WOTS THU OCT 7 21

Restoring the price of the Iraqi dinar to its previous era is a promise made

These are the articles I discuss on the My FX Buddies Podcast and they are in the order I discussed them:

Finance reveals the repercussions of raising the exchange rate on the Iraqi economy

link

The Ministry of Finance revealed, on Tuesday, the positive effects of raising the exchange rate on the Iraqi economy.

The ministry said in a statement received by "Al-Iqtisad News", that it has continuously followed up the indicators of devaluation of the currency against the dollar and over the past nine months. If it was $54 billion in December 2020, this came after implementing reform measures.

"The change in the exchange rate also helped reduce the demand for foreign currency, which was positively reflected in the decrease in imports and the increase in domestic production," she added.

The indicators confirm, according to the statement, the improvement of “commercial activity in the past nine months of the current year 2021” in light of the spread of the Corona virus, as well as “stopping the penetration of the Iraqi market and dumping it with cheap goods that curb attempts to upgrade local production.”

The ministry indicated that it is working "to reinvest the revenues of the generated funds with the aim of building a targeted production base outside the oil sector and relying on other sectors, which will contribute to a decrease in demand for the dollar as a result of compensating some of the goods produced, which made the proportion of imports to local consumption decline."

He pointed out that it has adopted, "since the formation of the current government, the development of plans and mechanisms to work on reforming Iraq's fiscal policy, and culminated in the adoption of the reform paper (the White Paper), which outlined future economic and financial policy steps to advance local production and reduce imports for the country. This measure also contributed to improving the state of the public budget and reducing imports." Orientation towards encouraging local product and providing job opportunities.

Finance reassures Iraqis: raising the price of the dollar stopped the currency's fall and boosted capabilities

The Iraqi Ministry of Finance issued, on Tuesday, a new clarification regarding the exchange rate of the US dollar, noting that changing it worked to "stop the fall of the reserve currency and enhance import capabilities."

The ministry said in a statement, which was received by Shafaq News Agency, that it has continuously followed the indicators of devaluation of the currency against the dollar and over the past nine months, and the indicators show that the change in the exchange rate contributed to increasing the foreign reserves of the Central Bank of Iraq to 60 billion dollars in April 2021, After it was $54 billion in December 2020, this came after implementing reform measures.

She explained that the change in the exchange rate also helped to reduce the demand for foreign currency, which was positively reflected in the decrease in imports and the increase in domestic production.

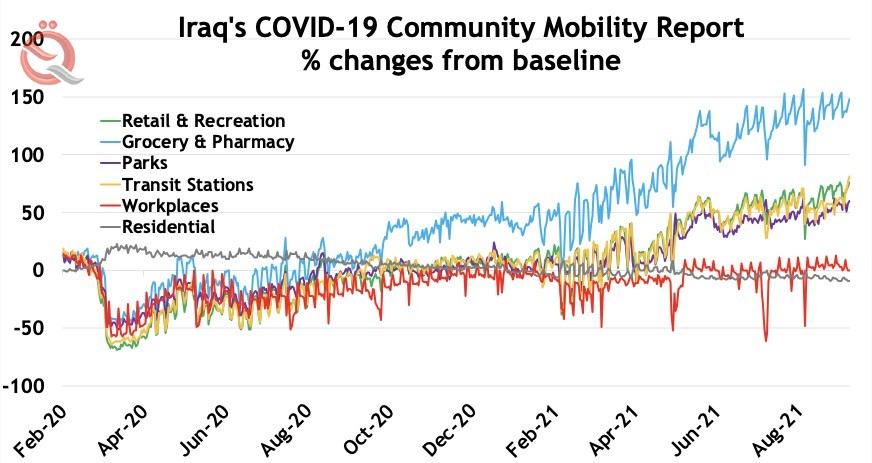

The indicators showed, according to the financial statement, a clear improvement in commercial activity in the past nine months of the current year 2021 in light of the crisis of the spread of the COVID-19 virus, and it also helped to stop the penetration of the Iraqi market and flood it with cheap goods that curb attempts to upgrade local production.

The ministry explained that it is working to reinvest the generated revenues with the aim of building a targeted production base outside the oil sector and relying on other sectors, which will contribute to a decrease in demand for the dollar as a result of compensating some of the goods produced, which made the proportion of imports to local consumption decline.

The ministry indicated that, since the formation of the current government, it has adopted plans and mechanisms to work on reforming Iraq's financial policy, and culminated in the adoption of the reform paper "White Paper", which outlined future economic and financial policy steps to advance local production and reduce imports to the country. Imports and the trend towards encouraging the local product and providing job opportunities, according to the ministry.

