President of the Republic reviews Iraq's long-term economic development plan in Davos

President Abdul Latif Jamal Rashid reviewed, on Friday, the main points of Iraq's plan for a long-term economic development strategy at the Davos Conference Center.

The video for this blogpost is below here:

A statement by the Presidency of the Republic received by "Mawazine News" stated that "President Abdul Latif Jamal Rashid participated in a dialogue session entitled (Towards a more stable land through land reclamation) at the Davos Conference Center."

The statement added that "during the session, which was attended by the Under-Secretary-General of the United Nations and Executive Secretary of the United Nations Convention to Combat Desertification Ibrahim Thiaw, the South African Minister of Agriculture Gwen Steenhuizen, the Executive Director of the Consultative Group on International Agricultural Research Asmahan Al-Wafi, the Executive Director and CEO of New Aero Farms Molly Montgomery, and the Deputy Prime Minister of Mongolia Togmeddin Dorjkhand, the President delivered a speech in which he emphasized his experience as an engineer specializing in water management with decades of experience, and he has devoted a large part of his career to addressing water scarcity issues and developing sustainable land use methods."

In his speech, the President explained the pressures that Iraq is facing due to climate change, water scarcity and desertification, stressing that "Iraq does not stand idly by in the face of these challenges, but has taken decisive and tangible steps to confront them through effective policies aimed at achieving sustainable development."

The statement continued, "The President reviewed the main points of Iraq's plan for a long-term economic development strategy, especially in the areas of agriculture, energy and water security," noting that "Iraq is currently participating in ongoing negotiations with neighboring countries such as Turkey and Iran, with the aim of concluding fair agreements to share the waters of the Tigris and Euphrates rivers," indicating that "these negotiations represent a strategic priority for the future of our region, in addition to its work at the international level with specialized international organizations to adopt agricultural practices that are resistant to climate change and ensure access to the necessary funding and expertise to achieve success."

The statement continued, "The session was attended by Deputy Prime Minister and Minister of Foreign Affairs Fuad Hussein, Chairman of the Advisory and Experts Authority in the Presidency of the Republic Ali Al-Shukri, and the Iraqi Ambassador to the Swiss Confederation Mohammed Al-Dabbagh."

Here is the text of the speech:

“I am pleased to be with you today at this important meeting. As a water management engineer with decades of experience, I have devoted a large part of my career to addressing water scarcity issues and developing sustainable land use methods.

These challenges are not new to me, nor are they merely theoretical issues; they are urgent realities that require us to act quickly. I am pleased to share with you today Iraq’s strategies to address these issues effectively and directly.

Today’s session, entitled “Towards a more stable land through land reclamation,” focuses on a critical global challenge: land degradation.

40% of the world’s land has lost its fertility, threatening the stability of our economic and social environments. This phenomenon has caused a decline in agricultural productivity, pollution of waterways, and increasing and accelerating drought, putting economies and livelihoods around the world at risk.

Iraq is no exception to these challenges. About 39% of our land is exposed to desertification, at a time when our water resources, which are the basis of agriculture and livelihoods, are under increasing pressure.

The situation is exacerbated by climate change, rising temperatures, and declining water flows from rivers coming from neighboring countries.

However, Iraq is not standing idly by in the face of these challenges. We are taking decisive and tangible steps to confront them, through effective policies aimed at achieving sustainable development.

Let me review with you some of the main initiatives that we have begun to implement:

* The first and most important step is to improve the management of our existing water resources, by enhancing water use efficiency, developing modern irrigation systems, and collecting rainwater to use it for irrigating land.

* A ten-year federal national program to combat desertification: This program focuses on reforestation, soil conservation, and adopting sustainable agricultural methods.

* Expanding green belt projects: We are in the process of establishing buffer zones around our cities, to reduce the risk of desert encroachment by using local plants that are drought tolerant.

These efforts are an integral part of Iraq’s long-term economic development strategy, particularly in the areas of agriculture, energy and water security.

Sustainable development is the real guarantee of balanced growth that preserves the health of our environment for future generations.

As part of our quest for sustainable development, we are shifting towards renewable energy. We are also working to promote climate-smart agriculture, diversify crops, encourage organic and regenerative agriculture, and tighten legal regulations for sustainable land use practices.

Addressing our water challenges requires cross-border cooperation.

Iraq is currently engaged in ongoing negotiations with neighboring countries such as Turkey and Iran to conclude fair agreements for sharing the waters of the Tigris and Euphrates rivers. These negotiations represent a strategic priority for the future of our region.

Iraq is working internationally, alongside global organizations such as the United Nations Convention to Combat Desertification, the Food and Agriculture Organization (FAO), the World Food Programme (WFP), and the World Bank, to adopt climate-resilient agricultural practices and ensure access to the financing and expertise necessary for success.

In conclusion, we know that sustainable solutions can only be achieved through effective local action and community engagement, which is the foundation of our strategy to address challenges.

Ladies and gentlemen,

land reclamation is not just an environmental imperative, it is a moral responsibility towards future generations.

It is about protecting livelihoods, preserving ecosystems and ensuring a sustainable future for us and our children.

Iraq is committed to this mission and I look forward to working with all of you to achieve these common goals. Thank you."

