Barzani thanks Bush for liberating Iraq from Saddam's regime

Iraq: Staff Concluding Statement of the 2024 IMF Article IV Mission

A Concluding Statement describes the preliminary findings of IMF staff at the end of an official staff visit (or ‘mission’), in most cases to a member country. Missions are undertaken as part of regular (usually annual) consultations under Article IV of the IMF's Articles of Agreement, in the context of a request to use IMF resources (borrow from the IMF), as part of discussions of staff monitored programs, or as part of other staff monitoring of economic developments.

The authorities have consented to the publication of this statement. The views expressed in this statement are those of the IMF staff and do not necessarily represent the views of the IMF’s Executive Board. Based on the preliminary findings of this mission, staff will prepare a report that, subject to management approval, will be presented to the IMF Executive Board for discussion and decision.

March 3, 2024: An International Monetary Fund (IMF) mission, led by Mr. Jean-Guillaume Poulain, met with the Iraqi authorities in Amman during February 20–29 to conduct the 2024 Article IV consultation. The following statement was issued at the end of the mission:

Economic growth is projected to continue amid fiscal expansion. Meanwhile, medium-term vulnerabilities to oil price volatility have increased significantly. Reducing oil dependence and ensuring fiscal sustainability while protecting critical social and investment spending will require a significant fiscal adjustment, focused on controlling the public wage bill and increasing non-oil tax revenues. In parallel, higher economic growth will be needed to absorb the rapidly expanding labor force, boost non-oil exports and broaden the tax base. The authorities should therefore seek to enable private sector development, including through labor market reforms, modernization of the financial sector and restructuring of state-owned banks, pension and electricity sector reforms, and continued efforts to improve governance and reduce corruption.

Economic Outlook and Risks

Growth in the non-oil sector has rebounded strongly in 2023 while inflation receded. Supported by increases in public expenditure and solid agricultural output, real non-oil GDP is estimated to have grown by 6 percent in 2023 after stalling in 2022. Headline inflation declined from a high of 7.5 percent in January 2023 to 4 percent by year-end, reflecting lower international food and energy prices, and the impact of the February 2023 currency revaluation. The current account is expected to have recorded a surplus of 2.6 percent of GDP and international reserves increased to US$ 112 billion.

These positive developments were supported by the normalization of trade finance and the stabilization of FX market. After some initial disruptions following the introduction of new anti-money laundering and combating financing of terrorism (AML/CFT) controls on cross-border payments in November 2022, the improved compliance with the new system and the Central Bank of Iraq (CBI)’s initiatives to cut processing time led to a recovery in trade finance in the second half of 2023. This ensured private sector access to foreign exchange at the official rate for imports and travel purposes.

In the meantime, the fiscal position worsened. Although the expansionary budget was under-executed due to delayed Parliamentary approval, the fiscal balance still declined from a surplus of 10.8 percent of GDP in 2022 to a deficit of 1.3 percent in 2023, due to lower oil revenues and an increase in expenditures by 8 percentage points of GDP, of which salaries and pensions contributed 5 percentage points as the authorities started hiring in line with the budget law.

Overall growth is projected to rebound in 2024 and risks are tilted downwards amid heightened uncertainty. Non-oil growth momentum will continue in 2024. Larger declines in oil prices or extended OPEC+ cuts could weigh on fiscal and external accounts. If regional tensions escalate, a disruption of shipping routes or damage to the oil infrastructure could result in oil production losses that could outweigh the potential positive impact of higher oil prices. In case of a deterioration in domestic security conditions, this could lead to a decline in business sentiment and suspension of investment projects. Over the medium term, non-oil growth is projected to stabilize around 2.5 percent given existing hurdles to private sector development. Furthermore, vulnerability to oil price declines has increased as higher expenditures are projected to push the fiscal break-even oil price above $90 in 2024. Absent new policy measures, the fiscal deficit is expected to reach 7.6 percent in 2024 and widen further thereafter as oil prices are projected to gradually decline over the medium term. As a consequence, public debt would almost double from 44 percent in 2023 to 86 percent by 2029.

Policy Priorities

An ambitious fiscal adjustment would be required to help stabilize debt in the medium term and rebuild fiscal buffers, while protecting critical capital spending. Most of the fiscal adjustment would have to come from reducing current expenditure, especially controlling the wage bill by limiting mandatory hiring and gradually introducing an attrition rule. The authorities should also seek to increase non-oil revenues by broadening the personal income tax base and making it more progressive, reviewing the customs tariff structure, and considering new taxes on luxury items. In parallel, efforts to make revenue and customs administration more efficient should continue. Further savings could be obtained through better targeting social support and increasing cost recovery within the electricity sector. These adjustment measures should provide room for the expansion of the targeted social safety net.

The authorities should also strengthen public financial management and limit fiscal risks. The mission welcomes initial steps towards the establishment of a Treasury Single Account (TSA), which is crucial to improve cash management. Further progress is needed and close cooperation between the CBI and Ministry of Finance will be essential. The next steps are to define TSA design options and complete the bank account census. In future years, overall ceilings on the issuance of guarantees should be specified in the budget law and be enforced. The mission advise against the use of extrabudgetary funds and highlights potential fiscal risks associated with their use. As a second best, it would be important to ensure the Iraq Fund for Development has appropriate governance arrangements, including governing board independence while ensuring transparency of the Fund’s activities including by publishing its investment plans in the annual budget documentation and restricting its ability to borrow.

The mission encourages the authorities to build on the CBI welcomed efforts to reduce excess liquidity. The CBI appropriately raised the policy interest rate and reserve requirements, introduced a 14-day CBI bill facility last summer, and scaled back its subsidized lending to the real estate sector. However, monetary policy pass-through has been muted, hampered by large excess liquidity and lack of market incentives in financial intermediaries, especially at state-owned banks. The CBI’s ongoing efforts should be supported by consolidating idle government deposits in a TSA, refraining from procyclical fiscal policy, reducing the reliance on monetary finance, and improving public debt management. In parallel, efforts to develop an interbank market with the help of IMF technical assistance should continue. The mission also welcomes the authorities’ steps to speed up the digitalization of the economy, reduce the reliance on cash and enhance financial inclusion.