It is noteworthy that the Central Bank of Iraq, on December 19, 2020, officially announced the amendment of the foreign currency exchange rate (the US dollar) to be 145,000 dinars for every $100, according to the state’s general budget for the year 2021 approved by the House of Representatives.

Finance reassures Iraqis: raising the price of the dollar stopped the currency's fall and boosted capabilities

The Iraqi Ministry of Finance issued, on Tuesday, a new clarification regarding the exchange rate of the US dollar, noting that changing it worked to "stop the fall of the reserve currency and enhance import capabilities."

The ministry said in a statement, which was received by Shafaq News Agency, that it has continuously followed the indicators of devaluation of the currency against the dollar and over the past nine months, and the indicators show that the change in the exchange rate contributed to increasing the foreign reserves of the Central Bank of Iraq to 60 billion dollars in April 2021, After it was $54 billion in December 2020, this came after implementing reform measures.

She explained that the change in the exchange rate also helped to reduce the demand for foreign currency, which was positively reflected in the decrease in imports and the increase in domestic production.

The indicators showed, according to the financial statement, a clear improvement in commercial activity in the past nine months of the current year 2021 in light of the crisis of the spread of the COVID-19 virus, and it also helped to stop the penetration of the Iraqi market and flood it with cheap goods that curb attempts to upgrade local production.

The ministry explained that it is working to reinvest the generated revenues with the aim of building a targeted production base outside the oil sector and relying on other sectors, which will contribute to a decrease in demand for the dollar as a result of compensating some of the goods produced, which made the proportion of imports to local consumption decline.

The ministry indicated that, since the formation of the current government, it has adopted plans and mechanisms to work on reforming Iraq's financial policy, and culminated in the adoption of the reform paper "White Paper", which outlined future economic and financial policy steps to advance local production and reduce imports to the country. Imports and the trend towards encouraging the local product and providing job opportunities, according to the ministry.

It is noteworthy that the Central Bank of Iraq, on December 19, 2020, officially announced the amendment of the foreign currency exchange rate (the US dollar) to be 145,000 dinars for every $100, according to the state’s general budget for the year 2021 approved by the House of Representatives.

Restoring the price of the dinar to its previous era is a promise made by candidates for the Iraqi elections... Is that possible?

he file of the devaluation of the Iraqi dinar against the dollar , which was taken by the government of Prime Minister Mustafa Al-Kazemi at the end of last December, took the lead in the campaigns of the competing political forces and parties in the elections scheduled for next Sunday .

Several Iraqi political forces made promises to the voters to restore the value of the dinar to its previous era at the threshold of 1200 dinars per dollar instead of the current value of 1450 dinars to the dollar, which observers and specialists in Iraqi economic and financial affairs considered promises that are not achievable at the present time, and involve economic risks as well. .

The "Al-Fateh" and "State of Law" alliance, led by Hadi Al-Amiri and Nuri Al-Maliki, is considered the most prominent leader in the promises to restore the value of the dinar to its previous era, but specialists told Al-Araby Al-Jadeed that these promises are unrealistic at the present time

And the government of Iraqi Prime Minister Mustafa Al-Kazemi decided at the end of last December to reduce the value of the dinar by about 25%, from the exchange rate of 1200 to 1450 for the dinar against the dollar, in light of the treatments approved by the government to confront the financial crisis that afflicted the country, and the decline in state revenues from hard currency. As a result of the drop in oil prices at the time.

Iraqi MP: Promises to return the price of the dinar to its previous era "media auction"

Member of Parliament's Finance Committee, Representative Jamal Kougar, strongly criticized the parties that made promises to citizens to restore the exchange rate to its previous state, describing these promises as a "media bid".

He added, in an interview with Al-Araby Al-Jadeed, today, Tuesday, that “setting the price of the local currency against the dollar is not within the authority of Parliament, nor even the Ministry of Finance, but rather of the powers of the Central Bank of Iraq exclusively, and it is the decision-maker, and therefore any such promise is only Incorrect electoral promises in addition to interference in the monetary policy of the Central Bank.

But the Iraqi economist, Hammam Al-Shamaa, sees from his angle that "the great mistake made by the Al-Kazemi government by reducing the price of the local currency, cannot be fixed by a countermeasure, that is, by raising it again."

Al-Shamaa, in an interview with Al-Araby Al-Jadeed, described the decision to reduce the price of the dinar from a political point of view as a “political gain” for the Al-Kazemi government, on the grounds that it was able to solve the economic crisis that resulted in the drop in oil prices, and “this means that it cannot be It also counteracts the action you view as an economic gain.”

