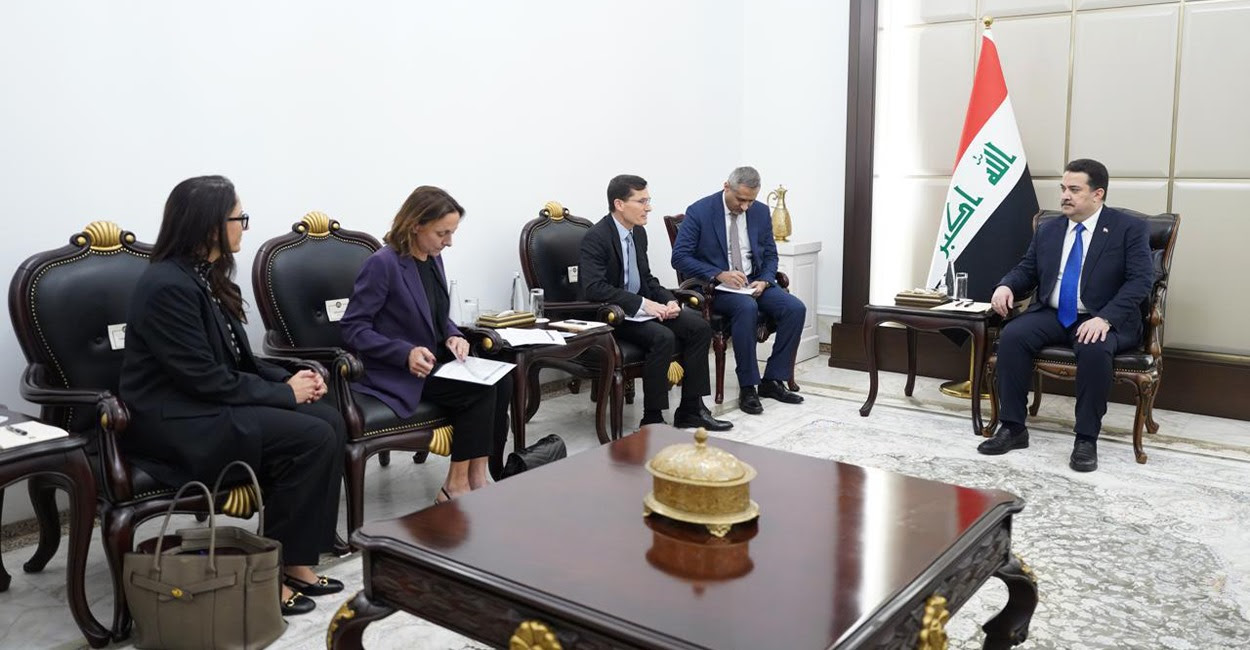

Prime Minister: The importance of the partnership between Iraq and the United States

At Biden's request, an American senator meets with Sudanese, and a detailed statement about their discussions

The Prime Minister stated, according to a statement, a copy of which {Al-Furat News} received, "the importance of the partnership between Iraq and the United States, stressing the transition to a bilateral relationship governed by the strategic framework agreement between the two countries, after completing the tasks of the international coalition, according to a specific timetable."

He stressed "the necessity of stopping the war in Gaza and ending the genocidal war committed by the occupation forces, especially with the approaching month of Ramadan."

For his part, Senator Coons confirmed that “his tour in the region and his meeting with the Prime Minister came at the request of President Joe Biden,” pointing to “the depth of the partnership between the United States of America and Iraq, and the need to expand it to include economic, cultural, and health aspects, in addition to the security that It takes place in accordance with the meetings of the Supreme Military Committee, and he also stressed the necessity of achieving stability and peace in the Middle East and a ceasefire in Gaza and the Palestinian territories.

Russia

Iraq and Russia are intensifying their cooperation to confront the scourge of corruption

During his meeting with the Prosecutor General of the Russian Federation (Igor Krasnov) in the capital, Moscow, Hanoun renewed the intention of the Iraqi regulatory agencies to partner with their counterparts in the Russian Federation, especially between the Authority and the Russian Prosecution, in addition to concluding a memorandum of understanding between the Iraqi Anti-Corruption Academy and the Public Prosecution University. Russian, expressing the Authority’s desire to benefit from the experience of the Russian Public Prosecution and its university and to train the Authority’s staff there, in addition to inviting their experts to train and participate as lecturers in studying the professional higher diploma in specializations related to anti-corruption announced by the Academy.

For his part, the Russian Attorney General (Igor Krasnov) noted the strengthening of relations between the Republic of Iraq and the Russian Federation and its coincidence with the eightieth anniversary of the beginning of the relationship between the two countries, pointing out that one of the main components of cooperation between countries is unifying efforts in combating the most serious challenges, among which corruption occupies a special place. He stressed that he supports the efforts of the Iraqi Integrity Commission seeking to recover the fugitive defendants and the looted funds wherever they are found.

He pointed out that the signing of the memorandum of understanding between the two parties is of great importance in deepening and developing the relationship between the Office of the Prosecutor General in Russia and the Federal Integrity Commission in Iraq, expressing his readiness for further professional dialogue on any issues of common interest, even if they are not stipulated in the memorandum or the program. Cooperation, expressing its pleasure to see employees of the Republic of Iraq in short-term training courses, at its affiliated university, whether among its students or among the participants, welcoming the Authority’s call for Russian prosecution experts to contribute to training its staff in the Iraqi Anti-Corruption Academy.