Prime Minister confirms Iraq's aspiration for more cooperation with the Arab Monetary Fund

Prime Minister Mohammed Shia Al-Sudani called on the Arab Monetary Fund to cooperate in building bridges with its financial institutions.

A statement from his media office received by "Al-Eqtisad News" stated that "Al-Sudani received the head of the Arab Monetary Fund, Mr. Fahd bin Mohammed Al-Turki."

He stressed "the government's support for the tasks of the Arab Monetary Fund, of which Iraq is a founder and the second largest contributor, after the Kingdom of Saudi Arabia."

Al-Sudani pointed out that "Iraq looks forward to further cooperation with the Fund, and that the effects of its work will be reflected on the Iraqi scene, through its contribution to financing the reconstruction and development campaign that the government has embarked on, especially in the field of infrastructure, as well as the desire for the Fund to work on expanding the contribution of Iraqi cadres in its work, and building bridges with Iraqi financial institutions."

He stressed "the importance of the Fund contributing to strengthening Arab ties, by regulating financial, monetary and trade relations, in a way that enhances common interests between them."

For his part, the Chairman of the Board of the Arab Monetary Fund stressed the Fund's keenness to support Iraq and participate in its development programmes, in a way that contributes to enhancing constructive cooperation in the field of financial and financing sectors.

International report confirms the strength and solidity of Iraq’s system in combating money laundering and terrorist financing

Hussein Al-Maqram, representative of the Anti-Money Laundering and Combating the Financing of Terrorism Office at the Central Bank, said in a press statement that “the Financial Action Task Force issued a report confirming the strength and solidity of the system followed in Iraq with regard to combating money laundering and terrorist financing.”

He added that "the report reflects the strong system in Iraq to combat these crimes, and the important efforts made by the state to combat them in accordance with international standards."

Al-Maqram pointed out that "the report focused on understanding the risks of money laundering and terrorist financing, and the effectiveness of implementing measures to combat these crimes, including international cooperation, confiscation of criminal proceeds, and investigation and prosecution procedures."

He continued by saying: “Based on the annual and comprehensive training plan to raise the level of knowledge and commitment to the requirements imposed in the field of combating money laundering, financing terrorism and financing the proliferation of weapons, the number of trainees concerned with the anti-money laundering and terrorist financing system during the past year reached (3415) trainees.”

Learn about the final draft of the draft budget law amendment

The National Iraqi News Agency documents the final version of the draft amendment to the Triennial Budget Law 2023-2024-2025 No. 13 of 2023, regarding amending the costs of production and transportation of oil produced in the region’s oil fields. /

Al-Haimus: We were able to increase the business of the Iraq Stock Exchange by about 16 percent

The Chairman of the Securities Commission, Faisal Al-Haimus, announced today, Thursday, that the Commission was able to increase the business of the Iraq Stock Exchange by about 16 percent, while pointing to cooperation with the World Bank on governance.

Al-Haimus told the Iraqi News Agency (INA): "During the past year, we were able to increase the business of the Iraq Stock Exchange by about 16 percent," expressing his "hope that the current year will be a stronger start on the subject of benefiting from the agreements signed with the Abu Dhabi Financial Market and the Saudi Market, which will help attract investors from abroad and increase the business of the Iraq Stock Exchange."

Al-Haimus added that "cooperation has been made with the World Bank on governance, and we will have completed it by the end of the first quarter of this year."

Parliamentary Finance Committee hosts Al-Alaq: We reject the mechanism of selling real estate through banks

Member of the Parliamentary Finance Committee, Mahasen Hamdoun, announced on Thursday that she will host the Governor of the Central Bank of Iraq, Mohsen Al-Alaq, to discuss the decision to buy and sell real estate through banks.

Hamdoun told Shafak News Agency that the committee will host the governor of the Central Bank next week to review the reasons behind the recent decision regarding considering the process of buying and selling real estate to be done through banks.

Hamdoun explained that the committee rejects this decision, noting that setting 100 million dinars as the value for selling real estate is not appropriate and does not meet the requirements, warning that this may contribute to money laundering operations.

Hamdoun added that the Central Bank must cancel the new mechanism for buying and selling real estate, and that the appropriate price for selling through the banking window should be set at 500 million dinars, as was previously the case.

The Central Bank of Iraq issued a new decision to reduce the minimum value of real estate sales, as the new value was set at 100 million Iraqi dinars, after it was 500 million dinars.

According to the new instructions, according to an official letter addressed to the Real Estate Registration Department (on January 15), which Shafak News Agency has reviewed, the sale of these properties will be done through licensed Iraqi banks only, and that this procedure comes within the due diligence controls for combating money laundering and terrorist financing specific to the Real Estate Registration Departments.

The Deputy Director General for Combating Money Laundering at the Central Bank of Iraq, Hussein Ali, told Shafak News Agency that these measures aim to accelerate investigations related to money laundering, with the Real Estate Registration Department supervising the monitoring of suspicious transactions and documenting any money laundering cases to facilitate the follow-up of the relevant authorities.

Earlier, the Deputy Chairman of the Investment Committee in the Iraqi Parliament, Hussein Al-Saabari, warned that the laws issued by the Central Bank and Iraqi ministries are characterized by confusion, which may lead to a decline in the investment market in Iraq.