Al-Shamaa criticized the fluctuation of the Iraqi dinar prices since 2003, saying that "the exchange rate cannot be a swing for the state, and it must be economically stable."

On the other hand, the researcher in Iraqi political affairs, Ahmed Al-Khidr, told Al-Araby Al-Jadeed that the decision to reduce the price of the Iraqi dinar “participated in all the political blocs, in addition to adopting the consultations of specialists in the economy, and not only Prime Minister Mustafa Al-Kazemi.”

What is the role of the new government in restoring the price of the Iraqi dinar to its previous era?

The Greens acknowledge the difficulty of restoring the exchange rate of the local currency to its previous era with the end of the parliament’s life (after tomorrow Thursday) and the transformation of Al-Kazemi’s government into a caretaker, and this can be done in the 2022 budget; That is, after the end of the elections and through the new session of the House of Representatives.

At the same time, the Greens expect that adjusting the Iraqi dinar exchange rate and controlling the local market will be "one of the first tasks of the new government."

For his part, activist and member of the Iraqi civil movement, Ahmed Haqqi, expects that the impact of the devaluation of the dinar will be "clear" on the Iraqi elections through the number of those affected by the decision, suggesting that those affected will boycott the elections.

Haqqi added, in an interview with Al-Araby Al-Jadeed, that “the economic factor for Iraqis in the election file is very important, so there has been a focus on the issue of the value of the dinar in recent days, and the Iraqi is well aware of the incorrectness of promises to return the dinar to its previous status in the coming period, and the government bears She is responsible for her silence about these promises, and she should have made clear to the street the situation of the next stage, at the very least."

Baghdad and Tehran exchange the remains of 31 soldiers killed in the Iran-Iraq war

Baghdad and Tehran exchanged today, Wednesday, the remains of 31 soldiers killed in the Iran-Iraq war in an operation supervised by the International .Committee of the Red Cross at the (Shalamcheh) border crossing

The committee stated in a statement that Iraq received the remains of 11 soldiers, while the Iranian side received the remains of 20 soldiers who fell in the war that took place between the .two countries during the period from September 1980 to August 1988 The committee pledged to continue support to the concerned authorities in "providing answers" to families who do not know the fate of their children who died.

They fell into the armed conflict .between the two countries after all those years The International Committee of the Red Cross organizes from time to time exchanges of remains between the two countries whenever they are reached by the competent committees between Iraq and Iran.

Create a website and e-mail for all authorized exchange companies, category (A,B)

Iraq signs solar power deal with UAE-based company | Middle East Monitor (10/7/21)

https://www.middleeastmonitor.com/20211007-iraq-signs-solar-power-deal-with-uae-based-company/

Iraq signed an agreement with the UAE-based solar energy specialist Masdar on Wednesday, Anadolu has reported. The contract was signed in a ceremony held in the Iraqi capital Baghdad attended by Iraqi Prime Minister Mustafa Al-Kadhimi and UAE Energy Minister Suhail Bin Muhammad Al-Mazrouei.

According to an official media statement, also present were the President of the Iraqi National Investment Authority, Suha Al-Najjar, and the CEO of the Abu Dhabi Future Energy Company, Muhammad Jamil Al-Ramahi.

The project represents the first practical step taken by the Iraqi government to switch to alternative, clean and renewable energy sources to produce electricity and meet the country's energy needs. Iraq is also holding talks with Gulf countries, led by Saudi Arabia, to import electricity by linking its network with the Gulf's.

Iraq's electricity generation capacity is 19 gigawatts, but it needs 30 gigawatts to cope with demand.

Iraq is without a parliament, starting today...and parliamentarians are without immunity

British report: Iraq will not recover economically during 2022

The British "Economist Intelligence" magazine expected that five countries, including Iraq, will not recover economically during 2022.

The magazine said in a report on its expectations for the economic and financial conditions in the Middle East for the next year, that "the Middle East will remain a very complex place for international business interests, but it will remain a strongly attractive place for these interests to be active and invest in it."

The report took into account the inequality between the countries of the region in the fight against the Corona virus and its repercussions on the investment climate in the region. While the oil-rich countries in the Gulf Cooperation Council recorded high rates of vaccination for their citizens (by up to 70 percent), most of the countries in the region are still It suffers from the lack of sufficient vaccines on the one hand, and the slowness in its administration on the other hand.

The report added that "the crisis witnessed by the raw materials markets, specifically the energy markets, as a result of the Corona pandemic, was fortunately shorter than the time taken by the global financial crisis in 2008-2009 and the crisis of low oil prices in 2014-2015."