During the meeting, a cooperation program was signed between the two parties, which will serve as a roadmap for implementing the terms of the memorandum over the next two years, which stipulates a full set of activities (workshops, meetings, and training courses). To exchange experiences in the field of international cooperation in the field of combating corruption, recovering the proceeds and proceeds of corruption crimes from abroad, forming national coordination committees to combat corruption, coordinating positions on multilateral international anti-corruption forums, and reviewing experiences in implementing legislation concerned with combating and preventing corruption, including those related to conflicts of corruption. interests, and financial disclosure.

The program also stipulated holding a round table meeting on the topic “Using modern digital technologies to combat corruption and holding training courses for the Authority’s employees by representatives of the General Prosecutor’s Office of the Russian Federation and the Public Prosecution University, as well as exchanging scientific and educational literature, periodicals and methodological materials on the topics of combating and preventing corruption.”

Al-Sudani discusses with the US Ambassador the files of his upcoming visit to Washington

link

Al-Sudani prepares to visit Washington and discusses files with the ambassador

Today, Wednesday, Prime Minister Muhammad Shiaa Al-Sudani discussed with the US Ambassador to Iraq, Alina Romanowski, the files that will be presented during his upcoming visit to Washington, to discuss cooperation mechanisms within the strategic framework agreement between Iraq and the United States

A statement by the Prime Minister’s Media Office:

Today, Wednesday, the Prime Minister, Mr. Muhammad Shiaa Al-Sudani, received the US Ambassador to Iraq, Ms. Alina Romanowski.

During the meeting, they discussed relations between the two countries and ways to strengthen them, and confirmed the continuation of bilateral dialogue rounds and the joint supreme military committee concerned with organizing the end of the international coalition’s missions in Iraq.

The meeting also discussed the files that will be raised during the upcoming visit of the Prime Minister to Washington, the cooperation mechanism within the strategic framework agreement between Iraq and the United States, and the committees formed in this regard.

A representative accuses America of standing in the way of the growing Iraqi economy

Today, Wednesday, the representative of the State of Law coalition, Muhammad Al-Shammari, accused the United States of America of obstructing Iraq’s economic openness to international countries.

Al-Shammari told Al-Maalouma, “The United States of America stands as a stumbling block in the way of Iraqi economic growth, through its interventions that obstructed arming the Iraqi army, controlling oil imports through the US Federal Reserve, obstructing reconstruction, and concluding contracts with reputable international companies.”

He pointed out that "America contributed greatly to preventing the arrival of reputable international companies to Iraq."

Washington restricts Iraq to the control of the Federal Reserve... manipulating the country’s capabilities and dominating financial sovereignty

With the principle of tightening the screws from all sides, the United States of America continues to manipulate Iraq’s vital capabilities from time to time, and in parallel with the important events that occur in the political, security and economic arena, given the dictatorship that Washington is implementing towards the country through the Federal Bank, and the delay in sending Iraq’s export funds. Oil for the purpose of causing a liquidity crisis that hinders the work of the government, especially the crisis of delayed release of recurring employee salaries as a result of; Reducing financial releases from America despite the increase in the country’s financial balance during the recent period, amid many calls for the government’s need to move towards achieving economic sovereignty and breaking American hegemony.

*Financial sovereignty?

Speaking about this file, a member of the House of Representatives, Thaer al-Jubouri, accuses the United States of America of controlling Iraq’s funds through the Federal Bank, while he stressed that Washington is creating pretexts to control a number of files.

Al-Jubouri said, in an interview with the Maalouma Agency, that “America is trying to force the country to pay the price of solidarity with the Palestinian cause and a position against the Zionist entity,” pointing out that “achieving economic independence is extremely important for the development of the Iraqi economy.”

He continues, "One of the reasons for the crisis of the rise in the parallel exchange rate of the dollar is the interventions of the US Federal Reserve, which takes decisions and imposes sanctions," adding that "America controls the rise and fall of the dollar price through many of the schemes it follows."

Al-Jubouri concludes his speech by saying, "Washington is always trying to influence the government's steps that seek to achieve economic and military independence for the country," accusing "the United States of America of dominating Iraq's funds through the Federal World Bank."

*Washington conspiracy?

In addition, the economic expert, Nasser Al-Kinani, warned today, Thursday, of a plan to seize Iraqi oil money from the US Federal Bank, while revealing details of a conspiracy against the Iraqi economy.

Al-Kanani said in an interview with the Maalouma Agency, “The sanctions imposed on Iraqi banks contributed to a liquidity crisis for the dollar in the local markets,” noting that “there are fears of stopping the export of money from selling oil to the country.”

He continues, "The Federal Reserve's sanctions on Iraqi banks are intended to benefit the rest of the Arab banks that partner with Washington," pointing out that "the dominance of the United States of America over the Iraqi economy still continues until now."

Al-Kanani added, "The United States of America has issued sanctions against 26 banks so far," considering that "the process of stopping these banks is unjustified and there are no reasons to take measures against them."

The United States of America continues to impose its influence on Iraq in many vital files, including the authority to deposit Iraqi oil sales funds in the US Federal Bank, amid clear blackmail to pass many files, or manipulate the dollar bill, which puts great pressure on the government.

An economist warns of the Washington scenario.. What is the Federal Reserve’s relationship?

link

Economist Nasser Al-Kinani warned today, Thursday, of a plan to seize Iraqi oil money from the US Federal Bank, while revealing details of a conspiracy against the Iraqi economy.

Al-Kanani said in an interview with the Maalouma Agency, “The sanctions imposed on Iraqi banks contributed to a liquidity crisis for the dollar in the local markets,” noting that “there are fears of stopping the export of money from selling oil to the country.”