Wide-ranging structural reforms are needed to foster private sector development and economic diversification. Iraq needs higher and more sustainable non-oil growth to absorb the rapidly growing labor force, increase non-oil exports and government revenue, and reduce the economy’s vulnerability to oil price shocks. Key reform priorities include:

- Adopting a comprehensive employment strategy aimed at phasing-out mandatory hiring in the public sector, leveling the playing field between public and private jobs, addressing mismatches between educational curricula and the skills needed in the private sector, and strengthening labor market institutions. The strategy should also aim at reducing informality and addressing legal, social, and cultural impediments to women’s participation in the workforce.

- Accelerating financial sector reform to improve access to credit. The authorities are committed to modernizing the banking sector and supporting banks’ ability to secure correspondent banking relationships and have taken steps towards consolidation of small private banks. Efforts to restructure the two largest state-owned banks should intensify, including by expediting certification of past financial statements and implementation of core banking systems, and enhancing corporate governance in line with best practices.

- Implementing a comprehensive pension reform. This is urgently needed to reduce the overall projected fiscal costs of the public pension scheme, better align the benefits and rules across the public and private schemes, ensure adequacy of pensions and intergenerational equity, and increase the ratio of workers participating in the private pension scheme.

- Combating corruption and improving governance, particularly by strengthening the institutional and legal frameworks needed to ensure the independence of the Integrity Commission and the Board of Supreme Audit, enhancing the publication of assets and conflicts of interests declarations for top level officials, and adopting an updated anticorruption strategy. Further, public procurement and business regulations should also be enhanced. The authorities should also continue to strengthen the AML/CFT framework and its effectiveness, including in the banking sector, guided by the priority actions identified in the MENAFATF Mutual Evaluation that will be concluded in May 2024.

- Removing other hurdles to private sector development by reforming the electricity sector to improve efficiency, cost recovery, and reliable access; simplifying procedures for business registration; and upgrading critical infrastructure.

The IMF staff team stands ready to support the authorities in their reform efforts and would like to thank them for constructive and productive discussions during this mission.

Source: Completing the procedures for opening branches of federal banks in the region to localize salaries

The source told Al-Furat News Agency that "the technical and logistical procedures have been completed to open branches of the federal banks in Erbil and Sulaymaniyah to localize the salaries of Kurdistan region employees."

On February 21, the Federal Supreme Court decided to oblige Muhammad Shia al-Sudani, Prime Minister of the Federal Council, and Prime Minister Masrour Barzani of the Kurdistan Regional Government to localize the salaries of employees and workers in the public sector at federal banks.

The court also decided to oblige the monthly budget of the region’s employees to be submitted to the Federal Ministry of Finance, while requiring the region’s Council of Ministers to hand over all oil and non-oil revenues to the federal government.

The ruling stressed that the decision to localize the salaries of the region’s employees is final and binding.

The Parliamentary Finance Committee indicated that “the amount of allocations will be part of the region’s allocations, which is 12.67%, and what remains of it is to finance projects and the requirements of institutions in the region.”

She noted that "the Ministry of Finance will monthly finance the salaries of employees and retirees in the Kurdistan Region according to the decision of the Federal Court," adding, "officials in the regional government should interact with the decision positively in order to finance employees' salaries normally."

Pavel Talabani: The international coalition is not invaders.. America must understand the relationship with Iran

The head of the Patriotic Union of Kurdistan, Bafel Jalal Talabani, confirmed on Monday that the international coalition in Iraq “are not invaders,” while calling on the United States to accommodate the “good partnership” between Iraq and Iran.

Pavel Talabani said, during the Al-Rafidain Dialogue Forum currently held in Baghdad, that the recent deterioration of the security situation in Iraq came as a result of the rejection of the American presence on Iraqi soil, indicating that America’s exploitation of its presence to strike Iraqi targets to defend its interests threatens the country’s security.

He added that the Iraqi government must focus its efforts to follow up on the security file.

Pavel Talabani saw that there is a need to understand the idea that the American forces present within the international coalition are not invaders, and we must make them feel safe as well.

He also pointed out that Iran is a good partner for the Iraqis on the political and economic levels, and the United States must accommodate these relations as long as they are in the interest of Iraq.

Regarding the relationship between Erbil and Baghdad, Pavel Talabani stressed, “If our relationship with Baghdad was strong, conditions would be better in the region.”

Regarding the Palestinian issue, Pavel Talabani said: I do not support any violence that affects civilians on both sides, and the barbaric attacks led by Netanyahu against the Palestinian people must be stopped, considering that the only solution to this issue is the necessity of moving towards a two-state solution.

Get $75 when you refer a friend

So YOU set up your account and receive your OWN $25 and then you will set up your family and friends and THEY will all get the same $25 and YOU get $75 for everyone that gets the $25.

It does take $10 to sign up for the account, and it has to come from a debit card (checking account) connected to you, but the $10 is available immediately in your account to use. So it's actually free to get your $25 but you need to have $10 available to set it up.

Yes it's true and it works and I have done it MYSELF!

Parliament: The European Union intends to open investment banks

The Parliamentary Investment and Development Committee reported agreement with European Union Ambassador Thomas Seiler to set 10 goals to achieve in the near future, including opening investment banks in Iraq and financing investment projects.

The head of the committee, Representative Hassan Al-Khafaji, said: “It was agreed to open investment banks and finance investment projects, fight corruption, and discuss the entry of foreign companies into Iraq, in addition to allowing the exchange of experiences in the industrial, agricultural and health sectors.”

Al-Khafaji added, in an interview with “Al-Sabah,” that “the agreement included opening a headquarters and a commercial representation in Iraq, similar to the rest of the embassies, and the work plan will be according to agreed upon timetables after intensifying meetings to support the European Union for Iraq,” explaining that “the government is very serious about providing services and has been completed.” Five residential investment city projects were referred, and more than one million housing units entered into implementation.

He pointed out that "the search for housing forced many citizens to resort to slums, or to parcel out agricultural lands," noting that "this phenomenon will end within the next two years as part of the move toward building moderate-cost housing complexes for citizens," he said.

In turn, European Union Ambassador Thomas Seiler said: “The Union wants to develop the political partnership to include the economic aspect, and there is a call from members of parliament and Iraqi economists for European companies to enter.”

Seiler added, to "Al-Sabah", that he will transfer Iraq's invitations to the European Union headquarters in Brussels, as well as to the member states of the European Union, indicating that "Iraq is secure and different from what it was previously, which constitutes a greater opportunity to activate investment for European companies." Providing experts in the field of investment, anti-corruption, economics and public financial management.” The European Union ambassador to Iraq added, "Iraq depends on oil revenues, so it must diversify its economy in the coming years, and oil revenues could help with that as well."

