Parliamentary Economy indicates the risks of the “parallel market”: “important” sessions with the Central Bank next week

Here is the video that goes along with this blogpost

https://screencast-o-matic.com/watch/cZVZQVVJBri

The Parliamentary Economics Committee pointed out the dangers of the “parallel market,” while revealing “important” sessions with Central Bank of Iraq officials next week in order to coordinate and support the market.

Parallel market risks

Today, Tuesday (January 23, 2024), a member of the Parliamentary Economics Committee, MP Briar Rashid, monitored the danger of the “parallel market” in Iraq.

Rashid said in an interview with “Baghdad Today” that “many factors contributed to creating the parallel market for the exchange of the dollar in Iraq, which is currently far from the official price set by the Central Bank at about 20 thousand dinars for every 100 dollars (the official price is 132 thousand dinars for every 100 dollars). $)".

Coordination with the central

Rashid pointed out that “the continuing gap between the parallel and the official is putting strong pressure on the markets and increasing the rate of price rise,” stressing that “his committee will hold a series of sessions with the Central Bank starting next week in order to coordinate towards supporting the markets and responding to the requirements of companies and traders in order to reduce prices as much as possible.” Possibility.

He explained that "supporting banks and openness in the labor market and production is a priority during the next stage," stressing that "increasing national production will reduce the demand for hard currency and lead to reducing the parallel market, and this is what we are seeking to achieve at the present time."

Deep State" control

On (January 4, 2024), financial expert Saleh Al-Bankari identified the danger of the deep state in the parallel market for the dollar, while pointing to 3 “pressuring” factors on price fluctuations .

The banker told "Baghdad Today", "The fluctuation of the dollar exchange rates in the parallel market recently is due to three direct pressing factors, and is centered on the Central Bank's measures to limit smuggling and launch its electronic platform, as well as the US Federal Reserve sanctions file and its handling of economic conditions . "

He added, "The third factor lies in government dealings through adopting the electronic payment file," indicating that "the political scene in its internal and external data and the events surrounding the region constitute the most dangerous factors for the parallel market in the country, noting that there is no complete control over the border crossings." With all its addresses to reduce smuggling . ”

Regarding the dollar in the parallel market, the expert said, “The parallel market is subject, in one way or another, to the control of the deep state, referring to very influential parties who are behind the series of speculations that took place in the past months in order to reap more profits .

Romanski: Deposits in Iraqi banks increased to 37 percent

The US Ambassador to Iraq, Alenia Romanski, announced today, Tuesday, that the total deposits held in Iraqi commercial banks have increased by about 37% over the past two years. The ambassador said in a post on the X platform, “Data from the Central Bank of Iraq indicates that the total deposits held in Iraqi commercial banks increased by about 37% during the past two years, and from 2021 to 2022, the total number of people with a bank account in banks increased.” Local by 31%.

She added, "We have made impressive progress. By working with Iraq on reforms, we are contributing to building confidence in the banking sector, as modern banking services enable us to promote a greater amount of foreign investment and protect funds from financial crimes, theft and loss."

External transfers

link they put her on blast! hahaha

Agents of foreign remittance service providers ( Western Union , MoneyCram ) and external remittances..For more, click here

the one page document is in Arabic but here is the text

Date 1/224/2024

Agents of foreign remittance service providers (Western Union, Money Gram)

m external transfers

good greeting

Given that Mrs. Rawad Tammuz (Mahmoud) carried out external transfers through the Western Union company using two Iraqi passports at the same time, issued during the year 2019, please exercise caution and caution regarding financial transactions on behalf of the above-mentioned invitee.

with respect .

Escorts

Passport copy number (2)

An academic explains the reasons for the "failure" of establishing solid banking relationships in Iraq

Today, Tuesday (January 23, 2024), the academic in economics, Mehdi Saleh, explained the reasons for the “failure” in establishing solid banking relations with the global and regional sector, while pointing to the necessity of developing banks and institutions at the regional level. The main player

Saleh said in an interview with “Baghdad Today” that “the central bank is the state bank and lending and issuing have important powers at its disposal that made it the main player in establishing monetary policy in Iraq,” pointing out that “the banking system, with all its civil and governmental titles, is the middle link between the central bank.” And the public,” referring to merchants, companies, and other segments.

He added, “The middle circle, referring to the specialized banks, is not sufficiently prepared to establish relationships with the global banking system because it has remained for many decades in local roles, that is, it has no experience, in addition to the very advanced situation of international banks, especially in the file of industrial and agricultural banks and the rest of the specialized banks.” ".

He added, "But this does not mean stopping, but rather striving to develop them, especially since Iraq was the first to establish banks at the regional level."

Parasitic performance

He pointed out "the necessity of staying away from the parasitic performance practiced by some banks by seeking speculation and quick profit, hunting for opportunities, and seeking to transfer the experience of Gulf and Southeast Asian banks in creating visions that contribute to the recovery of markets and building investments, to be the beginning of the move towards enabling performance in banking work at the level." Regional and international.”

Earlier, Prime Minister Muhammad Shiaa Al-Sudani reviewed to the President of the World Bank Group, Ajay Banga, Iraq’s steps towards financial and banking reform.