He continued, "The Federal Reserve's sanctions on Iraqi banks are intended to benefit the rest of the Arab banks that partner with Washington," pointing out that "the dominance of the United States of America over the Iraqi economy still continues until now."

Al-Kanani added, "The United States of America has issued sanctions against 26 banks so far," considering that "the process of stopping these banks is unjustified and there are no reasons to take measures against them."

He stated, "There is a conspiracy against the economy through the Arab banks that were opened in the previous period being linked to the US Treasury and not the Central Bank."

A member of the House of Representatives, Thaer al-Jubouri, had accused, in an interview with the Maalouma Agency, “the United States of America of dominating Iraq’s funds through the Federal World Bank,” while he stressed that Washington is creating pretexts in order to control many files.

A parliamentarian accuses the US Federal Reserve: “Enough of controlling the country’s money.”

Today, Thursday, a member of the House of Representatives, Thaer al-Jubouri, accused the United States of America of controlling Iraq’s funds through the Federal Bank, while stressing that Washington is creating pretexts to control a number of files.

Al-Jubouri said, in an interview with Al-Maalouma, that “America is trying to force the country to pay the price of solidarity with the Palestinian cause and a position against the Zionist entity,” pointing out that “achieving economic independence is extremely important for the development of the Iraqi economy.”

He continued, "One of the reasons for the crisis of the rise in the parallel exchange rate of the dollar is the interventions of the US Federal Reserve, which makes decisions and imposes sanctions," adding that "America controls the rise and fall of the dollar price through many of the schemes it follows."

Al-Jubouri concluded his speech by saying, "Washington always tries to influence the government's steps that seek to achieve economic and military independence for the country," accusing "the United States of America of dominating Iraq's funds through the Federal World Bank."

In an interview with Al-Maalouma, a member of the Parliamentary Finance Committee, Moeen Al-Kadhimi, criticized “the US Federal Reserve’s sanctions on Iraqi banks,” noting that they are “an attempt to undermine the government’s success that the latter is pursuing.”

ITC hosts Iraq National Trade Forum

With support from the government of Iraq, the International Trade Centre (ITC), a joint agency of the United Nations (UN) and the World Trade Organization (WTO), organized a two-day trade forum to help Iraqi businesses to identify and develop trade opportunities. The Forum was funded by the European Union (EU).

According to a statement from ITC, more than 450 participants from the agriculture and agrifood sectors, business support organizations, international and regional suppliers, and investors, including over 200 Iraqi and international companies, donors and development partners attended the first day.

The second INTF comes after the successful first edition held in 2022 that helped secure participating companies' potential deals worth $2.5 million through more than 170 business-to-business (B2B) sessions, bridging over 70 Iraqi companies with global suppliers and investors. 30% of participant companies that had participated in 2022, returned for the second year.

The B2B event remained an integral part of the INTF to better connect Iraqi micro, small and medium-sized enterprises involved in farming, food processing, packaging and logistics with international and regional suppliers and investors.

These interactions are key for expanding business networks, facilitating business deals, fostering sustainable investments and promoting innovation while sharing best practices from leading Iraqi agribusinesses.

In addition to plenary sessions, high-level panels with practical workshops and B2B meetings, the 2024 edition of the Forum featured a trade exhibition called 'Iraqi Bazaar' that showcased hundreds of locally produced items in a pop-up store.

The label 'By Iraqi Hands' to stimulate the food industry and encourage people to buy more local products and support sustainable development was launched at the INTF. Iraq's Potato Sector Development Strategy was also officially launched on the occasion.

The ITC flagship report, SME Competitiveness Outlook 2023, was also launched globally on 19 February at the INTF. The report focuses on the impact of fragility on the competitiveness and growth of small businesses.

The European Union Ambassador to Iraq, Thomas Seiler said:

"International trade presents a very good opportunity for Iraq to revitalize its agricultural sector, diversify its economy, and achieve sustainable economic growth. By fostering international partnerships and leveraging its agricultural potential, Iraq can become a player in the global market and an even more important economic actor in the region. The European Union will continue to remain a close partner of Iraq and promote its integration in the global and regional markets."

ITC Executive Director Pamela Coke Hamilton said:

"With over one million MSMEs in operation, smaller businesses account for two-thirds of Iraq's private sector jobs. And they provide much more than that: they deliver crucial goods and services for the functioning of the local economy and for the wellbeing of its communities. As hundreds of Iraqi companies connect with buyers and investors at the Forum, they contribute to sustainable, trade-led development in the country and beyond."

ITC Head of Country Programme in Iraq, Eric Buchot said:

"Small businesses forming two-thirds of Iraq's private employment, are key to its economy. The involvement of 300 businesses at INTF 2024 could be game-changing with a fundamental mindset shift. For real impact, fostering competitiveness and a market focused approach is essential."

Deputy Special Representative, Resident Coordinator for Iraq Ghulam Mohammad Isaczai said:

"The success of the Second Iraq National Trade Forum underscores the vital role of Iraqi SMEs in driving economic growth and sustainable development. Through fostering partnerships and promoting innovation, we are paving the way for a more prosperous future for Iraq. The UN is committed to supporting Iraq's journey towards economic diversification and resilience, highlighting the importance of collaboration at all levels. Together, we are building a stronger, more inclusive economy that benefits all Iraqis."

The INTF has become a platform for enhancing awareness of pivotal domestic reforms, aimed at fostering robust private sector development.

Smartphone Market in Iraq nearly Doubles

The market for smartphones in Iraq has reportedly grown by 86 percent year-on-year in Q4 2023.

