The Central Bank of Iraq reveals the mechanism for ending the electronic platform

The Central Bank of Iraq revealed, today, Wednesday (September 4, 2024), the mechanism for ending the electronic platform for foreign transfers.

The bank said in a statement received by "Baghdad Today", that "the electronic platform for foreign transfers managed by the Central Bank of Iraq began at the beginning of 2023 as a first stage to reorganize financial transfers in a way that ensures proactive oversight of them instead of subsequent oversight by the Federal Reserve auditing daily transfers, and this was an exceptional procedure as the Federal Reserve does not usually do this, and a gradual shift was planned towards building direct relationships between banks in Iraq and foreign correspondent and approved banks, mediated by an international auditing company to conduct a pre-audit of transfers before they are executed by correspondent banks."

The video for this blogpost is below here:

He added that "during the year 2024 and until now, 95% of the transfer process from the electronic platform to the mechanism of correspondent banks directly between them and Iraqi banks has been achieved, which means that only about 5% of it remains within the platform, which will be transferred using the same mechanism before the end of this year and according to the plan," explaining that "some expectations about potential impacts on the exchange rate and transfer operations are baseless, because the process will not be sudden or in one payment at the end of this year, but rather it was originally achieved during the past period with effort and careful follow-up, except for the remaining small percentage that will be completed in the coming short period."

He stressed that "trade with the United Arab Emirates, Turkey, India and China represents about 70% of Iraq's foreign trade as (imports), which prompted the Central Bank of Iraq to find channels for transfer in euros, Chinese yuan, Indian rupees, and Emirati dirhams, through approved correspondent banks in those countries, and (13) Iraqi banks have actually begun conducting transfer operations with a pre-audit mechanism that has been agreed upon and approved in addition to transfers in dollars."

He continued: "With the provision of channels for personal transfers for legitimate purposes and external purchases through electronic payment channels and international money transfer companies and cash sales to travelers, and the payment of cash dollars for incoming transfers to the parties and purposes specified in the Central Bank's published instructions."

The Central Bank of Iraq stressed that it "put foreign transfer operations and meeting dollar demands on sound paths consistent with international practices and standards and the Anti-Money Laundering and Terrorism Financing Law," explaining that "providing the aforementioned channels for all purposes at the official dollar price makes this price the true indicator of economic practices, which is proven by the reality of price stability and control of inflation, and any other price traded outside those channels is an abnormal price that those with unorthodox or illegal practices resort to, who avoid official channels in their dealings, and bear the additional costs alone by purchasing at a higher price than the official price to delude others with the difference between the official price and others."

The Central Bank of Iraq reveals the mechanism for ending the electronic platform

The electronic platform for foreign transfers, managed by the Central Bank of Iraq, began in early 2023 as a first phase to reorganize financial transfers to ensure proactive control over them instead of subsequent control through the Federal Reserve auditing daily transfers. This was an exceptional measure as the Federal Reserve does not usually do this. A gradual shift was planned towards building direct relationships between banks in Iraq and foreign correspondent and approved banks, mediated by an international auditing company to conduct pre-audit on transfers before they are executed by correspondent banks.

During the year 2024 and until now, 95% of the transfer process from the electronic platform to the correspondent banking mechanism directly between it and Iraqi banks has been achieved, which means that only about 5% of it remains within the platform, which will be transferred using the same mechanism before the end of this year and according to the plan.

Thus, some expectations about possible effects on the exchange rate and transfer operations are baseless, because the process will not be sudden or in one go at the end of this year, but rather it was originally achieved during the past period with effort and careful follow-up, except for the remaining small percentage that will be accomplished in the coming short period.The Central Bank of Iraq confirms that trade with the United Arab Emirates, Turkey, India and China represents about 70% of Iraq’s foreign trade as (imports), which prompted the Central Bank of Iraq to find channels for transfer in euros, Chinese yuan, Indian rupees and UAE dirhams, through approved correspondent banks in those countries. (13) Iraqi banks have actually begun to conduct transfer operations with a pre-audit mechanism that has been agreed upon and approved in addition to transfers in dollars.

Providing channels for personal transfers for legitimate purposes and external purchases through electronic payment channels, global money transfer companies, cash sales to travelers, and paying cash dollars for incoming transfers to the parties and purposes specified in the Central Bank’s published instructions.

The Central Bank of Iraq stresses that it has placed foreign transfer operations and meeting dollar demands on sound paths consistent with international practices and standards and the Anti-Money Laundering and Terrorist Financing Law.

He explains that providing the aforementioned channels for all purposes at the official dollar price makes this price the true indicator of economic practices, which is proven by the reality of price stability and control of inflation. Any other price traded outside of these channels is considered an abnormal price that those with unorthodox or illegal practices resort to, who avoid official channels in their dealings, and bear the additional costs alone by purchasing at a higher price than the official price, to delude others into believing the difference between the official price and the other.Central Bank of Iraq

Economist talks about new measures after stopping transfers

Economic expert Osama Al-Tamimi said: "The statements and interviews conducted by the Governor of the Central Bank of Iraq, Ali Al-Alaq, in New York over three days with US Treasury officials gave a new boost and confidence to the Iraqi banking system."