On the sidelines of his participation in the Davos Economic Forum, Al-Sudani met with the President of the World Bank Group, Ajay Banga, and discussed with him the cooperation relations between Iraq and the World Bank, in various economic fields, which contribute to supporting the government’s efforts and strategic plans, towards more investment and development opportunities in Iraq. According to an official government statement received by Baghdad Today.

The statement explained, "The meeting also witnessed a review of the measures and steps taken by the government and the Central Bank of Iraq, in terms of financial and banking reform. The projects financed by the International Finance Corporation (IFC) were also discussed, most notably the project to rehabilitate and develop Baghdad International Airport." .

The Prime Minister stressed, according to the statement, “the importance of the World Bank’s reports reflecting, realistically, the new government’s policies that were implemented in the economic and banking sectors and supporting the private sector, which aim to diversify the economy, increase its growth, and achieve financial stability, in light of the challenges facing the region and the world.”

Finance Matters

Al-Atwani: This year’s budget will approach 214 trillion

Fake, temporary, and affiliated with parties.” An economist talks about the reality of the situation of 90% of banks

Economist Abdul Salam Hassan said on Saturday that up to 90 percent of the banks in the country are “fake, temporary, and affiliated with parties.”

Hassan told that “Most banks are fake and temporary, as there are approximately 90 percent of fake and semi-fake banks affiliated with parties, and although the country’s financial situation is in good condition due to oil prices and the stability of the security situation, there are serious errors in the controls system, which caused... “With the loss of citizen confidence in banks.”

He explains, “For example, the interest rate when a citizen deposits an amount of one million dinars, where he is given 8 percent per year, provided that the deposits are fixed, that is, he is given 80 thousand dinars for every million dinars.”

He adds, “If the same citizen wants to borrow from the same bank an amount of 10 million dinars, 3 million dinars are taken from him as interest, and this applies to retirees, employees, and travelers.”

He continues, “One of the reasons for citizens’ exile from banks is not receiving the deposited amount in full, but rather the amount is paid in installments.”

The economic expert notes that “what is meant by the speech is the government bank (Al-Rafidain and Al-Rashid), while the National Bank is the one that controls the market.”

Specialist: There are Iraqis whose profits have reached $5 million through daily trading

Ali Linqawi, the Emirati researcher specializing in financial markets, revealed on Sunday the presence of Iraqi currency speculators on the stock market, who achieved profits amounting to $5 million, stressing that Iraq supports its currency through its local stock exchange.

In an interview with Shafaq News Agency, Naqawi attributed the large number of Arabs, including Iraqis, who trade stocks on stock exchanges to the advertisements and publication of the profits gained through them, indicating that “some of them (i.e. profits) are valid and some of them are to deception and fraud, and this is many in Iraq.”

The Emirati researcher explained, “There are Iraqis living in Dubai whose profits from trading and speculation have reached $5 million, but they do not want to appear in public,” adding that “among them are those who like to appear as businessmen or real estate owners.”

He added, "Adopting the Iraqi stock market to trade in the Iraqi dinar exclusively is a step to support the Iraqi economy and its local currency."

Linqawi pointed out, “Currently, there are no indications that Arab stock exchanges will reach the international level, but it is possible for the stock exchanges (Abu Dhabi and Dubai) to arrive in the future, and this takes time.”

Government and Central Bank meetings in Davos to shorten the time towards financial and banking reform

Arab Bank launches cross-border payment services “RemitEx” in cooperation with MasterCard

this is in Iraq's news it's a bank in Jordan

Arab Bank and MasterCard recently announced the launch of cross-border payment services “RemitEx”, which is based on MasterCard’s cross-border payment services platform with the aim of providing a money transfer service that will enable Arab Bank customers to make transfers in a faster and more secure way and for their full value without fees to the recipient

The launch of this new service comes within the Arab Bank's strategy to develop its digital payment system in addition to providing flexible and advanced banking solutions to its customers through a package of innovative and comprehensive solutions that meet their renewed needs and requirements. This service will also allow remittances to reach 28 countries, opening new corridors in a way that expands the bank’s global coverage and continues expansion plans in the future.

Commenting on the launch of this service, Mr. Yacoub Maatouq, Director of the Retail Banking Department at the Arab Bank - Jordan, said: “At the Arab Bank, we continue to provide the latest technological solutions in the banking industry and employ them to serve our customers, as the bank’s cooperation with MasterCard comes in light of the increasing demand.” On effective and secure payment services between countries. He added: “This service constitutes a qualitative addition to the payment services solutions provided by the bank, through which we seek to provide a comfortable, safe and almost instant financial transfer experience by taking advantage of the technology of the MasterCard platform for cross-border transfer services and using a variety of digital payment methods.”

Cynthia Al-Khoury, Head of Business Development for the Levant and Iraq at MasterCard, said: “MasterCard’s cross-border payment services are designed to provide innovative solutions that enable customers to make cross-border payments and transfers with the utmost security and ease. Through this cooperation with Arab Bank, our customers are able to send money transfers to their loved ones with ease and speed, and we look forward to seeing the positive impact on transfer services that Arab Bank customers in Jordan and the region will witness.”