He added to Shafaq News Agency that laws such as the real estate registration tax on the sale and purchase of homes are inappropriate, and that the Iraqi banking sector is suffering from deterioration and is unable to meet investment needs.

Al-Saabri also considered the Central Bank’s decision regarding combating money laundering ineffective, and that it does not address the problem of rising housing unit prices in the country.

President of the Republic: Our relationship with America and Iran is good, and we are not under the control or will of any country

Rashid said, in an interview with Asharq Al-Awsat newspaper, followed by {Al-Furat News}, that: “Trump’s return is an important step to resolve conflicts in the world and the Middle East, and Iraq is now free of terrorist operations, and what remains of terrorism does not exceed a few pockets.”

He added, "Our relations with the United States of America are good, and we thank the American position for standing by our side in fighting the terrorist organization ISIS," noting that "the American forces are present under bilateral agreements, and at the request of the Iraqi government and in coordination and consultation with the political forces in Iraq."

Rashid continued, "The factions are now under the control of the government according to procedures that the relevant authorities are working on, to reach a situation that ends any combat activity in these circumstances," stressing "the importance of the state of Iran as a state and our relations with it are good; but we are the decision-makers in Iraq, and we are not under the control or will of any state."

He added, "Our region is a historical and civilized region, and is considered one of the most important regions. It is rich in natural resources more than any region of the neighboring countries. Therefore, we must enjoy our wealth, enjoy security and peace, and work to solve the problems of the neighboring countries."

Rashid added, "We tried to contribute to finding solutions to settle the situation in Syria during the era of Bashar al-Assad's regime, several times. Syria is an important country in the Middle East, and it shares borders with a number of countries in the region, but Bashar's regime unfortunately did not invest in our attempts. We supported Syria's return to the Arab League, and we tried to bring the views of the former Syrian regime and the various factions closer together."

"We wish the new administration in Syria success in improving the situation, but things are not very clear yet," he added, explaining, "We share a long border with Syria, and the fact is that there are a large number of terrorist organizations on the Iraqi-Syrian border, and that worries us. The international community must work to find radical solutions to the crisis of terrorists in detention camps who hold different nationalities."

Regarding the water crisis, Rashid said, “The water crisis exists at the present time, and its solutions also exist. The solutions, in my opinion, are easy if there is a real and serious intention to solve this problem. There are three main factors that contribute to the water crisis: neighboring countries, climate, and improving water management in Iraq.”