According to research by Canalys, this has come, "despite rising restrictions on US dollar cash withdrawals by local banks exacerbating a shortage and driving up the parallel market exchange rate."

It says that vendors including TRANSSION and Xiaomi are targeting younger younger customers by offering appealing designs, advanced technology, and affordable prices.

Iraq's smartphone market surged with an impressive 86% growth, despite rising restrictions on US dollar cash withdrawals by local banks exacerbating a shortage and driving up the parallel market exchange rate. US dollars are crucial for Iraq's import-dependent cash economy. Meanwhile, vendors including TRANSSION and Xiaomi in Iraq are targeting younger demographics with marketing campaigns, capitalizing on a preference for smartphones with appealing designs, advanced technology, and affordable prices.

“Xiaomi, HONOR, and TRANSSION have emerged as leaders in the Sub-US$200 category, indicating a shift in consumer purchasing patterns amid rising living costs,” said Canalys Senior Consultant Manish Pravinkumar. “Xiaomi has actively expanded its offline presence in the region, increasing its footprint in retailers such as Sharaf DG in the UAE from four to 12 stores. It has also introduced improved offerings such as the Redmi 12C and restructured its team to enhance competitiveness. HONOR is following Huawei's legacy strategy in the region, launching flagship devices including the Honor Magic 5 Pro, while also emphasizing brand visibility with successful models in the Honor XA/B series, which has gained wider acceptance in markets such as Saudi Arabia and Iraq. Motorola's notable 49% growth demonstrates its commitment in the highly competitive landscape, with a focus on the Middle East and Africa markets. The vendor is dedicated to expanding its presence, aiming to enter over 10 additional markets.”

Get $75 when you refer a friend

So YOU set up your account and receive your OWN $25 and then you will set up your family and friends and THEY will all get the same $25 and YOU get $75 for everyone that gets the $25.

It does take $10 to sign up for the account, and it has to come from a debit card (checking account) connected to you, but the $10 is available immediately in your account to use. So it's actually free to get your $25 but you need to have $10 available to set it up.

Yes it's true and it works and I have done it MYSELF!

military stuff

Sudanese advisor via “Earth News”: The government does not want foreign forces to leave in a hostile manner

The political advisor to the Prime Minister, Sobhan Mulla Jiyad, confirmed on Wednesday that the government does not want foreign forces to leave in a hostile manner.

Mulla Jiyad told Earth News Agency, “Prime Minister Muhammad Shiaa Al-Sudani confirmed yesterday in his press conference the withdrawal of the American presence in Iraq, and that Washington, since the visit of the Iraqi delegation to it in 2023 and the delegation raised the issue of scheduling the withdrawal of international coalition forces, there was initial approval and then the approval came.” Officially through the American Embassy in Baghdad.”

He added, “The Supreme Military Committee was formed to study the conditions of the Iraqi security forces and what they need in terms of training, weapons, equipment, and information and intelligence issues, and began holding several meetings on this matter, given that Iraq has strong friendly relations and these countries stood by the country, so the government does not want to expel them completely.” Hostile, but the opposite in a friendly and agreed-upon manner.”

Multiple advantages and an important turning point... How did electronic payment methods affect the Iraqi economy?

The process of gradual transformation towards the use of electronic payment methods has constituted an important economic turning point in Iraq, especially with government support that stresses the necessity of adopting this type of dealings in all governmental and private departments, which specialists describe as “important”, stressing that the transformation towards... The use of “electronic money” represented by payment cards, and abandoning cash dealing, carries several advantages, including eliminating many cases of corruption, absorbing citizens’ hoarded cash, as well as the possibility of reducing the rise in inflation after using small amounts in buying and selling transactions through points. Electronic sales, according to the official newspaper.

This electronic transformation of the use of money in daily transactions represents the utmost importance in the government’s directions, which is making great efforts to complete this direction, especially after “the Council of Ministers had previously obligated private educational institutions, universities, private colleges, fuel processing stations, centers and shops of all kinds.” Restaurants, pharmacies, private medical clinics, stores, all wholesale and retail marketing outlets, professionals, and others that require payment for their interests within the boundaries of the Baghdad Municipality and the governorate centers and districts throughout Iraq, with a minimum amount of their cash receipts through the electronic point-of-sale (POS) system. .

Despite the short period of time in which it was officially decided to actually start using electronic payment methods (POS) in the country, “the World Bank believes that the infrastructure for electronic payment systems in Iraq is the best in the region,” praising during a meeting with the Governor of the Central Bank, Ali Mohsen Al-Alaq, Director of the World Bank Office in Iraq, Richard Abdel Nour, explained, “The Central Bank’s procedures for facilitating financial transfers to different segments in Iraq.”

Al-Alaq had confirmed that “the Central Bank and the government give great priority to the issue of electronic payment because of its important economic repercussions and raising the level of transactions away from excessive use of cash,” indicating that “the Iraqi economy is a cash economy par excellence and the electronic payment process aims to reduce the economic degree of cash in a way.” big ".

The Central Governor added, "The Prime Minister is very supportive of the process of transitioning to electronic payment and holds successive and continuous meetings in order to strengthen the procedures related to this issue. We have made important progress in arranging electronic payment at the level of collection and payment in state institutions."

The "gradual" dispensing with paper money is, according to a member of the Iraqi Economists Association, economic researcher Muqadam Al-Shaibani, of great importance capable of achieving packages of positive results, especially since the dissemination of electronic payment tools in all stores will contribute to gradually abandoning the use of cash, and this will be It has significant consequences for the national economy.