With the increase in electronic transformation... “frightening” risks for digital banks

With the increasing economic shift to the electronic sector, which is clearly evident in Iraq through the shift to electronic payment and other digital means, economic fears are emerging about reaching the stage of “digital banks” or digital banks, due to the risks they carry for the economy. National, as well as the money and privacy of individuals.

These banks rely on various recognized currencies or cryptocurrencies, and enable any customer to conduct his transactions, from his home, office, or anywhere, through his smartphone or tablet.

But these “temptations” may entail greater risks, as one of the negatives of digital banks is the difficulty of determining the volume of liquidity for any electronic bank, as it is not possible to know or limit the bank’s internal and external transactions, as well as the ease of harming the national economy of any country, as it is not possible to monitor it. These banks are very large, and financial transfers can be made just by pressing one of the phone buttons.

Also among the negatives is the ease of falling victim to fraudulent operations by forging some cards, and a computer technical professional can hack accounts or copy other people’s information, which enables the information to escape from its confidential framework.

It is always expected that a technical error will occur that could obstruct the work of the entire bank and expose people’s accounts to loss, and a virus could also penetrate this system and disrupt it.

In addition, there are legal risks, as many digital banking operations are under development, such as licenses, signatures, and digital contracts, and there is no clear legislation in this regard, so it is difficult to prove them, in addition to the risks of money laundering, which is highly active in digital banks.

Can Iraqi banks provide foreign currency directly?

link more citizen education

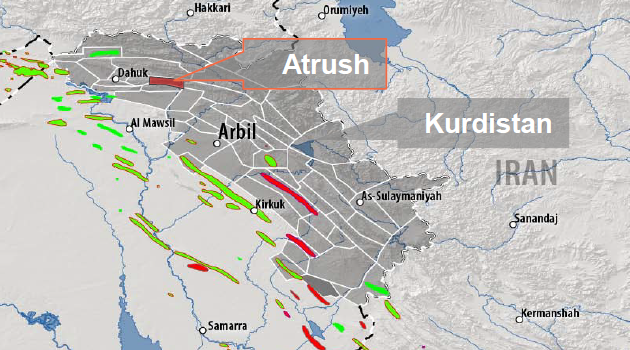

Shamaran, HKN to aquire TAQA's Interest in Atrush Oilfield

Canada's Shamaran Petroleum and US's HKN Energy are to aquire Abu Dhabi National Energy Company (TAQA)'s interest in the Atrush oilfield in Iraqi Kurdistan.

In a regulatory statement on Monday, TAQA said:

"... Abu Dhabi National Energy Company PJSC ("TAQA") has, through its wholly-owned subsidiary, TAQA International BV, entered into definitive agreements with General Exploration Partners Inc. ("GEP") to sell all of its interest in the Atrush oil field in the Kurdistan Region of Iraq.

"This transaction remains subject to obtaining third-party approvals."

Shamaran provided more details, saying that it will increase its indirect working interest in the Atrush Block from 27.6 percent to 50 percent, with HKN Energy IV, Ltd. ("HKN IV"), an affiliate of HKN Energy Ltd. ("HKN"), indirectly acquiring a 25-percent working interest and operatorship.

Garrett Soden, President and CEO of ShaMaran, commented:

"This transaction continues ShaMaran's consolidation strategy in Kurdistan. We are acquiring TAQA's 47.4% interest in Atrush and selling a 25% interest and operatorship to HKN IV. ShaMaran and HKN are already co-venturers in the adjoining Sarsang block operated by HKN. We look forward to working together at Atrush to realize significant synergies on both blocks."

A statement from HKN Energy, a privately-held oil company founded in 2007 by Ross Perot Jr, added:

"... we expect to realizen synergies and cost savings that benefit both the Sarsang and Atrush blocks. We anticipate a smooth transition without any interruption in petroleum operations for the Sarsang and Atrush blocks."

Full statement from Shamaran Petroleum:

ShaMaran Petroleum Corp. ("ShaMaran" or the "Company") (TSXV: SNM) (Nasdaq First North: SNM) has entered into definitive agreements for a two-step transaction to increase its indirect working interest in the Atrush Block in Kurdistan from 27.6% to 50%, with HKN Energy IV, Ltd. ("HKN IV"), an affiliate of HKN Energy Ltd. ("HKN"), indirectly acquiring a 25% working interest and operatorship, subject to required approvals. View PDF

Garrett Soden, President and CEO of ShaMaran, commented: "This transaction continues ShaMaran's consolidation strategy in Kurdistan. We are acquiring TAQA's 47.4% interest in Atrush and selling a 25% interest and operatorship to HKN IV. ShaMaran and HKN are already co-venturers in the adjoining Sarsang block operated by HKN. We look forward to working together at Atrush to realize significant synergies on both blocks."