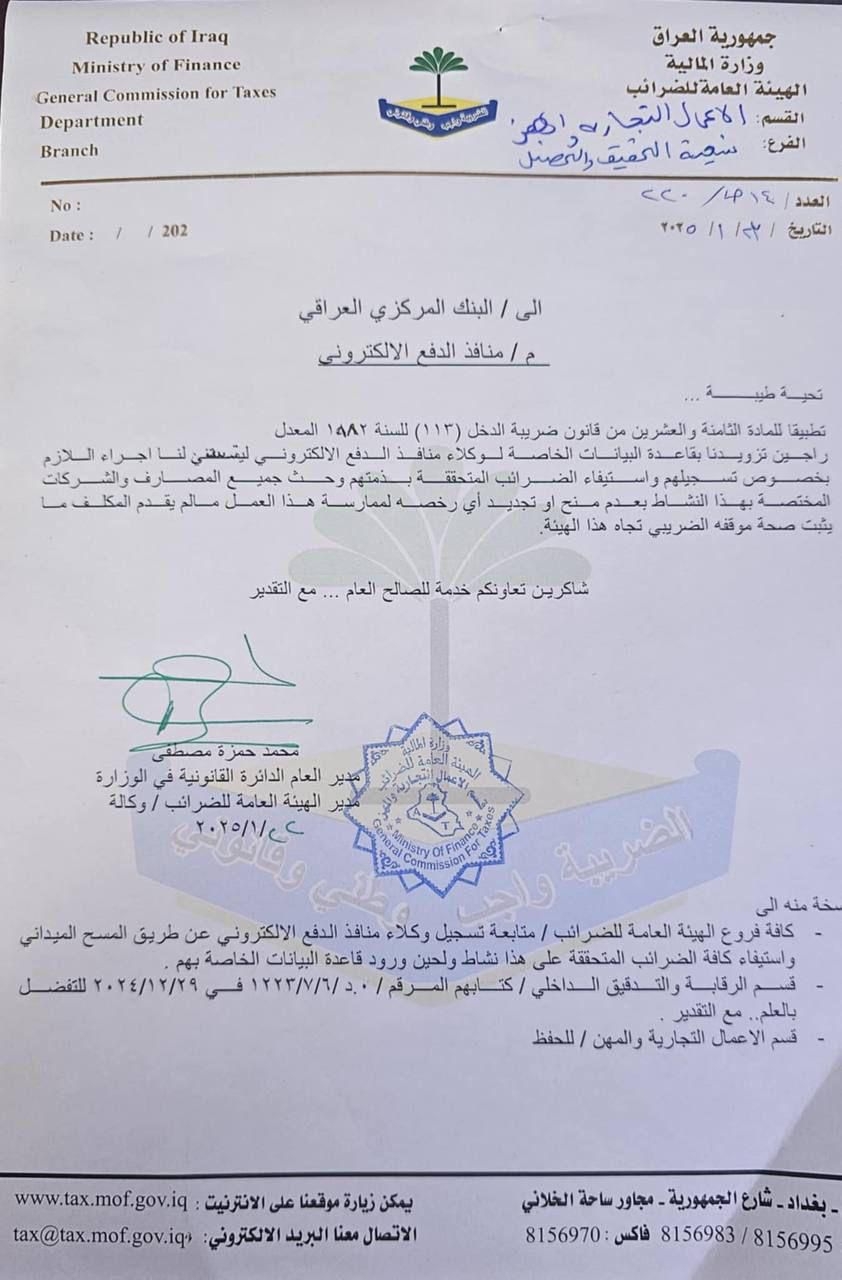

Taxes Knock on the Doors of Electronic Payment Ports in Iraq (Document)

The General Tax Authority, affiliated with the Iraqi Ministry of Finance, began operations on Thursday towards electronic payment outlets across the country, days after a decision by the Central Bank that sparked widespread controversy regarding closing these outlets or merging them with exchange companies.

A document issued by the Authority, obtained by Shafaq News Agency, was addressed to the Central Bank of Iraq, in order to provide it with a database of electronic payment outlets, in order to register them and collect taxes from them.

Last Monday, the Association of Financial Outlets for Electronic Payment in Iraq ended a strike that it had started that morning, in protest against the decision of the Central Bank of Iraq to close outlets or merge them with exchange companies.

However, the Central Bank later denied issuing any directive or statement regarding the closure of exchange outlets, stressing in a statement that the goal is to expand the spread of financial outlets through ATMs and licensed electronic payment companies.

Finance Ministry asks Central Bank to provide it with database of electronic payment outlet agents

Today, Thursday (January 23, 2025), the Ministry of Finance requested the Central Bank to provide it with a database of electronic payment outlet agents.

According to a document issued by the General Tax Authority, obtained by Baghdad Today, “it requests the Central Bank to provide it with a database of electronic payment outlet agents to enable it to take the necessary measures regarding their registration and collection of taxes owed by them.”

Today's FRI JAN 24 25

this is from telegram but I don't have a link

_ US President Donald Trump asked OPEC Plus countries to reduce oil prices to provide cheap energy and expedite the end of the Russian-Ukrainian war.

_ OPEC Plus' abandonment of its 4.650 million barrel cuts will be implemented within a few weeks, and oil prices will decrease as well as oil revenues for oil exporting countries.

_ The greatest damage from the reduction will be on Iraq, because although its production will increase by about 220 thousand barrels per day, the drop in oil prices to $60 will put the Iraqi finances in a very difficult position.

_ This means a drop in Iraqi oil revenues by about $15 billion, which will be provided through internal borrowing.

_ If prices drop to $50, reducing the exchange rate of the dinar will become one of the important options to raise public revenues denominated in dinars to reduce the deficit gap in the general budget.

Trump storm hits OPEC, sparks fears in Baghdad

Ambiguity surrounds the crude oil export file, in light of escalating global tensions and provocative statements by former US President Donald Trump, who called on OPEC to lower oil prices.

The remarks, made in a televised address at the Davos Economic Forum in Washington, caused a significant decline in global crude prices, raising new concerns about the implications for the economies of rentier states, especially Iraq, which relies on oil for more than 90% of its government revenues.

With the sudden drop in West Texas Intermediate crude prices to below $75, and Brent crude to below $79, observers are wondering how Trump’s statements will affect the stability of the global oil market, as well as the repercussions on the economies of countries that rely mainly on this strategic commodity.

Trump stressed during his speech that he will pressure the Organization of the Petroleum Exporting Countries (OPEC) to immediately lower prices, indicating that this move aims to reduce global inflation.

Trump added that lowering oil prices could also help increase pressure on Russia to end the war in Ukraine, which Western diplomats described as “an economic strategy with clear political dimensions.”

In addition, Trump called for lowering US and global interest rates, considering that monetary policies need to be adjusted simultaneously with the decline in energy prices.

These statements sparked widespread controversy in economic circles, as some analysts expected that crude prices could fall to $50 per barrel, if these political pressures and pessimistic expectations continue.

What about Iraq?

On the other side of the world, Iraq finds itself facing a tough economic test, as the Iraqi economy depends on oil revenues, which constitute about 96% of total government revenues, according to World Bank data.

The economic expert, Abdul Hassan Al-Shammari, believes that “experts and consultants have diagnosed the defect for years regarding the danger of relying on oil alone to finance the state budget, but the opinion of experts is constantly ignored, which ultimately led to the formation of a single-resource economy that is exposed to constant shocks due to its connection to the external factor and the problems of exporting oil.”

Al-Shammari explained to “Iraq Observer” that “the solutions lie in diversifying the economy by activating agriculture, industry, employing workers, developing the local economy, in addition to tourism and investing local resources in a better way, rather than keeping the country’s economy hostage to oil and its fluctuations.”

With the decline in crude prices, Iraq faces major challenges in financing its general budget, which includes a huge deficit estimated at about 64 trillion Iraqi dinars (about 49 billion US dollars).