Seiler stated, "Politicians must look at the long term, and this is what we call for in the European Union, and benefit from oil resources in order to solve the problems of other areas in industry, agriculture, higher education, and tourism."

He explained, "European investment in Iraq does not necessarily depend on the oil field, but rather in the field of industrial production, agricultural fields, solar energy, and environmentally friendly fields, because these fields are future-oriented, and this is what we would like to invest in in the European Union."

Experts: We are optimistic about the country's financial situation

Specialists in financial and economic affairs expressed their optimism about the future outlook for the country’s financial situation, and while they saw that Prime Minister Muhammad Shiaa Al-Sudani’s statement regarding this aspect and the overall economic file is correct and consistent with reality, they called for the continuation of steps to leave the unilateral rentier economy to a productive economy.

Advisor to the Prime Minister for Financial and Economic Affairs, Dr. Mazhar Muhammad Salih, said in an interview with “Al-Sabah”: The basis comes from the strength of the foreign asset reserves that Iraq possesses, which exceeded 100 billion dollars, which is the cover of the national currency, which means that there is complete coverage of cash. The national source of foreign currency, which provides ideal stability for the exchange rate of the Iraqi dinar, in addition to the fact that these foreign reserves embody the commercial efficiency of Iraq, as these reserves cover more than 15 commercial months, while the international standard is only three months.”

He added, "We must not forget that the surplus in the current account of the balance of payments relative to the gross domestic product also did not fall below (positive 8%), which is a high indicator that reflects the strength of the external sector in the national economy, that is, its stability and growth."

He pointed out that "the real growth rate in Iraq's non-oil gross domestic product has touched (6%), and it reflects the growth of the activities of important sectors, most notably the reconstruction, construction and housing movement, and the development of the transport and digital communications sector, and there is a continuing movement in developing the agricultural sector thanks to government support for crops." We expect Iraq’s grain production in the next few months to reach 6 million tons.”

Central: We spend millions of dollars on electronic payment, and Iraqis prefer cash

The Central Bank confirmed, on Monday, March 4, 2024, that Iraqi society prefers to deal with cash, pointing out that millions of dollars are spent annually by the bank on electronic payment.

Iraqis prefer cash in their transactions, while the Central Bank spends millions of dollars on electronic payments

Deputy Governor Ammar Khalaf said in a speech followed by “Ultra Iraq” that “Iraqi society prefers to rely on cash in daily transactions,” noting that “the government’s efforts to support digital transformation, especially in the financial sector and other sectors, gave a strong impetus to the Central Bank during the year.” the past".

According to experts , the Iraqi government, through attempts to implement electronic payment, aims to withdraw the monetary mass in circulation in Iraq, which amounts to 84 trillion dinars.

Khalaf pointed out that “the Central Bank spends hundreds of millions of dollars annually to develop infrastructure systems to build an important base for the development of electronic payment in Iraq,” explaining that “the digital financial transformation in Iraq began when the salaries of state employees were localized and bank accounts were opened” to use electronic payment .

The Deputy Governor stated that the Ministry of Oil, gas stations, and some ministries “quickly responded to the directives of the Central Bank and the Iraqi government,” in addition to “the Passport Directorate, which required that payment be electronic, and the General Traffic Directorate.”

Ten days ago, the regional president of Visa, in Central and Eastern Europe, the Middle East and Africa, Andrew Torrey, revealed “the company’s readiness to bring expertise, in addition to employing more Iraqis in its office in Baghdad, with the aim of reaching 500,000 acceptance points from points of sale with electronic payment.” in Iraq".

Official: The issue of Iraq’s accession to the World Trade Organization is coming soon

Undersecretary of the Minister of Commerce, Sattar Al-Jabri, considered on Tuesday that the issue of Iraq’s accession to the World Trade Organization was imminent, while he stressed that the current federal government would achieve self-sufficiency and not depend on the importer.

This came during his hosting of a discussion session on the sidelines of the seventh session of the activities of the third day of the Al-Rafidain Forum 2024 - Baghdad, under the title “Humanizing the Global Economy.”

Al-Jabri said during the hosting that the governmental curriculum developed by the Iraqi government is based on a strategy to keep pace with the development taking place in the global economy, as the government signed bilateral international memorandums of understanding in the field of trade and economics.

He stressed that "Iraq is seeking to enter the World Trade Organization, and the issue is coming soon."

The Iraqi government official spoke about the issue of import and export, saying: There is no trade balance between exported and imported materials, as the monetary mass was going to other countries, and this is what the current government seeks to address by relying on self-sufficiency.

At the beginning of 2024, the Kingdom of Saudi Arabia announced its support for Iraq’s accession to the World Trade Organization, especially after the political obstacles that prevented it were removed.

Saleh confirms Iraq's monetary sovereignty and reduces the effects of speculation in the parallel market

The financial advisor to the Prime Minister, Mazhar Muhammad Saleh, ruled out any effects on the exchange market due to “speculation” of the dollar in the parallel market.

Saleh told Al-Furat News Agency, “The effects on the exchange market no longer represent the real price operations of the basic market forces.”

He stated, “Parallel market operations are nothing but illegal speculative acts that profit from accidental profits on individual or marginal transactions and are undertaken by forces of speculators working against the law. This irregular parallel market has become isolated from the power of the official or regular market since the end of the legalization of economic transactions and the prohibition of... Any transactions in dollars in clearing debts within the national economy between natural and legal persons, as today any internal contracts, transactions or obligations concluded in foreign currency and denominated in a currency other than the national currency are not legally valid.”

Saleh noted that "this confirms the monetary sovereignty of our country through the stability of the national currency and dealing in it alone without the participation of foreign currencies in internal economic operations."