In the first step of the transaction, ShaMaran's wholly-owned Cayman subsidiary, General Exploration Partners, Inc. ("GEP"), entered into an agreement with TAQA International B.V. ("TIBV"), a subsidiary of Abu Dhabi National Energy Company PJSC ("TAQA"), to acquire TAQA Atrush B.V. ("TABV") ("Step 1"). TABV is a Dutch holding company with a 47.4% working interest and operatorship in the Atrush Production Sharing Contract in Kurdistan ("Atrush PSC"). Step 1 is subject to customary closing conditions for a share sale and purchase agreement in the Netherlands and customary stock exchange approvals in Canada.

At closing of Step 1, HKN IV will begin operating Atrush on a fee basis in contemplation of the second step of the transaction. The appointment of HKN IV as operator is subject to review by the Ministry of Natural Resources in Kurdistan.

In the second step of the transaction, TABV will transfer a 25% working interest in the Atrush PSC to GEP2, a new Cayman wholly-owned subsidiary of GEP. In parallel, GEP has entered into an agreement to sell GEP2 to HKN IV for nominal consideration such that HKN IV will hold a 25% working interest and operatorship in the Atrush PSC ("Step 2"). The sale of GEP2 to HKN IV will be subject to approval by the Kurdistan Regional Government ("KRG").

After closing the above transaction steps, the Atrush Block will have the following parties: GEP 50%, HKN IV (through GEP2) 25% and KRG 25%.

Full statement from HKN Energy:

HKN Energy IV, Ltd. ("HKN IV"), an affiliate of HKN Energy Ltd. ("HKN"), has entered into a definitive agreement to acquire GEP2, Ltd. ("GEP2"), a wholly owned subsidiary of General Exploration Partners, Inc. ("GEP"), which in turn is a wholly owned subsidiary of ShaMaran Petroleum Corp. ("ShaMaran"). At closing, GEP2 will hold a 25% working interest in, and operatorship of, the Atrush Block in Kurdistan following a transaction between ShaMaran and TAQA International B.V. ("TIBV"). The acquisition of GEP2 is subject to approval by the Kurdistan Regional Government ("KRG").

Concurrent with the closing of the transaction between ShaMaran and TIBV, HKN IV will begin operating Atrush on a fee basis in contemplation of closing the acquisition of GEP2. After the acquisition of GEP2 closes, the Atrush PSC will have the following parties: GEP 50%, HKN IV (through GEP2) 25%, and KRG 25%.

HKN IV is a sister company to HKN and its ownership interest in and operatorship of the Atrush Block do not directly impact HKN or HKN Energy III, Ltd. Working together with ShaMaran, we expect to realize synergies and cost savings that benefit both the Sarsang and Atrush blocks. We anticipate a smooth transition without any interruption in petroleum operations for the Sarsang and Atrush blocks.

Canada's Shamaran Petroleum and US's HKN Energy are to aquire Abu Dhabi National Energy Company (TAQA)'s interest in the Atrush oilfield in Iraqi Kurdistan.

In a regulatory statement on Monday, TAQA said:

"... Abu Dhabi National Energy Company PJSC ("TAQA") has, through its wholly-owned subsidiary, TAQA International BV, entered into definitive agreements with General Exploration Partners Inc. ("GEP") to sell all of its interest in the Atrush oil field in the Kurdistan Region of Iraq.

"This transaction remains subject to obtaining third-party approvals."

Shamaran provided more details, saying that it will increase its indirect working interest in the Atrush Block from 27.6 percent to 50 percent, with HKN Energy IV, Ltd. ("HKN IV"), an affiliate of HKN Energy Ltd. ("HKN"), indirectly acquiring a 25-percent working interest and operatorship.

Garrett Soden, President and CEO of ShaMaran, commented:

"This transaction continues ShaMaran's consolidation strategy in Kurdistan. We are acquiring TAQA's 47.4% interest in Atrush and selling a 25% interest and operatorship to HKN IV. ShaMaran and HKN are already co-venturers in the adjoining Sarsang block operated by HKN. We look forward to working together at Atrush to realize significant synergies on both blocks."

A statement from HKN Energy, a privately-held oil company founded in 2007 by Ross Perot Jr, added:

"... we expect to realizen synergies and cost savings that benefit both the Sarsang and Atrush blocks. We anticipate a smooth transition without any interruption in petroleum operations for the Sarsang and Atrush blocks."

Full statement from Shamaran Petroleum:

ShaMaran Petroleum Corp. ("ShaMaran" or the "Company") (TSXV: SNM) (Nasdaq First North: SNM) has entered into definitive agreements for a two-step transaction to increase its indirect working interest in the Atrush Block in Kurdistan from 27.6% to 50%, with HKN Energy IV, Ltd. ("HKN IV"), an affiliate of HKN Energy Ltd. ("HKN"), indirectly acquiring a 25% working interest and operatorship, subject to required approvals. View PDF

Garrett Soden, President and CEO of ShaMaran, commented: "This transaction continues ShaMaran's consolidation strategy in Kurdistan. We are acquiring TAQA's 47.4% interest in Atrush and selling a 25% interest and operatorship to HKN IV. ShaMaran and HKN are already co-venturers in the adjoining Sarsang block operated by HKN. We look forward to working together at Atrush to realize significant synergies on both blocks."