These figures represent a clear indicator - according to experts - of the fragility of the Iraqi economy, which has not yet been able to diversify its sources of income away from oil. Economists fear that the decline in oil prices will exacerbate Iraq's financial crises, including increasing unemployment rates and disrupting development projects.

Financial experts and consultants stress the need for Iraq to invest every additional dollar earned during periods of high oil prices, as proposals are being put forward to boost financial surpluses to reduce the government deficit, and invest in alternative sectors such as agriculture and industry, which would reduce total dependence on oil.

In addition, meeting the requirements of the International Monetary Fund and the World Bank may help Iraq improve its financial position and attract more foreign investments that could provide permanent solutions to its economic crises.

From Washington: The Iron Administration is Determined to Correct the Terrible Mistakes in Iraq...Restrict Weapons to the State

Iraqi politician Nizar Haider commented on Friday (January 24, 2025) on the possibility of Prime Minister Mohammed Shia al-Sudani merging the armed factions, as he officially announced a few days ago.

Haider, who resides in Washington, told Baghdad Today, "Iraq as a state, institutions and political leaders are preparing to enter the tunnel of the (Trumpian) era with minimal losses after it was proven to them that the iron-fisted American administration is determined to correct many of the terrible mistakes that the previous administration turned a blind eye to, at the top of which is the issue of Al-Sudani's failure to confine weapons to the state, the dollar and oil files, especially what relates to Iraq's smuggling of Iranian oil and other files."

He explained: "Therefore, we note that the statements in this regard have accelerated in an attempt by Al-Sudani to take proactive steps to fix things before the Trump administration settles in the White House and begins to deal directly and seriously with these files."

He added, "We have all followed the statements of the Republican representative close to President Trump (Joe Wilson) regarding the armed factions and his call to the US State Department to include them on the sanctions list or on the blacklist, as they call it, in addition to his efforts with a number of representatives from both the Republican and Democratic parties to submit a draft resolution to Congress that considers (Iran's arms in the region), as they describe it, terrorist formations and organizations, which if it happens, many armed factions in Iraq will be included under the new law, which will harm Iraq greatly, due to the organic overlap between these factions and many of the deep state institutions as well as with a number of political leaders, especially in the Coordination Framework."

He continued: "Al-Sudani and the Coordination Framework that supports and backs him must quickly commit to the terms of the agreed-upon government program on the basis of which his government was granted confidence under the dome of parliament, especially with regard to the clause of restricting weapons to the state to put an end to the existence of factions before Washington deals with it in its own way."

Prime Minister Mohammed Shia al-Sudani confirmed last Tuesday that he is working to integrate the armed factions within the legal and institutional frameworks.

Al-Sudani said in a speech that "the government is working to integrate the armed factions within the legal and institutional frameworks," stressing "commitment to the policy of openness and true partnership," noting that "the government is determined to build a new Iraq based on its Arab cultural heritage."

CBI expected to hit $500M in daily dollar sales as spending soars

The Central Bank of Iraq (CBI) daily sales are expected to approach $500 million due to rising government spending, the Iraq Future Foundation for economic studies and consultancy said on Friday.

The foundation's head, Manar Al-Obaidy, stated, "In 2024, the Iraqi government's average monthly spending reached approximately 12 trillion dinars. With the addition of loans and advances received by government agencies and ministries, estimated at around 2 trillion dinars monthly, the total government expenditure amounts to 14 trillion dinars per month."

The government, he said, typically operates for 20 days a month, meaning daily expenditure is approximately 700 billion dinars. “To cover this spending, the Ministry of Finance needs to sell at least $400 million daily to the CBI to ensure it provides the necessary liquidity to cover government expenses,” he explained.

The Central Bank can reportedly provide the Iraqi dinar required by the ministry only by selling an equivalent amount of dollars. As a result, the bank's dollar sales are directly linked to the increase in government spending. "The higher the spending, the greater the CBI's need to sell more dollars," Al-Obaidy clarified.

"If this trend continues, daily market sales could reach between $400 and $500 million through various mechanisms employed by the bank, reflecting the direct impact of rising public expenditure on the currency market," he added.

The focus, according to the foundation's head, should not be on daily dollar sales rates but on the daily spending rates driving the increase in dollar sales.

**1 USD = about 1.3k IQD

Government advisor reveals measures to revive insurance sector in Iraq

The Prime Minister's Advisor for Financial Affairs, Mazhar Mohammed Salih, confirmed today, Friday, that there is a serious government trend to activate the insurance sector in Iraq.

Saleh said in an interview with the Iraqi News Agency, followed by "Al-Eqtisad News", that "activating the insurance sector in Iraq and addressing the absence of insurance culture as a means of financial protection requires considering several intertwined factors, some of which relate to the movement of the overall economy, and others to the societal culture, including reviewing existing legislation, including, for example, the importance of providing tax incentives for companies and individuals who choose insurance and supporting small and medium-sized companies to provide innovative insurance products that suit market needs.

" He added, "Based on that, I find it important to design insurance products that suit different categories, such as agricultural insurance and disaster insurance, and informing citizens that there is mandatory insurance for car accidents, as there is an approved mechanism in this regard that not many people know about, and it is part of the absent societal culture regarding mandatory insurance in the country," indicating that "citizens' confidence in non-banking financial institutions must be enhanced, including insurance activity in particular, which is reflected in the development of the insurance sector as a whole and its interconnections in the entire national economy."