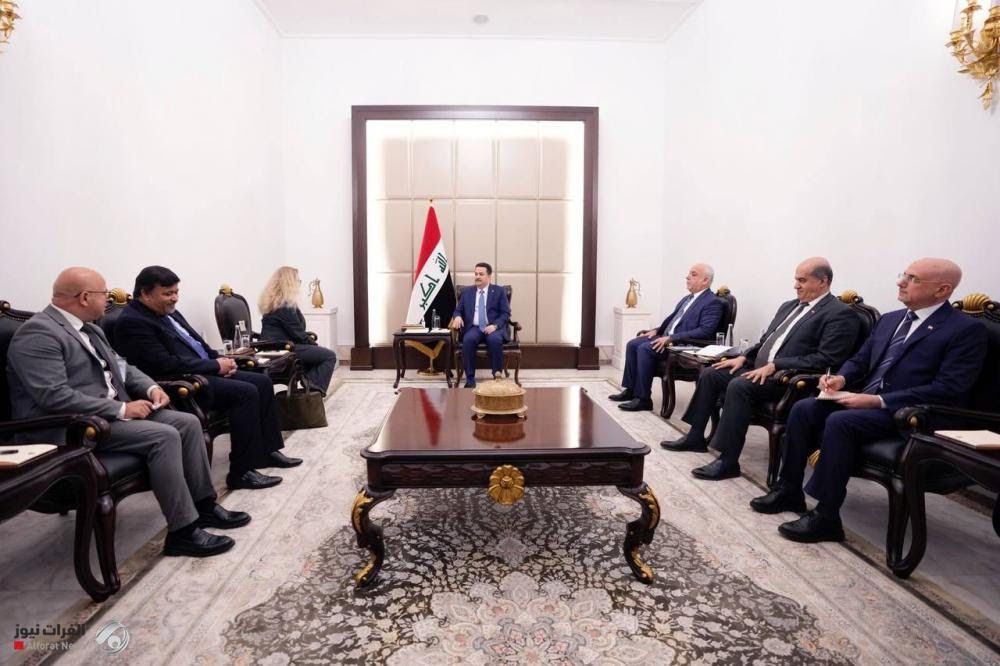

Al-Sudani calls on the International Finance Corporation to open a training institute in Iraq to develop banking work

Prime Minister, Mr. Muhammad Shiaa Al-Sudani, discusses areas of cooperation with the International Finance Corporation delegation

••••••••••

Today, Tuesday, the Prime Minister, Mr. Muhammad Shiaa Al-Sudani, received a delegation from the International Finance Corporation (IFC), headed by the institution’s Vice President for Middle East Affairs, Mrs. Hala Sheikh Rouho.

The meeting witnessed a review of areas and prospects for cooperation between Iraq and the Corporation, which is one of the institutions of the World Bank, stressing that the government is continuing with economic reforms and measures to improve the investment environment, as well as implementing projects that contribute to increasing the gross domestic product, supporting non-oil sectors and empowering the private sector.

His Excellency called on the Corporation to open a training institute in Iraq, specializing in developing banking work and preparing economic models for projects, and supporting the trends of the Iraqi private sector in the cement and construction materials industry, with the increasing demand following the progress of new city projects, as well as developing the capabilities of the General Company for Carbon Economics, which Iraq operates. On its founding.

Mr. Al-Sudani stressed the importance of supporting projects associated with the Development Road Project, as well as completing the discussion of plans prepared for the rehabilitation of Baghdad International Airport, which are sponsored by the Corporation.

For her part, Mrs. Hala Ruho affirmed the institution’s readiness to cooperate with Iraq in all fields, and appreciated the government’s role in expanding reforms and adopting a path that contributes to reducing carbon emissions, noting the continuation of work to complete plans to rehabilitate and expand Baghdad International Airport, support sustainable development and enhance the growth of economic sectors. Miscellaneous.

•••••

Media Office of the Prime Minister

5-March-2024

The Sudanese advisor details Iraq's financial situation and addresses exchange rates

Today, Tuesday, the Prime Minister’s Advisor for Financial and Economic Affairs, Mazhar Muhammad Salih, stated the real growth rate in Iraq’s non-oil gross domestic product, while referring to Iraq’s financial situation.

Saleh said, in an interview followed by “Al-Iqtisad News,” that “the basis comes from the strength of the foreign asset reserves that Iraq possesses, which exceed 100 billion dollars, and they are the cover of the national currency, which means that there is complete coverage of the national currency issued in foreign currency, which provides "Ideal stability for the Iraqi dinar exchange rate, in addition to the fact that these foreign reserves embody Iraq's commercial efficiency, as these reserves cover more than 15 commercial months, while the global standard is only three months."

He added, "We must not forget that the surplus in the current account of the balance of payments relative to the gross domestic product also did not fall below (positive 8%), which is a high indicator that reflects the strength of the external sector in the national economy, that is, its stability and growth."

He pointed out that "the real growth rate in Iraq's non-oil gross domestic product has touched (6%), and it expresses the growing activities of important sectors, most notably the reconstruction, construction and housing movement, and the development of the transport and digital communications sector, and there is a continuing movement in developing the agricultural sector thanks to government support for crops." We expect Iraq’s grain production in the next few months to reach 6 million tons.”

Minister of Communications: The Arab Gulf countries and large international companies want to pass their cables through Iraq to reach Europe

Minister of Communications, Hiyam Al-Yasiri, confirmed that “all the Arab Gulf countries and large international companies want to pass their capacity through Iraq to reach Europe, via Turkey or Jordan.”

She said in a statement that transit and submarine cables are important strategic projects in Iraq.

She added that the importance of these projects is no less than the fourth national mobile phone license project, noting that Iraq is distinguished by an important strategic location linking the east to the west and the north to the south.

She explained that “Iraq will be the international corridor competing with the Suez Canal in light of the current conditions in the Red Sea region and the Bab al-Mandab Strait.” It is the best in the region because it is the safest, the shortest distance, and the least expensive, instead of the passage of cables in the seas and oceans, the difficulty of maintaining them, and their high costs.”

She continued, “Since we assumed responsibility, we have succeeded in operating two submarine cable projects and a transit project (the Civilizations Road), which has entered the commercial operation stage.” After it was slow and faltering, we also noticed great interest from regional countries and international companies in the Iraqi corridor during our attendance at the Dubai Communications Capacity Conference.

German investors are looking to invest in the Kurdistan Region

German investors are looking forward to investing in the Kurdistan Region, as the ninth government formation continues to grant facilities to foreign investors.

The head of the Kurdish-German Friendship Association, Jian Sheikh Salman, said in a statement to Kurdistan 24, “We tried to establish business relations with car companies in Germany, and we will continue our efforts to attract German investors to the Kurdistan Region.”

For his part, former member of the Berlin Parliament, Ghayath al-Din Sayan, affirmed, "We are not tired of working for our people, but the Kurdish community must work as ambassadors for their country for the benefit of Kurdistan."

