or will be spent in the near future, and these projects will be produced. There are also new appointments that occurred in the previous budget, and these are all variables that were not present in the 2023 budget." Koger added, “Every year, the operating budget increases, while changes occur in the investment budget,” stressing that “when the government presented a budget for three consecutive years, the first goal was to continue spending beyond the first of January and ensure that we are not exposed to problems stopping the fiscal year and work in accordance with The principle of spending is one out of 12 until a new budget is approved.”

The representative continued, “Parliament granted the government the authority to continue spending the 2023 budget until it is completed and start with the 2024 budget without stopping,” expecting that “the government will not change anything in the 2024 budget, and since it did not spend the previous budget in the required manner, it will not need loans in the new budget.”

No comments:

Post a Comment