Al-Tamimi described, according to his statement to Mawazine News Agency, the advanced steps to join the global banking system in terms of expanding experience and international banking relations, which will increase knowledge in control procedures for foreign transfers and direct sales of the dollar."

The economic expert explained: "This will lead to the development of systems in line with international and local standards and the development of a system for covering foreign trade and protecting the banking and financial sector from money laundering and financing terrorism."

He continued, saying: "The Central Bank of Iraq will stop dealings with foreign correspondent banks in the future and reduce reliance on them, after developing the Iraqi banking relations network, gaining the necessary experience, reducing the commissions achieved as a result of foreign coverage transactions, and

gradually ending work on the electronic platform for transfers and replacing it with direct banking relations between Iraqi banks and the network of international correspondent banks, in addition to achieving stability in the exchange rate in the local market.

Al Nasik Islamic Bank adopts Bank Pia - France as its correspondent

The Board of Directors of Al-Nasik Islamic Bank for Investment and Finance, represented by its Chairman, Professor Sadiq Rashid Al-Shammari, and the Executive Management, completed on September 2, 2024, communicating with solid correspondent banks to build correspondents around the world, according to the directives and instructions of the Central Bank in selecting these banks.

Al Shammari said: All procedures for opening an account with BIA Bank - France have been completed by approving it as a correspondent bank for Al Nasik Islamic Bank for Investment and Finance. This visit was crowned by a meeting with the presidency of BIA Bank, represented by its Chairman Mustafa bin Khalifa, in the presence of Mohammed Maqrad, the Managing Director, Talal Al Kilani, and Fadi Nahma, officials from the commercial department

Al-Shammari explained that this trend comes as a reference to the directives of the Central Bank of Iraq regarding the establishment of basic and vital procedures to enhance the reforms of the banking sector and enhance initiatives to facilitate the process of establishing direct banking relations and building a strong and solid network of correspondents by Iraqi banks.

He explained that this step serves the Iraqi economy and revives foreign trade and comes for the purpose of improving systems, policies and procedures in accordance with international and local standards to enhance transparency in covering foreign trade and provide protection for the Iraqi banking and financial sector from money laundering, financing terrorism and financial crimes, and the procedures of the Central Bank of Iraq at the end of this year regarding the major shift in ending the work of the foreign currency sales window through the electronic platform for foreign transfers and replacing it with direct banking relations between Iraqi banks and the network of foreign correspondent banks for the purpose of developing work by opening documentary credits for Iraqi traders and foreign transfers within the European Union countries in euros and in accordance with the plan of the Central Bank of Iraq and the directives of the governor.

Al-Shammari stressed that this transfer has positive and important repercussions on the stability, fluidity and transparency of the country's international trade financing operations. The goal is to achieve the required stability in exchange rates and thus enhance the efficiency of the financial and banking system in Iraq.

The meeting also included the presentation of the shield of Al-Nasik Islamic Bank for Investment and Finance and symbols representing the civilization of Iraq. A group of books by Professor Dr. Sadiq Al-Shammari on banking work, banking work mechanisms, and several different books were also presented.

The honorable Chairman of Bia Bank also took the initiative to present a symbolic gift to Dr. Sadiq Al-Shammari, represented by the publications of the aforementioned bank.

Has Iraq entered the economic reform phase after Standard & Poor's classification?

Economists considered that Iraq has entered a new phase in the Standard & Poor's classification of investment grade bonds if their credit rating is B- or higher. As for bonds with a rating of B+ and below, they are speculative grades and are classified as meaningless bonds.

Credit rating

: In detail, the Ministry of Finance said that Iraq maintained its credit rating issued by Standard & Poor's Credit Rating Agency.

According to a statement by the ministry: “In the latest report issued by Standard & Poor’s Credit Rating Agency “S&P”: Iraq maintains its credit rating at B-/B with a stable outlook,” referring to “financial and economic stability in Iraq.”

He explained that “the new classification reflects the ongoing economic and financial reform policy pursued by the Ministry of Finance, in addition to maintaining the level of foreign currency reserves that exceed the external public debt and fulfilling other external financial obligations as a result of the stability of crude oil prices.”

The statement pointed out that the agency saw "the possibility of improving Iraq's credit rating in the event of an increase in the economic growth rate, diversification of the state's general financial revenues, oil and non-oil, an increase in the per capita income share of the national income, and the continuation of financial and economic policy reform measures."

Debt repayment

Standard & Poor's is a company that assigns credit ratings, which determine a debtor's ability to repay debt by making timely payments of principal and interest and the likelihood of default. The agency may rate the creditworthiness of issuers of debt obligations, debt instruments, and, in some cases, of underlying debt servicers, but not of individual consumers.

Debt instruments rated by credit rating agencies include government bonds, corporate bonds, certificates of deposit, municipal bonds, preferred stocks, and secured securities, such as mortgage-backed securities and collateralized debt obligations.