He said in a statement to Kurdistan 24: The Kurdish community has worked on the personal and organizational levels, as they say, and they had a role in introducing the Kurds and Kurdistan to the outside world and Western countries, and some of these figures and organizations were able to attract the attention of European companies and investors.

There is no solution without banking merger

The curse of the dollar continues to haunt the performance of banks and cause noise and chaos in the way of their activities as long as the banks rely for their continuity on buying and selling the dollar only without practicing the banking products for which they were established.

The dollar weapon remains famous to the banks because it is their currency, and the treasury has the right to act by preventing or allowing dealing in it.

Therefore, in such a case, it is linked to political factors sometimes and real technical factors at other times, due to the lack of experience or failure to follow or implement the standards it requires, which exposes banks to prohibition penalties and the inability to get rid of them.

Therefore, banks must leave their dependence entirely on the dollar and return to banking activities and products that enable them to continue in the financial market and labor market.

It must be noted that there is no provision in the law establishing banks that allows them to engage in the activity of buying and selling the dollar, as it is exclusively an activity of banking institutions.

What is the challenge that prevents our banks from wanting to merge?

There is a truth that cannot be overlooked and requires frankness and openness. I present this opinion knowing that it does not please or may bother some people, but if we delve deeper into the results that will be achieved in the future, we will find that our goal is for the benefit of the banking sector so that it continues despite all the challenges.

One of the most important of these challenges is the lack of conviction of the owners to give up the bureaucracy of management and control. This culture is prevalent and the reason is the non-enforcement of the banking governance law, which separates the responsibilities of the owners from the executive management of the banks and often causes a decline in the performance of the banks.

Here we note, through a review of the most important news of the financial market and banks, especially in our regional environment, specifically the Gulf market, that we hear and read that a merger has taken place between two or three of the largest well-known banks in their countries with the aim of strengthening financial capabilities and taking over activities related to the development of banking work and competing with banks in what... Among them are several examples that can be viewed. On Gulf electronic banking websites.

The culture of merger is an indicator of the level of awareness of the owners and beneficiaries of this merger to achieve profits and the stability of the continuation of banks in the financial market.

For this reason, we believe that any solution to the problem of our banks in the face of seemingly endless sanctions will include all banks for the reasons we mentioned without resorting to mergers to strengthen financial centers to enable them to absorb the market’s need for banking products and development requirements.

Just as a reminder, the decision to raise banks' capital to enable them to operate outside the Window platform faced difficulty in implementation due to the banks' inability to finance the increase, and therefore there is no solution without merger.

During 2023.. 7 Iraqi banks break the barrier of 1 trillion dinars in the amount of their deposits

Five Iraqi banks were able to exceed the barrier of one trillion dinars in the size of their deposits in 2023, while only two Iraqi banks were able to break the barrier of 2 trillion Iraqi dinars in the size of customer deposits with the two banks.

The economist, Manar Al-Obaidi, said, “The International Development Bank and the National Bank of Iraq were able to break the barrier of 2 trillion dinars in deposits in 2023.”

As for the five banks, they are the International Development Bank, the National Bank of Iraq, the Bank of Baghdad, the Iraqi Islamic Bank, and the Islamic South Bank, according to the economic expert.

He added, "The deposits of the five banks grew by 11.3% compared to the year 2022, bringing the total bank deposits to 9.25 trillion Iraqi dinars."

He pointed out, "Al-Janoob Islamic Bank achieved the highest percentage of growth in deposits at a rate of more than 147%, then the National Bank of Iraq, whose deposits grew in value by 90%."

Al-Obaidi stressed, “This growth reflects an increase in public confidence in Iraqi private banks and the ability of private sector banks to acquire part of the monetary mass issued outside the banking system, as it is noted that the volume of deposits for the five banks in 2019 did not exceed the barrier of 1.8 trillion Iraqi dinars, reaching today.” To more than 9.25 trillion dinars.

He continued: "It is expected that the five Iraqi banks will continue their control of the local market and the ability to attract deposits, whether from outside the banking system or from public sector deposits, as a result of the increased confidence in these banks and their spread in various governorates, in addition to the increase in the great competition between these banks in order to acquire the largest... Amount of deposit.

He pointed out, "The increase in the volume of deposits in the private banking sector will contribute to strengthening the wheel of economic growth by directing these banks to invest deposit funds in beneficial economic projects through which they can achieve profits to cover the interest paid on these deposits."

Al-Obaidi stated, “The total value of deposits in the private and public banking sector amounted to more than 133 trillion dinars at the end of 2023, and these five banks were able to acquire 7% of the total of these deposits, and the largest value of the deposits is still present in government banks.”

Al-Maliki stresses to an American official the importance of strengthening relations between Baghdad and Washington

The head of the State of Law Coalition, Nouri al-Maliki, today, Wednesday (March 6, 2024), stressed the importance of strengthening bilateral relations between Baghdad and Washington, noting Iraq’s keenness to activate the strategic framework agreement after the end of the role of the international coalition in Iraq and the transition to comprehensive relations in various fields between the two countries.

Al-Maliki's office said in a statement received by "Baghdad Today", "The head of the State of Law coalition, Nouri al-Maliki, received in his office today, Wednesday, the US Deputy Assistant Secretary of State for Iraq and Iran Affairs, Victoria Taylor, in the presence of the US Ambassador to Iraq, Alina Romanowski," noting that "it took place during... The meeting exchanged views on the developments taking place in the regional and international arenas, and a number of issues and files of common interest.”

The head of the State of Law coalition, according to the statement, pointed to “the importance of strengthening bilateral relations between Baghdad and Washington and ways to strengthen them in a way that serves the interests of the two friendly peoples,” stressing “Iraq’s keenness to activate the strategic framework agreement after the end of the role of the international coalition in Iraq and the transition to comprehensive relations in various fields.” areas between the two countries.

Al-Maliki stressed "the necessity of ending the aggression against Gaza and opening safe humanitarian corridors."

For her part, Taylor referred to "the cooperative relations between the two countries, and the keenness to maintain them in many areas," explaining that "the United States is moving to end the military operations in Gaza as soon as possible, and to work toward a political path that guarantees the legitimate rights of the Palestinians."

Comment from Parliament on the dollar exchange rate: Do not listen to the losers

Today, Wednesday (March 6, 2024), the Parliamentary Finance Committee confirmed that the dollar is controlled by the relevant government agencies, calling for not taking into account the rumors of losing and corrupt parties.