Al-Shaibani also pointed out that the government granted privileges to all store owners by exempting them from tax if they use electronic payment methods, and this constitutes an important incentive, pointing at the same time to what he described as the “fundamental point” that the electronic payment process can achieve.

He explained the possibility of absorbing approximately 92% of the cash mass saved in homes after the complete shift towards electronic currency dealing, as the banking system will be able to invest it in supporting productive projects that contribute to the continuation of the money cycle and reduce inflation rates and also contribute to a high degree in eliminating red tape and corruption in institutions. The state, stressing the need to issue punitive decisions on public and private institutions and entities that are reluctant to implement and publish electronic payment tools.

It is noteworthy that the Association of Private Banks, in a statement to the official agency, counted the number of electronic payment devices and payment cards during the year 2023, confirming that this issue is witnessing a major transformation.

The Executive Director of the Association of Banks, Ali Tariq, said: “The electronic payment file is making continuous progress thanks to the support and directives of Prime Minister Muhammad Shiaa Al-Sudani, and the government’s insistence on achieving this goal has stimulated all institutions, whether governmental, private or financial institutions, to cooperate in the field of providing electronic payment tools to the citizen.” Across the public and private sectors.”

He pointed out that "after the issuance of the Council of Ministers' decision to generalize electronic payment last year, a very significant progress and leap was achieved with regard to the number of points of sale, whether in the private or government sector, as it rose in just half a year from about 7,000 devices to 24,000 devices at the end of the same year." 2023, expecting that “the number of electronic payment devices will increase further during the year 2024.”

He pointed out that "nearly two and a half million cards were issued in 2023, whether prepaid cards or cards linked to an account to activate them in this field."

From Cash to Cards: Workers' struggle, electronic payment prospects, and Iraq's shift to a cashless future

In Iraq, the push towards electronic payment systems has encountered resistance from many workers who fear the impact on their livelihoods.

As the Government aims to phase out cash transactions and implement modern automation, concerns arise among citizens, especially those working in gas stations.

The Iraqi Ministry of Oil's Products Distribution Company has set the end of next March as the final date for cash transactions at government and private fuel stations. The first trial took place this week at the Muthanna government station.

In a statement, the Company's general manager, Hussein Talib, explained to Shafaq News Agency that "companies have connected fuel dispensers to Point-of-sale (POS) terminals (hardware systems for processing card payments at retail locations,) allowing citizens to enter fuel quantities and make payments without the need for human intervention."

The nightmare of unemployment

Fuel station worker Mohamed Ali, 33, believes that the electronic payment device placed next to him is the main reason for a decline in the tips he receives, and he may even lose his job as citizens increasingly use Visa cards to purchase fuel.

Ali, who has been working at a gas station in Baghdad for nine years, told our Agency, "I spend most of my time, from dawn to dusk, standing near this cabinet to serve those who want to refuel. They usually give me some tips for every refill, but now the tips are falling due to electronic payment systems."

Ali sees electronic payment systems as threatening his livelihood, "The situation doesn't look good, especially for those working at gas stations. Owners are talking about the possibility of reducing the number of workers, which will lead to increased unemployment, given the lack of new hires and limited job opportunities in other sectors."

Advantages of electronic payment

Electronic payment, a system for settling transactions without cash, has numerous advantages. One of the most significant benefits in Iraq is eliminating corruption, fraud, and direct bribery in government institutions. It also facilitates ease of transactions and increases cash deposits in banks and financial institutions.

However, the transition to this globally practiced system in Iraq is not without fraudulent activities that could occur both by merchants during citizens' transactions and through the imposition of additional fees under the pretext of current deduction charges, especially as the societal culture regarding electronic payment is weak.

Therefore, economy experts stressed the necessity to educate the community about using electronic payment and facilitating the opening of bank accounts for citizens to obtain electronic cards smoothly and without obstacles.

In this context, oil expert Govand Sherwani states, "The electronic card payment and billing system represents a modern approach to financial transactions, characterized by speed and accuracy. It reduces reliance on cash liquidity, which is usually susceptible to damage and requires compensation."

Sherwani adds, "Card transactions reduce dependence on currency, whether paper or cash, thereby reducing losses and saving additional funds for the state. The payment system provides a secure way to conduct financial transactions instead of carrying large amounts of cash in the wallet, which may be prone to loss or theft."

However, the challenges hindering the implementation of this system in Iraq may be, according to Sherwani, "the lack of adaptation by ordinary citizens, especially those with limited education or self-employed individuals, as well as the fees imposed on every purchase or sale using these cards."

He calls for "keeping the commission low to incentivize citizens to adopt the cards without hindrance, as card adoption is a preliminary step towards electronic banking without the need to visit the bank and deal with paper currencies, whether for withdrawals or deposits."

"Getting used to these cards will be a preparatory step for citizens who are not accustomed to visiting banks to open accounts, conduct commercial transactions, and even receive salaries, as mentioned in the smart card and key card, electronically transferring salaries to any point or agency for the key card anywhere in Iraq."

Sherwani notes that "employees are accustomed to this system, but non-employees, such as self-employed and traders, may find this new. However, with time, they will realize the benefits of electronic payment."

On the fate of workers at gas stations, Member of the Iraqi Parliament's Oil and Gas Committee, Deputy Kazem Jaru Al-Maghsoub, states that "in most Government and private gas stations, the worker takes an additional amount for himself (tips). Therefore, electronic payment will put an end to this."

"Putting money in the MasterCard will transfer the funds from the citizen's wallet to the state's balance. Therefore, electronic payment has many benefits and will reduce corruption." He told Shafaq News.