Issuers of obligations or securities may be corporations, special purpose entities, state or local governments, nonprofit organizations, or sovereign nations. Credit ratings facilitate the trading of securities in a secondary market. They affect the interest rate a security pays, with higher ratings resulting in lower interest rates.

Individual consumers are rated for creditworthiness not by credit rating agencies but by credit bureaus (also called consumer reporting agencies or credit reference agencies), which issue the credit rating.

Consultative meetings

and on Iraq’s openness to the Arab world and Prime Minister Mohammed Shia al-Sudani’s Arab tours and their impact: “The director of the Iraq Energy Center, Furat al-Moussawi, said: “This visit comes as a continuation of the previous tripartite consultative meetings between “Jordan, Iraq and Egypt”, within the framework of strategic economic agreements of interest to the countries involved, which will have positive repercussions for the stability of the countries of the region.

Al-Moussawi told the Iraq Observer Agency that the meeting was held to follow up on the projects that had been previously agreed upon, which include areas of investment cooperation in energy, housing, agriculture and reconstruction.

He pointed out that Iraq seeks to discuss the prospects of joint cooperation between the two brotherly countries, and ways to strengthen relations at various levels and fields, in a way that serves the interests of the Iraqi and Tunisian peoples.

He continued: “Al-Sudani, through the delegation participating with him, which includes the Ministers of Foreign Affairs, Oil, Electricity, Planning, Housing and Reconstruction, invited Tunisian companies to participate in investment projects and opportunities and build infrastructure in Iraq, and the importance of economic integration and the success of the upcoming meetings of the Iraqi-Tunisian Committee in Baghdad.

He pointed out: "Al-Sudani's government seeks to open up to its Arab surroundings to restore Iraq's pivotal and strategic role in the region, and this openness has become a vital strategic interest that enables Iraq and the countries of the region to overcome their economic crises through economic integration with their regional surroundings."

He added: One of the most important goals of Al-Sudani's visit is to try to unify the decision-making unit on the Palestinian issue and on ending the war in Gaza in order to restore security stability in the region, which is now threatened with explosion at any moment as a result of the escalation of geopolitical risks due to the criminal actions of the Israeli entity.

Exchange rate stability

in the capital Baghdad markets The exchange rate of the US dollar stabilized against the Iraqi dinar this morning in the Baghdad markets, while the prices came as follows:

The selling price is 150,250 dinars, while the purchase price was 148,250 dinars for every 100 dollars.

Iraq exports

The US Energy Information Administration also announced a decline in Iraq's oil exports to the United States during the past week.

The administration stated in a table that “the average US imports of crude oil during the past week from 9 major countries amounted to 5.608 million barrels per day, an increase of 156 thousand barrels per day from the previous week, which amounted to 5.452 million barrels per day.”

She added that "Iraq's oil exports to America amounted to 153 thousand barrels per day last week, down by 13 thousand barrels per day from the previous week, which amounted to 166 thousand barrels per day."

The administration indicated that “the largest oil revenues for America during the past week came from Canada at a rate of 3.874 million barrels per day, followed by Mexico at an average of 619 thousand barrels per day, then Saudi Arabia at an average of 311 thousand barrels per day, from Brazil at an average of 302 thousand barrels per day, and from Colombia at an average of 212 thousand barrels per day.”

Al-Sudani's advisor reveals the results of the discussions between the Central Bank of Iraq and the US Federal Reserve

The Prime Minister's Advisor for Financial Affairs, Dr. Mazhar Mohammed Salih, confirmed today, Wednesday, that the renewed understanding with the US Federal Reserve will allow the Monetary Authority to restore an internal banking market, while he indicated that the results of the discussions between the Central Bank and the Federal Reserve are good and consistent with the rules of work, and he pointed out that they will allow for the implementation of a precise path between Iraqi and international banks.