And she expected that "there will be an increase in the momentum of economic recovery next year, which will enable a good number of countries in the region to compensate for the losses they incurred due to the pandemic, with the exception of crisis countries such as Iraq, Lebanon, Syria, Palestine and Yemen.

According to the report, the recovery of oil and gas prices will play a key role in stimulating recovery, with expectations that the average of these prices will reach about $70 a barrel, which will ease budget pressures for oil-producing and exporting countries and help stimulate investments, in addition to easing closures and travel restrictions, which It will revive non-energy businesses, such as travel and tourism, which may be the main beneficiaries of this development, but the great threat to this recovery comes from the potential developments of the Corona virus and the possibility of the emergence of new strains of it.

Finance indicates the highest reserves of hard currency recorded by Iraq in its history

The Ministry of Finance announced today, Tuesday, that the highest foreign currency reserves in Iraq amounted to $82 billion in 2014.

The ministry said in its official statistics, which was seen by Shafak News Agency, that "the reserves of the Central Bank of Iraq witnessed their highest rise in July 2014, reaching 82 billion dollars," noting that "these reserves later decreased to reach 44 billion dollars in 2017."

She added, "The reserves fluctuated between 2020 and 2021 after the drop in oil prices and the rise in the dollar exchange rate in Iraq, as these reserves ranged between 45 billion and 61 billion dollars, noting that these reserves recorded 60 billion dollars in April of the year 2021."

Arrest and summons orders against dozens of Iraqi officials

Baghdad - the price on the stock exchange

148,150

....

The price is in most Baghdad exchanges

Purchase

147,500

Sale

148,500

—————————————————

Erbil - Bursa

148,250

————————————

Mosul - Bursa

148,300

————————————

Basra - Bursa

148,150

————————————

Sulaymaniyah - Bursa

148,250

Favorite Currencies Forex Quotes

| Symbol | Bid | Ask | High | Low | Open | Change | Time |

|---|---|---|---|---|---|---|---|

| USD/IQD | | | 1455.7000 | 1455.7000 | 1455.7000 | | 00:26 |

| USD/VND | | | 22737.9800 | 22730.7100 | 22730.7100 | | 22:55 |

| USD/CNY | | | 6.4457 | 6.4450 | 6.4457 | | 05:12 |

| USD/KWD | | | 0.3012 | 0.3011 | 0.3012 | | 05:25 |

| GBP/USD | | | 1.3606 | 1.3570 | 1.3580 | | 05:28 |

| USD/IRR | | | 42097.5000 | 42097.5000 | 42097.5000 | | 00:00 |

| USD/IDR | | | 14250.0000 | 14176.0000 | 14244.0000 | | 05:25 |

Stock futures rise after investors’ debt ceiling concerns dwindle

USA EDGES TO DEFAULT

PENTAGON GRAVE WARNING

British report: Iraq will not recover economically during 2022

The British "Economist Intelligence" magazine expected that five countries, including Iraq, will not recover economically during 2022.

The magazine said in a report on its expectations for the economic and financial conditions in the Middle East for the next year, that "the Middle East will remain a very complex place for international business interests, but it will remain a strongly attractive place for these interests to be active and invest in it."

The report took into account the inequality between the countries of the region in the fight against the Corona virus and its repercussions on the investment climate in the region. While the oil-rich countries in the Gulf Cooperation Council recorded high rates of vaccination for their citizens (by up to 70 percent), most of the countries in the region are still It suffers from the lack of sufficient vaccines on the one hand, and the slowness in its administration on the other hand.

The report added that "the crisis witnessed by the raw materials markets, specifically the energy markets, as a result of the Corona pandemic, was fortunately shorter than the time taken by the global financial crisis in 2008-2009 and the crisis of low oil prices in 2014-2015."

And she expected that "there will be an increase in the momentum of economic recovery next year, which will enable a good number of countries in the region to compensate for the losses they incurred due to the pandemic, with the exception of crisis countries such as Iraq, Lebanon, Syria, Palestine and Yemen.

According to the report, the recovery of oil and gas prices will play a key role in stimulating recovery, with expectations that the average of these prices will reach about $70 a barrel, which will ease budget pressures for oil-producing and exporting countries and help stimulate investments, in addition to easing closures and travel restrictions, which It will revive non-energy businesses, such as travel and tourism, which may be the main beneficiaries of this development, but the great threat to this recovery comes from the potential developments of the Corona virus and the possibility of the emergence of new strains of it.