In the first step of the transaction, ShaMaran's wholly-owned Cayman subsidiary, General Exploration Partners, Inc. ("GEP"), entered into an agreement with TAQA International B.V. ("TIBV"), a subsidiary of Abu Dhabi National Energy Company PJSC ("TAQA"), to acquire TAQA Atrush B.V. ("TABV") ("Step 1"). TABV is a Dutch holding company with a 47.4% working interest and operatorship in the Atrush Production Sharing Contract in Kurdistan ("Atrush PSC"). Step 1 is subject to customary closing conditions for a share sale and purchase agreement in the Netherlands and customary stock exchange approvals in Canada.

At closing of Step 1, HKN IV will begin operating Atrush on a fee basis in contemplation of the second step of the transaction. The appointment of HKN IV as operator is subject to review by the Ministry of Natural Resources in Kurdistan.

In the second step of the transaction, TABV will transfer a 25% working interest in the Atrush PSC to GEP2, a new Cayman wholly-owned subsidiary of GEP. In parallel, GEP has entered into an agreement to sell GEP2 to HKN IV for nominal consideration such that HKN IV will hold a 25% working interest and operatorship in the Atrush PSC ("Step 2"). The sale of GEP2 to HKN IV will be subject to approval by the Kurdistan Regional Government ("KRG").

After closing the above transaction steps, the Atrush Block will have the following parties: GEP 50%, HKN IV (through GEP2) 25% and KRG 25%.

Full statement from HKN Energy:

HKN Energy IV, Ltd. ("HKN IV"), an affiliate of HKN Energy Ltd. ("HKN"), has entered into a definitive agreement to acquire GEP2, Ltd. ("GEP2"), a wholly owned subsidiary of General Exploration Partners, Inc. ("GEP"), which in turn is a wholly owned subsidiary of ShaMaran Petroleum Corp. ("ShaMaran"). At closing, GEP2 will hold a 25% working interest in, and operatorship of, the Atrush Block in Kurdistan following a transaction between ShaMaran and TAQA International B.V. ("TIBV"). The acquisition of GEP2 is subject to approval by the Kurdistan Regional Government ("KRG").

Concurrent with the closing of the transaction between ShaMaran and TIBV, HKN IV will begin operating Atrush on a fee basis in contemplation of closing the acquisition of GEP2. After the acquisition of GEP2 closes, the Atrush PSC will have the following parties: GEP 50%, HKN IV (through GEP2) 25%, and KRG 25%.

HKN IV is a sister company to HKN and its ownership interest in and operatorship of the Atrush Block do not directly impact HKN or HKN Energy III, Ltd. Working together with ShaMaran, we expect to realize synergies and cost savings that benefit both the Sarsang and Atrush blocks. We anticipate a smooth transition without any interruption in petroleum operations for the Sarsang and Atrush blocks.

Government source: Issuing electronic cards to small merchants in Iraq

Government source: Issuing electronic cards to small merchants in Iraq

Today, Tuesday (January 23, 2024), a government source revealed the issuance of electronic cards to small merchants worth one hundred thousand dollars per month, according to a new 5-point mechanism.

Today, Tuesday (January 23, 2024), a government source revealed the issuance of electronic cards to small merchants worth one hundred thousand dollars per month, according to a new 5-point mechanism.

The source told "Baghdad Today", "Based on the directives of the Prime Minister and in light of the discussions that took place between the government, the Central Bank of Iraq and electronic payment companies for more than two months, a mechanism for issuing electronic cards to small merchants was approved."

He pointed out that "it has a ceiling of one hundred thousand dollars per month for carrying out payment operations for import purposes, ensuring a reduction in the demand for cash dollars by real merchants."

He explained that "the new mechanism includes:

1- Payment companies submit a request to the Central Bank to obtain approval to develop this product and launch the (merchant) card.

2- Determine the uses of the cards to be for small merchants in line with the external transfer controls issued by the Central Bank for the year 2023, provided that the ceiling for these cards is not to exceed (100) thousand dollars per month, with the possibility of raising the ceiling in the future in light of the results of the actual implementation.

3- The cards are used for the purposes of purchasing goods and services from known suppliers according to pre-defined white lists.

4- The company bears its duty to apply due diligence and in accordance with basic requirements, the most important of which are the main international ban lists of the United Nations, the Office of Foreign Assets Control and the European Union.

5- The money of small merchants is deposited in the branches of various Iraqi banks in Iraqi dinars.”