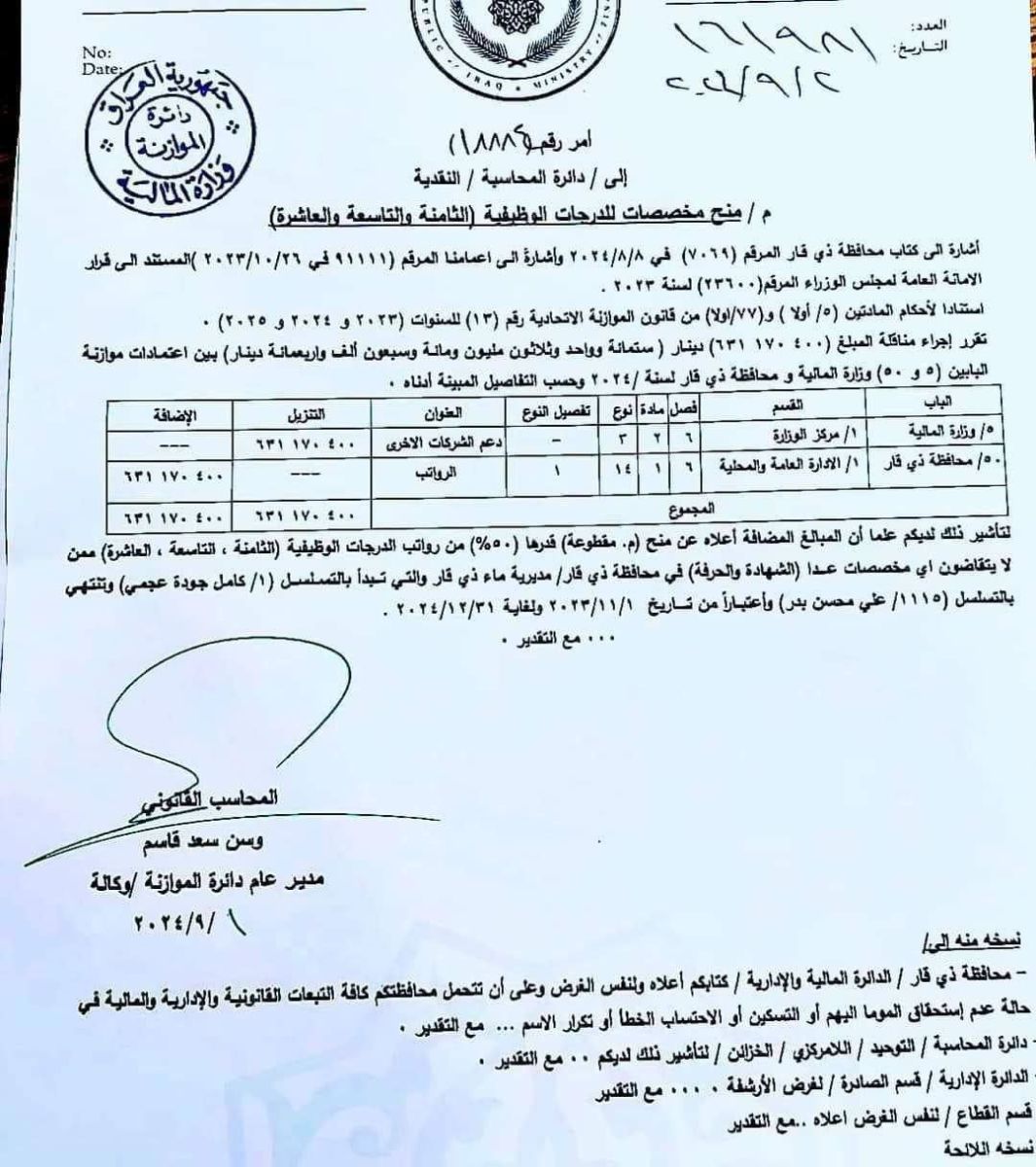

Retroactively.. Approval to disburse 50% allowances for lower job grades

The Ministry of Finance has approved the disbursement of the 50% allowances to the lower grades, retroactively.

A document from the ministry, seen by Al-Eqtisad News, stated that “approval was given to disburse the 50% allowances for the job grades (eighth, ninth and tenth) retroactively.”

Banking services in the Kurdistan Region have expanded fivefold, says PM Masrour Barzani

Prime Minister Barzani in his address at the HITEX24 referred to the “MyAccount” project and the overall status and reform efforts in the banking system in the Kurdistan Region.

On Tuesday, the Kurdistan Region’s Prime Minister Masrour Barzani announced that in the past ten months alone, banking services in the Kurdistan Region have expanded fivefold, underscoring that the banking system and financial services are the main principles of the reform process during the ninth cabinet.

Prime Minister Barzani in his address at the HITEX24 referred to the “MyAccount” project and the overall status and reform efforts in the banking system in the Kurdistan Region.

“I extend my gratitude for your cooperation and support of the "MyAccount" project, which serves as an exemplary demonstration of the initial steps we are taking to restore trust in banks and the banking system,” the Premier stated.

The Kurdistan Regional government plans to register one million salaried employees within the banking system over the course of a year.

Prime Minister Masrour Barzani highlighted that, “I was initially cautioned about the potential difficulties in achieving this within the given timeframe, I am happy to report that we are steadily approaching our objective.”

According to the Premier’s statement, the Kurdistan Region’s banking system is more robust and efficient than ever before, demonstrating commendable growth.

“Thousands of civil servants are no longer burdened with waiting in long queues to receive their salaries. Additionally, procedures for exporting and receiving remittances have been streamlined and can now be conveniently conducted via mobile phones. Moreover, we have installed 200 new ATMs throughout the region, bringing the total number to an impressive 1,000,” he underlined.

The Prime Minister also indicated that there have been over half a million public sector employees integrated into the banking system.

“In the past ten months alone, banking services in the Kurdistan Region have expanded fivefold,” the Prime Minister emphasized.

Regarding the employees who receive their salaries via digitalized means and through the MyAccount project, Prime Minister Masrour Barzani stated, “his month, more than 120,000 employees will receive their payments digitally, and next month, this figure will surpass 200,000, with approximately $200 million deposited directly into bank accounts. Remarkably, private sector banks accomplish this within a single day, whereas the KRG previously required a week and the involvement of numerous accountants to achieve the same outcome.”

