Payment of dues in black oil and tightening controls at ports are the main reasons for the dollar's decline.

The exchange rate of the dollar against the Iraqi dinar has witnessed a significant decline recently. This decline is due to a combination of intertwined economic and procedural factors, which vary in their impact but have collectively contributed to strengthening the dinar. The most prominent of these factors are:

1- Economic contraction and declining consumer confidence:

The uncertainty facing the Iraqi market due to the economic slowdown has led to a decline in individual and institutional spending confidence, negatively impacting overall demand and thus reducing the need for the dollar as a catalyst for trade.

2- Stopping government investment expenditures:

The government's focus on operating spending rather than investment has slowed economic activity. Since the general budget is the primary driver of economic activity, reducing investment spending has reduced aggregate demand, including demand for the dollar.

3- Tightening control over border crossings:

Government measures to prevent smuggling and regulate relations with the Kurdistan Region have helped curb the phenomenon of overbilling, reducing the unreal demand for dollars on the parallel market.

4- Merchants’ transition to the formal banking system:

Markets have witnessed a large segment of traders entering the formal banking system and adopting the official dollar exchange rate through approved platforms, which has reduced trading volume in the parallel market and eased pressure on the dollar.

5- Decline in re-export operations:

The decline in re-export activity to neighboring countries has reduced demand for imported goods, which has directly impacted the need for dollars to finance these trade transactions.

6- Settling the dues of major companies with petroleum products instead of cash:

The government has settled part of its debts to foreign companies in black oil and naphtha instead of cash, reducing reliance on dollars sold by the central bank and increasing their supply in the market.

7- Preparations for the electoral process:

As the election season begins, campaign spending increases. This spending is often financed from dollar reserves, which necessitates converting large amounts of these reserves into dinars to cover campaign expenses, thus increasing the supply of dollars.

8- Increase in the number of foreign visitors and arrivals:

The increasing number of immigrants to Iraq has brought significant amounts of foreign currency into the local market, providing an additional source of hard currency outside of central bank sales and contributing to increased dollar availability.

9- The cessation of illegal trade as a result of the closure of the border with Syria:

The closure of border crossings with Syria has curbed smuggling and illegal trade, which was heavily reliant on dollars on the parallel market, leading to a further decline in demand for the dollar.

10- Decrease in the issued currency and withdrawal of part of it from the market:

The Central Bank of Iraq withdrew a portion of the dinar money supply from the market, creating a double demand for the Iraqi dinar against the dollar. This balance in demand for the two currencies helped strengthen the value of the dinar and raise its exchange rate against the dollar in the parallel market.

Want to support My FX Buddies?

Support My FX Buddies Big or Small I appreciate it all

BuyMeACoffee CashApp:$tishwash

https://paypal.me/tishwash

Iraqi Dinar strengthens despite unclear economic drivers

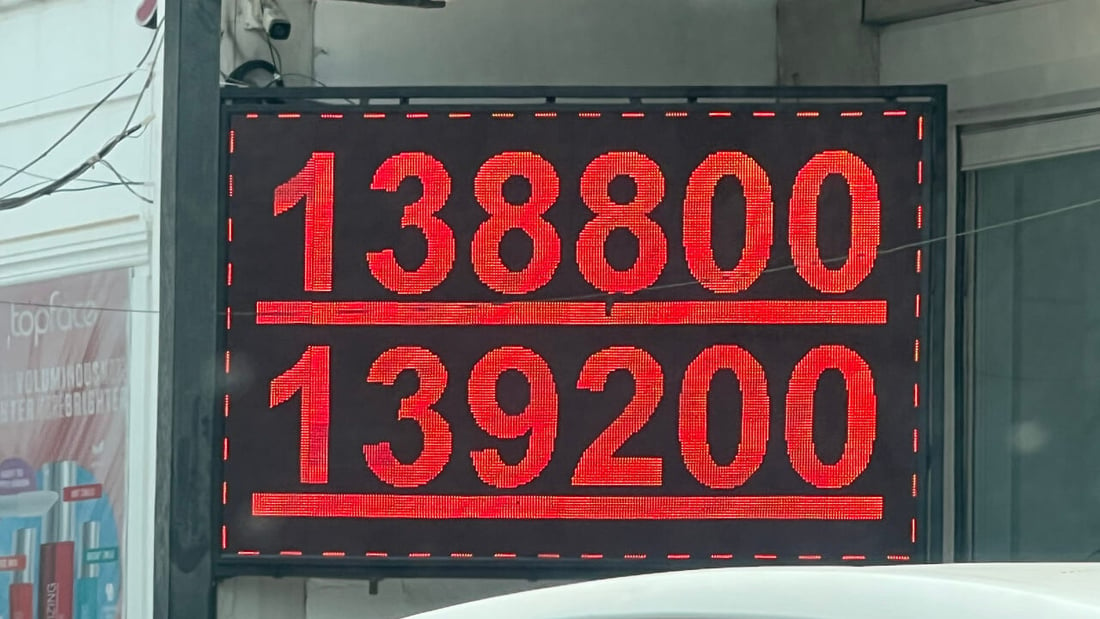

The Iraqi dinar has steadily strengthened against the US dollar, nearing the official rate set by the Central Bank of Iraq, a financial expert noted on Monday.

Speaking to Shafaq News, Mahmoud Dagher attributed the dollar’s decline to “a state of uncertainty in the Iraqi economy,” highlighting an imbalance between a shrinking supply of dinars and a high volume of dollars being converted as another contributing factor.

While no clear economic catalyst or direct government intervention appears to be driving this trend, Dagher pointed to lower government spending as a significant reason behind reduced demand and easing pressure on the currency.

Despite the dinar’s gains, a gap of roughly 8,000 dinars per $100 note—equivalent to about 6.11 US dollars—remains between market rates and the official Central Bank rate, with speculative activity continuing to influence currency movements.

.png)

No comments:

Post a Comment