Regarding the future of workers at the stations, he assures that "they will continue working and will not be affected. Perhaps their numbers in the sales department may decrease due to the availability of payment devices that perform their tasks, and the surplus will be distributed to the Oil Product Distribution Company, so the payment devices will not cause unemployment. However, workers in private stations may be affected due to the availability of devices that perform their roles, reducing their numbers."

On the other hand, Deputy Chairman of the Union of Gas Filling and Services Facilities, Abbas Mahioub, points out that "most citizens do not have a Visa card, and in my work, there is a problem in the gas-selling process. The gas agent who roams within cities to sell gas to citizens finds that most people do not have electronic payment cards."

Mahioub adds to Shafaq News, "Although the Visa card is available, it has a commission when charging and withdrawing, which is a loss for the cardholder. Despite the system's many benefits, these commissions may lead to price increases to cover these fees."

Providing POS devices in public places

Despite the directives of the Iraqi Government to implement the electronic payment system in state institutions, the private sector, commercial centers, markets, and other entertainment facilities, most markets and fuel stations lack POS devices.

It's worth noting that the Central Bank of Iraq's Board decided on December 13 last year to establish the "National Company for Electronic Payment Systems" nationwide.

According to the Central Bank, this step comes in parallel with the rapid growth in electronic financial services and products and the increasing number of users, aligning with the Government's program to support and adopt advanced electronic payment systems.

Additionally, the Iraqi Banks Association revealed, on December 12, a growth in bank accounts, bank cards, and electronic payment devices following the significant support provided by Prime Minister Mustafa Al-Kadhimi and the Central Bank of Iraq to the banking sector. This support included activating electronic payment in government and private institutions and reforming mechanisms for financing foreign trade.

The Board's chairman, Ali Tariq, stated in a press release that bank accounts grew by 14%, reaching 10.02 million by the end of September 2023, compared to about 8.79 million accounts at the end of 2022, which indicates the creation of more than 1.2 million accounts within nine months.

Iraq's shift from cash to electronic payments poses both challenges and opportunities. Workers like Mohamed Ali face uncertainties, yet the potential benefits of reducing corruption and improving efficiency are significant.

Therefore, the success of this financial evolution lies in embracing technology while safeguarding the workforce's well-being, striking a harmonious balance between progress and empathy.

The Governor of the Iraqi Central Bank identifies the advantages of “electronic collection”: a very important episode

Today, Thursday, the Governor of the Central Bank of Iraq, Ali Al-Alaq, described the issue of electronic collection as an “important link,” and while he pointed to the advantages of collection, he stressed the Central Bank’s commitment to supporting this initiative.

Al-Alaq said in a speech during a workshop organized by the Iraqi Private Banks Association, and attended by an “Al-Iqtisad News” correspondent, that “the launch of the electronic collection project comes as a translation of the commitment of the Central Bank and the banks and financial institutions subject to the supervision of the Central Bank to implement its vision and strategic objectives to develop the financial banking sector in Iraq.”

He added, "The project will contribute significantly to enhancing government resources and collecting them in a reliable, secure and transparent environment, relying on the infrastructure in payment systems and electronic payment platforms provided by the Central Bank and providing payment services."

Al-Alaq stated, “This project generally targets all governmental ministries, as well as non-governmental ministries, unions, and associations from which the amounts are collected,” pointing out that “this project will enable the automation of all collection operations, the adoption of electronic payment tools, and the reduction of cash transactions, which in turn will help reduce the burden of burden on citizens by accelerating the completion of transactions.”

The Governor of the Central Bank explained, “Customers can choose the time and place they want to pay bills, and this will save time and effort and provide services to pay citizens through multiple payment channels with a high degree of trust and security.”

He pointed out that “this matter increases collection rates, reduces costs, reduces the risks of cash dealing, raises the efficiency of the service provided to the citizen, and obtains integrated data and reports,” considering that “electronic collection is an important link among the links seeking to limit the phenomenon of the cash economy, which the Central Bank seeks to achieve.” Working on it at several levels for optimal use of transportation and expanding financial inclusion.”

Al-Alaq stressed, “The Central Bank affirmed its full commitment, in partnership with its colleagues, to support this initiative by supporting the growth and use of the local economy while preserving its stability and status through cooperation and purposeful challenge.”

Banks and the Iraqi Central Bank: We face challenges in electronic collection

On Thursday, the Iraqi Private Banks Association, under the auspices of the Central Bank of Iraq, held a workshop to enhance electronic government collection.

Director of the Operations and Settlements Department at the Central Bank, Zaid Hamid, told Shafaq News Agency, “Government collection is very important, and the decisions of the Council of Ministers and the direct follow-up of the Prime Minister will contribute to society’s shift from relying on cash to electronic dealing.”

He pointed out that "the Central Bank provided the infrastructure and systems necessary for the success of the electronic payment process," explaining that "the percentage began to rise gradually through the spread of electronic culture in society."

For his part, Deputy Executive Director of the Iraqi Private Banks Association, Ahmed Al-Hashemi, told Shafaq News Agency, “The workshop briefed all government institutions on how to activate the electronic collection project, the challenges that departments face in the transformation process, and finding quick solutions regarding this matter.”

He pointed out, "Initiating the issue of collection in a number of ministries and state departments, including the Interior, Oil, Passports, and Gas Stations, and this program can be implemented in all state institutions."

Al-Hashemi continued, “The state departments are committed to the directives of Prime Minister Muhammad Shiaa Al-Sudani to activate electronic payment tools for government collection,” adding, “We have some challenges that we face in the process of transitioning to electronic payment.”