Prime Minister Barzani also believed that the heightened liquidity and availability of securities are instilling greater confidence in private and commercial banks, enabling them to extend loans to their partners, both individuals and companies.

The banking system and financial services are the main principles of the reform process during the ninth cabinet.

Prime Minister Masrour Barzani stressed that, “While the banking system and financial services constitute a cornerstone of our reform process, our efforts have not ceased there. Citizens are now conducting a significant portion of their interactions with the government online, a development that enhances speed and efficiency for everyone. We have also established a data and information center that adheres to international standards. Furthermore, the process of registering companies and businesses has been significantly simplified and expedited.”

Prime Minister Masrour Barzani also highlighted the future initiatives of the Kurdistan Regional Government in terms of technological advances, digitalization, and public service development.

“In the forthcoming year, we will be unveiling several additional initiatives poised to revolutionize the daily operations of citizens and businesses. One such initiative involves issuing over 1.5 million digital identity cards. These cards, already initiated under this cabinet, will enable access to a range of public services in the near future. Anticipate a substantial increase in this number next year,” he said.

Salary 600 thousand" and the joy is indescribable.. The Retirees Union in Sulaymaniyah is excited and thanks Al-Sudani

The spokesman for the Retirees Union in Sulaymaniyah, Sadiq Othman, described today, Tuesday (September 3, 2024), the decision to equalize the salaries of retirees in the region with their peers in the rest of the governorates as "important and historic."

Othman told Baghdad Today, "This decision is the most important decision that the retiree was waiting for. There are people who left life and their wishes were not fulfilled. The situation of the Kurdish retiree was very miserable, and his salary was small and below standard."

He added, "Currently, the lowest salary for retirees in the region is 500 thousand dinars, and with the increase given by the Iraqi government, the lowest Iraqi retiree receives a salary of 600 thousand dinars per month," adding, "The joy on the faces of the retirees cannot be described."

Othman expressed his thanks to the Federal Court and its decision, which he described as historic, regarding retirees. He also expressed his thanks to Prime Minister Mohammed Shia al-Sudani and Minister of Finance Taif Sami .

He explained that "this decision made the people and families happy, and the wish to unify salaries was fulfilled today, and brought them joy. The decision is the result of patience, efforts, and communication with the federal government and the Iraqi judiciary.

The federal government agreed to pay the salaries of retirees in the region for the month of July in accordance with the unified Iraqi retirement law and to equate them with their peers in the rest of the governorates .

An informed source told Baghdad Today on Saturday (August 31, 2024), "Federal Finance Minister Taif Sami agreed to pay the salaries of retirees in the region for the month of July, in accordance with the Iraqi retirement law and to equate them with their peers in other Iraqi governorates ."

He added, "The Federal Ministry of Finance informed the regional government that it must pay the shortfall in salaries and deliver the salaries to retirees in accordance with the Iraqi retirement law, and the amount disbursed by the Kurdistan government will be compensated, and the regional government must also send the pension differences monthly to the federal government ."

On Wednesday (July 3, 2024), the Kurdistan Regional Council of Ministers discussed the report of the Minister of Finance and Economy, Awat Sheikh Janab, to unify the salaries of Kurdistan Region retirees with their counterparts in the federal government, in accordance with the provisions of the Unified Retirement Law No. 9 of 2014 in force in Baghdad, which replaced Law No. 27 of 2006 .

Based on the decision of the Federal Court and the proposal of the joint audit team of the Federal and Regional Financial Supervision Bureaus, the Kurdistan Region, like the rest of the regions of Iraq, should work in accordance with Law No. 9 of 2014 to achieve equality in salaries, privileges and financial dues for all retirees in the region, numbering 277,541 people, where the total monthly expenditure on their salaries amounts to 122 billion dinars .

The Council of Ministers in the region approved the proposal of the joint team of the Federal and Regional Financial Supervision Bureaus, regarding the unification of the retirement law throughout Iraq, including the Kurdistan Region, in a way that serves the interests of the region’s retirees, and equating their salaries with their peers in the federal government .

The Council of Ministers directed the Ministry of Finance and Economy, the Court, and the Cabinet Secretariat to take the necessary legal measures and communicate with the Federal Ministry of Finance in this regard. On the internal level of the region, the Ministry of Finance and Economy will continue the necessary preparations to reorganize the retirement sector within the framework of the Unified Retirement Law No. 9 of 2014.

For the first time, civil servants in Sulaymaniyah receive their salaries according to the “Hisabi” system

The process of disbursing salaries of employees and workers in the public sector in Sulaymaniyah Governorate began this Wednesday morning, according to the electronic "My Account" system, for the first time.

Shafaq News Agency correspondent in Sulaymaniyah reported that turnout was limited on the first day for several reasons, the most important of which is that the percentage of employees whose salaries were localized within the "Hisabi" program in Sulaymaniyah ranges between 30% to 33%, compared to 98% in Erbil, according to private sources.

The sources indicated that the localization of employees' salaries in Sulaymaniyah took place recently, which required more time to complete the procedures.