He added that "the disparity in purchasing power of many segments of society makes them focus on basic needs instead of future financial planning, and for inherited reasons as well due to years of wars, conflicts, and social and economic changes that have affected society."

He pointed out that "the decline in insurance culture is the main factor in the lack of development of this vital sector due to the lack of knowledge of the benefits of insurance and its importance as a means of financial protection, as families, communities, and clans are often relied upon to confront risks instead of resorting to appropriate insurance solutions guaranteed by law."

He stressed "the need to build integrated awareness programs targeting youth and various business sectors and improve the level of services in a way that enhances trust between customers and insurance companies, in addition to increasing the number of options provided by current insurance companies and activating the use of digital technology to improve the customer experience in terms of easy access to insurance services," noting "the importance of promoting partnership between the state and the private sector in the scope of life insurance, its services, and its institutions, and I find that it represents the second phase of the financial and economic reform undertaken by the government program."

He pointed out that "there is a serious government trend towards activating the insurance sector as it is the financial guarantor of the individual's and society's life, due to its significant positive impact on the national economy in general and the development of the financial market in particular by reducing risks and enhancing financial stability in the country."

Good news for Iraqi employees.. Parliamentary Finance announces the date of launching bonuses and promotions

The Finance Committee in the Iraqi Council of Representatives clarified on Friday that it is waiting for the Iraqi government to send the 2025 budget schedules for approval, and while it expected the date for launching employee allowances and promotions according to the applicable timetable, it confirmed that allowances and promotions are a natural right of employees from the Ministry of Finance.

"The budget approved in 2023 is a three-year budget for the years (2023, 2024 and 2025), and the change that occurred as a first stage is the amendment to Article 12/Second/C only, which is regarding the resumption of oil exports from the Kurdistan Region with a capacity of 400 thousand barrels of oil, at a cost of extracting and transporting one barrel of $16 instead of $6, and this was read in the first reading, and the discussion remains in the second reading and then voting on the amendment, and after this amendment there are no other amendments to the budget," committee member, Moeen Al-Kadhimi, told Shafaq News Agency.

Al-Kadhimi added, "The Finance Committee is waiting, after the budget amendment is completed, for the government to send the budget tables that will show whether there are specific increases or otherwise."

Regarding employee bonuses and promotions, Al-Kadhimi explained, "This is related to the Ministry of Finance, which issued a statement suspending bonuses until the budget is approved, and according to the timetable in effect, bonuses may be added to employee salaries next February, which is a natural right of employees over the Ministry of Finance."

On January 17, the Iraqi Ministry of Finance confirmed that employees’ rights to bonuses and promotions are “fully preserved.”

The Ministry's media said in a statement received by Shafak News Agency, "Based on the Ministry of Finance's circular No. (555) for the year 2025, we would like to clarify that the procedures related to stopping the transfer of services, promotions, calculating contract services, press and legal services, and others, are regulatory procedures that are adopted annually to accurately determine financial allocations."

She added that "transferring services from one entity to another requires transferring allocations, which currently cannot be implemented due to the lack of 2025 budget schedules, as this allows knowing the financial allocations for each entity to ensure that there are no violations or imbalances in the financial distribution."

She explained that she is working to "ensure the regulation of government spending and determine the ceilings of financial allocations for ministries and entities not affiliated with a ministry, including the Kurdistan Region."

The ministry stressed, according to the statement, "the importance of following up on new appointments and knowing the numbers of direct and indirect employees to avoid any funding shortage and ensure that salaries are paid correctly during the current month of January."

The Ministry stressed that "employees' rights to bonuses and promotions are fully preserved, and that they are calculated in accordance with the Legal Department's Circular No. (7497) dated 3/9/2021, which is calculated from the date of entitlement and not from the date of issuance of the ministerial order."

The ministry noted that "the procedures for direct admission of top students and graduates for the year 2024, launched by the Federal Service Council, have not been fully completed, and their data is still being updated."

The ministry indicated that "most of the financial allocations for the new grades for the year 2024 were included in the schedules of the ministries' headquarters, but the actual direct actions and distribution took place at the level of the departments, and have not yet been sent to the Ministry of Finance. Therefore, the ministry is currently working on following up on the financial costs of the employees to include them correctly and to ensure that there is no shortage in the allocation from the 2025 estimates schedules."

How Iraq is Delivering Innovation through its Leading Businesses

From the Iraq Britain Business Council (IBBC):

How Iraq is delivering innovation through its leading businesses

Iraq is stable, its economy is expanding and diversifying to meet the needs of the people. IBBC have been asked by the Iraq Prime Minster, Mr Al Sudani, to hold a Baghdad conference on Innovation.

Following a successful visit to the UK by the Prime Minister and several of his top ministers, a significant trade deal was announced with UK and Iraq, estimated at $15bn, across several sectors, to include cutting edge technology and knowledge transfer to Iraq. Some of these companies will be speaking at the Baghdad conference and the conference is dedicated to the theme of delivering innovation.

The purpose of the conference will showcase how Iraq is currently delivering Innovation and what might be possible to do soon, with the help of the Uk and International partners. IBBC has several members already delivering innovative solutions and products in Iraq, which will be showcased at the conference. We will be examining the power of knowledge transfer across all the panels and discussing what Iraq needs to do to deliver this internally, and the benefits of delivering innovation successfully.