Committee member Moeen Al-Kazemi told “Baghdad Today” that “there are some politically losing parties and personalities who have major suspicions of corruption, working to continue spreading rumors that the government is not in control of the dollar market and the Iraqi dinar is declining, for the purpose of political influence as well as influencing the market".

Al-Kadhimi added, "The government is currently in complete control of the dollar in all its transactions, and there is real and serious work to strengthen the Iraqi dinar," stressing that "everyone is required not to take into account the rumors of losing and corrupt parties, as they do not want economic stability, to achieve their suspicious agendas."

The expert in economic affairs, Ahmed Al-Tamimi, confirmed earlier today, Wednesday, that the dollar crisis in Iraq is behind corruption mafias, with political protection from some influential people and parties that are trying to obstruct economic reforms.

Al-Tamimi told "Baghdad Today", "The politically protected corruption mafias were the primary beneficiaries of the dollar crisis and they worked to exacerbate this crisis for their own interests and gains. They are also currently working to obstruct any government reforms in the financial and economic sector."

He added, "These mafias have political protection from some influential people and parties, and these parties work politically to create problems so that any government efforts that want reform fail. This is why we see that the dollar crisis is still continuing and ongoing despite all government steps. The parallel market is still witnessing a significant increase." at the official price.

Exchange rates have not stabilized for nearly two years, despite many measures taken by the government in an attempt to control it, all of which failed, due to the existence of political “protection” for the black dollar, according to observers.

Governmental weevils” are a direct threat to the state: extreme wealth exposes advocates of reform

As the voices of some politicians and elites rose on the issue of reforms and directed harsh criticism at state institutions regarding the provision of services to poor citizens in order to live a decent life, they soon began to decline again, during a period in which the citizen was still suffering from the repercussions of the depletion of the country’s wealth and the chaos of laws and procedures amidst a state of extreme poverty and poor health conditions. Services, where popular voices rise to combat what some call “government weevils.”

Hope portal

Abdullah Al-Tamimi, a retired government employee, pointed out in an interview with “Baghdad Al-Youm” that “Prime Minister Muhammad Shia’ Al-Sudani’s steps in managing the state are good and have given a glimmer of hope that we will finally have a government that is aware of its duties and is not hostage to the adventures and agenda of parties and quotas.”

He added, “The crisis of the dollar, housing, water, and unemployment is the real danger in Iraq currently, and the government has put in place plans that, if implemented, will create a gateway of hope to get out of the impasse, but there are parties that do not want the matter to proceed and a strong government to be formed in Baghdad, so it is pushing to create any crises and obstruct the state’s laws, especially in Economic file.

Whales of corruption... who are they?

As for the independent politician Sadiq Ali, he believes that “some reform advocates are basically practicing a hidden role in blackmailing state institutions, and the evidence is their obscene wealth and their silence after they have achieved a specific trend after every period,” pointing out that “the application of the Where did you get this law? is what gives sufficient answers to the question.” Knowing the good from the bad.”

Ali added in an interview exclusively with “Baghdad Today” that “there are representatives accused of corruption and have cases against them who criticize the Sudanese government, and this matter raises many question marks,” wondering what is the reason for the wealth of some of them, they and their relatives? ".

He continues by saying, "Corruption is an octopus in state institutions and the Sudanese government cannot proceed with any reforms without real blows to the whales of corruption, some of whom are protected by political immunity that recognizes that they are corrupt, but at the same time they are banks that finance campaigns during election seasons."

The body of the state is dilapidated

For his part, the head of the Diyala Chambers of Commerce, Muhammad Al-Tamimi, admitted in an interview with “Baghdad Al-Youm” that “Iraq’s main problem is the penetration of the whales of corruption into all its institutions, which is more like a mite that has been eating away at the body of the state for many years, but it has become stronger in light of the marriage of money and politics.”

He added, "Corruption is much more dangerous than terrorism and is a direct cause of the suffering of 40 million Iraqis because any government measure for correction faces obstacles within government institutions because the arms of corruption are large."

He concluded by saying: How can any government employee have huge wealth and not be asked about its source?

Unannounced investigations

Earlier, a parliamentary source revealed the existence of unannounced investigations into the wealth of nine Iraqi officials in several governorates.

The source said in an interview with "Baghdad Today", "A lot of evidence was presented by representatives and figures about the file of the extreme wealth of some officials in Baghdad and the provinces, amid questions about the source of that money, especially since they are government employees."

The source, who preferred not to reveal his name, added, “Indeed, there are investigations currently underway into the file of 9 officials,” pointing out that “extreme wealth is a source of real concern that has prompted regulatory authorities to open important files in the past months in order to clarify the sources of that money, which some have tried to do.” It involves purchasing real estate and land.

He pointed out that "2024 will witness a qualitative shift in the fight against corruption, especially in the suspicious wealth of some," expecting "important decisions to be issued in the coming weeks."

The “black dollar” is protected by influential political parties that obstruct economic reforms

Economic expert Ahmed Al-Tamimi confirmed today, Wednesday (March 6, 2024), that the dollar crisis in Iraq is behind corruption mafias, with political protection from some influential people and entities that are trying to obstruct economic reforms.

Al-Tamimi told "Baghdad Today", "The politically protected corruption mafias were the primary beneficiaries of the dollar crisis and they worked to exacerbate this crisis for their own interests and gains. They are also currently working to obstruct any government reforms in the financial and economic sector."

He added, "These mafias have political protection from some influential people and parties, and these parties work politically to create problems so that any government efforts that want reform fail. This is why we see that the dollar crisis is still continuing and ongoing despite all government steps. The parallel market is still witnessing a significant increase." at the official price.

Exchange rates have not stabilized for nearly two years, despite many measures taken by the government in an attempt to control it, all of which failed, due to the existence of political “protection” for the black dollar, according to observers.

Member of the Parliamentary Finance Committee, Mudar Al-Karawi, confirmed on Tuesday (March 5, 2024) that the government has achieved good success in containing the most dangerous Iraqi economic files represented by reducing the value of dollar prices and limiting its rise again.

Al-Karawi explained to “Baghdad Today” that “the dollar in the parallel markets has for years been a source of wealth for some and a depletion of the country’s resources in various ways, especially with smuggling in a way that threatens Baghdad’s economy and pushes the dinar to collapse repeatedly, which puts pressure on the markets and pushes the country into the maze of sanctions.”