The Deputy Executive Director of the Iraqi Private Banks Association stressed, “Ensuring the implementation of the electronic collection program in a correct manner to preserve the state’s funds,” noting that “this project preserves funds.”

Fate of Laws withdrawn by Iraqi government remains uncertain: lawmaker

The legal committee of the Iraqi parliament on Thursday revealed the fate of the laws withdrawn by the government of Mohammed Shia al-Sudani since the formation of the legislative session in 2021.

Committee member Aref al-Hammami told Shafaq News Agency that "the process of withdrawing laws by the government is a legal and constitutional procedure, especially since some of the laws present in the House of Representatives were withdrawn by the government to improve their financial basis."

Al-Hammami explained that "the government withdrew the Compulsory Military Service Law, the Law on the Treatment of Housing Encroachments, the Reconstruction Council Law, the Companies Law Amendment, the First Amendment to the Iraqi National Oil Company Law, the Second Amendment to the Public Roads Law, the Federal Civil Service Law, and others."

He added that "the government withdrew these laws, as they were sent by the previous government, and they need to be amended and need to have financial allocations within the budget, which is the basis for withdrawing the laws," calling on the government to "speed up sending the important laws to the House of Representatives, as it has not yet sent those laws back."

The withdrawal of laws by the government has raised concerns among some lawmakers and observers. Some argue that the government is using this process to delay the passage of important legislation or to bypass the parliament's oversight role.

The government has defended its decision to withdraw the laws, arguing that it is necessary to ensure that they are properly drafted and that they have the necessary financial backing.

It remains to be seen when the government will resubmit the withdrawn laws to the parliament.

Some of the withdrawn bills were on compulsory military service and housing encroachments, in addition to amendments to the national oil company law, public roads law, and federal civil service law.

Al-Sudani praises Visa's cooperation in expanding electronic payment technology

The Iraqi Prime Minister, Muhammad Shiaa Al-Sudani, confirmed on Thursday that the government has placed the issue of economic and banking reform among its most important priorities, while he praised the cooperation of the “Visa” company in expanding electronic payment technology and digital transformation.

This came during the Prime Minister’s reception of the Regional President of Visa in Central and Eastern Europe, the Middle East and Africa, Andrew Toure and his accompanying delegation, according to a statement received by Shafaq News Agency.

Al-Sudani stressed that “the government has placed the issue of economic and banking reform among its most important priorities, and it seeks and welcomes cooperation in this field,” pointing to “the approval of the electronic payment system in the Council of Ministers.”

The Prime Minister praised "the company's cooperation in expanding electronic payment technology and digital transformation, whether through training workers in Iraq or by contributing to education for the electronic payment process."

For his part, Andrew Torrey expressed “the desire to continue cooperation with the Central Bank of Iraq and all institutions of the Iraqi banking sector,” pointing to “Visa’s interest in supporting the Iraqi government’s plans towards electronic payment and economic and banking reform, by introducing advanced solutions and technologies to the market.” As well as its readiness to bring expertise, in addition to employing more Iraqis in its office in Baghdad, with the aim of reaching 500,000 acceptance points from electronic payment points of sale in Iraq.”

Training and education.. The Sudanese discusses with “Visa International” the electronic payment file in Iraq

This afternoon, Thursday (February 22, 2024), Prime Minister Muhammad Shiaa Al-Sudani discussed with the Regional President of Visa, in Central and Eastern Europe, the Middle East and Africa, Andrew Toure, and his accompanying delegation the electronic payment file in Iraq.

Al-Sudani confirmed during the meeting, according to a statement from his office received by “Baghdad Today,” that “the government has placed the issue of economic and banking reform among its most important priorities, and it seeks and welcomes cooperation in this field,” pointing to “the approval of the electronic payment system in the Council of Ministers.”

The Prime Minister praised "the company's cooperation in expanding electronic payment technology and digital transformation, whether through training workers in Iraq or by contributing to education for the electronic payment process."

For his part, Andrew expressed “the desire to continue cooperation with the Central Bank of Iraq and all Iraqi banking sector institutions,” noting “Visa’s interest in supporting the Iraqi government’s plans towards electronic payment and economic and banking reform, by introducing advanced solutions and technologies to the market, as well as its readiness To bring expertise, in addition to employing more Iraqis in its office in Baghdad, with the aim of reaching 500,000 acceptance points from electronic payment points of sale in Iraq.”

Al-Sudani: The government has placed economic and banking reform among its most important priorities

Prime Minister Muhammad Shiaa Al-Sudani confirmed, on Thursday, that the Iraqi government has placed economic and banking reform among its most important priorities, indicating its endeavor to welcome work in this field.

The Prime Minister’s media office said in a statement, seen by Al-Iqtisad News, that “Al-Sudani received, this afternoon, Thursday, Andrew Toure, the regional president of Visa for Central and Eastern Europe, the Middle East and Africa, and his accompanying delegation.”

The Prime Minister stressed, according to the statement, that “the government has placed the issue of economic and banking reform among its most important priorities, and it seeks and welcomes cooperation in this field,” pointing to the approval of the electronic payment system in the Council of Ministers, praising the company’s cooperation in expanding electronic payment technology and digital transformation, Whether through training workers in Iraq or by contributing to education for the electronic payment process.”