In his paper on 'ease of doing business in Iraq' Professor Frank Gunter, who is speaking, pointed out that modernising and digitising the financial system, not only will enable swifter transactions, access to and international funds, but also reduce the opportunities for corruption. Both EY and Hogan Lovells will explain their work on modernising the Central bank systems of Iraq and consolidation among banks and banking reforms.

1001 is a leading Anglo- Iraqi streaming company that has already signed up over 2 million subscribers, but it is focused on protecting Intellectual property in Iraq, and this is a new opportunity for Iraqis to produce content, derive income and tax receipts from subscriptions. We expect to be joined by companies discussing 5G technology, and provision of fast internet for the delivery of state-of-the-art communications and explaining the importance of cyber protection for Iraqi assets, communications, and defence.

Maritime innovation is becoming essential to Iraq as the Al Faw port opens opportunities for trade and servicing oil and gas projects in the south. Al Zaman are responding to this challenge with the construction of ship production and maintenance factories in Basra and the knowledge transfer of maritime know how from the UK to a new maritime academy in the region. Unihouse Global as innovative online and skills educators, will be training students on skills and maritime capabilities for the academy.

Innovation in energy is also critical in Iraq, not only to reduce the country's carbon footprint but also to find ways to generate more diverse sources of electricity from solar and gas to power the growing population and industries. Hydro C- are solar energy providers to the oil industries, while BP , BGC and Shell can explain how they technically capture gas for electricity that previously burned off and use technology to manage oil fields more efficiently.

Finally, Mr Jon Wilks, IBBC senior advisory and former ambassador to Iraq, will be chairing the day and contributing his insights on geo politics, placing Iraq in the regional context and explaining why technology is important to the diversification of the economy and Iraq's future development.

IBBC has invited several Government ministers to attend and join the panels.

A reception will be held on 16th February for all delegates to network and meet the significant list of sponsors, including principal Sponsor Al Buttsan, Gold Sponsors BP, Al Zaman, SAP, Hydro-C, Al Maseer insurance; Silver sponsor SABIS, Bronze sponsor Defaf al Khaleej. Conference dinner sponsor Sardar Group, conference reception sponsor - Al Busttan and conference lunch sponsor - Iraqi Red Crescent and conference coffee break sponsor - 1001 Media. A historic tour of Baghdad is scheduled by Bil Weekend tourist company.

The conference sets out some of the innovative work IBBC members are already delivering in Iraq and will offer a template for the future.

To register, please contact us on: london@webuildiraq.org

Expert: 70% of Iraq's remittances are controlled by Jordanian and Gulf banks

Economic expert Ahmed Abdel Rabbo confirmed today, Wednesday, that Jordanian and Gulf banks control more than 70% of financial transfers in Iraq, noting that the dollar is delivered to only four Jordanian and Gulf companies.

Abdul Rabbo said in a statement to Al-Maalouma Agency, “Jordanian banks did not provide any real services to Iraq,” adding that “closing the dollar selling platform opened the way for Jordanian and foreign banks to take over the Iraqi financial market, which "Raised questions about the role of Iraqi financial institutions in this regard."

He pointed out that "Jordanian banks control more than 70% of financial transfers in Iraq," explaining that "this control constitutes a direct harm to Iraq's sovereignty and financial decisions, especially with the absence of any effective role for these banks in serving the Iraqi economy."

He called for "reviewing financial policies and strengthening the local role to ensure the stability of the country's financial sector."

Reports indicate that 8 Jordanian and Gulf banks control money transfer operations in Iraq, which led to these banks controlling the flow of dollars into the country. This control imposed the exclusion of more than 1,000 Iraqi banks and offices, which raises concerns about negative effects on the local economy and financial autonomy.

Foreign dominance.. Iraqi banks retreat before Jordanian and Gulf influence

n recent years, the role of Jordanian and Gulf banks has become prominent in Iraq, especially in the field of money transfers. Benefiting from wrong agreements, these banks were able to acquire the largest share of money transfer operations, becoming the main player in the dollar market.

Economists believe that this dominance has negative effects on the Iraqi economy, as it reduces the role of local banks in facilitating financial transactions, and weakens the ability of the Central Bank of Iraq to control the flow of the dollar, which is the backbone of many commercial and investment activities.

With the growing influence of foreign banks, reports indicate that more than 1,000 Iraqi banks and exchange offices have been excluded, which has led to a decline in their ability to deal with foreign remittances. In contrast, Jordanian and Gulf banks have benefited from facilities that have strengthened their control over the Iraqi financial market.

These conditions raise growing concerns about their repercussions on the national economy, as Iraq faces the risk of losing control over its financial markets and monetary autonomy. As dollars continue to flow into foreign banks, the Iraqi economy is increasingly vulnerable to regional economic fluctuations and pressures resulting from the financial policies of other countries.

Speaking about this file, economic expert Ahmed Abdul Rabbo confirmed that Jordanian and Gulf banks control more than 70% of financial transfers in Iraq, noting that the dollar is delivered to only four Jordanian and Gulf companies.