He added, "The government's measures have achieved a glimmer of hope in confronting and containing the most dangerous economic files by reducing the value of the dollar and stopping its rise, even by limited rates, but they have given strength to the dinar and dealt with a good percentage of the smuggling file and seeking to end the dollarization file in the markets and move to electronic payment."

Al-Karawi pointed out, “All the government’s measures face obstacles in different ways because the dollar was and still is the supplier to the deep state and some corrupt people and those who have lived off crises to increase their wealth in various ways,” pointing out that “strengthening the strength of the dinar and closing the smuggling loopholes will harm the interests of many at home and abroad, and thus parties will move.” "There is a lot to sabotage citizens' joy in the existence of correct economic paths that contribute to saving the economy and pushing it to recovery after lean years."

He continued, "Government measures are moving in the right direction despite the side pressures, but they provide incentives to achieve economic growth and ensure the development of solutions to the issue of smuggling, corruption, and the depletion of hard currency in various ways."

Last Sunday (March 3, 2024), Prime Minister Muhammad Shiaa Al-Sudani confirmed that lowering the exchange rate means giving the dollar to “illegitimate” trade.

Al-Sudani said during his participation in the opening of the activities of the Al-Rafidain Dialogue Forum in Baghdad, “The financial situation in Iraq is at its best and commercial transactions are collected through commercial institutions.”

He added, "We give the student, the patient, the merchant, the contractor, and the investor the dollar at the official rate," pointing out that "the notes recorded on Iraqi banks from the US Treasury are from the time of previous governments."

He pointed out that "economic reform was one of the most important priorities of the government program," noting that "the salaries of employees and retirees constitute the largest cash block in the financial budget."

It is noteworthy that Iraq relies on the platform for selling currency directly to local banks and companies, which was previously known as the daily dollar auction, as one of the mechanisms for preserving the value of the Iraqi dinar and combating speculative operations in the parallel market.

The Governor of the Central Bank of Iraq, Ali Al-Alaq, confirmed on February 6 that “some groups are trying to stay away from the platform for selling foreign currency to evade taxes or customs or the presence of illegal trade,” indicating “the possibility of meeting all requests for the dollar,” adding that “the bank has no problem.” In offering or selling the dollar.

He pointed out that "the bank is in a comfortable position to respond to requests to buy dollars. We have sufficient reserves, and soon we will launch a mechanism to ensure that only real travelers get the dollar."

Setting a new ceiling for withdrawing the dollar for Iraqi travelers outside the country

The Central Bank of Iraq raised the ceiling for financial withdrawals from the dollar outside Iraq, to $500 per day, after it was only $250 per day.

text

Banks and all electronic payment service providers regulate cash withdrawals outside Iraq

good greeting ....

Based on the regulatory role of this bank on electronic payment services, and in light of the continuing efforts to strengthen the regulatory procedures for cash withdrawals via ATMs outside Iraq via debit and credit cards that are allowed to be used abroad.

To settle the amounts through the approved channels, it is decided to oblige you to do the following:

The monthly cash withdrawal ceiling outside Iraq for the aforementioned cards is ($3,000) or

Its equivalent in other currencies. The daily cash withdrawal limit outside Iraq for these cards is $500 or its equivalent

In other currencies. You confirm what was stated in our Circular No. 14/3419 of 17/12/2023, as it is your responsibility

Taking the necessary measures to regulate electronic financial transactions.

Please kindly take the necessary measures and amend the ceilings in accordance with what was stated above, starting from the date of issuance of this book. These ceilings will be reviewed on an ongoing basis in accordance with regulatory requirements.

with respect.

No budget until April.. A parliamentarian complains about the government’s delay: Only employees’ salaries are disbursed (document)

Today, Wednesday (March 6, 2024), a member of the Parliamentary Legal Committee, MP Muhammad Al-Khafaji, suggested that the federal budget will be delayed until next April, revealing that the budget schedules have not reached Parliament yet.

Al-Khafaji said in a post on Facebook, followed by Baghdad Today, that “the budget schedules scheduled to be sent to the House of Representatives for the purpose of approval have not yet arrived from the government,” noting that “most of the expenses are currently suspended and only employees’ salaries are being disbursed.”

He stressed "the necessity of sending it before the end of last year," noting that it was "delayed for more than four months and has not been sent until today."

He continued, "Therefore, until the fourth month, there may not be an approved budget and schedules."

On Thursday (February 29, 2024), independent MP Kazem Al-Fayad called on the Iraqi government to expedite sending the federal general budget schedules for the year 2024.

Al-Fayyad told Baghdad Today, “We are approaching half of the fiscal year, and until now the government has not sent us the schedules of the federal general budget for the year 2024 to review and vote on for the purpose of its entry into force, especially since it contains many projects, in addition to some Limited appointment grades.

He stressed that "the Iraqi government is required to expedite sending the budget schedules for the year 2024, as when they arrive, they will take a long time to study them and may need amendments by the Parliamentary Finance Committee, and it is not unlikely that there will be political disagreement over them, as is usual, and that is why it will be delayed in voting on them upon their arrival." By the government, so we must speed up the transmission, and we do not know what is the reason for all this delay.”

The Ministry of Finance announced on the 25th of this month that it would complete the budget schedules for the fiscal years 2024 and 2025 and submit them to the Council of Ministers for approval.

It is noteworthy that Prime Minister Muhammad Shiaa Al-Sudani announced during a press conference held on February 20, that “the government continues to scrutinize the tables for the 2024 budget, as the government carefully confronted the deficit within the 2023 budget,” indicating that “the volume of spending has increased significantly due to the presence of... Job grades within the 2023 budget, in addition to new projects.”

He pointed out that "the 2024 budget tables will be sent to the House of Representatives for a vote."

The Securities Commission sets regulations to open its branches in Kurdistan and Basra

Deputy Chairman of the Iraqi Securities Commission, Nagham Hussein, confirmed on Wednesday the development of a new strategy to attract investors, noting that there is a regulatory regulation for opening branches in the Kurdistan Region and Basra.

Hussein told Shafaq News Agency, “The Securities Commission has set regulations for opening branches of the stock market in all Iraqi governorates in accordance with the controls and conditions set by the Commission.”

She added, "The regulations established by the Securities Commission allow investors to open a branch of the stock market in the Kurdistan Region and Basra in accordance with the controls," pointing out that "the Commission has not officially received offers to open branches in the provinces."