Get help paying off those Christmas bills

A set of directives from the Cabinet Secretariat for institutions regarding electronic points of sale

Today, Tuesday, the General Secretariat of the Council of Ministers issued a set of directives to official institutions regarding cooperation with licensed banks regarding electronic points of sale.The secretariat stated, in a statement received by Al-Iqtisad News, that “based on the directive of the Prime Minister, Muhammad Shiaa Al-Sudani, regarding electronic points of sale (POS), and in order to achieve a streamlined implementation of the procedures for implementing the aforementioned system, and to raise the level of preparedness on all sides, in a way that contributes to In serving citizens, the General Secretariat of the Council of Ministers confirms the following:1. Commitment to implement what was stated in Paragraph (First/2) of Council of Ministers Resolution (23620 of 2023) and in cooperation with licensed banks, in accordance with the scope of their work and the organizational structure of their accounting and financial procedures through the use of electronic payment tools from the procurement committees and implementation committees of the Secretariat.2. Emphasis on cooperation and coordination from all government institutions, with the companies that provide electronic payment services and the banks contracting with them for the following purposes:a. Placing billboards and screens displaying materials and short videos for citizens explaining the mechanisms of using electronic payment tools, their benefits and methods, and encouraging them to use them and educating them in this regard, until 3/1/2024 as a maximum.B. Conducting awareness campaigns to spread financial and banking culture and electronic payment in the field, within the buildings of institutions and formations and their locations periodically.3. Providing the Central Bank of Iraq with the procedures taken regarding the adoption of electronic payment tools in financial transactions and services, in addition to the proposals and challenges facing the process, so that the aforementioned bank can study them and find the necessary solutions as far as the matter is concerned with the specialization of the Central Bank of Iraq.The statement indicated, “The Department of Cabinet Affairs and Committees in the General Secretariat of the Council of Ministers will take it upon itself to follow up on the implementation of the directives.”

America Stuff

Al-Badri: America is waving the economic card to ensure that its interests are served in Iraq

Political analyst Saeed Al-Badri said on Sunday that Washington often waves the economic card against Baghdad in order to ensure the implementation of its agendas and the continued presence of its forces in Iraqi territory for as long as possible.

Al-Badri said in a statement to Al-Ma'louma, “America is a country that cannot be trusted after the crimes and massacres committed by its forces in Iraq and the support it provided to the terrorist ISIS, in addition to the fact that It is still manipulating the economy, the dollar currency, and Iraq’s funds.”

He added, “America, under the pretext of protecting Iraqi funds, is working to ensure Iraq’s continuation within Chapter Seven, and therefore Iraqi balances will remain hostage to the American administration, and the Federal Bank and the Treasury Department will manipulate and control them. "

He stated that "America is always threatening economic sanctions and disrupting the course of the Iraqi government, by manipulating the dollar currency and exchange rates, and preventing the government from contracting for advanced armament that guarantees autonomy on land, air, and sea." Ended

Al-Maliki stresses to the US Ambassador the importance of strengthening friendly relations and cooperation and continuing to develop them

Head of the State of Law Coalition, Mr. Nouri al-Maliki, receives the US Ambassador to Iraq

The head of the State of Law Coalition, Mr. Nouri Al-Maliki, received in his office today the Ambassador of the United States of America to Iraq, Ms. Elena Romanski.

During the meeting, the two sides reviewed the future of bilateral relations between the two countries, as well as the escalation of tensions in the region, the repercussions of Operation Al-Aqsa Flood, and Baghdad’s keenness on the necessity of ending the Zionist aggression and opening humanitarian corridors to bring in aid.

The President of the State of Law Coalition stressed the importance of strengthening friendship and cooperation relations, and continuing to sustain and develop them in a way that serves the interests of the two friendly peoples, pointing out the necessity of activating the agreements concluded between the two countries, especially the strategic framework agreement, in line with the importance of the current stage.

Mr. Nouri Al-Maliki referred to the many crises facing the region, especially the events in occupied Palestine, Lebanon, the Red Sea, northern Syria and Iraq, calling for speedy action to reduce tension and end the mutual attacks that may herald the expansion of the war.

In turn, the American Ambassador renewed her country's support for the stability of Iraq, stressing the continuation of dialogues between the two countries in order to strengthen partnership projects in various important and vital sectors.

The US Treasury includes Fly Baghdad on the sanctions list: cooperating with the Iranian Quds Force

The US Treasury includes Fly Baghdad on the sanctions list: cooperating with the Iranian Quds Force

The US Treasury Department announced, on Monday, the designation of the Iraqi airline “Fly Baghdad” and its CEO to provide assistance to the Iranian Revolutionary Guard “Qods Force” and its proxy groups in Iraq, Syria, and Lebanon.

The Treasury stated in a statement translated by Shafaq News Agency, “For several years, Fly Baghdad Company has supported the operations of the Quds Force of the Iranian Revolutionary Guard and its agents by delivering equipment and personnel throughout the region.”

She added, "Fly Baghdad flights delivered arms shipments to Damascus International Airport in Syria, for transfer to members of the Iranian Revolutionary Guard, the Quds Force and Iranian-allied militias on the ground in Syria, including the Syrian Arab Republican Guard, the Lebanese Hezbollah, and the Hezbollah Brigades." Hezbollah Brigades, affiliated with the Abu al-Fadl al-Abbas Brigades.

According to the US Treasury, Fly Baghdad delivered a group of weapons to these groups operating in Syria, including Iranian-made Fatah, Zulfiqar, and Fajr missiles, in addition to AK-47 and RPG-7 rifles, grenades, and other machine guns.