In a statement to Al-Maalouma Agency, Abdul Rabbo said, “Jordanian banks did not provide any real services to Iraq,” adding that “closing the dollar selling platform opened the way for Jordanian and foreign banks to take over the Iraqi financial market, which raised questions about the role of Iraqi financial institutions in this regard.”

He pointed out that "Jordanian banks control more than 70% of financial transfers in Iraq," explaining that "this control constitutes a direct harm to Iraq's sovereignty and financial decisions, especially with the absence of any effective role for these banks in serving the Iraqi economy."

It calls for "reviewing financial policies and strengthening the local role to ensure the stability of the country's financial sector."

In this regard, economic expert Mustafa Akram Hantoush confirmed that the banking system is going through a major crisis, pointing out that the Gulf and Jordanian banks have come to control the cash and dollar sector inside Iraq.

Hantoush said in a statement to the Al-Maalouma Agency, “The Iraqi banking system is almost non-existent at the present time, as four or five Gulf and Jordanian banks control the movement of money.”

He added that "four Jordanian banks submitted applications to enter the Iraqi market, two of which succeeded in operating, while two others, namely Al-Ittihad and Al-Iskan, are still under study."

He explained that "this situation reinforces the dominance of these banks over the dollar, while local banks are now facing major challenges, as some of them remain in the market, while others are forced to seek agreements with Jordanian and Gulf banks in order to continue operating," adding, "Those who do not succeed in reaching agreements with these banks will move towards merging or exiting the market."

He points out that "the banking system was previously suffering from a weak structure, and today it is in a state of complete collapse," stressing that "it has become very difficult to obtain loans in Iraq easily, and whoever succeeds in doing so needs relationships and mediation, which reflects the state of stagnation and paralysis in the Iraqi banking system.”

Reports indicate that 8 Jordanian and Gulf banks control money transfer operations in Iraq, which led to these banks controlling the flow of dollars into the country. This control imposed the exclusion of more than 1,000 Iraqi banks and offices, which raises concerns about negative effects on the local economy and financial autonomy.

MP: America imposed control of Arab banks over financial transfers to Iraq

Former MP Fawzi Akram Tarzi confirmed today, Wednesday, that Washington is imposing control over Arab and foreign banks over financial transfers in Iraq and the movement of the dollar in it in order to achieve great gains for its own benefit.

Tarzi said in an interview with Al-Maalouma Agency, “The control of foreign and Arab banks over the movement of the dollar and financial transfers to and from Iraq is intended to control the country economically and obtain financial gains for external parties. This threatens the country from the economic and political aspects and affects its general situation,” indicating that “the United States of America is behind this issue.”

He added that "the continued submission of Iraq to foreign financial domination in this way will lead to disastrous results, and we have great concerns in this regard," calling on "senior officials and the Central Bank of Iraq to take immediate measures and have a "clear agreement with Washington that guarantees Iraq's financial and economic interests as quickly as possible and not to leave things as they are now."

Reports confirm that 8 Jordanian and Gulf banks control money transfer operations in Iraq, which led to these banks controlling the flow of dollars into the country. This control imposed the exclusion of more than 1,000 Iraqi banks and offices, which raises concerns about negative effects on the local economy and financial autonomy.

Al-Akeili: Iraq faces a challenge in light of America's control over its economy

Political analyst Sabah Al-Akeili said on Thursday that Iraq is facing a real challenge in light of America's control over its economy and its arms projects with other countries, noting that America is pushing towards keeping Iraq weak in the face of the capabilities of the Zionist entity.

Al-Akeili told Al-Maalouma, “The United States of America controls the Iraqi economy, controls the armament file, and imposes its conditions on Baghdad regarding contracting with countries in terms of projects and arms contracts.”

He added, "Iraq is facing a real challenge in light of America's control over the Iraqi economy, as it aims through this to keep Iraq weak in front of the Zionist entity as it is part of the axis of resistance."

He explained that "the new US President Donald Trump has his intentions towards the Middle East and the region in general, especially since he has issued threats to turn the region into hell if the Zionist prisoners held by Hamas are not released before a ceasefire is agreed upon in Gaza, and therefore there are clear intentions to give the green light to the Zionist entity to attack the countries of the axis of resistance."

Government spokesman: Al-Sudani keen to create political stability in Iraq

Government spokesman Bassem Al-Awadi confirmed today, Friday, that internal political stability has contributed to transforming Iraq into an international meeting place for brothers and friends, while indicating that Prime Minister Mohammed Shia Al-Sudani is keen to create political stability in Iraq.

Halliburton to Develop 2 Oil Fields in Iraq

The Iraqi Cabinet has approved a Heads of Agreement (HOA) with US-based Halliburton for the development of the Nahr Bin Omar [Nahr Bin Umar, Nahr Ben Umar] and Sindbad oil fields in Basra.

According to a statement from the Media Office of the Prime Minister, the project will employ Integrated Field Management Services (IFMS) and the EPCM model, aligning with national efforts and licensing round frameworks.

The South Gas Company (SGC) and Halfaya Gas Company (HGC) signed a contract for the development and processing of gas from the Nahr Bin Umar last year, while China's United Energy Group (UEG) was awarded the contract for Sindbad in 2018.

(Source: Media Office of the Prime Minister)

.png)

No comments:

Post a Comment