Hussein continued, "The Securities Commission has developed a new strategy that helps attract investors," noting that "the Commission worked on this through advertising promotion campaigns in cooperation with the Iraq Stock Exchange."

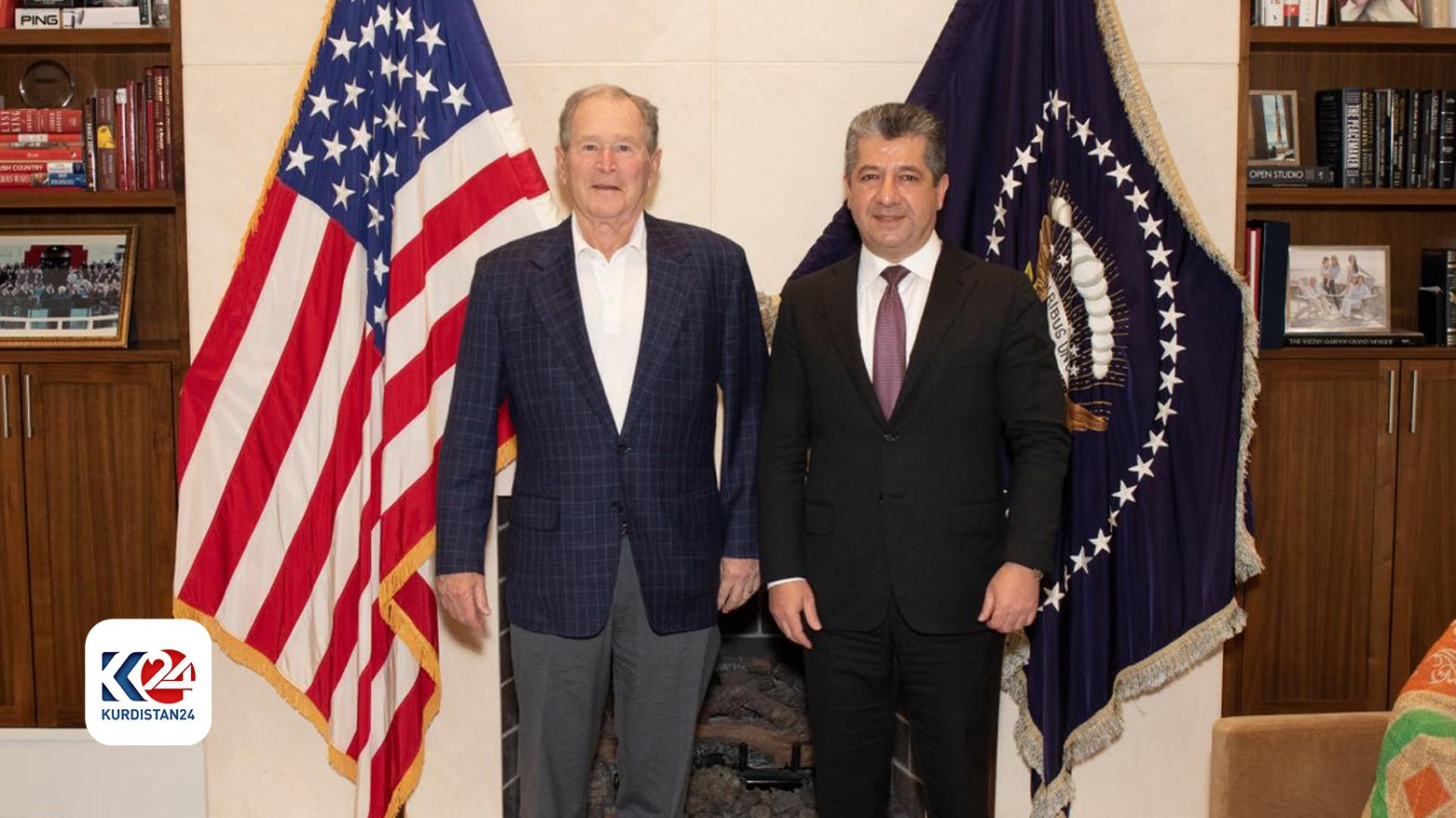

The Prime Minister of the Kurdistan Regional Government meets former US President George Bush

link why is he meeting with Bush? hmmmmm

As part of his visit to the United States, the Prime Minister of the Kurdistan Regional Government, Masrour Barzani, met on Tuesday, March 5, 2024, with former US President George W. Bush.

During the meeting, the Prime Minister expressed his thanks and appreciation to President Bush for his support for the people of the Kurdistan Region and Iraq, as well as the liberation of Iraq from the dictatorial regime, and his support for the democratic system in the country.

For his part, President Bush sent his special greetings to President Barzani, and also expressed his wishes for contentment and prosperity to the people of Kurdistan and all the citizens of Iraq.

Barzani thanks Bush for liberating Iraq from Saddam's regime

The Prime Minister of the Kurdistan Regional Government, Masrour Barzani, thanked former US President, George W. Bush, for his role in “liberating Iraq” from the former regime headed by Saddam Hussein in 2003.

A statement issued by the Presidency of the Region today, Wednesday (March 6, 2024), received by “Baghdad Today”, stated that “as part of his visit to the United States, the Prime Minister of the Kurdistan Regional Government, Masrour Barzani, met (yesterday), Tuesday, with former US President George W. Bush.” .

During the meeting, according to the statement, Barzani expressed his "thanks and appreciation to President Bush for his support for the people of the Kurdistan region and Iraq, as well as the liberation of Iraq from the dictatorial regime, and his support for the democratic system in the country."

For his part, Bush sent his special greetings to Barzani, and also expressed his wishes for contentment and prosperity to the people of Kurdistan and all the citizens of Iraq, according to the statement.

Al-Muayad heads the Iraqi delegation to the World Bank’s Global Digital Summit in Washington

The Communications and Media Commission delegation, headed by Ali Al-Moayyed, participated in the inaugural World Bank Global Digital Summit in the United States of America, which continues until March 7.

The summit, which will be held at the World Bank building in Washington, D.C., will be attended by a number of senior officials and ministers in governments and bodies regulating the communications and information technology sector, as well as major international companies.

The summit will discuss several topics, the most important of which are addressing the digital divide in remote areas, information security, electronic governance, investment in the digitization sector, cloud computing, accelerating digital transformation, artificial intelligence, and the future of digital transformation in the world, in addition to building digital skills.

No comments:

Post a Comment