For his part, the regional president of Visa expressed “the desire to continue cooperation with the Central Bank of Iraq and all Iraqi banking sector institutions,” noting that “Visa’s interest in supporting the Iraqi government’s plans towards electronic payment and economic and banking reform, by offering advanced solutions and technologies.” To the market, as well as its readiness to bring expertise, in addition to employing more Iraqis in its office in Baghdad, with the aim of reaching 500,000 acceptance points from points of sale for electronic payment in Iraq.

Iraq reopens largest oil refinery after decade-long shutdown

link from Kurdish news and they showed the speech on TV too

ERBIL, Kurdistan Region - Iraq’s Prime Minister Mohammed Shia’ al-Sudani on Friday presided over the reopening of the country’s largest oil refinery that was captured by the Islamic State (ISIS) nearly a decade ago.

The North Oil Refinery in Baiji, northern Salahaddin province was captured by ISIS militants in mid-2014. The group was territorially defeated in Iraq in 2017.

With the refinery now back online, “we are on track to meet the country's total oil derivatives needs by mid-next year, potentially even surpassing this goal ahead of schedule,” Sudani said.

Repair work was done in cooperation with the Kurdistan Regional Government (KRG), according to Sudani, who said he first visited the refinery in May “to examine its condition and observe the recovered equipment and machinery.”

Iraq is one of the world’s top oil producers, pumping out some four million barrels per day according to Sudani, and its economy is highly dependent on crude exports. However, it still imports gas and refined products, especially from its neighbor Iran.

“Halting oil derivative imports will save billions of dollars,” Sudani said, “that can be reallocated to other public services and economic sectors, marking significant reform.”

Sudani’s government has eyed self-sufficiency in several energy-related sectors, especially oil and gas.

In April, the Iraqi government and French TotalEnergies signed a deal that will see the energy giant build four projects for oil, gas, and renewables in southern Iraq in 25 years. The contract was initially signed in 2021, but was delayed due to disagreements over Iraq’s stake in the deal as Baghdad demanded a 40 percent share.

Sudani at the time said in an interview with Alawla TV that the agreement with the French giant would make the country self-sufficient and an exporter of natural resources within three to five years.

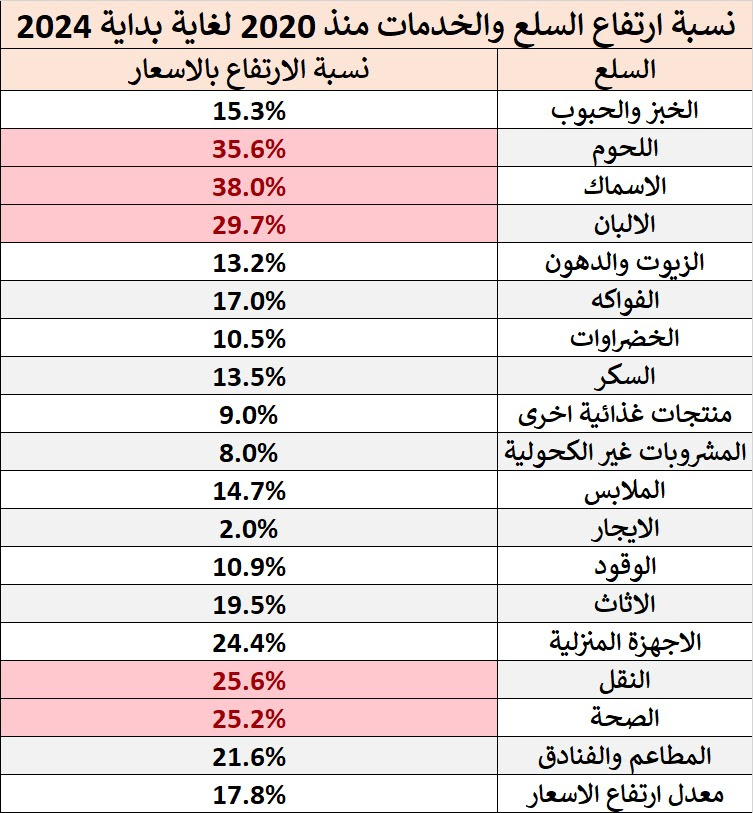

Economic institution: Prices of goods and services in Iraq increased by 18% in 4 years

The Future Iraq Foundation for Economic Studies and Consultations announced on Friday that the prices of goods and services in Iraq rose by 18% from the beginning of 2020 until the beginning of 2024, according to price data issued by the Ministry of Planning and the Central Bureau of Statistics.

The Foundation stated in a report issued by it that important and basic commodities for the Iraqi citizen witnessed an increase of more than 30%, led by meat, which rose by 36% compared to the year 2020. Fish prices also increased by 38%, as well as dairy prices by 30%.

According to the report, health services and transportation services also witnessed a significant increase, reaching more than 25% for both services, indicating that the services with the least increase in prices were rents throughout Iraq, which only increased by 2%, as well as non-alcoholic beverages, which only increased by 2%. 9%.

In its report, the organization expected that inflation rates would continue to rise, especially with the rising costs of international supply chains, in addition to climate changes affecting a wide sector of food commodities.

The report pointed out that, despite these increases in inflation rates over four years, they are considered the lowest compared to the rest of the neighboring and global countries, which have greatly exceeded their inflation levels during the past four years.

The Foundation warned that failure to develop plans to secure various commodities, whether through local production or import, will exacerbate the price problem, and will have major repercussions on the Iraqi citizen in the coming years, as it will have social impacts on the citizen and an increase in poverty rates.

Parliamentary Finance: Increasing the salaries of 3 levels of employees by 50%

The evolution of the Kuwaiti dinar

link does someone feel threatened? hahaha

No comments:

Post a Comment