CBI Update: Just a note:

including $16,120,000. CASH

The Central Bank of Iraq’s foreign currency sales schedule for Monday 11/10/2021 and implemented today

ISX Update: Shares Traded: not updated for todayValue Traded: not updated for today

The Central Bank of Iraq’s foreign currency sales schedule for Monday 11/10/2021 and implemented today

10-7-2021 Newshound/Intel Guru Mnt Goat ...we see...the oil prices jumping again...Tuesday, reaching their highest levels in at least three years. Brent crude rose to $81.48 a barrel has put substantial amounts in the foreign reserves of Iraq. This is huge news and Iraq should certainly take advantage of the high prices.

10-6-2021 Newshound/Intel Guru Mnt Goat They can only do this if they are able to use the dinar, not the U.S. Dollar, in the purchase of imports. This can only be done with the agreements they have made in the recent past with other countries to accept each other’s currencies...These new instructions are pushing the banks to take alternative measures for revenue generation away from the auctions...Will they decide to use the Iraqi dinar in place of the U.S. Dollar in trade? Can they do this? If they do this the rate of the Iraqi dinar will skyrocket. Seems to me they may be heading in this direction. [post 2 of 2]

10-6-2021 Newshound/Intel Guru Mnt Goat The really huge news this week is that the central bank of Iraq last week issued new instructions to banks and exchange companies and brokered the sale and purchase of foreign currency licensed. These instructions aim to strengthen the role of the banking system and non-banking financial institutions in securing foreign currency...To me it sounds like they intend to stop the currency auctions and proceed to other means to exchange foreign currency. Other means to pay for imports. [post 1 of 2....stay tuned]

10-6-2021 Newshound/Intel Guru Vital Brad CBI Document "Instructions for buying and selling foreign currency for the year 2021" We've got intel with documented proof gets me excited! ...but we've got to be cautious of intel...we don't want to get our hopes up but at the same time we have a documented stamped CBI document saying it's going to be reinstated on the international market on...I looked at a calendar - October 17th is a Sunday...it's a very real possibility. Is it possible? Is it here? We've been waiting a long time...it's right on the Central Bank's website. A date. If what it's saying is what we're interpreting as...it's huge.

10-6-2021 Intel Guru Bruce [via WiserNow] ...everything has been very quiet...but usually we have to regard that as “good news” – no news is good news – and in this case that seems to be good for us...So we did find out a little bit more here and there – I would say that the Iraqi Dinar has been put in a position where it is trading now on Forex and going up in value and it will be put out but its still not out publically yet – But they will not do that until we get started – by that I mean – we get notified... So I feel as though if we don’t get anything unusual or another monkey wrench thrown in the mix here we are good to go – I really believe that – so we’ll see how that manifests to us...

10-6-2021 Intel Guru MarkZ [via PDK] I am very much expecting it at any moment...at this point I know we are very close... in Iraq they are still in the waiting process. The news I got from a contractor over there is they are expecting to be paid in all new rates on October 15th over there. They are expecting the RV at any time over there…It could be 2 minutes…it could be days.

10-6-2021 Newshound Guru Pimpy Article "Adviser to the Prime Minister: Offering and selling government bonds to move idle money" Doesn't that look like a nice stack of - I don't even know what denominations those are. [See photo below] I have a feeling they're the bonds themselves because the article is about bonds...I've been staring at them trying to figure out if those are a denomination of some sort. But if they are they're definitely the lower ones. It looks like maybe the tens. That'd be weird for them to be handling lower denominations since they have, oh I don't know, zero value at the moment! Are they showing us something? Is this a hint? ...This is probably an old picture, if not it looks like they're pulling out the lower denominations. You never know because they keep talking about the exchange rate once again...

10-6-2021 Newshound Guru BobTheTaxMan Now if the Biden Administration does get what they want and if they do limit our retirement accounts to 10 million dollars this could be a problem Houston...The way around that is your IQD is sitting in your Roth [IRA], you can always pull those notes out because there's no taxable event to pull those notes themselves out and put it into a CRUT (Charitable Remainder Unitrust). That'll take that limitation away. You'll still get money out of that which will be marvelous...[Note: At the appropriate time consult your tax professionals to create a tax strategy that's right for your unique circumstances]

10-6-2021 Newshound/Intel Guru Mnt Goat The Ministry of Finance announced...Tuesday, that the highest foreign currency reserves in Iraq since in 2014 when they amounted to $82 billion. So, they are now over that amount...They are probably reaching about $90 billion? Then in another article...they tell us that the monetary policy of Iraq depends on the amount of foreign reserves supporting the Iraqi dinar, that is, the efficiency of the reserves and their escalation towards safe lines...we have been watching the amount of reserves all along as a positive sign of moving towards getting the project to delete the zeros accomplished. So this news today reinforces our hopes.

No comments:

Post a Comment