Shafaq News correspondent said that the electronic payment centers were equipped with a number of government employees to facilitate the disbursement process, which takes less than 5 minutes, which is faster and simpler than the traditional disbursement process through banks.

The agency's correspondent confirmed that the electronic payment centers in Sulaymaniyah operate from 7 am to 12 midnight, with more than one center available for delivering salaries in various parts of the city.

It is noteworthy that the "Hisabi" system is an electronic payment system developed by the Kurdistan Regional Government to facilitate the process of disbursing salaries to government employees and retirees, as salaries are deposited in electronic accounts designated for each employee.

Employees can receive their salaries through payment centers distributed in different areas of the region, without the need to go to banks. The system aims to reduce reliance on cash and improve the efficiency and security of disbursement operations.

From Iraq to Iran... How does fuel smuggling affect the Iranian economy?

Energy-rich Iran suffers from fuel smuggling across its borders. Its naval forces regularly intercept fuel smuggling, especially diesel, in its southern waters, which are Iran’s most important gateway to the world.

Kerosene, gasoline and diesel fuel are the main fuel smuggling operations from Iran. According to the Iranian IRNA news agency, the volume of fuel smuggled (diesel and gasoline) from Iran ranges between 10 and 20 million liters per day.

Smuggling under sanctions

The continuation of this situation has led the Iranian Revolutionary Guards Navy to continuously monitor fuel smugglers and deal with them in coordination with the GCC countries.

For example, on April 24, 2022, the head of public relations for the IRGC’s Second Navy Region, Gholamhossein Hosseini, announced the seizure of 200,000 liters of smuggled fuel, the confiscation of the ship, and its transfer to the port of Bushehr (southern Iran) to follow up on legal procedures, according to the state-run IRNA news agency.

The Pakistan Petroleum Traders Association told Reuters that petroleum traders have reported an increase in the smuggling of Iranian fuel into Pakistan, saying that up to 35 percent of diesel sold in the South Asian country comes illegally from Iran.

On the other hand, a group of experts in the field of sanctions believe that this measure may be an unofficial attempt by Tehran to circumvent the US Treasury Department sanctions in order to provide the foreign currency that the country needs, but so far this claim has not been responded to and has not been confirmed or denied by the official Iranian authorities.

The extensive fuel smuggling operations in the Gulf waters under sanctions represent a major problem for Iran, and result in huge economic damage.

Economic damage

Middle East researcher Mohammad Bayat explained that in recent years, Iran and Saudi Arabia have recorded the largest amount of fuel smuggling in the Gulf due to the allocation of large subsidies to the energy sector.

Meanwhile, with the onset of the Ukrainian crisis and the migration of influential minority and Russian companies to the region to circumvent US and EU sanctions, the fuel smuggling crisis has entered a new phase, according to the researcher, who added that in this illegal chain, groups linked to organized crime play a role in the fuel smuggling network.

Bayat said that the four main variables, which are “neutralization of US sanctions,” “large government support for energy,” “low fuel production prices,” and “depreciation of the national currency,” are the main factors behind Iranian fuel smuggling in the region.

He added that the decline in the value of the rial, the allocation of large subsidies to the energy sector, and the payment of 90% of the cost, created a great incentive for fuel smugglers in the southern and southeastern regions of the country to transport diesel and gasoline from Iran to neighboring countries.

He pointed out that the price of a liter of gasoline in Iran, for example, is about 12 US cents, but when smuggled to countries neighboring Iran, this figure rises to $1.23 (i.e. a profit of about one dollar). This profit margin leads fuel smugglers, individually or collectively, to monopolize this illegal business and create a platform for smuggling fuel safely and continuously to countries neighboring Iran, such as Pakistan, Iraq, Turkey and Azerbaijan.

The researcher concluded that the continued smuggling of fuel produced in Iran will cost the government billions of dollars and reduce its ability to meet domestic needs.

economic crisis

On the other hand, energy expert Hamid Reza Shokohi explained that there are two ways to smuggle diesel by sea:

- The first method is done through barges, as they sell their fuel at sea to other ships at a higher price, or the fuel is purchased in coastal cities and then transported to the barges.

- The second method is adopted on islands and some ports through which many ships pass, which is to connect pipes from the land to the sea and transport diesel through them to the sea and load it onto ships.

- Iranian security forces have discovered this type of smuggling more than once on Qeshm Island and other areas of Hormozgan Province overlooking the Strait of Hormuz.

The energy expert added, “We see news every month about Iranian forces discovering and seizing fuel smuggling operations in the Gulf waters, and this is due to the fact that diesel smuggling has caused great damage to the Iranian economy.”

Shukohi continued that there is a severe economic crisis and deprivation in the southern governorates, which makes citizens turn to businesses that bring them large and quick profits such as smuggling, especially smuggling fuel such as gasoline and diesel in cars across land borders or in pipelines and ships across the sea.

He said that diesel smuggling weakens the fuel supply centers located in coastal areas around the sea and in Iran, as passing ships prefer to supply with smuggled diesel at a lower price, instead of supplying from state-owned centers, which weakens the economy.