According to the Treasury statement, Kataib Hezbollah uses Baghdad Air to transport fighters, weapons, and money to Syria and Lebanon to support the Syrian regime, as Kataib Hezbollah leaders used Fly Baghdad flights on multiple occasions to transport bags of American currency and American-made weapons obtained by collecting them from... The battlefield from Iraq to Lebanon. Kataib Hezbollah also sent fighters from Iraq to Lebanon on flights operated by Fly Baghdad and Victory Wings designated by the United States to attend special operations training run by Hezbollah in October 2023, following The horrific terrorist attack launched by Hamas on Israeli civilians.

Fly Baghdad participated in transporting hundreds of Iraqi fighters, including fighters affiliated with the terrorist organization designated by the United States and the Iranian proxy militia (Asa’ib Ahl al-Haq AAH), in support of Iranian proxies’ attacks on Israel.

FlyBaghdad was designated for providing material assistance, sponsorship, or providing financial, material, or technological support, goods, or services to the Quds Force of the Iranian Revolutionary Guard.

The US Treasury Department said, "Bashir Abdul Kadhim Alwan Al-Shabani (Al-Shabani) is the CEO of Fly Baghdad. Al-Shibani was listed for owning or controlling, directly or indirectly, Fly Baghdad."

The US Treasury's Office of Foreign Assets Control identified two aircraft registered in Iraq owned by Fly Baghdad, tail numbers YI-BAF and YI-BAN, as prohibited property in which Fly Baghdad has an interest.

In response to Washington's sanctions...Hussein Muanis calls for liberation from “dollar dominance”

Today, Monday, the leader of the Hezbollah Brigades, Hussein Moanis, called on the resistant peoples to be liberated from “dollar hegemony.” In response to his inclusion on the US sanctions list.

it's a tweet yes I still say tweet

The American Ambassador on the punishment of Fly Baghdad: confirmation of the continued confrontation of the Revolutionary Guard

The US Ambassador to Iraq, Alina Romanowski, commented on Monday on the Treasury Department’s decision to include the “Fly Baghdad” company and three leaders of Kataib Hezbollah on the sanctions list.

Romanowski wrote in her blog post on the

She added, "This decision confirms the United States' determination to confront the ongoing threat posed by the Iranian Revolutionary Guard and its loyal network in Iraq," noting that "Iran's use of an Iraqi airline to smuggle weapons, fighters, and the US dollar represents a blatant violation of Iraq's sovereignty."

Earlier today, the US Treasury Department included three leaders and supporters affiliated with the Iraqi Hezbollah Brigades, which the ministry accuses of supporting the Iranian Revolutionary Guard in Iraq, on the sanctions list, in addition to including a company that transfers and launders money for the Brigades.

The US Treasury also included the Iraqi airline company “Fly Baghdad” and its CEO, on the sanctions list, for providing assistance to the Iranian Revolutionary Guard “Qods Force” and its proxy groups in Iraq, Syria, and Lebanon.

Legal Stuff

A parliamentary move to approve strategic laws during the next stage

On Sunday, the representative revealed the coordination framework within Radhi, a parliamentary agreement to pass important laws during the current legislative term, while determining the fate of the blocked strategic laws.

Radi said in an interview with the Maalouma Agency, “It is expected that the current legislative term will witness an important legislative agenda that includes draft laws submitted by the government related to amendments to laws to reduce the burden on citizens.”

He added, "The Civil Service Law, the Slum Law, the Oil and Gas Law, and the Federal Court are awaiting legislation," noting that "there are laws present in the Council, some of which the committees were not able to begin discussing Because they were referred in the last sessions of the last legislative term."

He explained that "there is a political and parliamentary consensus to pass the obstructed and important laws," pointing out that "the current legislative term will be rich in terms of legislating important laws."

A member of the Parliamentary Legal Committee, Omid Muhammad, had confirmed to Al-Maalouma, Parliament's intention to approve a group of important laws during the next legislative term, indicating that the priority will be for service projects.

Other Countries

The Minister of Finance discusses with the Finnish Ambassador to Iraq enhancing economic and investment cooperation opportunities between the two countries

The Minister of Finance, Taif Sami Muhammad, met today, Sunday, at the Ministry’s headquarters, with the Finnish Ambassador to Baghdad, Anu Saarila, and her accompanying delegation.

The Ministry of Finance stated in a statement, “The two sides reviewed aspects of cooperation and coordination between the two friendly countries in various fields, most notably the field of finance and business, in addition to discussing enhancing opportunities for economic and investment cooperation, with the possibility of benefiting from Finland’s experience in the infrastructure sectors and reconstruction efforts, especially since Iraq It is witnessing an unprecedented stage in the field of reconstruction and construction.”

The Minister affirmed "Iraq's keenness to raise the level of relations and advance them for the benefit of the two friendly countries."

For her part, Ambassador Sarila affirmed, "His country's continued support for Iraq in the next stage, and the Finnish side's aspiration to deepen joint cooperation between the two countries, expressing her country's government's readiness to strengthen cooperation frameworks with Iraq at many levels, especially in the field of finance and business.

The Foreign Minister arrives in Vienna to discuss regional and international developments

Foreign Minister Fouad Hussein arrived in Vienna on Sunday to discuss regional and international developments.