Adel Al-Jubouri: When Iraq is the first foreign stop for the new Iranian president

Iranian political and media circles, both governmental and non-governmental, announced that the new president, Masoud Pezeshkian, will visit Iraq in mid-September, in response to an official invitation he received from Iraqi Prime Minister Mohammed Shia al-Sudani.

If this visit takes place, it will be President Pezeshkian's first foreign stop after assuming office and his government gaining the confidence of the Iranian Islamic Consultative Assembly (parliament).

There is no doubt that this has important implications and points to essential facts about Tehran’s vision of Iraqi-Iranian relations, regardless of who holds the position of president in Iran, and regardless of the many tensions, problems and crises in the general Iraqi political scene. In other words, Tehran attaches great importance to Baghdad, just as the latter attaches the same importance to Tehran, for various considerations, motives and reasons.

On July 8, after announcing his victory in the elections, Pezeshkian said during a phone call with Iraqi President Abdul Latif Rashid, “We attach great importance to the great country of Iraq, and the two countries - meaning Iraq and Iran - have common views and positions in many areas, which is appropriate for deepening relations and developing cooperation.” Perhaps this is a clear indication from the new Iranian president of his keenness to maintain and strengthen relations and ties with the two neighboring countries in all aspects and areas, in a manner consistent with the interests of both parties, and in a manner that contributes to enhancing security and peace in the region, as well as strengthening and consolidating the resistance front, in which both Iraq and Iran are pivotal and influential parties.

By following the course of Iraqi-Iranian relations over the past twenty years, three levels of these relations can be identified. The first level is represented by agreement, understanding and harmony in visions, positions and orientations within the general comprehensive framework, despite the presence of obstacles and impediments here and there. This has become clear in terms of cooperation and coordination in fighting terrorism, whether Al-Qaeda or ISIS, as Iran’s role in helping Iraq in this regard has been pivotal and decisive in many cases, and this is what Iraqi politicians and officials have acknowledged before the Iranians.

The other level is represented by the existence of complexities and problems alongside agreements and understandings, and this is found in relation to economic, commercial and investment files. These complexities and problems are often technical in nature, even if some of their motives and drivers are political, and these do not affect the constants and principles on which they are based, and in light of which the rhythm of relations between Baghdad and Tehran moves, as is the case with the file of exporting Iranian gas to Iraq and its financial dues, which are often delayed. While the third level is represented by pending controversial issues whose roots go back to the seventies and eighties of the last century, related to border demarcation and war compensation (1980-1988), and the fate of the remaining prisoners and missing persons from both sides, in addition to the problem of water shares in the shared rivers.

Although the third level files have not been resolved, they have not, in fact, constituted a real obstacle to investing in the available opportunities and prospects to achieve the greatest possible benefit for both parties. The volume of annual trade exchanges, which exceeded ten billion dollars during the past few years, according to official and unofficial sources, the flourishing of religious and natural tourism, and the growth of cooperation in the construction, reconstruction, health and education sectors, all of this and more, indicates that both Tehran and Baghdad realize the importance of focusing on points of convergence more than stopping too much at points of divergence.

Here, the Pezeshkian government must be careful not to squander the gains and achievements made in the course of relations with Baghdad, which is what President Pezeshkian indicated, as well as what the late President, Mr. Ibrahim Raisi, indicated after assuming office in mid-2021, and what previous Iranian presidents emphasized.

In contrast, decision-makers in Baghdad view maintaining and strengthening relations with Tehran as important. During his visit to the latter in December 2022, Mohammed Shia al-Sudani stressed that “Iraq does not forget Iran’s support for it since 2003 and the fight against the terrorist ISIS gangs, and that visits and meetings are necessary to push for the activation of activities in all fields.” At the time, al-Sudani appreciated “Iran’s supportive position towards Iraq in gas supplies.”

There is no doubt that the files that President Pezeshkian will discuss with senior Iraqi officials are the same ones that have always been present on the Iraqi-Iranian dialogue table, at all levels and in all aspects and fields.

There are common and mutual economic interests, there are security challenges, there is the Arbaeen visit and what the two countries should do and coordinate on to achieve more successes in it, and there are identical political positions on a number of regional and international issues and affairs, perhaps foremost of which is supporting the Palestinian cause and backing the Palestinian people in their struggle against the usurping Zionist entity, in addition to seeking to end the American presence in Iraq.

In addition, Baghdad has played a positive and effective role in resolving the crises between Tehran and regional and international parties, noting that, during the past three or four years, it has moved in this direction and succeeded in gathering representatives of the Iranian and Saudi governments around one table, amidst welcome and satisfaction from Tehran and Riyadh. There is no doubt that the resolution of crises and the resolution of problems between these two traditional rivals had a tangible positive impact on the overall situation in Iraq and the region.

The more solid the relations between Baghdad and Tehran are, the more specific and clear their paths are, and the more deeply strategic their nature is, the more this will be reflected positively on the overall movement in the regional and international arenas, and consequently, many complexities and problems will be resolved.

President Pezeshkian will come to Baghdad, and Iraqi-Iranian relations will have gone beyond the scope of private political and diplomatic circles, and the economic and financial spaces confined to the scope of large companies and institutions and owners of capital, to the various social, religious, cultural and academic spaces, and a great occasion such as the Arbaeen pilgrimage is nothing but a prominent example, revealing the broad-minded popular dimension of relations between the two sides.

In other words, Bazishkian will come to complete a long path that those who came before him have traveled long distances, many stations, and many stages.

PM's adviser warns of 'risks of low oil' on fiscal policy, spending

The financial advisor to the Prime Minister, Mazhar Muhammad Salih, warned today, Wednesday, of the "risks of a decline in oil revenues" with the decline in crude prices in global markets.

Saleh told {Euphrates News} agency, "First, there must be a systematic investigation into the fundamental factors behind the decline in crude oil prices in global markets and their rapid decline in the past few weeks, as China is one of the world's largest economies importing crude oil among nations, as its crude oil imports exceed 10 million barrels of oil per day, and Iraq alone contributes about 10% to China's need for oil, or about 30% of Iraq's oil exports are directed to the Chinese market."

He explained, "China's demand for oil is linked to the annual growth rates of its economy, and it is a truly direct relationship, as the more the annual growth in GDP increases, the more the demand for crude oil increases."

Saleh pointed out that "there is a parallel between the increase in GDP and the increase in oil consumption by a percentage ranging between 0.5% to every 1% increase in GDP, although this parallel may change based on energy efficiency and market developments."

He pointed out that "with this slowdown in Chinese economic growth (the second largest economy in the world), it has begun to escalate during the second half of this year, as the annual growth rate is expected to decline to about 4.5% after it was 5.4% at the beginning of the year, and thus the decline in growth in the Chinese economy has become an urgent issue that greatly affects the global economy and the stability of demand in the energy market."

He noted that "Chinese economic data shows noticeable weakness, especially in the industrial and service sectors, as the China Purchasing Managers' Index in August 2024, which is a key measure of economic activity, fell to its lowest level in six years."

He continued, "Such a decline reflects a decline in both domestic and external demand for goods and services, as new export orders in China fell in July for the first time in eight months, indicating a decline in global demand for Chinese products."

The government advisor explained, "New home prices in China also rose, but at a very weak pace, adding more pressure on the Chinese economy itself."

He pointed out that "international expectations indicate that the growth in the country's GDP will continue to decline to about 3.5% until 2028, reflecting the structural challenges facing the Chinese economy in the long term."

Saleh said that "based on the above, oil prices witnessed a significant decline today, September 4, 2034, as Brent crude fell to below $74 per barrel. This sharp decline is attributed, as we mentioned earlier, to ongoing concerns about the slowdown in economic growth in China, which negatively affected the demand for oil, which increased the concerns of global markets about the continued weakness of global demand for crude oil."

He concluded by saying, "As far as Iraq is concerned, the federal general budget issued by Law No. 13 of 2023 (the three-year budget) still hedges against a hypothetical annual deficit of nearly 64 trillion dinars and the price of a barrel of oil for the purposes of assessing oil revenues in the budget during the past year at about $70 per barrel (annual average), so the fiscal policy may face the risks of a decline in oil revenues, by activating the necessary precautionary financial measures to sustain expenditures and in accordance with the priorities and principles outlined by the Federal General Budget Law itself, whether in financing the deficit or in arranging public spending priorities."

Iraq opens second berth for exporting condensates and liquefied gas

The Ministry of Oil opened, on Wednesday, the second berth for exporting condensates and liquefied gas at the Umm Qasr port in Basra, noting that gas investment rates will rise to 70% by the end of this year.

The Undersecretary of the Ministry for Gas Affairs, Ezzat Saber Ismail, said in a statement issued by the ministry, "The dock will provide flexibility in the export operations of liquefied gas and condensates, which currently amount to 50 tons per month, and it is hoped that by the beginning of 2025 it will reach 80 tons per month," indicating that "production rates will reach this increase to 125 tons per month."

Ismail added that "the ministry is implementing a number of strategic projects to invest associated gas in a number of oil fields," explaining that "gas investment rates will rise to 70% by the end of this year."

The Director General of the Southern Gas Company, Hamza Abdul-Baqi, said, "The Ministry is implementing a number of promising projects to invest in gas, and thanks to the joint efforts with the Basra Gas Company, surplus rates have been achieved for the local need for consumption of liquid gas (LPG), and this gas is different from the gas that is imported to operate power generation stations, or that is used in petrochemical industries, cement industries, and others."

In turn, the Managing Director of Basra Gas Company, Kazim Port, said, “The second berth includes four loading arms, which provide flexibility and increase in export operations for the second berth,” explaining that “the capacity of two of the loading arms is 2,400 cubic meters per hour to load butane and propane,” while the capacity of the remaining 4,800 cubic meters per hour to load condensates, compared to 500 cubic meters per hour, which represents the capacity of the third berth from which exports are currently taking place.”

.jpeg)

.jpeg)

.jpg)

No comments:

Post a Comment