His media office stated in a statement received by {Al-Furat News} that "the latter arrived in the Austrian capital, Vienna, on an official working visit during which he will meet with Foreign Minister Alexander Schallenberg and a number of officials to discuss enhancing joint cooperation and regional and international developments."

Iraq and Austria sign a memorandum of understanding in political consultations between the two countries

The Ministry of Foreign Affairs announced, on Sunday, the signing of a memorandum of understanding in the field of political consultations between Iraq and Austria.

The Ministry stated, in a statement received by the Maalouma Agency, that “Deputy Prime Minister and Minister of Foreign Affairs, Fouad Hussein, arrived today in Vienna on an official visit.”

She added, "The Minister signed with the Minister of Foreign Affairs of the Republic of Austria for European and International Affairs, Alexander Schallenberg, a memorandum of understanding in the field of political consultations between the two countries at the headquarters of the Austrian Ministry of Foreign Affairs, in the presence of the Ambassador of the Republic of Iraq in Vienna, Bakr Fattah Hussein, and the Ambassador of the Republic of Austria in Baghdad, Andrea Nassi."

She explained, "This came on the sidelines of the official visit conducted by Foreign Minister Fuad Hussein to the Republic of Austria."

Military Stuff

Parliamentary security reveals obstacles to entering US military bases in Iraq

Today, Sunday, the Parliamentary Security and Defense Committee revealed the possibility of parliamentary committees entering US military bases in Iraq, while confirming that the matter requires official letters and addressing several parties in order to approve the entry.

Committee member Yasser Watout said, in an interview with the Maalouma Agency, that “entry to the American bases requires submitting a request to the Joint Operations Command in order to approve the visit request,” noting that “entry requires procedures that include the reasons for the visit in a written formal request to the bases.” detailed".

He continued, "The Joint Operations Command is the one who submits the request to enter American military bases according to the official methods and specifications previously established," indicating that "there is no time limit for the period during which entry approvals are obtained."

He continued during his speech: “Members of the Parliamentary Security and Defense Committee cannot directly enter the American military bases present in the country,” pointing out that “the matter requires official letters and addressing many parties in order to approve entry.”

A fire broke out inside an Iraqi army shed in Baghdad

link this was more than a little shed ...

A security source in the capital, Baghdad, reported today, Monday (January 22, 2024), that a fire broke out inside a barracks belonging to the Iraqi army in the areas between the Yusufiyah and Mahmoudiyah districts.

The source said in an interview with "Baghdad Today", "A fire broke out inside a barracks belonging to the Iraqi army (22nd Brigade) in the areas between the Yusufiyah and Mahmoudiyah districts."

Then, the Joint Operations Command announced, “A fire in a small warehouse belonging to the 22nd Infantry Brigade in the 17th Division led to the explosion of light and medium equipment and it was brought under control and an investigation into the matter was ordered.”

Washington: We will deal with attacks on its forces in Iraq “very seriously”

he United States confirmed on Sunday that it is dealing “very seriously” with the attack launched by Iranian-backed factions on Saturday on a base hosting American forces in western Iraq.

The US military said that Iranian-backed factions fired “several ballistic missiles and rockets” at Ain al-Asad air base in western Iraq late Saturday, wounding one Iraqi and possible casualties among US forces.

“It was a very serious attack, using ballistic missiles that posed a real threat,” White House Deputy National Security Advisor John Feiner said Sunday.

“We will respond... by establishing deterrence in similar cases and holding accountable these groups that continue to attack us,” Viner added during his appearance on the “This Week” program on the American ABC network.

“You can be assured that we are taking this matter very seriously,” he continued.

Viner and the Pentagon explained that most of the projectiles fired at the base were intercepted by air defenses.

The White House: The Ain al-Assad attack is dangerous, and we will respond with “extreme” seriousness.

The White House confirmed, on Sunday, that the United States is dealing “very seriously” with the attack launched by Iranian-backed factions on Saturday on the Ain al-Assad base, west of Anbar Governorate.

Yesterday, Saturday, the US military announced that Iranian-backed factions fired “several ballistic missiles” at Ain al-Asad air base in western Iraq, wounding one Iraqi and possible casualties among the ranks of American forces.

In this regard, Deputy National Security Advisor at the White House, John Feiner: “It was a very serious attack, using ballistic missiles that posed a real threat,” adding: “We will respond by establishing deterrence in similar cases and holding accountable these groups that continue to attack us, and you can be sure of "We take this matter very seriously."

Since mid-October, dozens of attacks have been recorded on about 2,500 American soldiers in Iraq and about 900 deployed in Syria with other forces from the international coalition against ISIS.

The "Islamic Resistance in Iraq", an alliance of armed factions linked to Iran and opposed to American support for Israel in its war against Hamas in Gaza, claimed responsibility for most of the targets, including Saturday's attack.

The use of ballistic missiles represents an escalation in attacks that previously used low-tech missiles and drones.

The attack on the air base came on Saturday in light of escalating tensions in the Middle East after the outbreak of war between Israel and Hamas on October 7.

No comments:

Post a Comment